The tax season is a hard time. Crunching down the numbers can be challenging and time-consuming. Not to mention, hiring someone else to do it for you can get a little costly. With the right solution, you can ensure the accuracy of your filings, hasten the process, and send them digitally.

To find which software will suit you best, this article will be comparing two popular tax preparation software, namely TurboTax and SimpleTax. This TurboTax vs SimpleTax Canada comparison will help you determine which of the two software can better cater to your needs this filing season.

TurboTax Overview

TurboTax is one of the longest-running and most popular tax software out there in the market. It is brought to you by Intuit, the software giant who also created Quickbooks, one of the best bookkeeping software out there.

TurboTax Users

If you’re one of those people who have no access to Netfile, then TurboTax might help you with that. It is designed so that even those without Netfile can file their returns, print them, and mail it to The Candara Revenue Agency (CRA) themselves. To see if you’re eligible for Netfile or not, you can check the list of restrictions on the CRA website.

TurboTax for Beginners

TurboTax makes filing your taxes quick and painless. It has a questionnaire-like format that you can simply fill in to start working on your tax returns. The software will then guide throughout the process to ensure that everything is filled up properly.

You can also upload your files from your MyCRA account into TurboTax to access its Auto-Fill feature. From RRSP receipts to T4/T5 slips, the solution can use these documents to fill up your forms without further interference on your part.

TurboTax Support

If you’re new to filing taxes, TurboTax can help you with that. It will give you a step by step guide of the process so that all forms are filled up correctly and completely. It provides explanations of complicated words. All you need to do is click on the word to get its definition. They also have a database of frequency asked questions where you can search for the answers you’re looking for regarding tax filing.

In case you need some more assistance, there is an option called “Live Assist & Review” and “Live Full Service”. This will allow you to employ the services of tax experts. They can either review your forms or do it for you. However, this would also mean paying more for such services.

TurboTax Guarantee

Not satisfied with their services? TurboTax has you covered. As their website boasts, “Your taxes done right—guaranteed,” it offers you several options for refunds or compensations in cases of negative experiences.

The first is in the form of a direct refund. They will return the same price you paid for their product if you ask it from them. Likewise, it promises to pay any penalties or interest you’ve incurred from their calculation errors. Just make sure that these errors are from the software itself and not from your own or from the CRA auto-fill feature. There is also a 60-day period in case you want to return their product if you’re not happy about it.

TurboTax Access

You can utilize TurboTax through your web browser or by installing their app from iStore and Google Play. This will allow you to file taxes through your smartphones or tablets. Likewise, you can also download their application straight into your PC. This downloaded version offers the same tools and features as that of the web version.

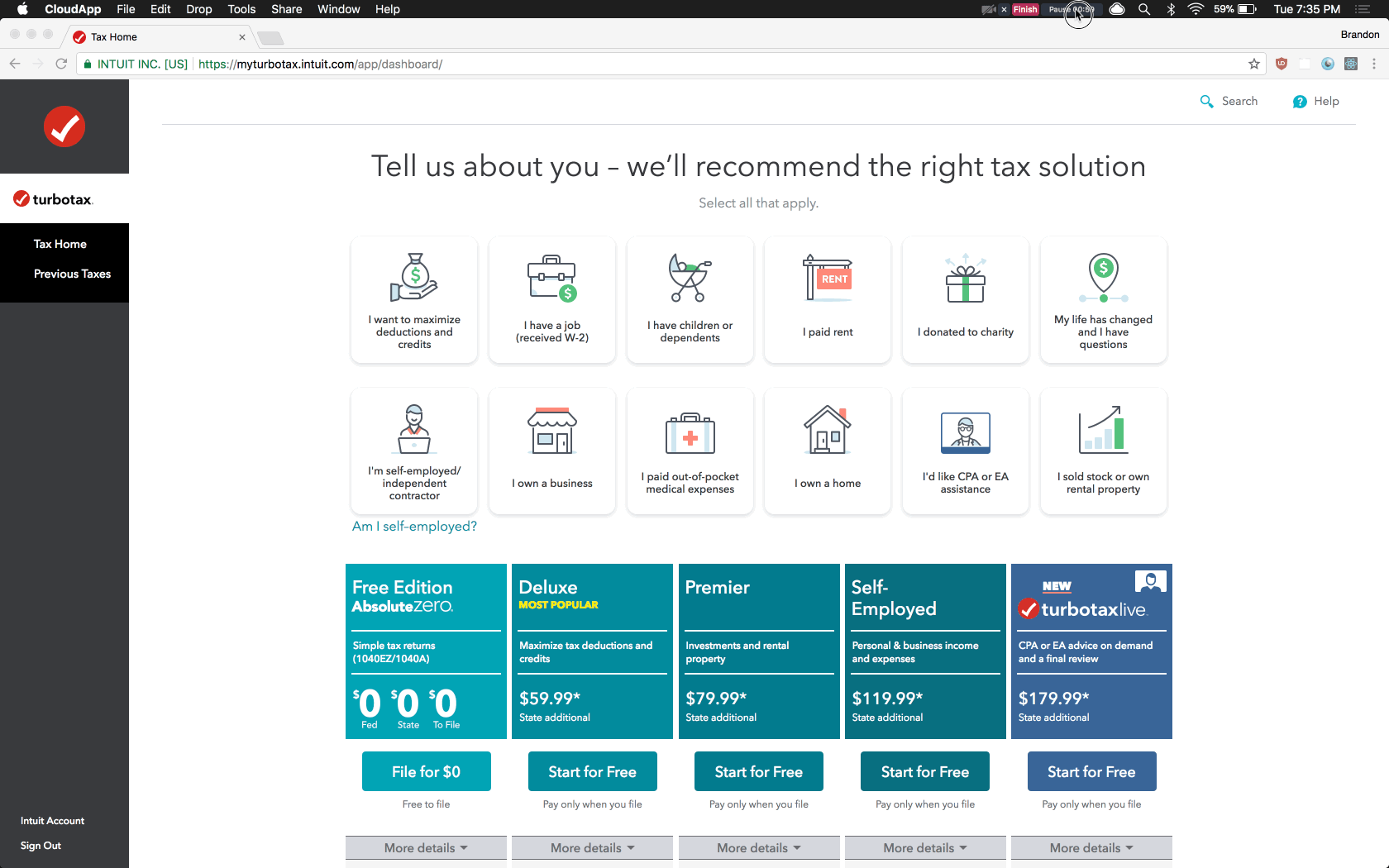

TurboTax Pricing

As mentioned earlier, there are several ways to access TurboTax. Each one has different pricing options that you can choose from to cater to your budget.

Web-version

- Free: This option offers the most basic and barebones features and tools to help you file your tax returns. It may not have an extensive support system from the other pricing plans, but this trade-off can go a long way especially if you just want to turn in your tax returns this year.

- Standard ($19.99): This is the on-demand version since it is the cheapest while also covering all the needed tools for filing tax. It offers assistance for your tax computation if you also need to account for medical bills, RRSPs, and other expenses.

- Premier ($34.99): This version is ideal for those with investments or properties and those crunching up figures on dividends and capital gains. The price has gone down from last year, but it still covers everything you need to do the job.

- Self-employed ($44.99): As the name suggests, this version caters to those self-employed people. Its price has gone down as well, but it still offers all the necessary tools to help you deduct taxes from your business’ expenses.

Download-version

- Basic ($19.99): The downloaded version doesn’t have a free option. The cheapest on the lineup, however, lets you file a maximum of 4 returns and have your previous files and information from last year’s filing season transferred to your current return.

- Standard ($34.99): This version is highly similar to the web’s Standard version. However, you can only file 8 returns with this one.

- Premiere ($74.99): Yet another counterpart in the web version’s pricing list, this one lets you file 12 returns maximum.

- Home & Business ($119.99): The download option for the Self-Employed web version, this one gives you the same features and tools. You can make 12 tax returns with this one. Do note, however, that tax software is can also be deductible into your taxes under expenses for your business.

TurboTax Live Assist & Review

- TurboTax Live Assist & Review ($79.99): If you’re looking for that added help from a real tax expert, then this is the version best suited for you. It offers services from professionals who can go over your tax return for you.

- TurboTax Live Assist & Review Self-Employed ($99.99): This version offers the same services as the one above, but this time, it is tailor-fitted for those who are self-employed.

TurboTax Live Full Service

- TurboTax Live Full Service ($129.99): This version offers you the full benefits of having a tax professional in your service. With this, you can move on to other responsibilities and tasks and leave the filing entirely in their capable hands. Just set up your account and give them the authorization to access pertinent documents and to do the work for you.

- TurboTax Live Full Service Self-Employed ($129.99): Similar to the one above, it provides the service of someone qualified to compute your taxes for you if you are self-employed since tax software and tax preparations are deducted from your tax as a business expense.

SimpleTax Overview

Between TurboTax vs SimpleTax Canada comparison, SimpleTax is a relatively newer and smaller organization compared to TurboTax. And just recently, it has been bought by WealthSimple. It’s because of this that they may not have all the features that TurboTax has, such as the assist and full-service features, but they can still be relied on computing your taxes for you.

SimpleTax User

Unlike TurboTax, SimpleTax is only for those with Netfile. Anyone who fits into any description in the restriction list posted by CRA might want to reconsider using this software.

SimpleTax For Beginners

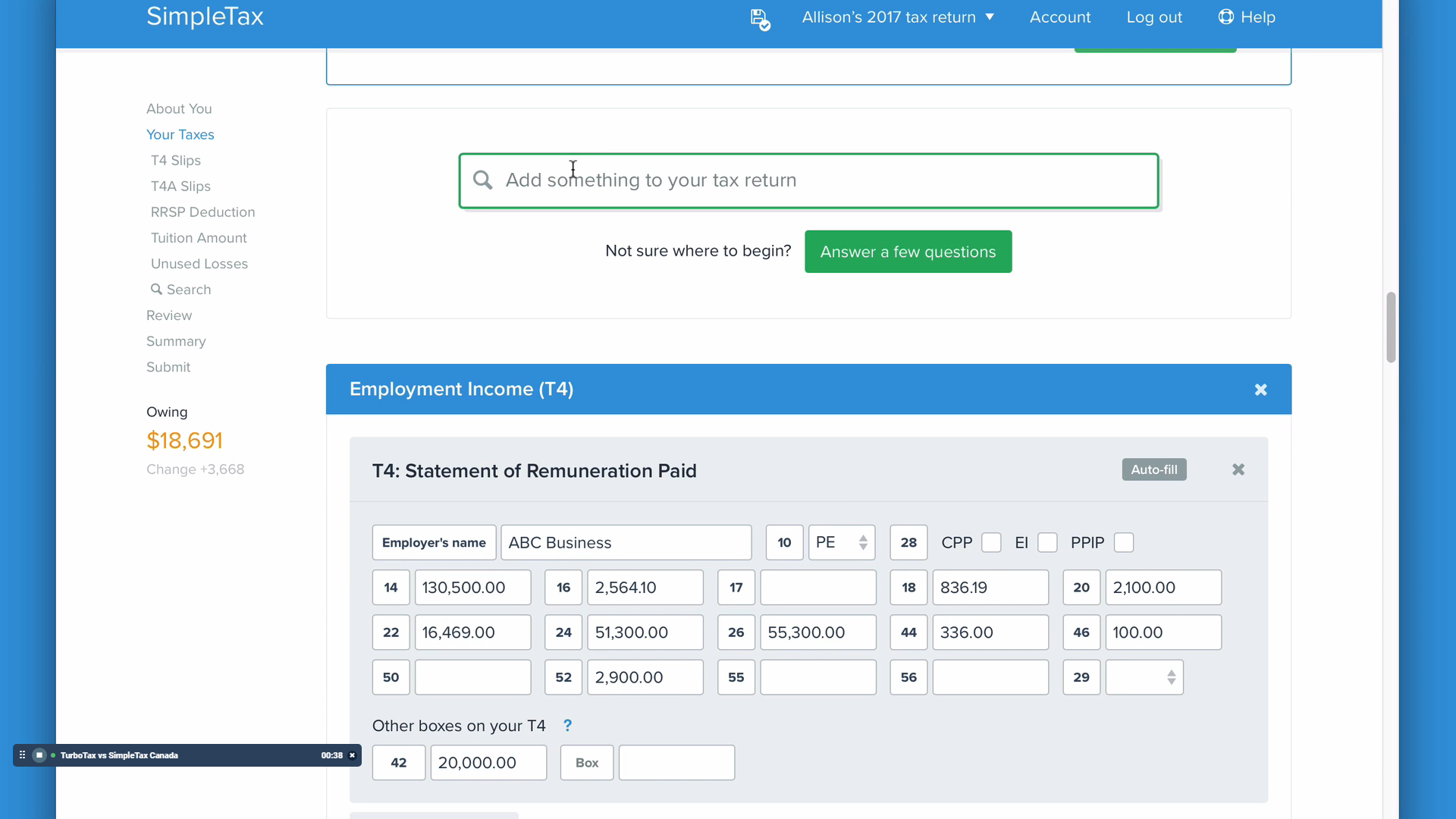

When filling out your forms in SimpleTax, you’ll be faced with a single, long page that you need to scroll through several times to get to the end. Fortunately, the solution has shortcuts that will let you jump to other sections without further scrolling.

SimpleTax offers two ways on how you can file your forms. Either you do it manually by searching for the sections yourself or work with a “wizard” to guide you through the important stuff. From there, you can start filing returns.

The solution also has an auto-fill feature similar to TurboTax. Simply upload your receipts and slips from your CRA account, and SimpleTax will fill in the necessary blanks in your forms. Just make sure that all needed information is correct to avoid errors. Likewise, it has an auto-save feature to ensure that all data are backed up properly.

SimpleTax Support

You can learn as you go by clicking on the terms that need explaining. SimpleTax will then define them briefly, similar to TurboTax’s feature. For more info, SimpleTax can redirect you to the CRA website where you can find more info regarding tax filing. However, you’ll be on your own to decipher its complicated language.

You can also simply search for the answers in their database or contact them. However, don’t expect a swift response since they’re only a small team. Likewise, they will only entertain queries regarding the software and not on your tax itself.

SimpleTax Guarantee

Just like TurboTax, SimpleTax guarantees 100% accuracy in their computations and filings. They will shoulder any penalties or interest you get from their services. They won’t consider your own typing errors or from the auto-filled data. SimpleTax also offers refunds and returns if you’re not satisfied with your experience with them. They can also do your tax for free if you’re not happy with their results.

SimpleTax Access

You can access SimpleTax through web browsers and an app exclusively from Apple Store. This means you can use your laptops, smartphones, and tablets to file your taxes with SimpleTax. However, if you are planning to use it via your phone, you might find it more difficult to navigate because of the smaller screen.

SimpleTax Add-ons

As the name suggests, SimpleTax offers a very basic set of functions and features for your tax filing. Therefore, there aren’t any other options, versions, or add-ons for the software. Nonetheless, it functions as what you would expect for what you paid for.

On another note, if you’re looking for more tools that can help you further with your accounting needs, you can click here.

SimpleTax Pricing

SimpleTax offers its software for free. You can use their tools and features without needing to break the bank or even pull out your wallet. However, they will ask you if you can pay them any amount you feel reasonable for their services. This small fee will, of course, help keep their operations going.

The best one for you

Based on this TurboTax vs SimpleTax Canada comparison, both software is simple and navigable. Likewise, their processes are relatively straight-forward with auto-fill options for both.

So if you’re looking for the best invoicing software between the two, it is a matter of how knowledgeable you are when it comes to filing taxes. For beginners, SimpleTax may seem overwhelming at first especially with its single-page format. Likewise, its definition for terms is more limited than TurboTax.

With this, TurboTax is best for those who are new to tax filing and would need comprehensive guidance in filling up their returns. It offers a variety of plans and options that permits you to coordinate with a real tax expert instead of leaving the task entirely to automation. It’s because of this that TurboTax has a lot more to offer than SimpleTax, which only offers basic options.

However, if you’re tight on the budget, TurboTax might be too costly for you. While it does have a free version, you’ll only get the basic features. This only serves to even up the playing field between TurboTax and SimpleTax.