Despite being a basic administrative function, payroll management is a difficult process to master. No one really has the time to go through attendance reports and timesheets at the end of each pay cycle. Plus, there are taxes and wage policies to contend with. For this reason, businesses lose billions in penalties due to payroll errors.

With all these complexities, it’s not really surprising that many companies have opted to automate payroll management through payroll software. Payroll software provides an automated, organized system for calculating and paying wages, managing deductions for benefits, and providing regulatory reports to tax agencies. Additionally, payroll software allows your company to keep abreast of changes in the world of payroll management, like flexible pay periods.

In this guide, we’ll be discussing the ins and outs of payroll software and the benefits brought by these systems. We’ll also list the key features to look for in payroll tools, along with the top 5 payroll companies today. In this way, you can better understand how these platforms work and decide if payroll automation is a good fit for your business.

What Is Payroll Software?

Payroll software is designed to make payroll processes more efficient through automation. These tools typically each come with their own features and capabilities, but these platforms share the same core functions. Employers must input employee information and work schedules into the system. The software then automatically calculates wages, taxes, and deductions according to this information. Lastly, the system draws paychecks or makes direct deposits into employees’ accounts.

These systems also alert you to any changes in tax laws and apply these changes as needed. Likewise, users will get reminders for filing various tax forms. Once the required information is entered into payroll software, there’s minimal input required from employers or payroll staff.

List of Best Payroll Software

There are plenty of payroll management tools that business owners can choose from today. Here are the most popular payroll companies today:

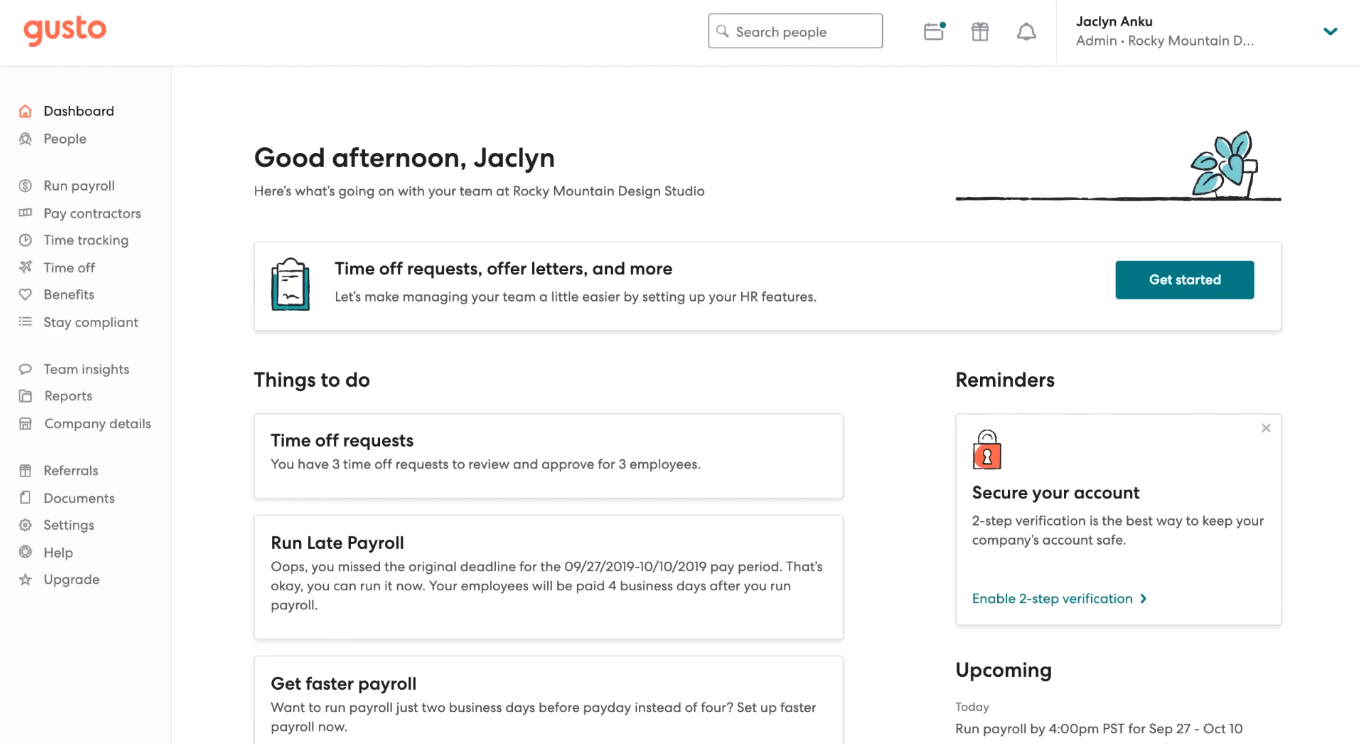

- Gusto: Gusto offers powerful features for payroll management. Designed for small businesses, the software provides automated calculation and submission of payroll taxes. The platform’s Core plan starts at $45 per month.

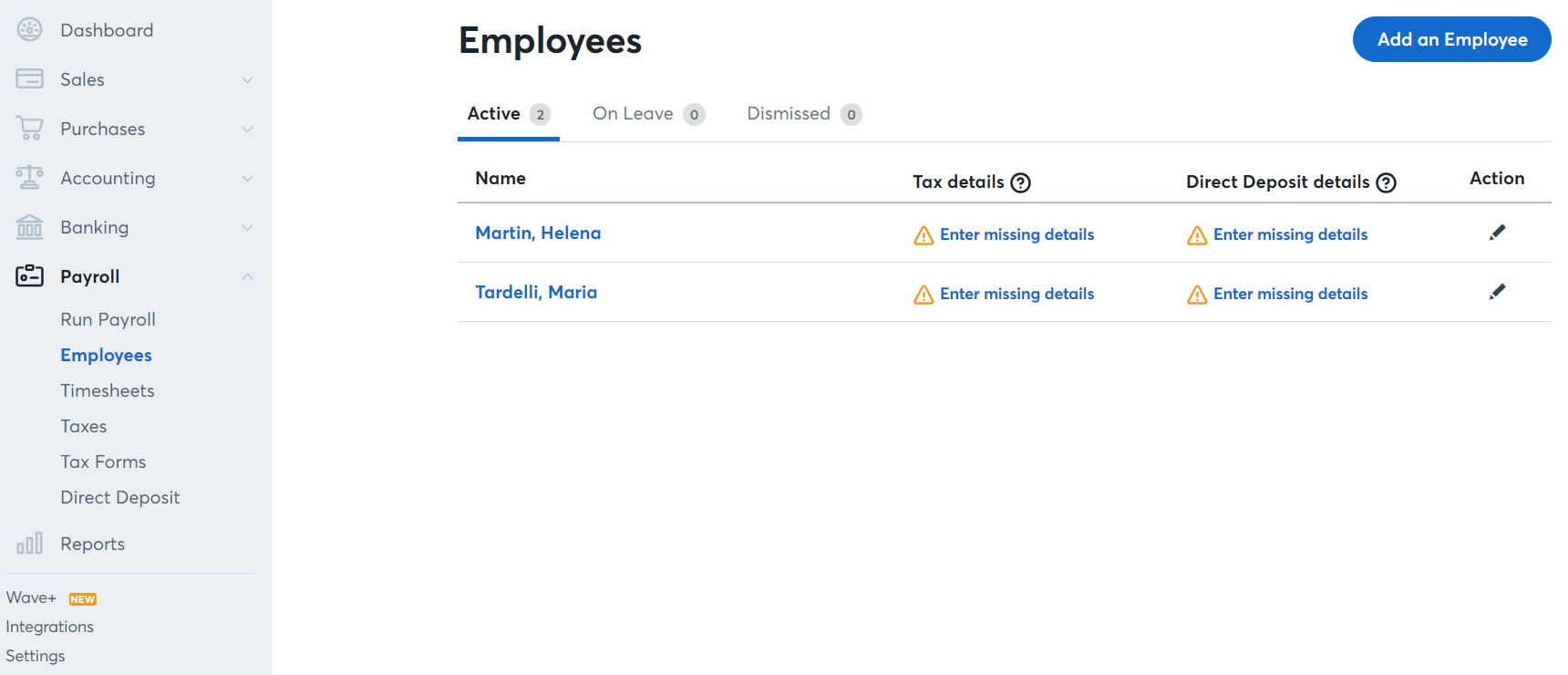

- Wave: Wave combines invoicing, accounting, and payroll into one platform. The software allows users to make accurate payments through a wide variety of payment methods. Ideal for small businesses, Wave offers payroll functions at $20 per month.

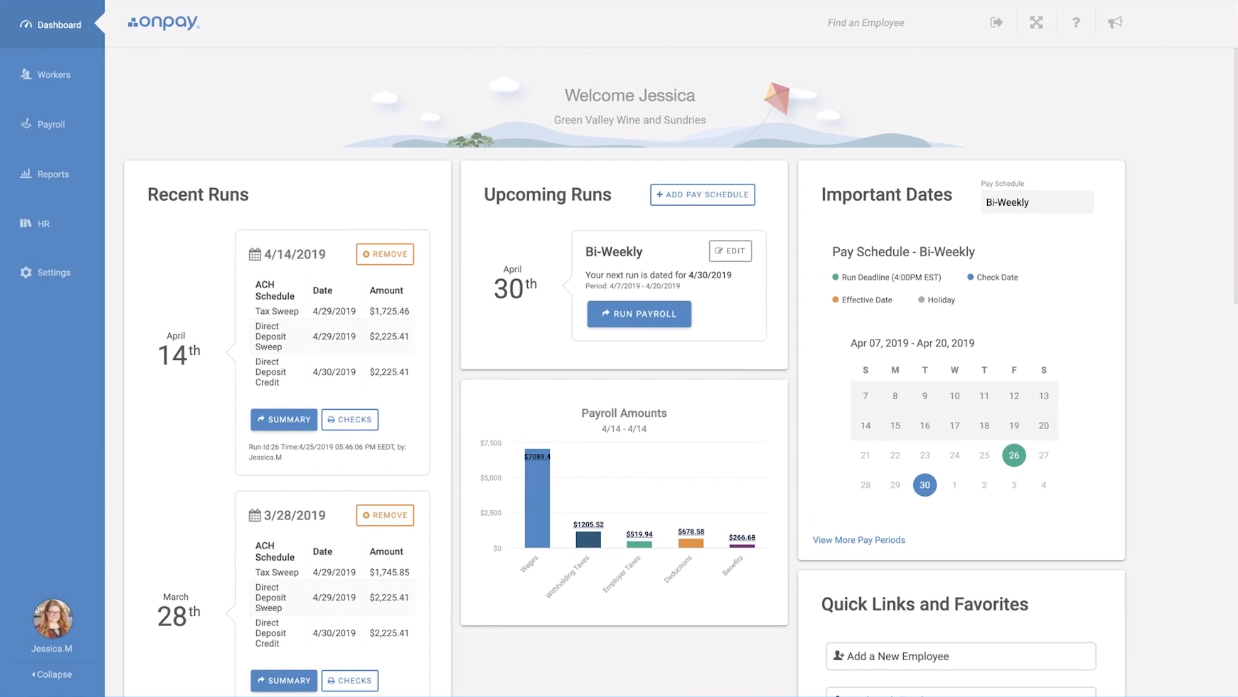

- OnPay: OnPay is a cloud-based payroll tool that can automate payment workflows and tax filing. It offers unlimited payroll runs for W-2 employees, as well. The platform’s Basic plan starts at $40.

- Paycor: Paycor is an integrated Human Capital Management platform that offers payroll solutions. The platform ensures consistent tax compliance and provides automated workers’ compensation. The software offers quote-based pricing for businesses.

- Patriot Payroll: Patriot Payroll offers a simple three-step process that will help business owners handle payroll tax deposits and filing. The software also provides unlimited payroll runs with direct deposit capabilities. The software’s Basic Payroll service starts at $10 per month.

- QuickBooks Payroll: QuickBooks Payroll allows you to automatically run payroll once the initial setup is completed. The software also helps resolve errors on your payroll taxes, offering tax penalty protection for businesses. The QuickBooks Payroll Core plan starts at $22.50 per month.

- Zenefits: Zenefits provides advanced payroll features for businesses of all sizes. For instance, the software automatically calculates for time off, benefit deductions, and salary changes. The platform also offers flexible pricing plans, with the Essentials plan starting at $8 per month per employee.

- ADP: ADP Payroll software helps businesses save time by automating payroll calculations and tax deductions. The software also provides ready access to tax forms. You can also get customized pricing for the software by contacting the vendor.

- Paycom: Paycom provides one system of records for all employees in a business. Features such as general ledger mapping also make it easier to track and present payroll accounting data. You can contact the vendor directly to book a demo and get a customized quote.

- UZIO: UZIO is a cloud-based human resources management software designed to streamline payroll, benefits, and compensation management. Its user-friendly hub makes it easier for users to automate HR tasks such as onboarding, offboarding, tax management, and time tracking, among others. Pricing is around $4 per employee per month for the payroll.

Why Use Payroll Software?

Payroll software provides many benefits for companies to enjoy, not the least of which is the automation of a painstaking, time-consuming process. Here are the most important benefits of using payroll tools.

- Fewer errors – Manual payroll processing is prone to errors, and mistakes can be costly. This is especially true since federal regulations, in an effort to ensure data integrity, now include payroll. Payroll automation makes sure that your payroll processes remain accurate and error-free, helping your business avoid costly mistakes.

- Increased employee satisfaction – Inaccurate or delayed payouts negatively affect employee morale and foster distrust. Payroll software speeds up the process and ensures consistently accurate wage calculations, so employees always receive the right wages on time.

- Consistent compliance – It can be difficult to keep track of changes in tax rules and wage regulations that affect your company. Payroll software automatically tracks these changes and alerts users to these changes. This way, your business avoids hefty fines and stays on the good side of state and federal laws.

- Improved transparency and self-service features – Many payroll tools have features that allow employees limited access to their payroll information for viewing pay stubs and tax information. These tools usually provide self-service options through a dedicated employee self-service website.

- Payout tracking – Aside from wages, payroll software also tracks financial benefits like bonuses, incentives, and commissions. This data can prove to be valuable in monitoring the performance of your employees.

- Lower costs – This is especially true for smaller businesses. Payroll software, especially those with pay-as-you-go models, are often a lower-cost alternative to hiring an in-house accountant. Owners of SMBs themselves can easily manage payroll through these payroll tools to keep operating costs down.

Types of Payroll Software

Like other types of software, payroll management software can be classified into various categories. For instance, these tools can be categorized by deployment or target market. However, most payroll tools can be classified into these two main categories:

- Dedicated payroll services – These platforms focus on payroll management functions such as attendance tracking, benefits administration, wage distribution, and tax planning. To extend their capabilities, these tools can often be integrated with business software such as HR systems and accounting platforms. This type of payroll software is a popular choice among SMBs.

- Integrated payroll services – Payroll functions are sometimes also integrated into accounting or HR software or ERP systems. Integrated payroll includes calculations for taxes and wages, payroll recording, and paycheck printing. These payroll management functions can be standard features or paid add-ons to the main software.

Key Features of Payroll Software

We’ve given you a general idea of what payroll software does and how these tools can benefit your business. Now let’s take a look at the specific capabilities of payroll management systems.

- Wage calculations – Payroll tools automatically calculate employee wages at the end of the schedule you choose. The software takes into consideration all factors that affect wages, including attendance, benefits, leaves, advances, taxes, and regulations. This way, it can accurately calculate each employee’s salary. Users only need to set up employee information and wage structures, and the system takes care of the rest.

- Tax processing – This is another essential feature of payroll software. These tools automatically process tax deductions and ensure compliance with the latest government regulations. Some payroll management software also offer features for tax filing and reporting.

- Expense management – Aside from employee wages, these tools can also track employee-related costs such as loans and advances. These features ensure that you have a record of all business expenses. Advanced payroll management software have a module where you can enter approved expenses to make reimbursement more convenient.

- Benefits tracking – Payroll tools also track benefits and benefits claims, including allowances, paid time off, and maternity and paternity leave. Some of these platforms also offer self-service options that allow employees to file claims and monitor leave balance.

- Reporting – These systems can automatically generate payroll reports, including salary statements, and leave summaries. These reports come in handy for compliance purposes and for measuring the efficiency of payroll processes.

- Recordkeeping – Payroll software also securely stores employee records, wage information, and other related documents. Aside from records, payroll platforms serve as a repository of forms, including payslips, payroll forms, and tax forms. Employees may be able to access these forms through self-service portals.

Latest Trends in Payroll Software

Digital transformation is affecting all aspects of business, and payroll management is no exception. As a result, many of the trends for payroll management center around technology.

- Integrated payroll solutions – Software buyers tend to choose payroll processing software that does more than just payroll. More payroll systems in the future may integrate core HR features and time-tracking capabilities. Conversely, vendors of larger ERP or HCM suites may also incorporate payroll solutions to offer a more rounded-out software to business owners.

- Diverse payment options – As non-traditional work models become the norm, more employees opt for new forms of compensation. Employers may be looking at a future where employees are paid not only via paper checks or direct deposits but also through cryptocurrencies like Bitcoin. Surveys say that 39% of Americans are open to using Bitcoin for transactions and purchases, too.

- Manual payroll processes to become obsolete – Automation greatly benefits the payroll process, which demands complete accuracy and timeliness. More small businesses will abandon paper-driven payroll management. Some HR experts even predict that artificial intelligence and automation could take over the entire payroll process in the near future.

The Wave Payroll dashboard makes it easy to add employees and their payroll information to the system.

Potential Issues of Payroll Software

As useful as payroll services are, there are still various issues that users can encounter with these solutions. Here are some potential problems with these payroll platforms:

- Data security – This issue commonly affects cloud-based payroll software, which stores your data on shared servers. This security issue is particularly prickly since payroll management software deals with employee records and wage information.

- Non-compliance – Financial processes like payroll and accounting are bound by strict regulations at the local, state, and federal levels. To avoid hefty fines, business owners must make sure that the payroll software they use is always updated for changes to tax laws and regulations.

- Incompatibility with other software – While many payroll tools offer native integrations with other business software such as HRM and accounting platforms, some payroll systems don’t work well with other software, causing delays in syncing information. This can throw a wrench in your business’ payroll process.

- Insufficient features – Not all payroll systems offer the same set of features. For instance, some payroll tools focus on payroll administration and attendance tracking. This means not all payroll software will be a good match for the needs of businesses of varying sizes.

Factors to Consider in Choosing Payroll Software

Choosing the right payroll software for your business isn’t a decision to be taken lightly. It’s best to carefully study all your options before making a purchase decision. Here are some critical features you can focus on to make the process easier:

- Ease of use – The payroll tool you choose should have an interface that’s easy to understand and master. This ensures that the software won’t hinder the productivity of payroll staff.

- Total cost of ownership – Payroll systems have their own pricing plans; other software may also have add-on features that add to their cost. Make sure to read the fine print, so you’ll get what you pay for. Remember, payroll management doesn’t generate any revenue, so it’s best to keep these costs as low as possible.

- Compliance – The payroll service you choose must support laws and regulations related to payroll administration. The best payroll software can adjust wages according to these regulations and generate the required reports for compliance.

- Integrations – Payroll software must be able to integrate with software for HR and accounting, among other systems. This ensures a smoother, more efficient payroll process. At the very least, payroll tools should be able to accommodate import/export functions for standard file formats such as DOC, CSV, and TXT.