The introduction of spreadsheet software revolutionized the practice of accounting, turning a once manual task into an automated, programmable function. However, spreadsheets, over time, became unreliable, prone to user error, version problems, and data corruption. Horror stories abound where major companies had to deal with errors in the millions or billions of dollars caused by an incorrect entry or a faulty computation.

Modern needs require modern solutions beyond the spreadsheet. Accounting software has come a long way, as automation made complex tasks easier, and collaboration among co-workers increased. As automation and advanced intelligence marches on, accountants all over are excited over the prospect of more developments in the field. In fact, 80% of accounting executives believe that AI leads to a competitive advantage.

The introduction of cloud servers made things even better, getting rid of a common spreadsheet issue–reliability. Collaboration used to mean taking turns on one copy and saving it in a local server at the office. With cloud accounting, you can access your most recent data anywhere, anytime, with virtually no danger of version control or double/inaccurate entries. With most companies warming up to accounting software, the age of cloud accounting has definitely arrived and it is growing 25% a year.

What is accounting software?

Accounting software is a suite of programs designed to perform and automate accounting processes such as accounts receivable, account payable, ledger, payroll, and others. It provides the company an ongoing report on its financial health and accounts for all financial transactions made by the company during a year. In addition, accounting software provides analysis and reporting functions that help management make decisions.

List of best accounting software

- QuickBooks: A top-selling accounting software for small and medium businesses. A simple, user-friendly interface operates a powerful accounting engine that handles all financial-related tasks. The majority of the company’s clientele are large enterprises, but the company also works with mid-market businesses. It focuses most of its expertise on financial software development services.

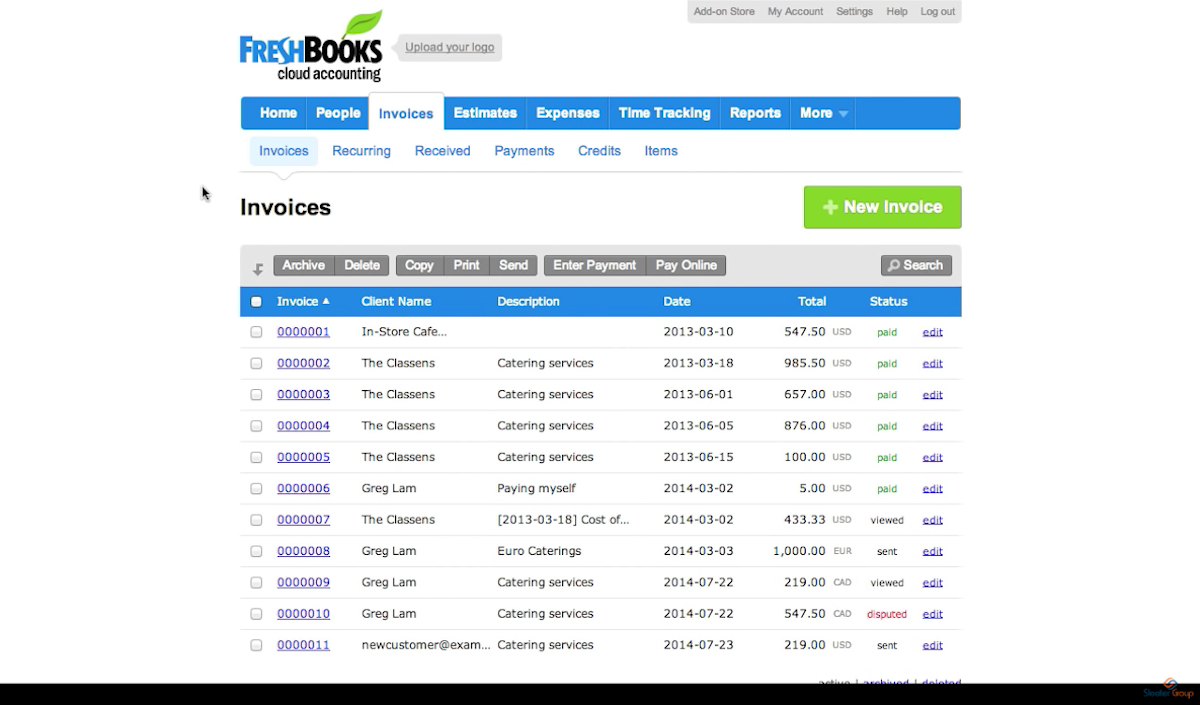

- FreshBooks: Owns the highest customer satisfaction rates among users. Surprisingly intuitive and features plenty of customization tools, FreshBooks turns accounting from a mundane task into a more enjoyable chore. You can also download their free accounting templates, invoicing templates, balance sheet templates and others, to easily manage your finances.

- Zoho Books: Part of the Zoho suite of office applications, it lets you perform invoicing and collection from a single platform. Designed with SMBs in mind, Zoho Books helps streamline your financial operations and organize your processes.

- Accounting by Wave: A small business accounting software, it delivers exactly what it promises: a compact, integrated platform for accounting, invoicing, and receipt scanning. If you want to include the payroll and payment options, a nominal fee is charged. Perfect for small businesses of 10 employees or less, it serves as an introductory step to accounting automation. While limited in its capabilities, the free price tag does arouse interest among many lookers.

- Odoo: One of the more price-friendly options, the software is an open-source software that handles not just accounting tasks but CRM, marketing, sales, HR, and logistics – all fully integrated. Whether you’re running a small business or setting up an enterprise, Odoo is scalable to handle all sizes and lets you pay only for the modules you need.

- Freeagent: A cloud-based accounting software that targets small businesses and freelancers. It handles invoice and expense management, project management, sales tax computations, and more.

- Sage 50Cloud: Sage 50Cloud brings cloud accounting on your computer, tablet, and phone and shares real-time data to your team, especially your accountant. Sage also updates important financial information for easy compliance: data entry, reconciliation, reporting, accounting, and sales tax.

- Xero: Xero lets you access your bookkeeping tasks conveniently – whether using a Mac, PC, tablet, or phone. Featuring an easy-to-use interface, accounting processes get simplified and displays results in real-time.

- NetSuite: Oracle’s Netsuite cloud financials and accounting software is part of the Oracle NetSuite, which also includes a compliance management module to ensure finance standards are met. NetSuite is designed for large enterprises that have more complex financial operations.

- Dear Systems Accounting: Accounting is just one module of Dear Systems, which has modules for sales, manufacturing, purchasing, eCommerce, and inventory. Dear Systems features VAT-compliant processes for an easier time managing your accounts.

- Vyapar: An Indian-based free accounting software designed for small businesses. The software lets you perform common accounting tasks that include invoicing, GST reports, and stock inventory management.

- Ledgerlite: Touted as the world’s simplest accounting, it does not even require installation or an internet connection: just download the app and start. It operates using double-entry bookkeeping principles and use it to your heart’s content.

- Slickpie: A free accounting software that offers online invoicing and billing, automated data entry, live bank feeds, financial reports, and other accounting tasks. The interface is made simple, clear, and intuitive to provide ease-of-use for even novice users.

- 17Hats: A complete business tool geared for “solopreneurs” and includes a bookkeeping component. Organize your expenses and create accountant-ready reports along with managing your other business tasks.

- Kashoo: With its software, this softwar promises a simpler accounting process that will only take 15 minutes/week. Kashoo links your existing bank accounts so you get a complete picture of your finances within minutes.

- Fyle: It is an expense management software that can make expense reporting and reimbursement collaboration seamless between the finance team and employees. The software is cloud-based, which means even if a business’s workforce isn’t co-located anymore, they can still have access to all expense data. Fyle takes care of all the mundane expense reporting, tracking, and management tasks. It enables employees to report their expenses, such as cell phone bills, subscription fees, etc., in real-time.

How does accounting software work?

Accounting software takes manual labor out of finance by automating the entire accounting process. The software takes over the capture, consolidation, interpretation, and analysis of transactional data, leaving less need for manual means of entries and, thus, fewer chances of errors. Also, you get accurate, up-to-date information on your finances, that when paired with round-the-clock cloud availability, leads to better and quicker decision making. These software solutions come in all shapes and size, from single-purpose modules to multiple-entry enterprise software.

Features of accounting software

Most accounting software contains features that work like their real-world counterparts:

- Accounts Receivable

- Accounts Payable

- Financial close

- Budget and Forecasting

- Payroll

- Fixed Asset

- Fund accounting

- Project accounting

- Revenue recognition and management

Of course, modern accounting software offers improvements not only in the data entry methods for the above, but also enhancements in data consolidation, reporting, and analysis.

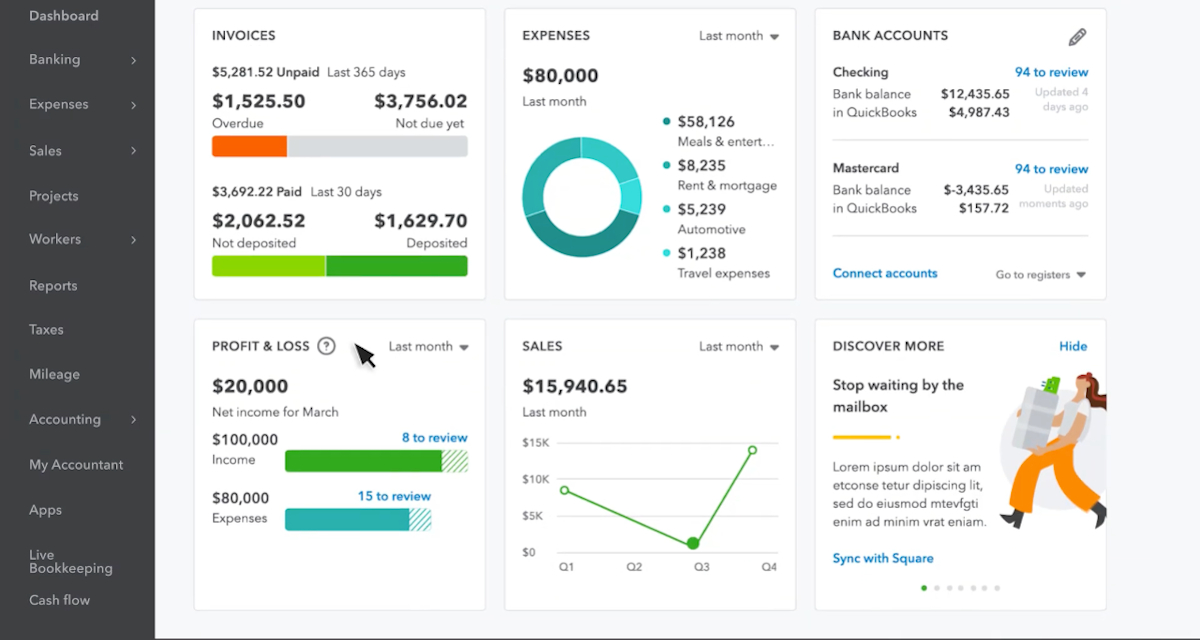

Quickbooks’s Dashboard provides a summary of the company’s financial health

Benefits of Accounting Software

- The most apparent benefit of accounting software is the preservation of data integrity. The reduction (or removal) of manual data entry greatly reduces errors in the information. This results in more accurate reports about your company’s financial status.

- Modern accounting software ensures the availability of reports on demand. Cloud servers ensure availability, no matter when or where data is needed.

- With the automation of previously manual tasks, accounting work becomes less tedious in data collection and gives you more time for analysis and making recommendations.

- Any improvement in efficiency and reduction in errors lead to considerable savings. Not only do you save on manpower costs, but you also avoid any potential out-of-budget expenses to fix errors.

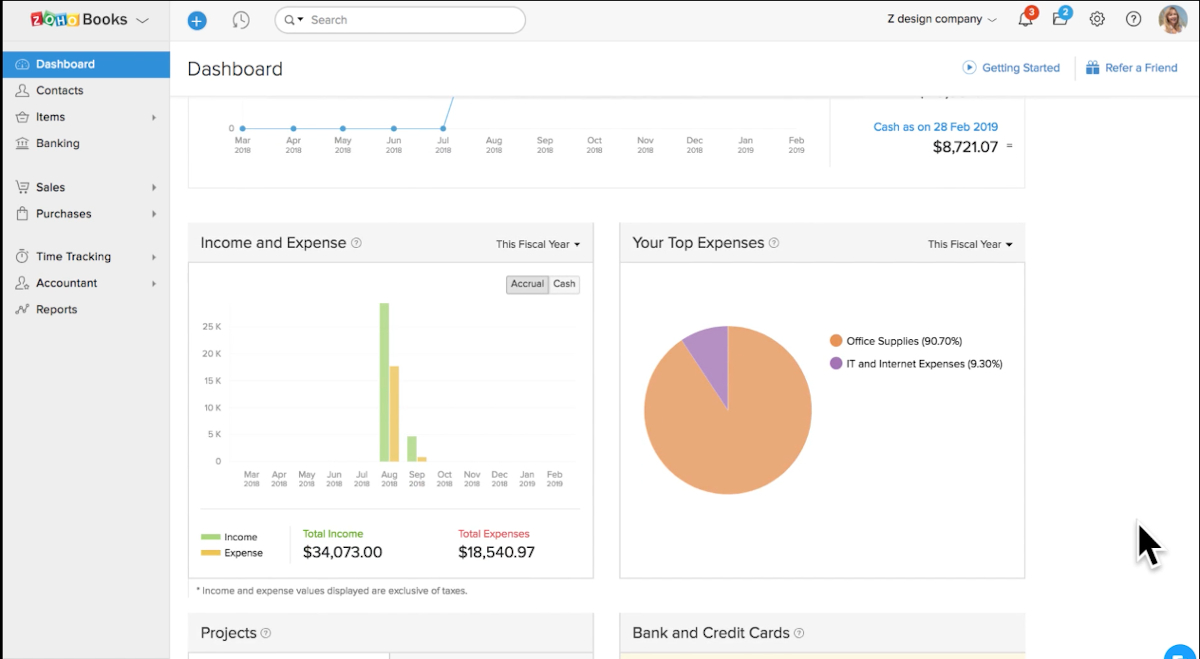

Reports are a key feature of accounting software. Shown here is an example of an expense report generated by Zoho Books.

Types of Accounting Software

Common types of accounting software include the following:

- Billing and invoicing system – features basic accounting practices. This documents all transactions about the buying and selling of goods.

- Payroll systems – provide control over your company’s wages. It automates the conversion of man-hours worked to the equivalent salary for each worker. Scheduled deductions, taxes, overtime wages, and bonuses are factored into the pay.

- Enterprise resource planning – made for big businesses. ERP software manages almost all functions of the company and ensures that data gets shared among different modules. Aside from accounting, ERPs also feature inventory management, product planning, project management, and even HR.

- Time and expense – these focus on the work areas that can still improve performance and turnaround time. Time and expense software help narrow down chokepoints and bottlenecks in operations that cause inefficiency and helps come up with solutions for improvement.

FreshBooks displays a list of all processed invoices, including their payment status.

Latest trends on Accounting Software

While accounting has already benefited from technological leaps in bookkeeping, there will always be new and exciting things in the field that are potential game-changers. Some of the rising trends include the following:

- Improvements in OCR can help reduce the need for manual input further. Already scanners can read and convert receipts and accept check photos. Further advancements may help authorize signed receipts and other forms.

- Outsourcing accounting services is on the rise, and with it, the need for software that is not dependent on physical storage. With potential savings in the millions, more and more companies will see outsourcing as their next step forward.

- Big data is making its mark felt in accounting. With less time to ensure data accuracy due to software automation, CPAs are now turning to data analytics to help improve businesses. It only gets better from here.

Potential Issues with Accounting software

Apart from bugs, software sometimes poses risks when haphazardly implemented. It’s always best to check the caveats before committing to a purchase.

- Security will always be a concern when dealing with sensitive information. Who ensures your data’s security becomes equally important as those who handle the data. This is why the choice of software should also consider its security.

- Depending on your business objectives and mission, you may experience growth beyond your software’s means. A scalable accounting software that can handle growth might be something for consideration instead of the off-the-shelf solution.

Factors to consider when choosing the right accounting software

- Costs for accounting software may be variable. Some may charge per user, per module, or the whole package regardless of users. Given your company’s size and requirements, you may need to check first which package fits your needs and your budget.

- Your business may require integration of your accounting software package to your other areas like inventory, CRM, online sales, or warehousing. An accounting software that features integration with finance-related modules would be an ideal choice.

- Getting a one size fits all software solution when your business depends on a specific industry may cause problems in the long run. Make sure your software fits your industry and not the force the other way around.

What accounting software should I consider?

Accounting systems have undergone a massive upheaval over the last few years, and the age of spreadsheets is slowly coming to an end. Fortunately, solutions that offer a vast improvement in efficiency, accuracy, and ease-of-use widely available. If you haven’t yet, you should consider trying modern bookkeeping software and see the difference. Don’t stop at one or two products. Depending on your company’s size, it would be wise to go through a couple of recommended solutions and see which one fits your needs and your budget best.