Accounts payable, or AP, is a subset of accounting that deals with recording, managing, and finally paying the money owed by the company to its suppliers or creditors. An analogy can be made when running a household: bills from electricity, phone, cable, or other regular services all comprise AP. In a business, however, these “bills” are numerous and come in broader or multiple forms or modes, which is why help in the form of accounts payable software is needed.

There is a clear benefit to using AP software to automate these processes. Manual invoicing and processing take time. If an accountant does it, it’s a waste of their time and skill that could be better reserved for higher-level tasks. In fact, studies show that companies that use AP automation can save up to $16 per invoice.

Put another way; it can also save an hour a day so your accountants can do more tasks instead of filing paperwork.

This post will introduce you to what accounts payable software is, what it can do, and provide some examples that can help you choose one that your company’s situation requires.

What Is Accounts Payable Software?

Accounts payable software is an application used to track, manage, and automate your company’s accounts payables. Because an AP department in any accounting division handles huge amounts of data, including purchase orders, invoices, contracts, and reports, AP can streamline the workflow associated with each by removing repeated, mind-numbing tasks, thus, leaving only the ones that need human input to its users.

These solutions encompass a variety of features that cater to different levels of experience, company size, and needs. Some AP software solutions are full-featured accounting platforms that connect directly to your ERP, while some are nothing more than single-entry bookkeeping programs that assist an AP officer in tracking and maintaining the general ledger.

Why do you need an accounts payable software, though, when you have an employee whose task is to manage this part of your accounting and finances? This is because AP software can do much more, with much greater detail and accuracy, than any human operator. By eliminating manual tasks, it also minimizes errors and keeps all records up-to-date. Automating AP lets your focus on your company’s growth without incurring penalties and helps you get a real-time grasp of your organization’s financial health.

List of Best Accounts Payable Software

There are various examples of AP software, but some deserve mention. Ten of the noteworthy ones are below.

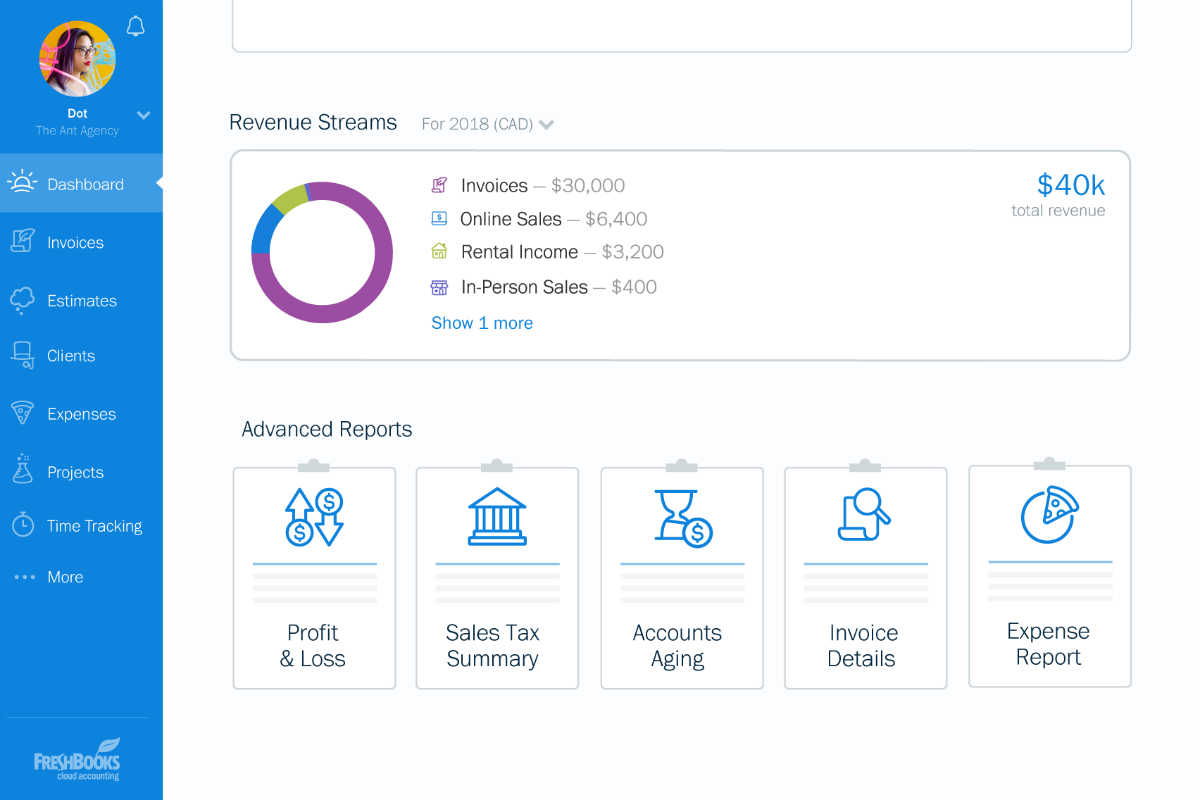

- FreshBooks: FreshBooks streamlines client invoicing, time tracking, and recurring payments designed specifically for designed for small and starting businesses and freelancers. FreshBooks is offered at competitive rates but comes with a robust set of features you’d expect only to find in more upscale applications.

- AvidXchange: AvidXchange is a comprehensive AP and billing solution trusted by over 5,000 B2B companies across the United States. It eliminates paper invoices and automates payment processes using its several modules. These modules range from PO modules, invoicing modules, and more.

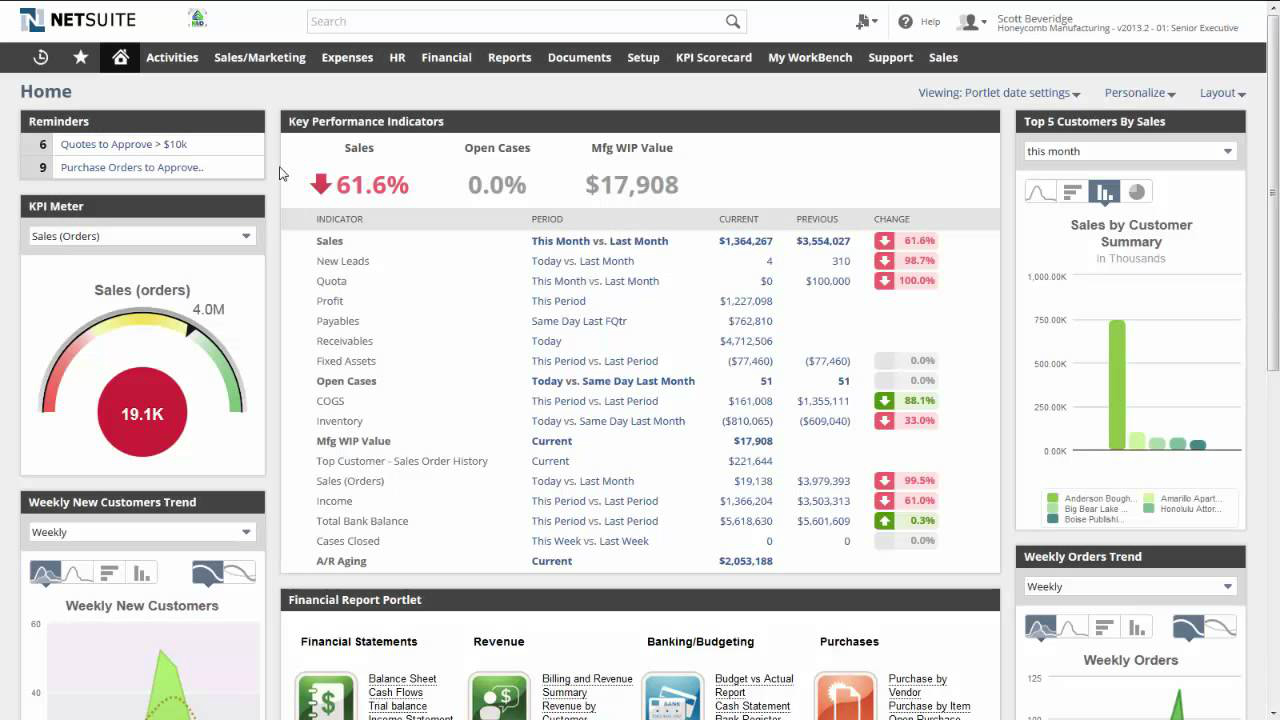

- NetSuite ERP: NetSuite ERP is an ERP platform designed to cover all your company’s financial management needs, whether you’re a small business or a large enterprise. It automates many of an organization’s backend, including accounting, billing, inventory management, purchase orders, asset management, and reporting.

- PaySimple: True to its name, PaySimple is a user-friendly cloud-based AP/AR automation platform. It offers features and tools that minimize time wasted on chasing and monitoring payments. Like any accounts payable software, you can automate all invoicing and provide your customers with a variety of payment options.

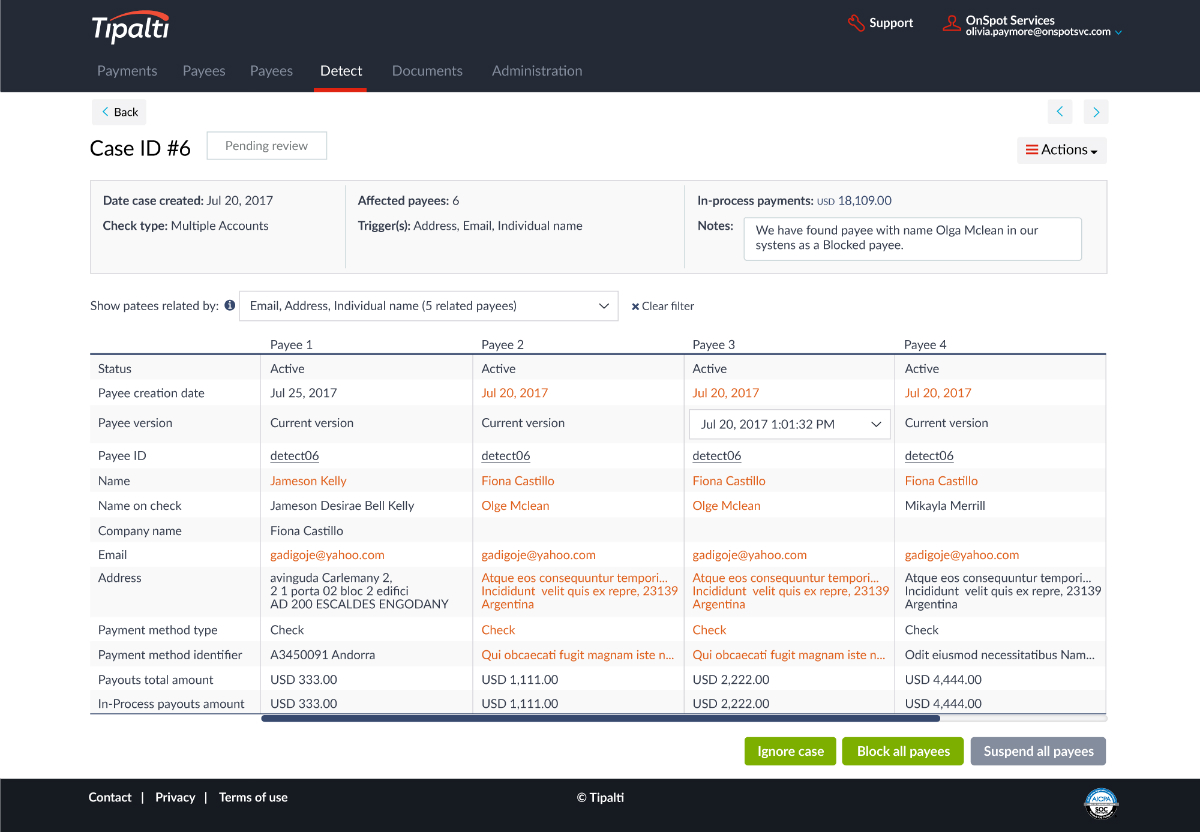

- Tipalti: Tipalti optimizes payment to reduce finance management times. Tipalti can turn complex and confusing processes into a mundane, automatic task. Tipalti is highly accurate so you not only get to slash your accounting times significantly but make sure you do it with utter precision.

- Concur Invoice: Concur actually has several software modules in one, and one of these is Invoice. It offers a dynamic toolset to integrate with your PO and invoicing workflows. It can automate vendor payments through various methods and even features a supplier self-service portal.

- Zoho Books: Zoho Books is part of the Zoho family of products concerned with the accounting side of any business. This software is a user-friendly accounting solution that can handle all aspects of an organization’s cash flow and can help you make data-driven decisions with its insightful analytics and reports.

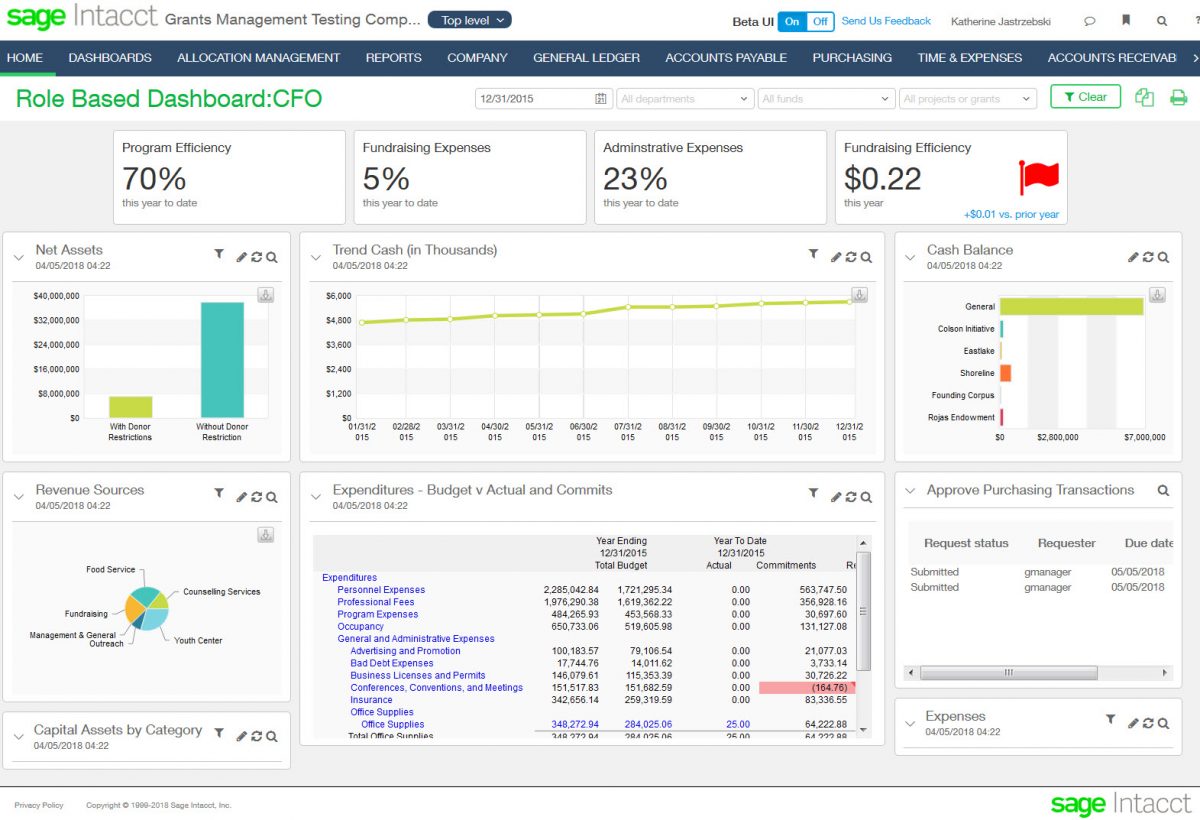

- Sage Intacct: Sage Intacct is an innovative financial management application, making it the preferred financial application for AICPA businesses and leading CPA firms. It comes with cash, order, and spend management tools, AP/AR, and other features to extend the software’s functionality.

- Bill.com: Bill.com is among the leading digital business payments companies, which facilitates 200,000 users to make and receive payment. Its Business Payments Network allows SMEs to access a simple online bill payment process, alongside unlimited storage for invoices, custom invoicing, and collaboration.

- FreeAgent: Feature-rich FreeAgent is an online accounting solution that sees a lot of use among small businesses and freelancers. It offers a slew of tools that can help users manage several facets of the financial and accounting side of a business, including payroll and managing expenses.

FreeAgent is an example of an accounts payable software geared toward small businesses and freelancers.

How Does AP Software Work?

Employing AP software is simple. Operators simply feed the software with all types of invoice that are then converted to digital form. This is usually done using an optical character recognition (OCR) scanner, though other forms may also be available depending on the company. Modern AP solutions also come with OCR out of the box.

Next, the software will route the invoice through the digital workflow. This workflow will be based on how the organization handles AP and accounts receivable (AR). Some AP solutions are also integrated with ERP, or even part of an accounting software that, in itself, is sometimes part of an inclusive ERP.

Other things that an AP software can do include receiving invoices (such as opening, sorting, and managing metadata), audit trails, routing, and escalating workflows, automating data extraction, and document storage.

This might seem simple enough that any human can do it. This, however, is the beauty of the system. AP software can process this thousands of times in a minute while also performing other tasks, letting you have a handle on your company’s financial data, and stay on top of your game.

What Are the Key Features of an AP Software?

There are various features of an AP software, and it all depends on which type of industry or the size of the business the application is marketed toward. Still, to be qualified as an accounts payable software, it needs a number of core features that would distinguish it from other accounting software.

Some of these features include:

- Process huge volumes of accounts payable documents, such as supplier data, invoices, or credit

- Match these documents with the corresponding purchase orders

- Act as an approval process for payments and transactions

- Use document imaging features like OCR to convert paper-based invoices or documents to electronic, software-readable formats

- Issue e-invoices and allow payment submissions

- Streamline and automate accounts payable workflows, especially repetitive tasks

- Support multiple payment methods

- Provide a searchable database so users can search for and retrieve records

- Offer an SSoT (single source of truth) for these records

- Have reporting and analytics features

- Comply with local, international, or company-wide policies for accounting processes

- Integrate with other relevant software, such as accounting or ERP

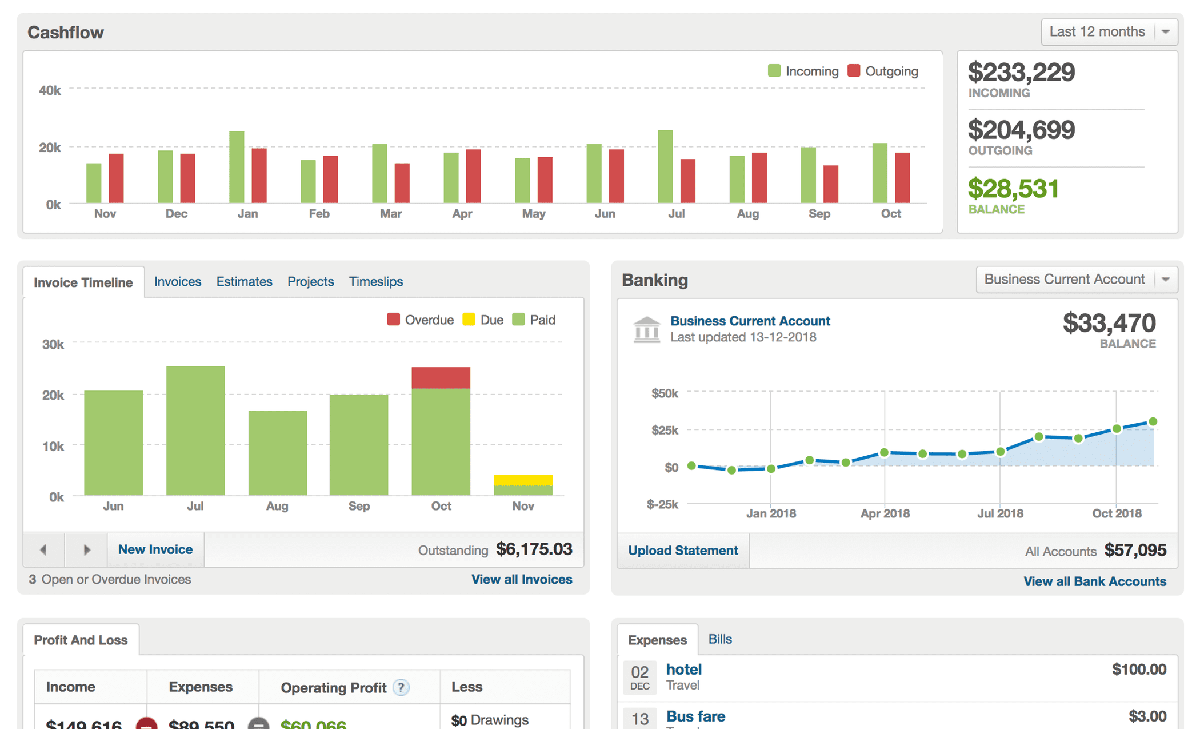

The dashboard of FreshBooks is clean and user-friendly, guiding users to the functions that they need.

Note that some accounting or ERP software, especially those with more robust features or more premium plans, have accounts payable features already built-in. This doesn’t mean that a separate AP software is redundant; however, as a discrete AP solution may simply cover gaps that built-in accounts payable features have no support for (or are lacking in).

What Are the Benefits of AP Software?

Processing credit memos and invoices are not only demanding but very repetitive, and doing it by hand just opens professionals to human error. And if your figures don’t match, it means you won’t have a solid grasp of your financial condition and would make you prone to committing a grievous mistake. Noncompliance would even be a factor.

By contrast, an accounts payable software can eliminate the tediousness of these tasks and, therefore, remove the possibility of human error (unless there is an error in the input, to begin with). It can also process large volumes of accounts payable data all at once, which would be impossible for strictly manual processing.

Here are the benefits of an AP software laid out in a more in-depth fashion:

Increases your company’s financial agility

Using an AP application is basically outsourcing these tasks to a machine. In essence, outsourcing is a strategic delegation of time-consuming, low-value tasks so you can focus on bigger or broader concerns. By outsourcing these functions to software that can do them all much faster and much more accurately, you can utilize fewer resources far more efficiently. This results in a high-level economy of scale, which is attractive for industries where low margins are common—but are ideal for any organization that needs to focus on growth.

Minimizes risk

In accounting and in other financial-related tasks, compliance is the norm. There are local, international, and even company-wide policies that dictate whether transactions are legal or allowed. When you manually perform your accounts payable duties, however, human error may inadvertently permit some transactions that are beyond the norm, or even illegal.

By employing AP software, however, you automatically minimize these risks. You simply input the policies you need to comply with, and the software does the rest. It will also automatically detect and block fraudulent payments or transactions, keeping you safe from dishonest suppliers while making sure you follow regulations to the letter.

Saves on costs

Hiring scores of employees (or even just temps) only to count invoices and process them is a vastly inefficient and ultimately wasteful use of company resources. Why hire employees whose job, by definition, is irregular instead of investing in one simple application that can do the job of hundreds?

Also, you may be thinking that developing your own application can save you more money. It can, but consider this: creating, maintaining, and upgrading an in-house technology to manage your accounts payable need a lot of resources. These include time, money, manpower, and hardware, which are assets that you may not always have. Instead of investing in such a solution, purchasing a ready-made application and customizing it to your company’s requirements is much more practical. This allows you to save on upfront costs as most AP software charge by user monthly, or even by transaction.

Deploys rapidly and with flexibility

There have been AP solutions for as long as computers have existed in the modern workplace. You would likely think of accounting software as slow behemoths installed on local computers. Not so with modern ones. Like many B2B applications employing a SaaS (software as a service) model—which is hosted in the cloud and accessed either by a web browser or a mobile app—AP software can now be deployed anywhere. Setting it up takes minutes instead of hours, and it can give you a complete overview of your accounts payable in hours rather than days.

A SaaS model also gives you another benefit: no additional hardware needed, which means no need to hire support staff for it as well. An AP software as a service means your support is from the vendor itself, making them experts on the subject, and investing in upgrades, maintenance fees, and concurrent costs are a thing of the past.

NetSuite ERP gives you total control over all your accounting needs—and more.

Types of Accounts Payable Software

AP solutions run the gamut of types, based on categories such as deployment and industry. In general, though, there are three major types of AP software based on deployment: on-premise, SaaS, and hybrids.

On-premise AP software are installed on the client’s local machine. SaaS programs, as explained above, are hosted on the vendor’s server and can be accessed at nearly 100% uptime anywhere you have an internet connection, a browser, or an app. Hybrid ones have both on-premise and SaaS versions, with local on-premise data synced to your backup on the cloud. This is an advantage, as in the off chance that the vendor’s servers are down (such as for maintenance), you can still work on your local copy of the software and then later upload data when the servers are back up.

On the other hand, AP software can also be categorized by the business they’re targeting. In general, businesses that can see the most use for these applications are obviously accounting firms that look to boost revenue. They can help these organizations simplify and automate their processes by connecting their ledger to clients and suppliers. Using AP software can make them more efficient, giving them control over most transactions and a bird’s eye view of their accounting data.

AP software can also be used by bookkeepers or bookkeeping businesses that want to improve and streamline their customer records. The functions of a typical AP software can help them nurture relationships with their clients and practice under the industry they’re currently employed in.

Finally, general-purpose AP solutions also exist, which can be used by any SME and large enterprises. All businesses need accounting and audit, after all, and an application like this can offer them a centralized way to see and manage their balances and cashflows, even claim expenses, maintain inventory, and generate reports.

Tipalti is an example of an accounting software deployed in a SaaS model.

Trends in Accounts Payable in 2020

Like any other industry, AP is also subject to new movements with the potential to shake it up. We’ve chosen two below, which would likely figure to be the most important in the coming years.

AI and Machine Learning

Artificial intelligence is set to revolutionize the way people do business, from retail to services. AP is not immune to these changes. While AP automation can sometimes look like “artificial intelligence” to the uninitiated, the true potential of AI is yet to manifest in this industry. New ways of using AI to AP include intelligent invoice data capture that “learns” as you feed the system with invoice or manual entries, advanced AP analytics and AI-backed recommendations on how to improve your process, and totally eliminating human intervention.

Cloud Deployment

More software are now using the SaaS model than ever, but some AP software are still deployed using the antiquated on-premise model. This is because a locally deployed application is inherently inflexible and cannot be upgraded as quickly as a cloud-hosted solution. In other words, expect to see ERP, accounting, and AP solutions that are all working from the cloud, and with the latest networking technologies like 5G, it will be even faster than the best cutting-edge on-premise AP software.

Issues Facing Accounts Payable Software

Accounts payable, as one of the central tasks of any accounting department in a business, faces several problems. Most of these can be eliminated by excellent software, or at least minimized. Some of the major issues include:

Data Entry Errors

Inaccurate data entry is one of the banes of modern accounts payable. Manually entering invoices and billing information, not to mention creating purchase orders, is putting your business at risk of incorrect information. Even if you use software, such as a spreadsheet, studies show that almost 9 in 10 spreadsheet documents have errors in them. Backtracking and correcting these mistakes can take a lot of time, and you won’t even know if you had caught them all.

Processing Takes Too Much Time

While we’re on the subject of time, manually processing invoices can take even more time, which you probably won’t have. This is one of the most time-consuming tasks involved in accounts payable, and its repetitive nature can quickly become tiresome and lead accountants to commit mistakes.

Instead of manually processing your documents, however, AP software can automate these tasks by up to a factor of five. That just means you can process invoices five times quickly, and you can process more.

Sage Intacct is a one-stop-shop for all of your business’s financial needs. Shown here is a typical dashboard (note the Accounts Payable menu at the top bar).

Factors to Consider When Choosing AP Software

Naturally, with these many options, you’ll be hard-pressed to find one that actually works for you. Before you cite the Choice Paradox, here are a few ways to sort through your choices and find one that works for you. Note that we’ll go past the regular AP features all AP software should have, but these few things are the icing on the cake, so to speak.

Custom User Dashboards

Most AP software can accommodate multiple users, but that’s where it can get really confusing. This is why the AP software you should choose must be able to support custom user views or at least allow you to set permissions for each user, user level, or type of user. For example, an invoice approver should have an easy-to-use UI to facilitate approvals, while more advanced users need more granular control functionalities.

Integrations

AP is part of a larger business ecosystem, which is accounting. And in some businesses, especially the larger ones, accounting is part of ERP. This means an AP software should be integrated tightly into your other business processes, and a siloed software is no better than a spreadsheet. Look for solutions that can support third-party applications, or at least can be integrated via Zapier. The more the integrations, the better the software typically is.

Pricing

Finally, the pricing of any product can make or break its success on the market. Software is no different. Modern software platforms are now on a SaaS model, which means the application is hosted on the vendor’s servers, and you can access it using a subscription. When comparing pricing, however, the monthly recurring fees are just the tip of the iceberg. Some may have additional charges when processing invoices, or others have poor support. Compare their features carefully and decide whether that additional 1,000 invoice or the 24/7 support is worth the extra bucks.

Accounts Payable Automation Is the Future

Managing accounts manually can dry your productivity and waste a lot of your man-hours devoted to a tedious, unskilled task. This is why you can let software do all these things for you in a fraction of the time, cost, and number of errors.

The question of whether you need an AP software is, thus, irrelevant; every business needs one, whether you’re a small, one-man team, or a multinational conglomerate. Fortunately, you will never have a dearth of AP software available for any conceivable purpose. From the small business-friendly FreshBooks to a more complete package like NetSuite ERP, you will have all the accounts payable solutions you will ever need.