In 2018, a survey revealed that 61% of small businesses did not have official and documented budgets. This practice seems to be most prevalent among business ventures with one to ten employees only. Because of this lack of understanding of the importance of a budget, these small organizations are risking their financial health and stability.

This can only lead to problems in the future that may impede their growth. That is because apart from being a safety net, a budget plan is a business’s benchmark for their goals. Without it, they have little to nothing to utilize when trying to measure their performance.

However, if these businesses begin planning their budgets, they can track where their money goes and who is responsible for the expenditures. Thus, they can understand their spending behaviors and find ways for optimization.

Doing so manually can be problematic, though. That is why budgeting software came to be. This kind of software solution lets users create budget plans and track cash flow. On top of that, it can have advanced functions like forecasting and profit and loss reporting. Some are also equipped with visualizations for a better understanding of the budget data. You can learn more by reading our in-depth guide below.

What Is Budgeting Software?

Budgeting software is an application that you can use to plan your future expenses. It can be simple, or it can be sophisticated–depending on your needs. There are systems that scale from the basic functions to the more complex ones. Meanwhile, there are also solutions that are limited to elementary or advanced capabilities. In any case, it aids your business in doing away with manual tasks so that you can focus on ensuring that your accounts are balanced.

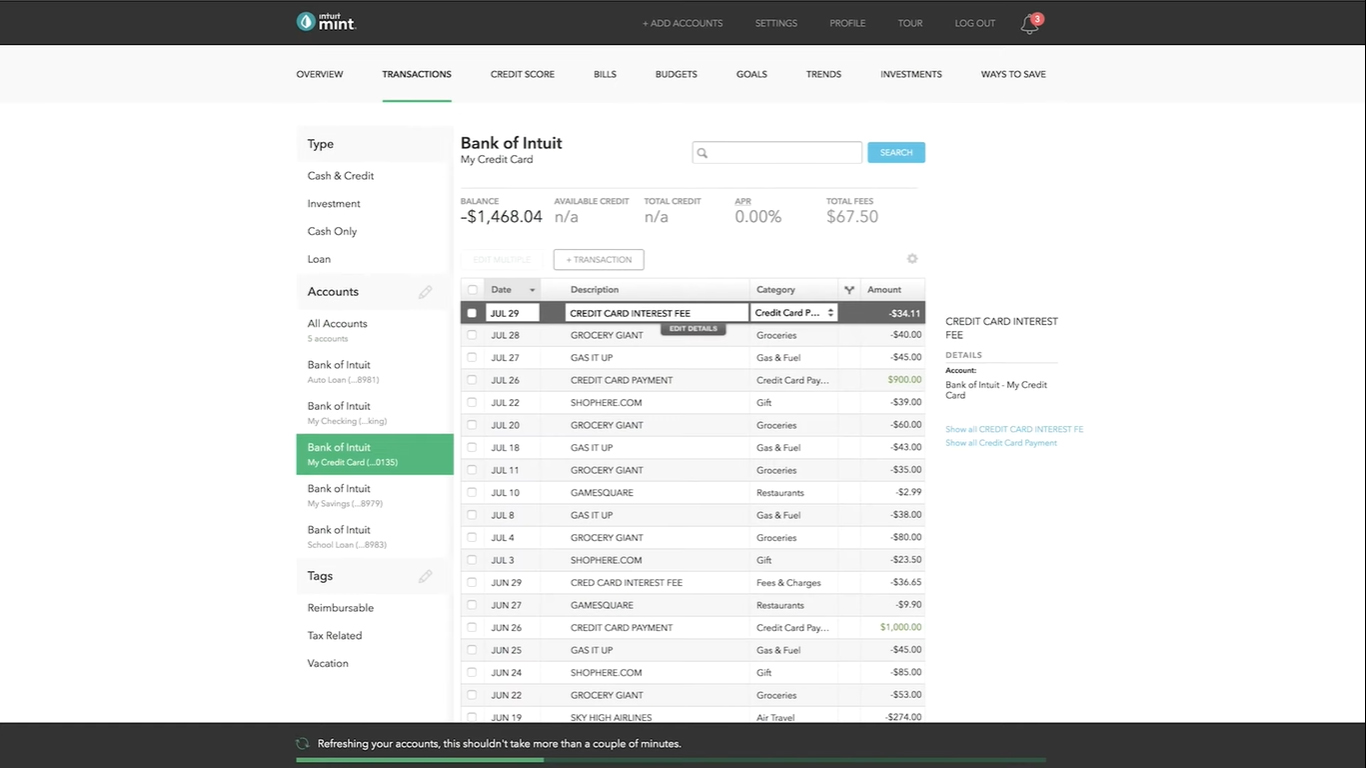

Intuit’s payroll software, Mint, is popular not only for being free but also offering features that you would have to pay for with other payroll solutions.

List of Best Budgeting Software

There are plenty of ATS in the market, but only a few truly stand out. Here are some of them:

- Mint: This online budget application comes free from Intuit, the same company that developed QuickBooks. It can aid you in managing your cash, credit debt, investments, and more.

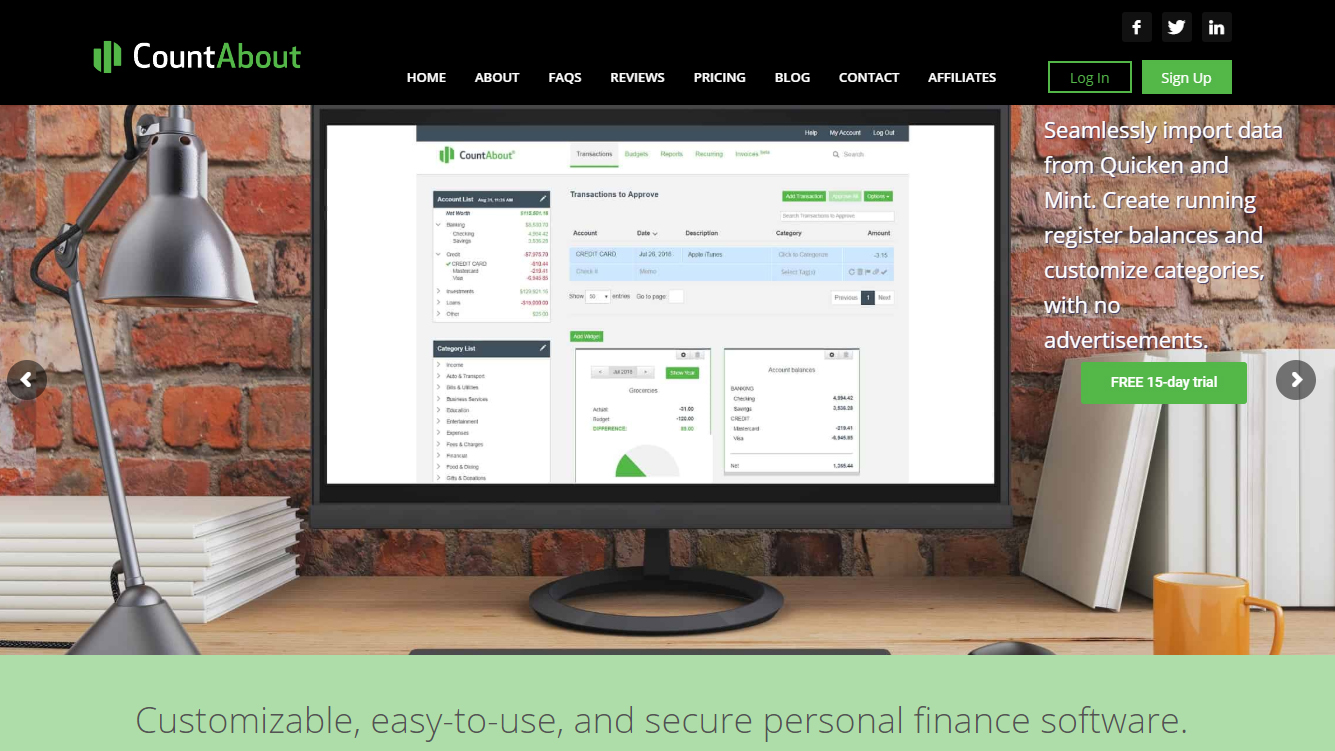

- CountAbout: This web-based solution enables you to keep track of your budget by letting you import data from Quicken, Mint, and your bank, credit, retirement, and investment accounts.

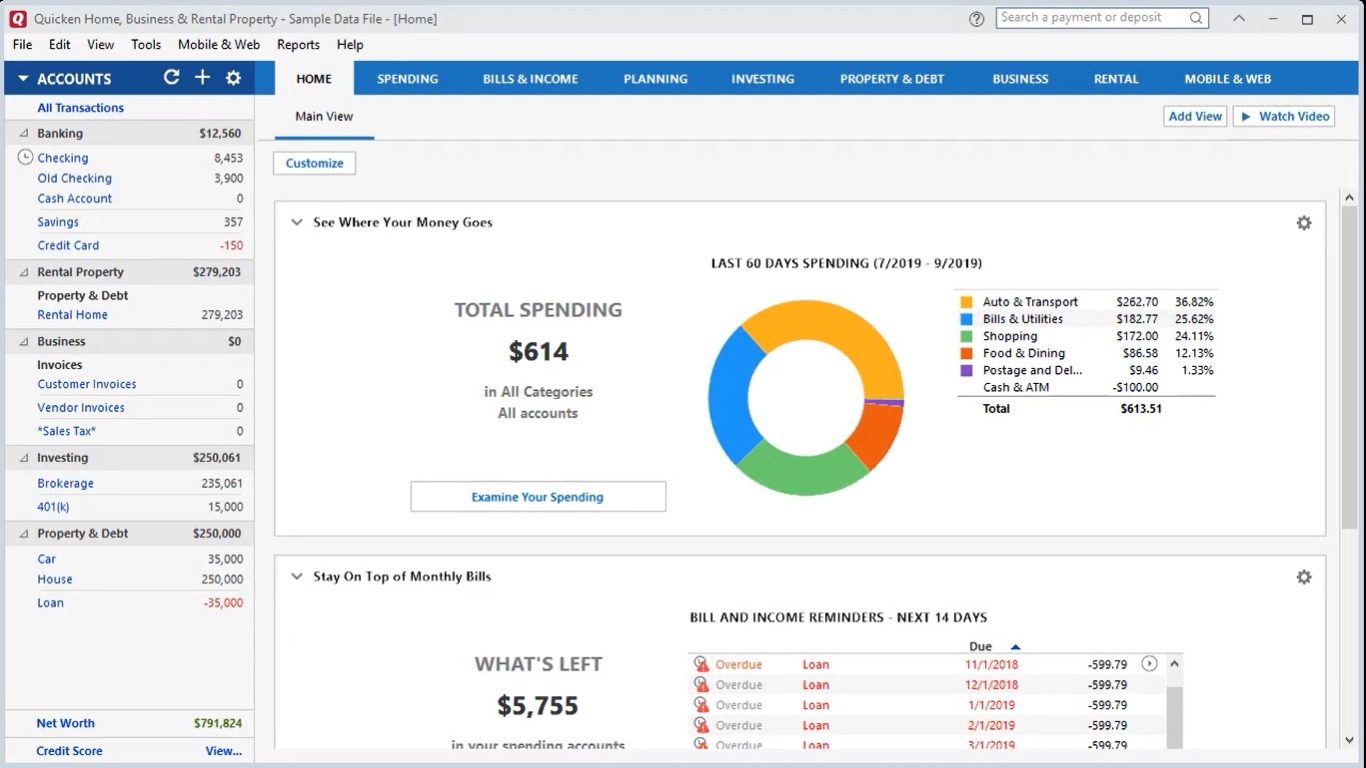

- Quicken: An on-premise budgeting software available for Windows and Mac. It provides depth when it comes to financial management because it organizes everything related to your expenses and investments in one place.

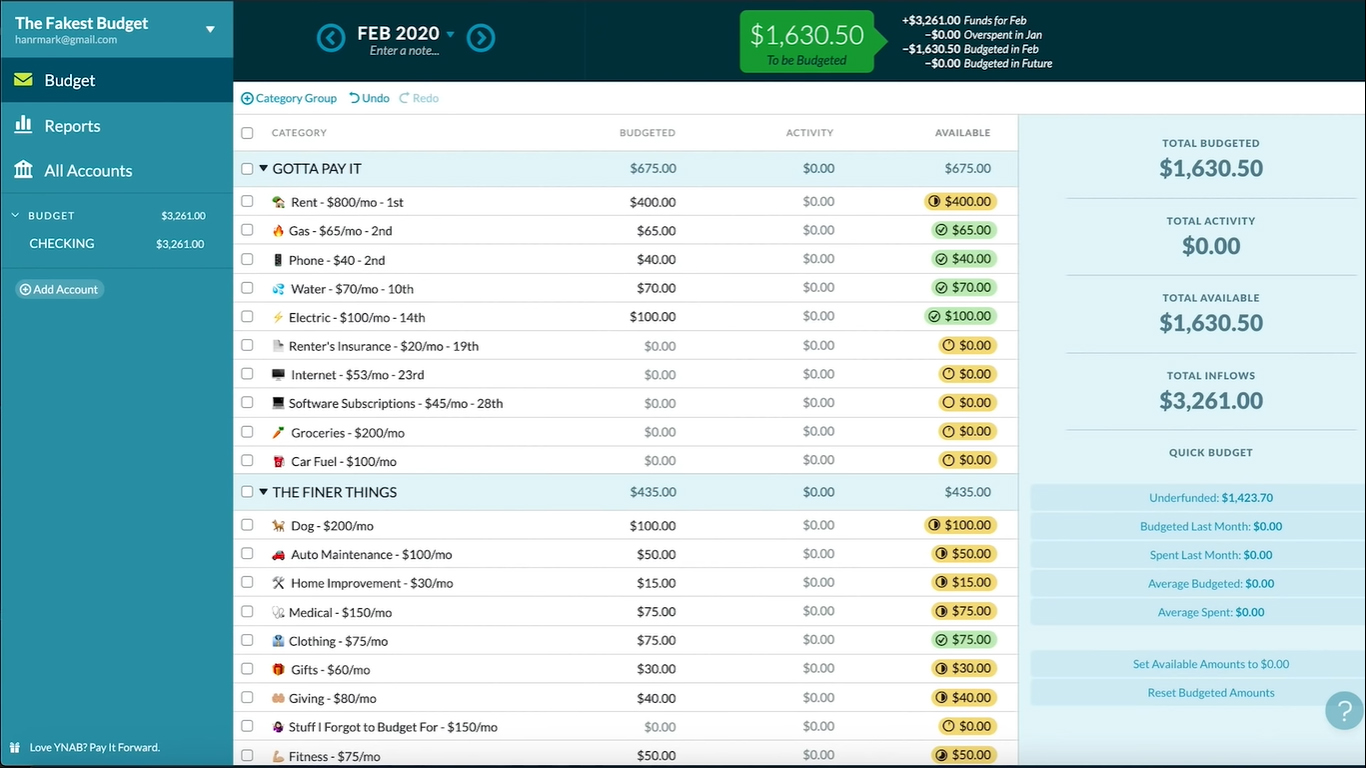

- You Need A Budget (YNAB): This easy-to-use software keeps you on budget with its four rules to help you control your expenditure and save money.

- BudgetPulse: With this platform, you can get a good grasp of your finances just by looking at visualizations. That is because the software has charts and graphs that present your cash flow to make it easier for you to achieve your financial goals.

- Moneydance: If Quicken is for Windows, then Moneydance is for Mac users. It has capabilities that are similar to Quicken and it allows users to set up a budget. It even helps users to keep track of their bills, as it rings alarms when a bill’s due date is coming up.

- Mvelopes: This application pushes a one-of-a-kind budgeting approach that enables users to save 10% on costs and expenses. Because of its methodology, you can also reduce stress since you do not have to keep worrying about debt.

- Personal Capital: If you have multiple bank accounts, you can still keep track of transactions in one place because the app lets you import data. It has a wide array of charts that you can use to get a good look at the status of your finances.

- Acorns: While you watch your budget, you can invest. With Acorns, you can grow your money with just spare change. This way, you can have cash that you can set aside for a certain goal or for whenever a rainy day comes.

- Budget Maestro: Perfect for small businesses, this software is an accounting solution that can help pay invoices directly from the platform. It also includes forecasting to assist companies in planning future budgets.

Detailed screen in payroll software YNAB.

How Does Budgeting Software Work?

Budget Plan

With a budgeting software, you can set a budget ceiling for projects or the entire organization for a certain period. In this way, you can check your expenses regularly to see whether you are limiting your spending. And in case you are going over, you can either adjust your budget or your expenditure.

Tracks Expenses

One method that can help you make sure you are still working within the budget is by tracking your expenses. And a budgeting software does just that. It lets you add any expenditure you have made under a project or a category. By doing that, you can see how much you have spent already against a budget.

Keeps Receipts

Accountability is important when it comes to budget planning. That is why budgeting apps can keep your receipts for you. You can upload them to the system and attach them to expenses. This way, you can ensure your accountants that your expense is valid. This is also beneficial in case you need reimbursements.

Who Is Budgeting Software For?

Having a budget is important to every undertaking. It doesn’t matter if you are a small team or if you are a large enterprise with a finite fund.

-

- Project-based teams. Clients usually set budgets when working on a project. It is crucial that the team handling requests stick with them. With a budgeting solution, they can keep track of expenses and adjust if they are spending money too fast.

- Growing organizations. If yours is a booming business, you can utilize a budget software to track past performance. With it, you can have a good idea of how much you need to set aside for future activities.

- Established enterprises. Even large companies that have a steady income flow need to set a budget for every undertaking. This is crucial, especially if they have different revenue-making activities that require their own budgets.

Types of Budgeting Software

If you are just starting to learn about budgeting software, you will find that there are multiple types. There are free and basic solutions, and there are top-shelf applications. They also vary widely when it comes to their features. On top of it all, they have different deployment types, which we will tackle below:

- On-premise budgeting software. This kind of software requires a one-off payment or has a payment plan that covers the ownership of a lifetime license. You can choose to sign up for future upgrades for a fee, too.

- SaaS budgeting software. Unlike the previous type, this has a flexible pricing scheme. Vendors usually offer two options: monthly or annually. This is becoming more popular since companies do not have to worry about maintenance and updates.

- Cloud-based budgeting software. This is not to be confused with the SaaS type. This is accessible straight from a web browser and can range from free and simple to costly and sophisticated.

One of the more popular cloud-based payroll software is CountAbout, which also works with Mint and Quicken.

Main Features of Budgeting Software

- Cash flow management. With budgeting software, you can track the money coming in and going out.

- Accounting. A budgeting app helps companies keep numbers in balance with profit and loss statements.

- Forecasting. Sophisticated budgeting solutions have forecasting capabilities that base predictions on historical business data.

- Reporting and analysis. This feature allows every business unit to have a comprehensive look at their spending. Some software solutions may also include interactive visualizations.

Report and analytics dashboard in Quicken.

Latest Trends in Budgeting Software

- Artificial intelligence is in demand. Developed countries are looking for budgeting software with AI and are the ones driving growth in different regions. This is because AI can be configured to plan annual budgets and assist in making informed decisions.

- Predictive analytics is also a trend in budgeting software because it provides organizations with an accurate expense forecast. It can even compare historical cash flow data and expense

Benefits of Budgeting Software

- Accurate data. Even the best number cruncher can be prone to mistakes. That is why it helps to have a budgeting software. With it, you can avoid errors to have accurate data and even expedite calculations.

- Uniform reports. Reports prepared by employees can be reusable if they are uniform. That is exactly one of the things that budgeting software can do. Thus, abstracting the need to generate the same reports repeatedly.

- Improved forecasting. Advanced budgeting applications have smart algorithms as part of their foundations. Because of that, they are capable of producing accurate forecasts.

- Simplified budgeting. Preparing a budget plan and keeping track of it does not have to be a complicated affair. With a budgeting solution, you can save time because of automation.

Potential Issues of Budgeting Software

- It does not support more than one user. Budget planning is not something that can be done by one person alone, even with the help of powerful budgeting software. It requires collaboration to hurry the process along. On top of that, some steps require approvals. That is why when you are choosing a budgeting app; you have to go for one that is multi-user to avoid bringing your process outside of the immediate software system.

- It cannot import or export data. If for any reason you need to import or export information, your budgeting solution should be able to let you do it with ease. If it does not have this capability, it can only hinder your workflow, as you may be forced to do double data entry.

What to Consider When Choosing a Budgeting Software

The success of your organization partly hinges on how smartly you handle your finances. That said, it is crucial that you select a budgeting software carefully. To help, here are some things you need to remember when choosing:

- User license terms. How many users can utilize the solution? How long does the contract last? These are important questions you need to ask.

- User-friendliness. Acquiring budget software is moot if your users have difficulty in utilizing it. That is why you have to check first its ease of use before signing on the dotted line.

- Integration. Your budgeting software may have basic accounting tools, but that may not be enough in the long run. Ensure that it can connect with other solutions to avoid data exchange problems in the future.

Choosing a budgeting software requires as much care as budget planning

Selecting a budgeting software requires care. That is because if you choose one only because it fits your budget or if because it has sophisticated bells and whistles, it may not work for you. Instead, you may meet difficulties in actually creating and tracking your budget. You may even end up wasting your investment because you are not using the advanced features available. Thus, you have to carefully assess the current state of your finances and list your requirements. This way, you can better evaluate potential budgeting applications.