Poor accounts receivable (AR) management leads to a number of cash flow problems. These, in turn, create a ripple effect that affects every aspect of your company. Without a methodical approach to tackle AR processes, you run the risk of delayed payments and turning liquidity issues into profitability problems.

And unless you want to join the 93% of businesses that often experience late payments from their customers, it’s high time to consider using an accounts receivable software.

You may be wondering, what exactly is this software and how can it help you manage your accounts receivables? And more importantly, how can you choose the best platform for your company?

To answer those questions, we prepared this guide where you can find all the details you need to know about an accounts receivable software. We’ll discuss its definition, key features, benefits, and factors to consider when buying one.

What Is an Accounts Receivable Software?

An accounts receivable software helps manage the accounting and financial aspects of businesses. In general, it has tools for check writing, bookkeeping, and general ledger. Some advanced accounts receivable platforms also offer additional features for invoicing, fixed assets, inventory, and more.

This type of software brings a number of benefits for every business. It keeps your books accurate, automates repetitive tasks, and eliminates manual errors. This tool also ensures that your company stays compliant with the standard regulations to avoid costly penalties.

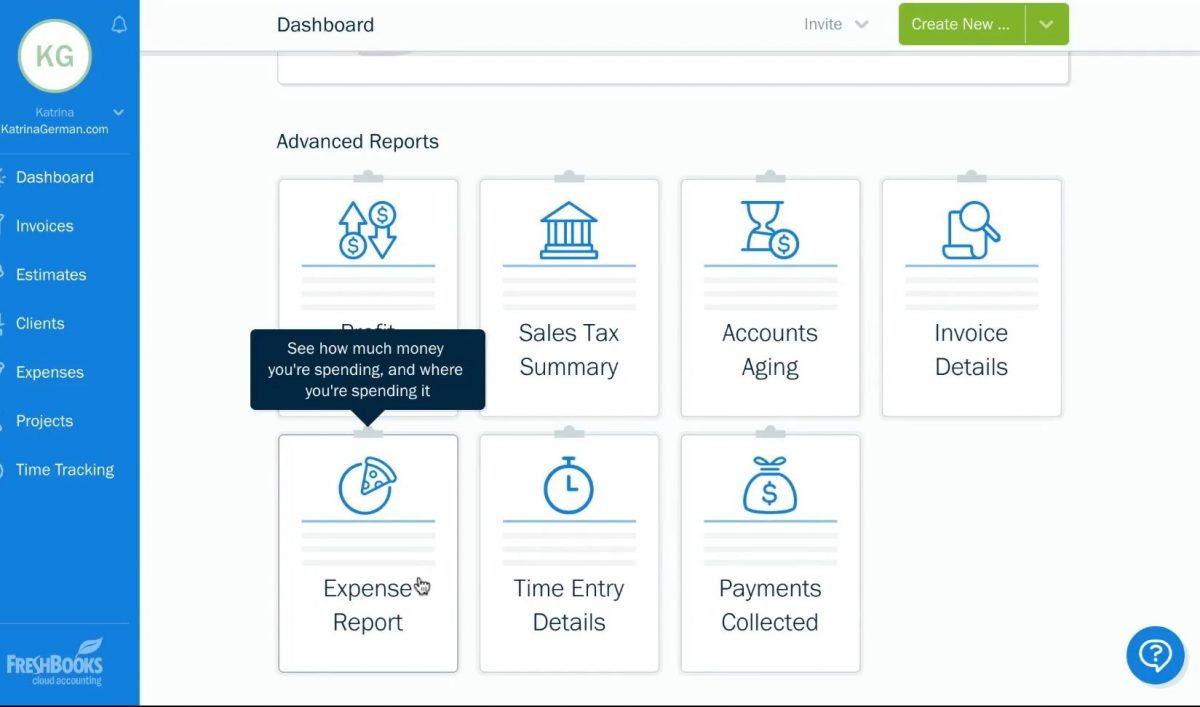

Freshbooks offers essential tools to help you manage your accounts receivables.

List of Best Accounts Receivable Software

One of the many benefits of an accounts receivable software is that it keeps your finances organized and updated at all times. To give you the complete picture of how an accounts receivable software works, let’s take a look at some of the examples below:

- Quickbooks. Quickbooks is an accounting software that lets you manage banking-related tasks with its powerful automation tools. Some of its features include expense tracking, tax calculation, and invoicing. The pricing starts at $150/month.

- Bill.com. Perfect for small to midsized businesses, Bill.com is an intelligent bill payment platform that helps you get paid on time and gain control of your accounts payable. Its pricing plans start at $39/user/month.

- Freshbooks. Freshbooks offers advanced accounting features to simplify complex financial management. It has comprehensive accounting reports that provide a closer look into your balance sheet, general ledger, and sales tax summary. It has several plans ranging from $7.50/month to $25/month.

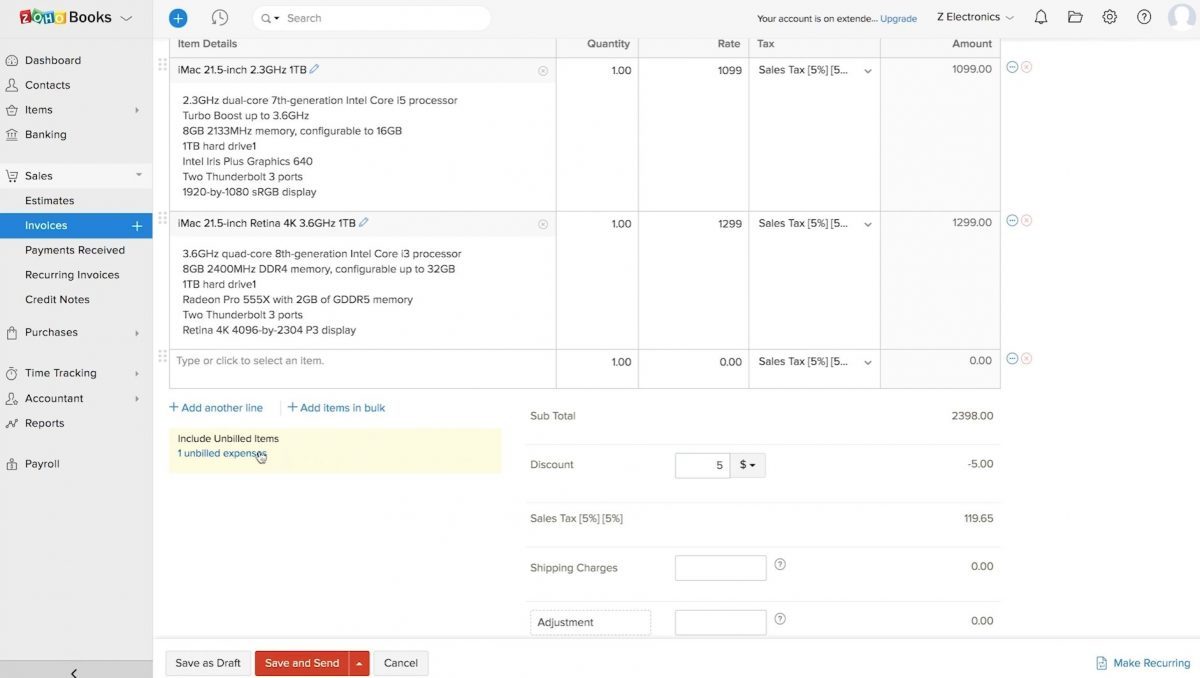

- Zoho Books. Zoho Books is a smart accounting system ideal for growing businesses. It is an end-to end solution that lets you manage your payables and receivables in one platform. Pricing starts at $9/organization/month.

- Sage Intacct. Sage Intacct is an innovative financial management platform that offers cloud computing and accounting. It has features to cover essential accounting tasks such as cash management, order management, and accounts payables and receivables.

- YayPay. YayPay is an accounts receivable management platform that streamlines credit collections, internal escalations, payment reminders, and invoicing.

- SoftLedger. Softledger automates billings and collections and helps you in the timely collection of customer receivables. It has features such as general ledger, financial reporting, and cash management. Pricing starts at $399/month.

- Acumatica. Acumatica is another accounts receivable software that keeps track of all the credit or cash your customers owe you. It helps you generate invoices, verify balances, and track commissions.

- Anytime Collect. This software offers customer communication, payment processing, invoicing, and credit and collection tools. The product offers an Essential plan priced at $3,900/year, while Standard and Pro plans are available by quote.

- Esker. Esker is an accounts receivable solution that streamlines invoice collection, credit and collections, and customer payment. It offers tools that allow you to create, assign, and manage invoice-related issues.

Benefits of Accounts Receivable Software

Whether you have a small business or a large enterprise, using an accounts receivable software can help you simplify AR management. There are a number of benefits that you can reap from using an accounts receivable software.

First, an AR software automates simple and repetitive tasks. You already know how invoicing late notices, account changes, and payment reminders can take a lot of time when done manually. Using an AR software, you can automate these functions and save boatloads of time that you can allot to more productive tasks.

Think about it: the more time it takes for you to prepare and send invoices, the more time it also takes for you to get paid. With an automated invoicing and billing tool, your customers get reminded of their due payments and have more payment methods to choose from.

AR software also gives you a complete view of your company’s financial status. Insightful dashboards and financial reports give you valuable information about your profit and loss. With an AR system’s reporting tools, you gain access to important business reports to help you determine your business’s health.

Other benefits that you may want to consider include the following:

- Reduced staffing costs

- Improved capital control

- Understanding cash-out position

- Better communication with customers

- Efficient management of digital invoices

- Minimal credit risk

- Encourages on-time payments

- Provides accurate and timely AR data

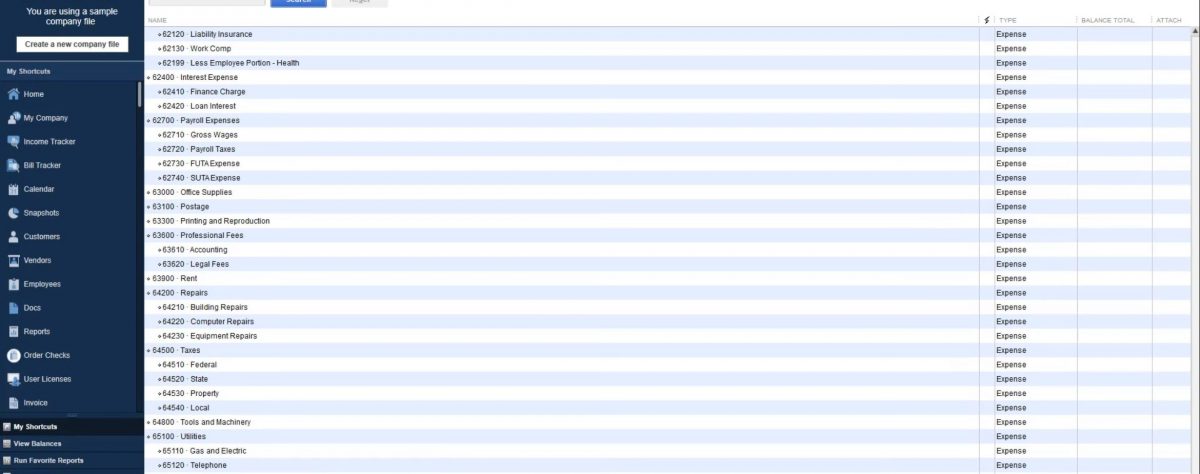

QuickBooks keeps track of your business expenditures.

Common Features of Accounts Receivable Software

When choosing an accounts receivable software, it’s important to have a clear picture of what accounting features your business needs. Do you need only the basic functions or the advanced and scalable features? Below, we listed down some of the most common features of an accounts receivable software that you should look out for.

General ledger

An accounts receivable ledger contains a list of customers and their payment history. This is an essential tool that allows you to record important information from your transactions such as customer name, sales tax, and total amount billed. It also keeps your invoices and credit and debit memos.

Expense tracking

This feature makes it easier to keep up with your business expenses. Most accounts receivable software allows you to connect the system to your bank account. This way, you can easily track your expenses and see where your money is going.

Aging report

An aging report is a list of unused credit memos and unpaid customer invoices. This is a primary tool that helps you organize accounts receivables based on your specific needs. For example, you can arrange certain columns and ranges based on payers or dates.

Payment processing

Most accounts receivable software have their own payment processing tool, which allows you to get paid directly from the platform. This feature also provides your clients multiple payment methods so they can easily clear their due payments without hassle.

Invoicing

Usually, an accounts receivable software also has an invoicing feature. It automatically generates invoices based on the customer information you have. After the invoice is prepared, it notifies your customers of their due payment. This tool relieves you of manual invoicing tasks and encourages your customers to pay on time.

This is how Zoho Books looks in action.

Types of Accounts Receivable Software

The different types of accounts receivable software vary greatly from basic tools to comprehensive accounting suites. In terms of deployment, there are two different types of accounts receivable software that you can choose from: on-premise and cloud-hosted.

- On-premise accounts receivable software. This type of tool is hosted on your own server and requires a complex setup. It involves hardware installation, which is why it’s usually the most expensive type of accounts receivable software. One great thing about on-premise tools is that you only have to pay for your user license once. It also gives you total control over the platform, making the data, hardware, and software all yours.

- Cloud-hosted accounts receivable software. This is the most common type of accounts receivable software that you can easily find. The vendor hosts the software in their server, which makes it easier to set up and maintain. Accounts receivable platforms of this type are usually paid on a monthly or yearly basis.

Factors to Consider When Choosing an Accounts Receivable Software

Now that you know what features to expect from an accounts receivable software, it’s time to pick the ideal solution for your business. Choosing a suitable accounts receivable software for your business can be a tricky task, so we prepared this short list of factors that you need to consider.

Reduced cost

Cost is a huge factor in picking which software to use. It has to be tied up to your budget and, at the same time, it has to cover all the features that your business needs. However, there are several SaaS accounts receivable products that offer pay-as-you-go plans. This means you’ll only pay for the tools you need and have the option to upgrade as your business grows.

Ease of use

An accounts receivable software should be able to make things easier for you and not add to the complication of your accounting tasks. A great AR tool is one that has a user-friendly interface, allowing your team to get used to the system fast. Vendors usually offer a free trial of the software to get you up to speed with its features.

Variety of packages and modules

There is no one-size-fits-all AR software so, as much as possible, it’s best to pick out one that can be tailored to your specific needs. Scrutinize carefully each vendor’s packages to see if you can find one that covers your needs enough. This way, you can prevent having to pay for some additional tools that you most likely won’t be using.

Centralized database and web access

Having a centralized system keeps your team on the same page at all times. Choose a platform that allows your team to access data from any location and from any device. For instance, a mobile version of the software is a helpful feature when you have a team that needs to work remotely.

Latest AR Trends

Keeping up with the latest AR trends allows you to take advantage of recent developments in the industry. Looking out for the following key trends in the receivables management sector will keep you in the know:

Personalized communication

Collecting overdue payments is no easy task; when done improperly, poor communication can lead to customers losing their trust in your brand. This is why personalized solutions are increasingly becoming popular. A platform tailored to customer preferences improves customer relationship and helps maintain good communication.

Flexible payment options

As more customers now prefer completing their purchasing transactions online, vendors are also offering them a variety of payment methods. This helps you get paid faster and reduce bad debt. With a flexible payment system in place, customers can easily access invoices and send payments directly from the platform. These payment options can include credit or debit cards, online payments, checks, money orders, cash, or payment plans.

Use of e-invoicing

Experts forecast that by 2024, 90% of B2C invoices will comprise if e-invoices. With the European standard on invoicing in effect, European public entities are now also required to receive and process e-invoices. This underlines the importance of automating invoice processing for business owners.