It’s hard to keep track of customer payments, especially when you haven’t graduated from printed documents and spreadsheets. Clever business professionals use billing software and invoicing tools to help them make things convenient and keep their records accurate. With these tools, they don’t miss payments often and keep their records pristine.

Another thing that makes billing software useful is that you get to keep everything in one place. In this way, you generate reports faster as well as accelerate the computation and filing of your taxes. Furthermore, billing software is not just for large corporations, individual professionals, and small firms can also make use of this wonderful tool.

In this article, we will explain what a billing software is and discuss its key features and benefits. Also, we’ll touch on usage trends to give you an idea of how successful businesses use it.

What is a Billing Software?

Businesses use billing and invoicing software to make accounting and financial tasks easier. There are many types of billing software out there. Some are just single-entry programs for check writing and bookkeeping. Others include more advanced features like ecommerce and even project management, while some come equipped with collaboration tools.

Also, many billing software today can be accessed using mobile phones. This feature increases collaboration and allows users to keep up with their business anywhere, anytime. Furthermore, billing software products can usually integrate with other business tools, such as CRM software, business intelligence software, maintenance management software, and many others. Users find these integrations to be useful as they enable them to consolidate data coming from other platforms. This helps save time when preparing data for analysis.

Lastly, many may think that only large enterprises can afford to use a billing system. However, software providers, especially cloud-based ones, offer product packages for small and medium-sized businesses as well. Businesses in different industries that range from manufacturing to legal firms can take advantage of the computing power of billing software products.

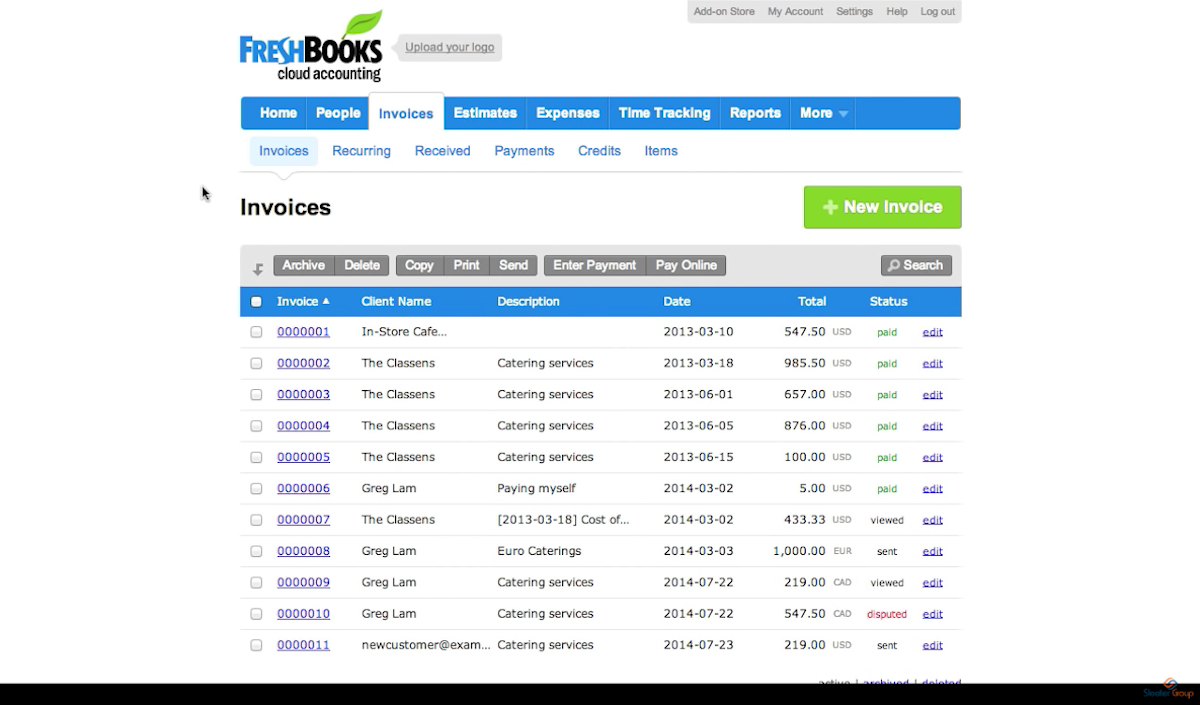

FreshBooks is an award-winning accounting tool that offers comprehensive billing and invoicing functionalities.

List of Best Billing Software

Having discussed the different deployment types, it’s time to take a quick look at some top billing software solutions available today. The products on this list are among the cream of the crop of billing and invoice software solutions on the market. Most of them also go beyond simple billing and invoicing as they offer advanced features that help users run their businesses properly.

- Freshbooks: This popular platform streamlines both time-tracking and invoicing processes. It also includes collaboration tools to help team members work together in the system as well. Some of its core features include invoice customization, estimates management, late payment fees management, online payment processing, quick discount creation, sales tax management, offline payment tracking, timers, and team timesheets. Freshbooks also includes a robust reporting module that generates reports for invoice detail, accounts aging, and balance sheets, among others. Furthermore, it integrates with other popular software like PayPal, Basecamp, and MailChimp. Lastly, Freshbooks has mobile apps for both Android and iPhone users to keep your work accessible wherever you go. Paid plans start at $15 per month.

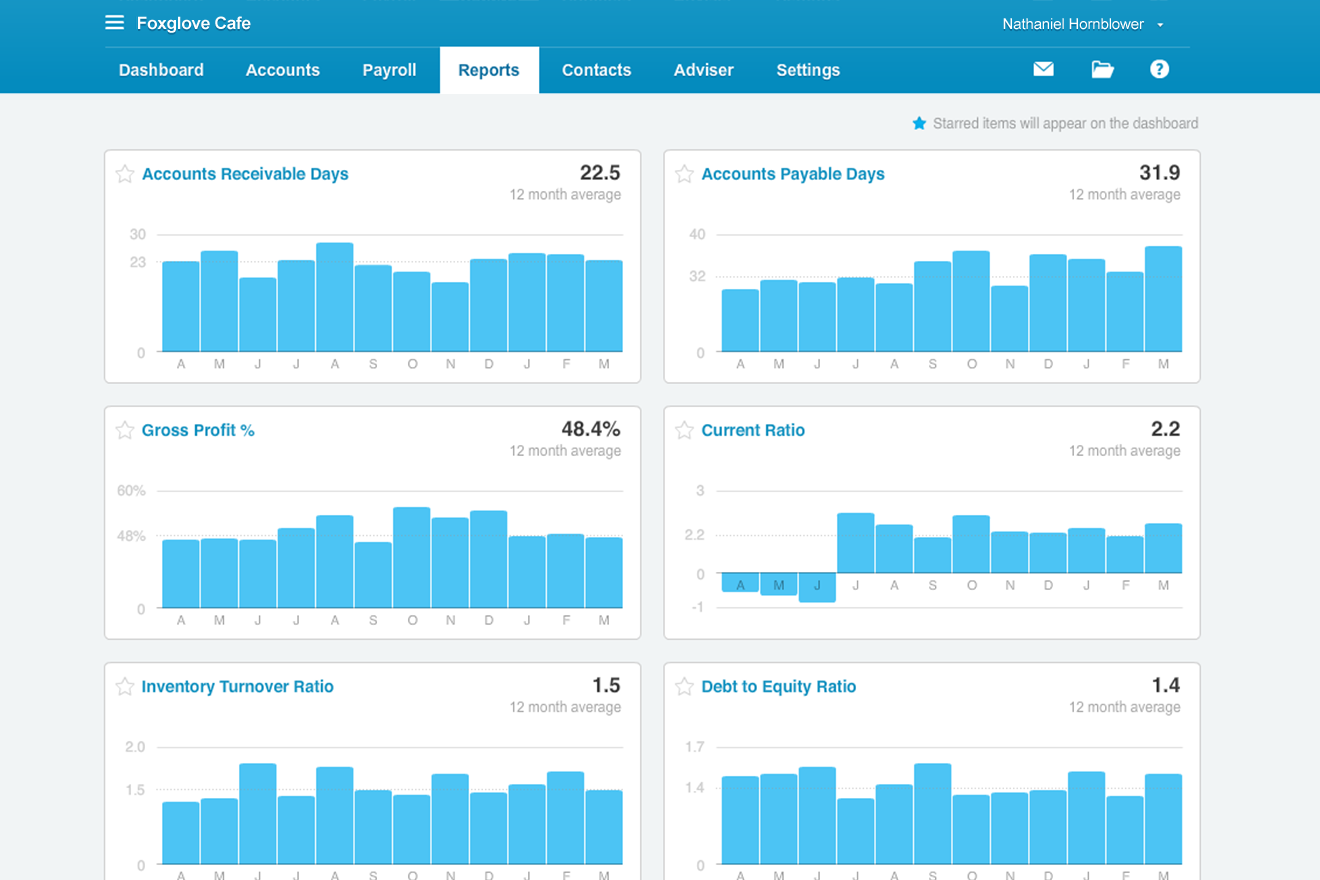

- Xero: A go-to app for many finance professionals, this is a complete accounting software that goes beyond simple invoicing and billing. It has advanced features for inventory and project management as well as core tools that include bank reconciliation, online accounting, invoicing, multi-currency support, payroll management, orders management, and financial reporting. The solution also has easy-to-understand controls and an intuitive design. Moreover, this mobile-ready platform can integrate seamlessly with other business tools, including Squarespace, Vend, PayPal, and Evernote, among others. Lastly, pricing for Xero’s paid plans starts at a low $9 per month. This includes five invoices and quotes, five bills, and 20 bank transactions. Perfect for a freelance professional business.

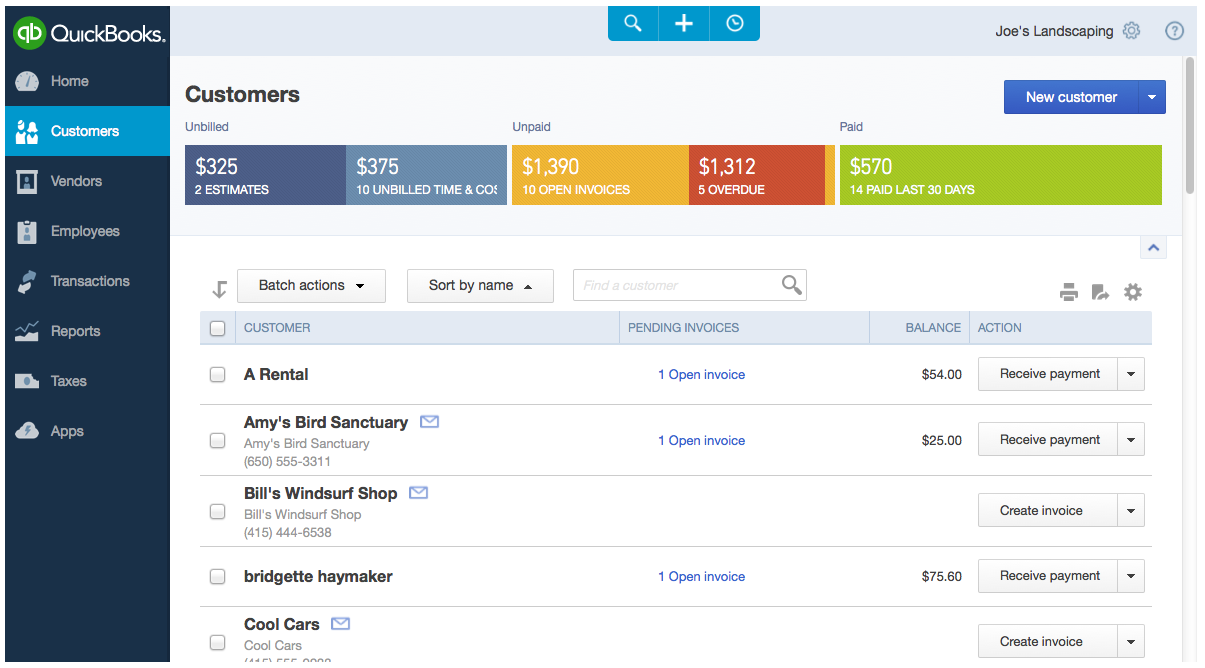

- QuickBooks: Touted as one of the best applications for small businesses, freelance bookkeepers, and startups, this solution provides tools for expense tracking, invoice management, and tax calculation. If your organization is large, you can go for QuickBooks Enterprise instead. However, QuickBooks Online already packs a big punch. Core QuickBooks Online features include modules for estimate creation, invoice management, bill management, banking data synchronization, payment tracking, automated online banking, balance sheet reporting, and profit and loss reporting. Moreover, the system has open API tools so it can integrate seamlessly with other online solutions like Mavenlink, Jobber, and Method CRM. As for pricing, paid plans start for as low as $10 per month.

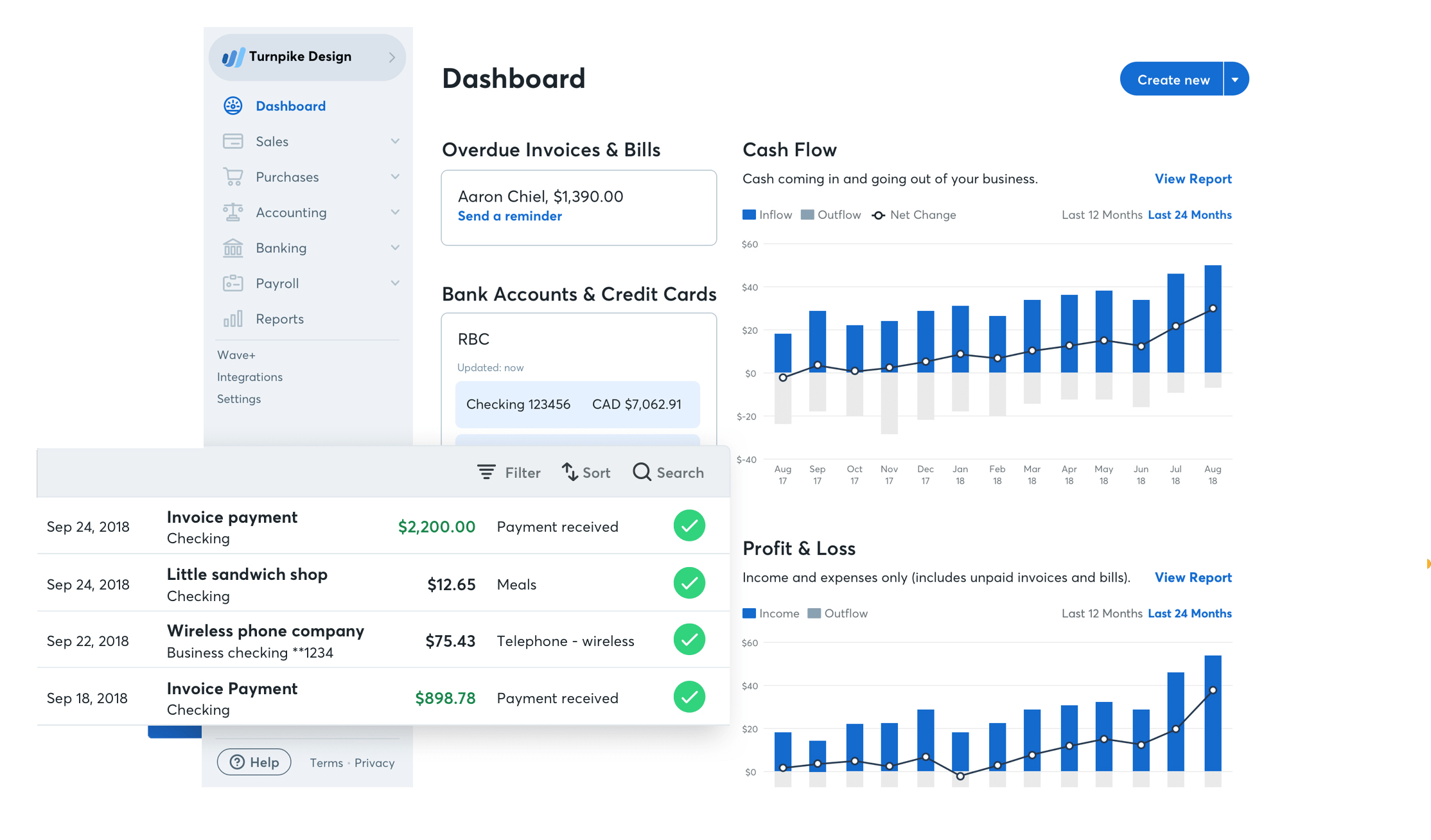

- Wave: Another accounting platform for small businesses, this combines invoicing management, receipt scanning, and accounting capabilities in one comprehensive feature stack. It is perfect for firms with 10 or fewer employees, making it ideal for freelancers, entrepreneurs, and business consultants as well. Core features include invoicing, payroll management, accounting, receipt management, yearly record keeping, direct deposit processing, and tax management. This intuitive and easy-to-use platform also works seamlessly with other digital systems, such as Etsy, PayPal, HubSpot, and MailChimp, among many others. Lastly, it has free packages for its accounting, invoicing, and receipt scanning modules and paid plans that start at $20 a month.

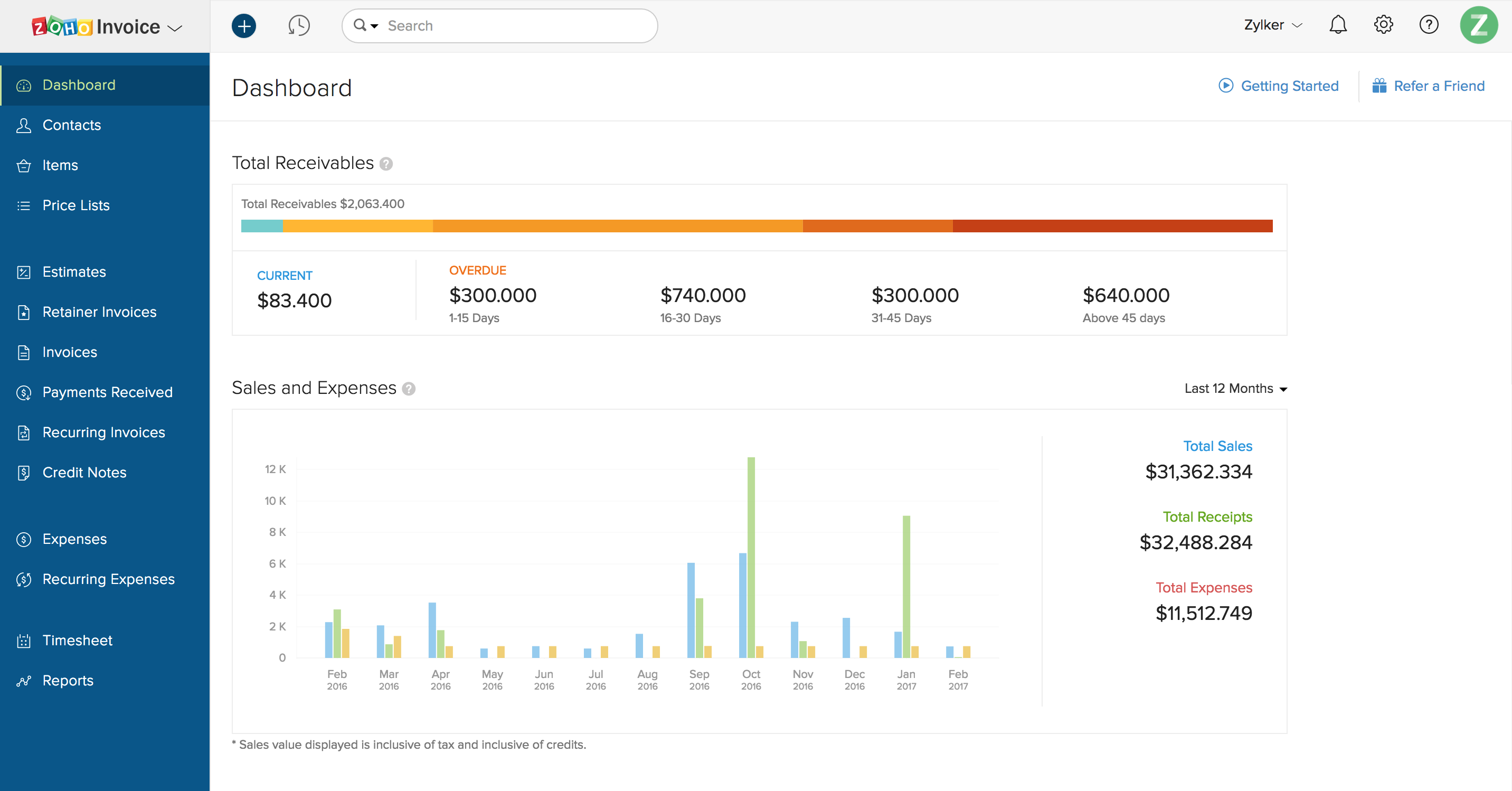

- Zoho Invoice: A comprehensive finance and accounting solution with tools for invoice management, multi-currency support, client portals, partial payment processing, and time tracking. It also has a robust reporting module that lets you generate highly-visual and easily-understandable reports. In addition, it comes with a calendar view for timesheets for easier invoice creation. What’s more, Zoho works perfectly with other Zoho products so you can extend its functionalities seamlessly. Last but not least, this mobile-ready platform can work well with other business systems. The long list includes Google Drive, OneDrive, Braintree, and Clockodo, among others. For those interested, Zoho Invoice has a free version available. If you have a larger team that requires more sophisticated features, the pricing for paid plans starts at $9 per organization per month.

Zoho Invoice is a popular invoicing tool from the Zoho productivity suite. It is known for its simple interface and robust features.

- Oracle NetSuite SuiteBilling: This platform helps you synchronize complex processes from orders to billing and revenue recognition. Many enjoy this platform as it can be used as a strategic differentiator rather than just a back-end process. Moreover, you can do different billing methods using the solution, ranging from transaction- and subscription-based to usage-based or any hybrid of the three. With SuiteBilling, you can connect transactions, subscriptions, and your projects to your billing and financial engines. Some of its key features include real-time data and insights, multi-currency support, audit logs, change tracking, flexible subscription models, easy-to-use interface, and quick reporting tools. The software is available via custom quotes.

- HDPOS Smart: An easy-to-use POS and billing software, this platform also has modules for inventory management, accounting, bookkeeping, reporting, and even CRM. In fact, HDPOS Smart is a complete suite that’s perfect for small businesses. It can be used for various retail establishments like a bookstore, computer shop, or an electronics store. Plus, it works on any type of Windows hardware, from desktops to laptops and tablets. Other features include data intelligence, offline service, payments, customization, and CRM. For a single computer, HDPOS Smart is priced at $22 per month with a minimum payment of three months. Moreover, you can always check the solution out with no commitment by signing up for its free trial option.

- ProfitBooks: This is a go-to application for many businesses who prefer using freeware. As of the writing date, it is free for startup businesses. It can support an unlimited number of invoices, products, suppliers, and sales orders. Furthermore, it helps you accept only payments and can deal with multiple currencies. This platform can also integrate with ecommerce apps for a more streamlined operations. Key features include invoice creation, inventory tracking, detailed tax reports, and many more. With ProfitBooks, you don’t only have a free software solution. You’ll also have a comprehensive platform to start with and scale once you outgrow your current needs.

- Tally.ERP 9: This is an enterprise resource planning solution complete with billing and invoice modules. With its easy-to-understand dashboards and quick reporting, you’ll have an overview of your business processes. Also, you can keep watch of your cash flow from order to fulfillment. Moreover, its other features include an inventory management module, payment timelines, and stock movement module. With this application, you can simplify the complicated and make the complex digestible. Product pricing starts at $630 for a single PC.

- Aradial: Coming from a company that’s been around for 20 years, this is perhaps one of the strongest billing software targeted for ISPs. It is complete with support for prepaid and postpaid subscribers. Plus, it includes post-paid rating tools and a customer-care module. Key features include multi-currency support, product catalog, business control engine, credit limits, prepaid statements, and many more. Whether you are a small operator or a large service provider, Aradial is the most specialized platform that will suit your needs. As it is deployed according to your exact needs and can be scaled accordingly, it is offered in custom quotes.

Types of Billing Software

There are many types of billing and invoicing software out there when it comes to features. As they are far too many to mention in this article, we’ll only discuss the types of deployment as well as their advantages and disadvantages.

On-Premise Billing and Invoicing Systems

These types of platforms are what you can call traditional. Remember when you have to buy and CD to install a product? Well, these are just like that except that you don’t use a CD anymore, you just download the software from the provider and install it on your office computers and use them. What’s great about this is that you get to own your data in the sense that you have it with you on-site. This may also increase the security of your files, depending on your on-premise security protocols and tools. However, as these tools aren’t built for collaboration, it might only be ideal for a one- or two-man teams.

SaaS on the Cloud

Today, cloud-based software services are almost the norm. You don’t have to buy expensive machines to avail of great computing power. All you have to do is sign up with a software service provider and access the software via the web. Meaning to say, all you would need is a browser. Most of the time, these billing software solutions are offered in monthly plans. Some providers provide them via cheaper annual plans as well. Thus, you can just pay as you go. However, the downside is you won’t get access to your data and files should your internet access fail. Also, there is the possibility of service downtimes. Plus, having your files on the cloud is, in principle, not that safe as people with malicious intent can hack your account and steal your information.

Hybrid

Hybrid products have on-premise clients that sync with their web clients. This is the preferred setup of many companies. They like both their software and data available in their hard drives, their private networks, and on the cloud as well. This deployment type has the most flexibility. Also, most hybrid products have mobile apps. Even purely cloud-based software providers offer mobile applications with their platforms too. Thus, with the app, you can take your data wherever you are. It is more accessible and even shareable with other team members.

Furthermore, with a hybrid deployment, you don’t have to worry about internet outages or service downtimes, thanks to its on-premise feature. You also get to collaborate with other people on your web-based platform. That said, it’s no wonder why many companies prefer a hybrid setup.

Wave is a cloud-hosted accounting tool, so users don’t have to worry about complex installation processes.

Core Features of Billing Software

Even though there are different deployment types and feature sets for product solutions, there are general features that make a billing software solution a well-put one. In this section, we’ll list these general features and briefly discuss why they make any particular software a good fit for billing and invoicing.

Invoice and Tax Management

This is not a single feature but a collection of features that pertains to invoices. Firstly, your chosen solution should allow you to create well-designed and professional-looking invoices. It should have a module powerful enough to allow you to brand every client touchpoint. Moreover, this feature should be easy to use, as well. Plus, you should choose a solution with an invoice module that can pull information easily from your timesheets, projects, and customer records easily. Also, choose one that prevents entry duplication.

What’s more, top-tier systems like we mentioned above have good tax reporting and management features to boot. You don’t need another subscription or software to do your taxes. So, we recommend you choose a system with this in tow already.

Payment Management

Good invoice and billing software have built-in integrations to manage payments and receipts. Firstly, you want a solution that can accept many payment types like credit cards and PayPal, among others. This makes it easy for you and your customers both. You don’t have to transfer to another system; you do it right from within your platform. The same thing goes for your client. They get to pay via their client portal — no more redirections.

Moreover, you should choose a system that has a recurring payment option available. You don’t want your clients to sign up and sign out. Also, once enabled, it is less likely that you will miss a payment as well. Furthermore, it is best to choose a software solution with multi-currency support. This is especially useful when you have international clients.

Customer Database Management

You’ll want your customer information to be handy. Thus, you should have a solution that has a database feature that can pack information under client names. Moreover, find a product that has a good search filter that returns quick results. Also, choose a software product that has a function for importing and exporting data. Firstly, you need this to send quotes to your customers. Second, you should have this feature available should you want to use a different system for CRM.

Collaboration Tools and Templates

Working on finance-related tasks is a hard job to do alone. There are instances where more heads are better than one. Sometimes you may miss a thing or two, and another team member will help you correct your work. Thus, it is best to have a solution with easy-to-use collaboration tools. Also, we recommend choosing one with a communication module so easy-to-use that it is reminiscent of social media interfaces. This cuts adoption time and eases your team members’ learning curve.

Additionally, choose a system that has a quick template creation feature. This feature will save you time when designing things for communications like letters and invoices. Also, it is very important to brand it as your own.

Xero comes with features that not only help you perform your billing tasks but also process payments and promote collaboration.

Benefits of Billing Software Usage

The benefits of using invoicing and billing software depends on your business’ use of the tool. However, there are general benefits that using these systems properly provide. There are ideal benefits that potential billing software adopters seek to accrue before buying one. Here they are below:

Minimizing Late and Missed Payments

Billing software can streamline your processes for you. It can also help you keep all pertinent data handy. These include payments and other deadlines. With reminders, you can minimize the things you or your customers miss.

Furthermore, this will help you nudge your clients to pay you for recurring bills automatically. With these, you can cut down on late and missed payments. You may still encounter them from time to time, but a good billing software system can minimize it.

Professional Touchpoints

Your invoices are important touchpoints for your business. You can argue that it is the most important touchpoint as it is directly related to sales. Thus, you need to put your best foot forward with it. This means you shouldn’t use general and generic-looking invoices. Rather, you should put a professional-looking stamp of your brand in your invoices. Also, invoices and billing software solutions usually have a client portal. This is another touchpoint that you can use to improve your profitable relationship with them. You can customize this to provide your clients with more options.

Factors to Consider When Purchasing Billing Software

There are general factors to consider when purchasing any business solution. These apply in choosing a billing software as well. But, of course, there are also specifics to take into consideration. Here they are:

Ease of Use

Managing your billing, invoices, taxes, and finance-related processes are already complex as it is. Luckily, you can use software to make the job a little easier. That said, you don’t need a software solution that makes the complex more complicated. What you want is a solution that has intuitive controls reminiscent of social media platforms. You want easy controls like a drag-and-drop interface to access your most-used features. Also, choose a software provider that has a self-service knowledge base too. Nobody wants to call up a representative or even just shoot an email for every minor question.

Communication and Collaboration Tools

Most professionals work with other team members. It pays to have more careful eyes on your finances and processes. After all, accounting does not exist in a silo. It permeates every business component. Thus, it’s best to have a solution that can facilitate collaboration and sharing. One such feature that you should look for is a commenting feature. Another is an internal chat module. These features help you and your team keep your lines open at all times for easy communication. Plus, be sure that your chosen software has a comment history feature as well or, at least, has a forum module to keep important conversations stored and accessible.

Security

This just may be the most overlooked yet highly-important factor to consider when purchasing any software. This is especially so when you purchase something with a cloud-based interface. Why? Passwords get hacked all the time. Often, you store very sensitive financial information in these software solutions.

Moreover, it is not only your business’ information that is up there. You have private data from your clients as well. A breach is not only costly in terms of money. It can also cost you your reputation. Thus, it is best to review your software for its security features. This includes your provider’s privacy protocols. Also, make use of your permission options and check out the security of your client portal. You don’t want breaches from the customers’ end.

Packages and Pricing

Of course, these are probably two of the most significant factors to consider. In fact, the pricing determines whether you can get the software or not. Thus, you have to exert due diligence in this aspect not only to know if you are within budget but also if you are getting the right package. Usually, software solutions are offered in tiered plans. Each tier has a different price point with a different number of features. Of course, the higher-priced ones offer more capabilities. Some businesses make the mistake of choosing the wrong plan and sticking with it for a few months. This can accrue costs in the long run. Also, be sure to check the best payment option for you. A lot of times, providers offer their software at a discounted price if you go for an annual payment. If this fits your budget and if you plan to stick to the software for long, you should choose the annual plan to avail of the discount.

QuickBooks is one of the most popular tools on the market because of its low learning curve, reasonable rates, secure interface, and powerful set of features.

Potential Issues when Adopting a Billing Software

There are many potential issues when it comes to using a billing software product. This is especially true when you are a new adopter. The issues, often, do not come from the product itself. It comes from the adopters themselves. Of course, product features and usability come into play. However, it is they that choose and use the product that made the poor choice to start with.

Wrong Software, Wrong Plan

Many times, we make rash decisions. This never ends well when we do it with our software choice. We get stuck for a while with the wrong software. And again, opportunity cost and other losses abound.

What’s more, we also choose the wrong package. Sometimes, we get more features than needed and, other times; we get the plan with lesser features that make our lives a bit more difficult. Thus, when making software purchasing decisions, be sure to review the software’s pricing package and plans.

Adoption

We don’t only adopt a software solution. We also have to make it work alongside new workflows and techniques. Both of these compound to unsuccessful adoption processes most of the time. Many companies or departments start strong with the new software only peter out after just a few months. Change is tough to manage, especially when your organizational culture is not amicable to it. So, before you make any commitment to purchase, make sure you and your team are ready to change your daily workflows. Also, be sure you are resolute in sticking with it.

Poor Practices

Invoice and billing software products do exactly what you tell them to do. They are programs that follow rules and your input. Thus, when you have a bad input, they’ll just return whatever the result of that is. Also, when you don’t input complete information, you don’t get a full picture of your operations. This is a big issue when it comes to accounting. We don’t put in enough information. This is just one example of poor business practice that you should avoid. Remember, your digital data is just a representation of your business health. You have to put in the work in making that picture reflect your reality better.

Latest Trends in Billing Software Usage

In the big picture, experts predict that the market for accounting platforms will reach $117 million by 2026. This is just a sign that many more firms will be adopting new digital tools like billing software and the like.

Also, there are many reasons for this. There are tighter regulations, generational changes, new client demands, and firms are putting in more investments to gain competitive advantages. A cultural shift is underway, and digital tools are a part of the future. Without them, businesses will not have a better view of their financial health.

This is even more true with small business owners. In fact, about 5% worry about being fined for noncompliance. Also, 35% of self-employed contractors feel that making mistakes with their accounts is the most stressful thing. Moreover, about 15% worry about the length of time needed to complete their records, and 13% find the process too complex. Thus, it is almost a no-brainer that many professionals and businesses choose to use digital tools to help to keep their work accurate and themselves stress-free.

Lastly, we are witnessing the rise of AI when it comes to financial processes. In fact, 58% of accountants believe that AI will help automate tasks. The scary thing for them, however, is that their jobs may be outsourced to machines. Thus, many think that accountants will need to pivot and function more like financial analysts than doing just mere accounting. If you think about it, when you have good software for billing and invoices, you won’t need another person to do it for you. So, people in the accounting business need to think of ways to keep their services and discipline relevant in the maturation of the digital age.