Manual filing of documents is challenging for businesses of every size. It is especially crucial to input accurate information when it comes to financial data since errors can cause cash flow problems. Fortunately, there are numerous software solutions available in the market. This research on bookkeeping discusses the importance of automating your accounting processes.

Additionally, you must exercise caution when processing tax documents. Two popular platforms can file your taxes with the federal and state government without any hassle. These programs are Credit Karma Tax and TurboTax. Both systems include comprehensive tools and support to guide you in reporting accurate tax information.

In this Credit Karma Tax vs TurboTax comparison, you will know their different features and which program responds to your company’s needs.

Credit Karma Tax Overview

Since 2017, Credit Karma Tax has been helping individuals and businesses save time and money. However, the program does not include additional tools that large companies may need. Still, thousands of people use Credit Karma Tax due to its intuitive interface. What’s more, it has a built-in Audit Defense that ensures the accuracy of tax information. When combined with the best accounts receivable program, you can manage your finances successfully. It is essential to analyze and compare accounts receivable software to know which app suits your business.

The platform allows you to access and edit common tax forms. However, Credit Karma Tax does not permit filing taxes from multiple states and foreign income. Moreover, you cannot file for state returns if you are married and filing separately in community property states. Besides, the system does not allow part-year state filings.

Thus, if you have a complicated tax situation, Credit Karma Tax might not be for you. But if you are an individual or a small business owner, this platform can respond to your tax filing needs.

TurboTax Overview

Alternatively, TurboTax has been in the market since 2001. For almost two decades, the app has been a leader in online tax filing. It also enjoys a good brand reputation due to its straightforward interface and updated functionalities. TurboTax helps small to large businesses with their tax computation and filing needs.

In terms of the latest features, Turbotax introduces live CPA guidance. This functionality requires you to pay additional fees due to the premium service that it provides. Live CPA guidance allows you to have a live chat with a certified public accountant. The CPA then checks your taxes and answer specific questions about your taxes. This process ensures that you only file accurate tax information.

Read this invoicing software analysis to discover the top 10 programs that help you generate invoices for error-free financial statements.

Besides the CPA guidance, the system provides you with three financial numbers: credit score, debt to income ratio, and overall income for the tax year. With TurboTax, you can access this information anytime and anywhere. It also provides safe storage for these confidential business details.

Since you already have an introduction to the two programs, it’s time to examine how they perform based on shared features. The main Credit Karma Tax vs TurboTax comparison scrutinizes the sign-up process, interface, pricing options, and security of both platforms.

Sign-Up Process

In terms of the sign-up process, both programs have similar procedures.

With Credit Karma Tax, you only need to have a valid email address to start the application process. The sign-up page will also require you to input a password. After this process, you can already navigate the system and compute your taxes.

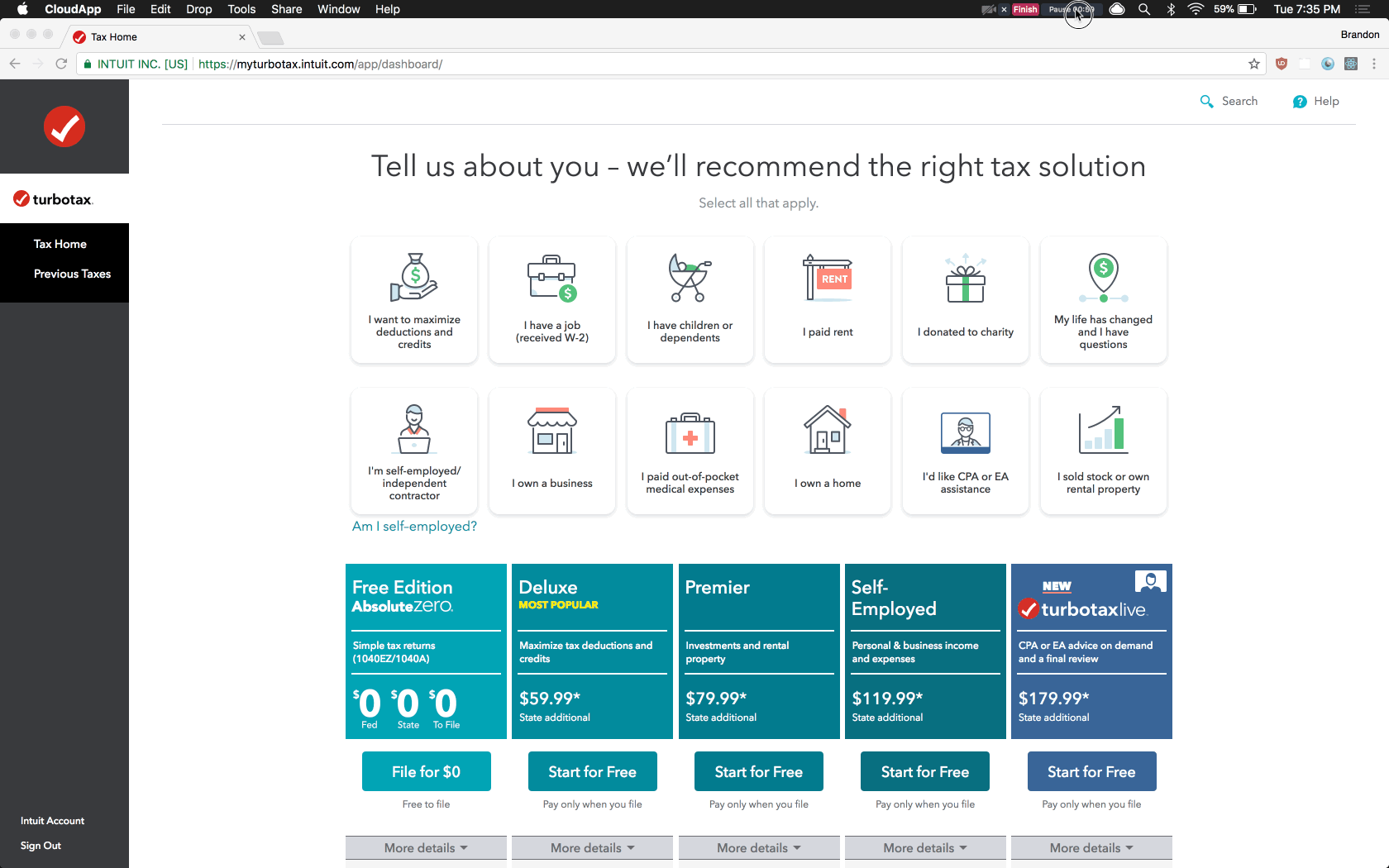

On the other hand, TurboTax asks you to choose your desired version before signing-up. You can also change the plan if you need more tax forms. This process is relatively easy to execute so that you can upgrade quickly. More importantly, the system does not charge you until you file your taxes.

Pricing Options

Credit Karma Tax and TurboTax have entirely different pricing plans.

With Credit Karma Tax, you don’t need to pay for a monthly subscription. You can then use this program for free. Regardless of your tax situation, the platform does not require you to pay additional fees. Hence, you can file for investments, cryptocurrencies, and rental properties with its free plan. The system also generates state filings for your company.

On the contrary, TurboTax features both free and paid versions. Individuals and businesses with an adjusted gross income (AGI)of less than $36,000 can file for free using TurboTax. With the free plan, you can generate W-2 form entry from your employer. The IRS’ Free File program allows this process. Fortunately, you can still file for free even if you earn more than the $36,000 limit. For such cases, you need to go directly to TurboTax’s website.

TurboTax has three paid plans; these are Deluxe, Premier, and Self-Employed. The Deluxe option, which is the most popular plan, costs $60 and includes credits and deductions functionalities. Moreover, it has built-in tools for homeowners.

Also, the Premier plan requires you to pay $90 for taxes related to investments, cryptocurrencies, and rental properties. Lastly, the Self-Employed costs $120 with additional support for forms. Additionally, it includes deductions that are beneficial for contractors, freelancers, and small business owners.

The said plans are only for online software. Besides, you need to pay $50 for state filing in addition to other fees. In this Credit Karma Tax vs TurboTax comparison, the former poses a great advantage in pricing options.

User-Friendliness

In terms of user-friendliness, both platforms guarantee that you are always updated on tax forms. If you have a part-time or full-time job, your tax returns mostly include W-2 forms.

Credit Karma Tax features an easy entry form with the option of uploading your W-2 for quick file import. You can toggle on each box to see additional information about specific wages, tips, benefits, and taxes. Alternatively, TurboTax presents you with two options. First, you can import W-2 forms from employers. An alternative includes copying form information into a simple web form.

Hence, both Credit Karma Tax and TurboTax are ideal even for first-time users. If you have experience with email platforms, then you can use the two programs with ease.

Financial Returns

Credit Karma Tax and TurboTax’s main benefits include maximum refund and precise tax details. Users of both programs report the same results when using Credit Karma Tax and TurboTax. Hence, freelancers and small business owners opt for the free Credit Karma Tax over TurboTax.

However, some users reported that they experienced issues with Credit Karma Tax. The updated 20% pass-through deduction was not added to Credit Karma Tax’s system. On the contrary, TurboTax included the deduction to its network. Hence, the feature is a notable addition to TurboTax.

If you have regular taxes for investments, properties, and W-2 or 1099 income, you should consider Credit Karma Tax. But if you own a business with complicated financial information, then TurboTax should be a top choice.

Security

Both Credit Karma Tax and TurboTax have built-in bank-level encryption that ensures industry-standard security for your tax information. More importantly, they feature security layers that are approved by the IRS.

Additionally, Credit Karma Tax and TurboTax offers updated tax filing services authorized by the IRS. This way, you can guarantee that your tax information is safe from security breaches. It also ensures that no uninvolved individuals can access such sensitive information.

Cross-Platform Availability

Credit Karma Tax features a mobile-friendly site that allows you to file taxes using your smartphone. You can then manage tax forms anytime and anywhere. You just need a mobile phone with an internet connection.

On the contrary, TurboTax is available on Android and iOS-run devices. You only need to download from the Play Store and App Store to take advantage of TurboTax’s tools. Hence, this platform wins in the category of multi-platform availability since it can be accessed through its app.

Customer Support

In terms of customer service, Credit Karma Tax provides chat and email support. You can communicate with their agents about technical and general issues. More importantly, the platform has high ratings when it comes to customer support. They also have a section for frequently asked questions on their website.

Similarly, TurboTax offers email and chat support from agents. What’s more, the company works with CPAs and tax professionals to provide you with in-depth tax advice. However, expect additional fees for their services.

Which is the Best Tax Program for Your Business?

This Credit Karma Tax vs TurboTax comparison article reveals both programs’ pros and cons. The two platforms are both reliable and produce accurate results for your business. However, each system suits different business types.

If you have a standard tax situation, then Credit Karma Tax is the right program for you. It offers free tax filing services with all the essential tools. However, if your company has complicated taxes and further questions, you should opt for Turbotax. With this platform, you can communicate with CPAs and file complex yet accurate tax.

Hence, it is essential to evaluate your business’ needs in terms of tax filing procedures. This way, you can utilize the most cost-efficient software for your company.