No matter how we look at tax filing, it is a painstaking obligation that requires attention down to the smallest detail. Getting lost in completing the process is also bound to happen, which can result in inaccurate tax returns or incorrect information that needs to be amended. These errors happen during tax preparation, and these errors remain prevalent even today when there’s quite a number of tax preparation software promising accurate results. But despite the access to advanced technology, not all tax preparation software is created equal.

In this article, we will examine the two reputable online tax preparation solution in the US–Free TaxUSA and TurboTax software. And through this Free TaxUSA vs. TurboTax comparison, the aim is not to determine which one is better but to help you decide which tax preparation software is right for your needs.

What Is Free TaxUSA?

Free TaxUSA is an affordable online tax service for preparing, printing, and filing federal and state tax returns online. It covers all major tax situations, such as extension tax filing, tax filing for self-employed, military, state, and 1099 taxes. An IRS-authorized online tax filing service, Free TaxUSA has currently filed more than 40 million federal taxes with the IRS.

Features, interface, and ease of use

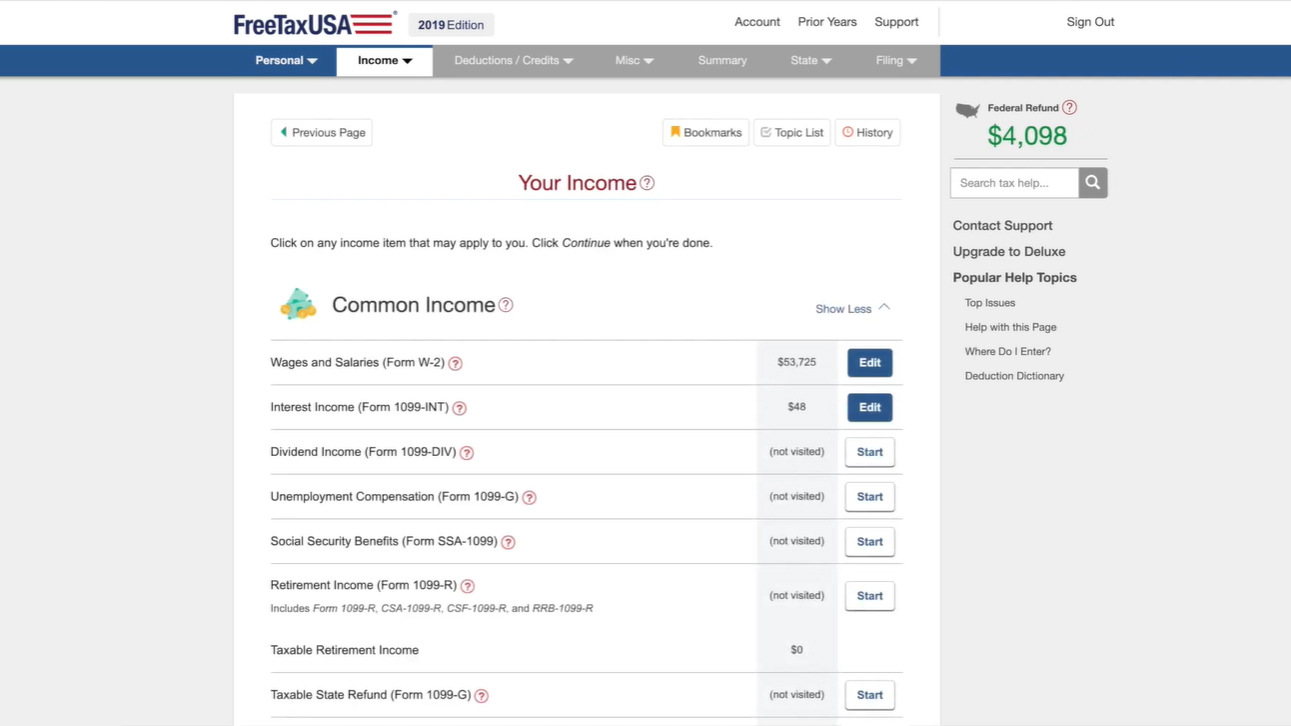

Free TaxUSA has a simple and straightforward interface; it is also equipped with tools to make tax preparation and calculation fast, easy, and most importantly, accurate. Despite being basically free, Free TaxUSA delivers beyond basic tax filing features, such as information rollover, previous years filing, and prior year’s tax returns. This is an excellent accounting systems to use for best accounting practices.

You can file tax returns from far as back as 2012; please, however, take note that all prior tax returns filed should be mailed–only the current year’s tax return can be filed online. Below is a list of some of TaxUSA’s core features:

- Over 360 credits/deductions

- Prior year information import

- Tax return backup

- Small business, investment, and rental income

- Student loan interest

- Audit assist

- Priority live support chat

- Unlimited amended returns

FreeTaxUSA dashboard.

Customer support

Free TaxUSA support team can be reached via email and the account message center. Audit assistance is also provided to the tax filers depending on the version you are using. For Deluxe users, live chat support is also provided.

Pricing

When it comes to pricing and pricing model, Free TaxUSA has two versions–Free and Deluxe. Covered under the free version are simple tax returns, investment and rental income, 1099 income and expenses, student loan interest, and extension of the filing deadline. As for the Deluxe option, which is priced at $6.99, additional features such as priority live chat support, unlimited amended returns, and dedicated audit assistant are included.

Deluxe features can also be purchased separately in case you are using the free version of Free TaxUSA. Also, although filing for the previous year’s federal tax return is free, it can cost $14.99 to file for the state tax return.

Pros of using Free TaxUSA

- Supports major types of income and federal forms

- The free version can cover all the basic tax filing needs

- Affordable paid version

- Simple and easy to use

- Dedicated audit assistance

Cons of using Free TaxUSA

- Does not support publicly traded securities under Form 8283, Section A

- Prior year’s tax returns are mailed.

What Is TurboTax?

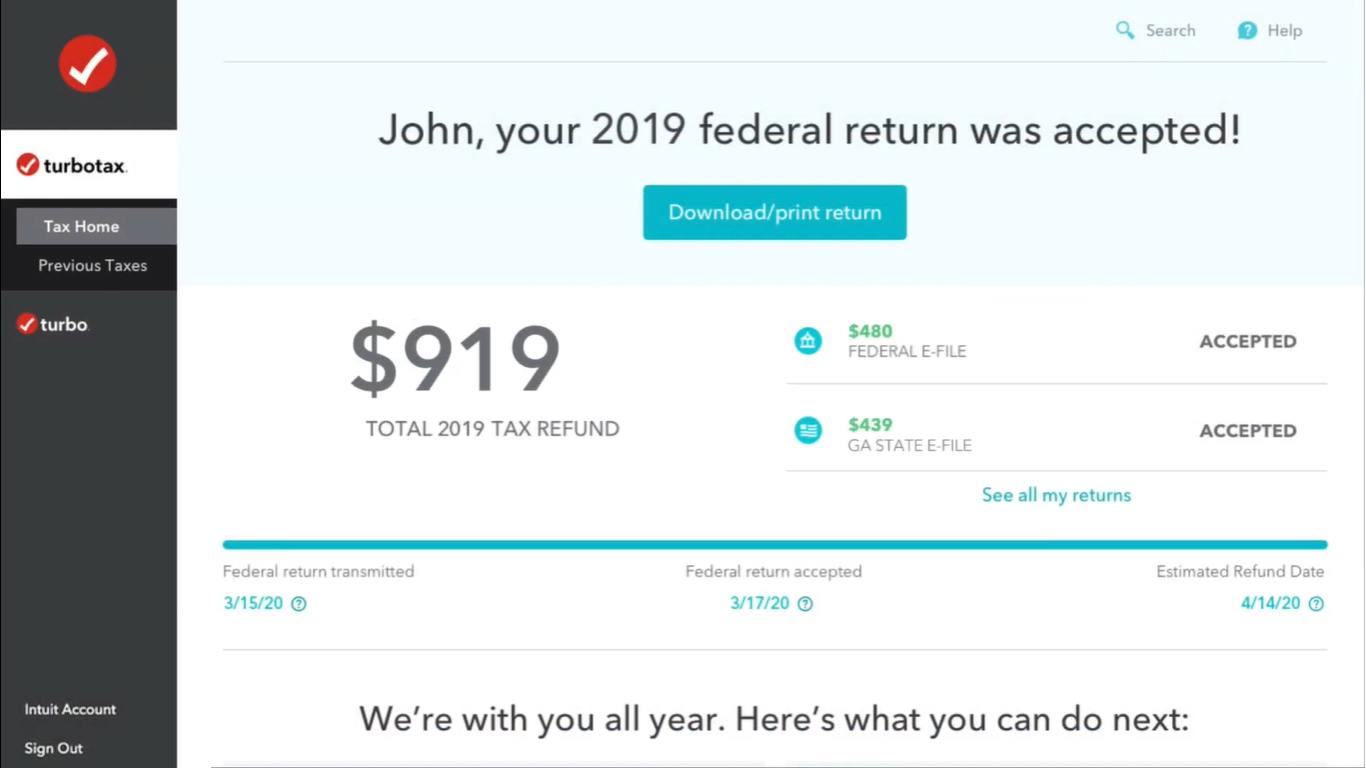

TurboTax provides a comprehensive online tax preparation platform developed by Intuit. Unlike Free TaxUSA, TurboTax is more advanced not only features but also in its interface. But despite its seemingly more intricate system, TurboTax is easy to use and is well-equipped.

Features, interface, and ease of use

In this Free TaxUSA vs. TurboTax comparison, it is evident that the latter has more advanced features. TurboTax has a dedicated mobile application that can be installed on Android and iOS devices. Importing data from 1099 or W-2 forms is also made easier–just take a clear photo of the form and upload it to your TurboTax account.

This tax software offers intuitive tools such as tax bracket calculator and the TaxCaster, which is a mobile application for calculating income tax. Other tools include self-employed expense estimator and IRS W-4 withholding estimator. Other features include how you can determine the dependents credits and deductions you can claim. There is also a checklist of all the documents to make sure that you have everything you need before preparing and filing your tax online. TurboTax’s built-in integrations with the best payroll software also prevent the hassle of manual data entry.

Furthermore, TurboTax’s proprietary CompleteCheck tool automatically reviews your tax form to make sure that all necessary details are provided. Below are some of TurboTax’s key features:

- Free simple federal and state tax returns

- Audit support guarantee

- Real CPA and EA tax advice and review

- Mobile app

- CompleteCheck

- Photo capture of W-2

TurboTax dashboard.

Customer support

One of TurboTax’s core features is its capability to connect you with skilled professionals (CPA and EA) to help you with your tax filing issues. These professionals can do a line-by-line review of your tax return and offer you expert advice. This feature, which is exclusive to TurboTax Live, is accessible all year long and there is no limit to how many times you can request for the assistance of CPAs and EAs.

TurboTax also has an extensive knowledge base from help articles, videos, and detailed learning resources regarding tax filing.

Pricing

For tax filers who have simple tax returns (Form 1040), TurboTax Free Edition is enough. Beyond Form 1040, however, you will have to upgrade to TurboTax Live. TurboTax Live is the paid version and has four tiers:

- TurboTax Live Basic – $90

- TurboTax Live Deluxe – $130

- TurboTax Live Premier – $180

- TurboTax Live Self-Employed – $210

Pros of using TurboTax

- Dedicated mobile app

- More advanced tools compared to Free TaxUSA

- Extensive learning resources about tax filing

- On-demand and unlimited consultation with CPA and EA

Cons of using TurboTax

- The free version does not cover itemized deductions, rental property income, credit deductions, and student loan interest deductions.

- The paid plans are on the pricey side

- The free plan only covers simple tax return

Conclusion

Free TaxUSA and TurboTax are well-known online tax preparation solutions, and in this Free TaxUSA vs. TurboTax comparison, the benefits and disadvantages of each are brought to the forefront to help you make an informed decision. While Free TaxUSA excels in its affordability, simplicity, transparency, TurboTax makes up for it in its advanced technology and flexibility. Also, TurboTax works seamlessly with accounting and billing software platforms to ensure data accuracy.

At the end of the day, however, different users have different needs and they will be the ones to determine which tax preparation software is right for them.