Keeping track of the travel expenses of employees can be a real pain not only for the accounting department but also for employees themselves. Collecting receipts and filling out reports are just a couple of activities employees would rather not do. As for accounting staff, following up on expense reports and verifying spending records take up precious hours that could have been spent on other tasks.

Regardless of how meticulous these issues sound like, there are more serious problems that can be encountered, such as policy violation and fraud. Unfortunately, fraud detection and compliance monitoring are two important features that even some expense management solutions don’t have. When you conduct a detailed accounting systems analysis, it is obvious that typical finance-related features are not enough. Luckily, Concur, an expense management software addresses all these issues.

What Is Concur?

Concur provides a fully automated travel and expense management platform for businesses and their employees. From capturing receipts to reimbursing employees, Concur’s goal is to deliver fast and accurate results to ensure that employees are reimbursed on time, all expenses are accounted for and within spending limits, and there is no possible legal problem.

Concur, however, is not the only application that does this, and the other options might be more suitable for your business. In this article, we list down 10 Concur alternatives for you to consider.

1. Captio

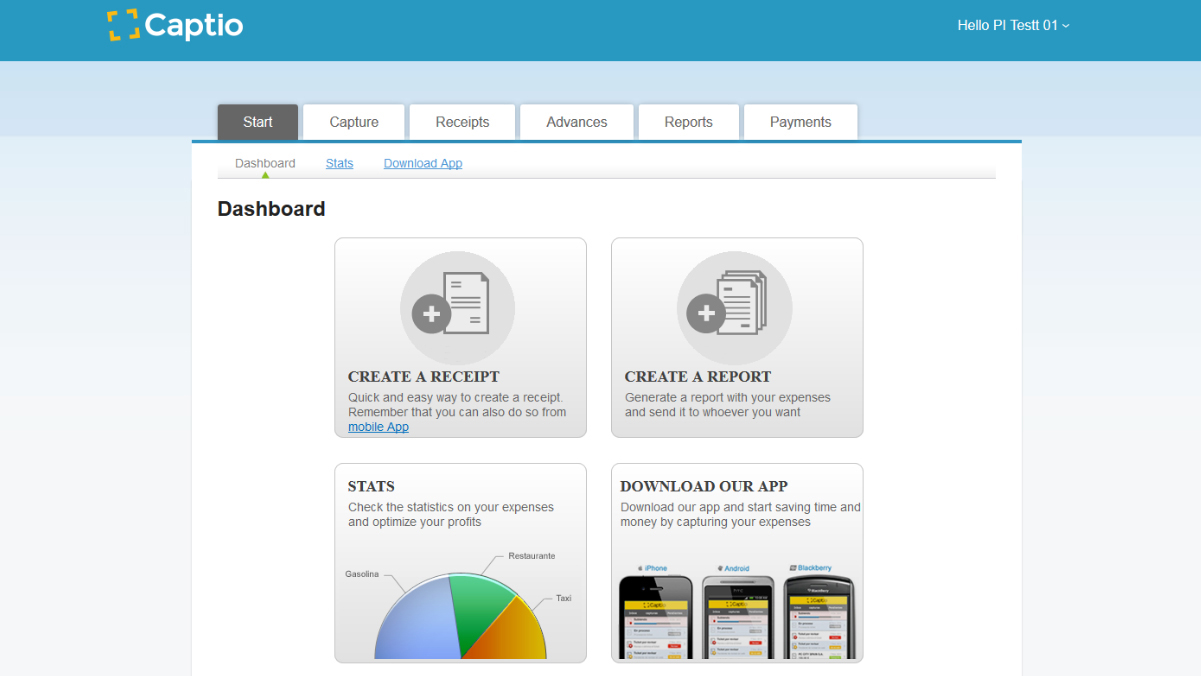

Captio is a finance and accounting solution that simplifies expense monitoring, especially for traveling employees. Instead of collecting a bunch of receipts, Captio mobile app uses intuitive tools to capture your receipt’s details by taking a photo of your receipt. A copy of your receipt will be saved in your Captio account. This way, your expenses (i.e., gas, taxi fare, plane tickets, lunch, etc.) will be automatically stored safely and in an organized manner.

To avoid the tedious and time-consuming process of filling out and reviewing expense reports, you can integrate Captio with your payroll or ERP system or by using SEPA files. By doing this, the reimbursement process will be much easier not only for the employee but for accounting people as well.

As for pricing, Captio plans start at €6/month for every user.

Captio dashboard

2. Certify

Certify is a full-featured expense management application with advanced features that go beyond spend monitoring. Unlike other Concur alternatives on the list, Certify also assists in finding tickets, accommodations, car rental, etc., with the most reasonable rates.

The Certify app is also configurable based on your company’s travel policy, as well as the travel and expense policy set by the US GSA. Furthermore, Certify can track down all unused tickets and turn them into savings.

Certify seamlessly integrates with accounting and credit card solutions, such as Oracle NetSuite, Sage, QuickBooks, Paycor, and more. This travel and expense solution’s paid plans start at $8/month for every user.

3. Coupa Expense

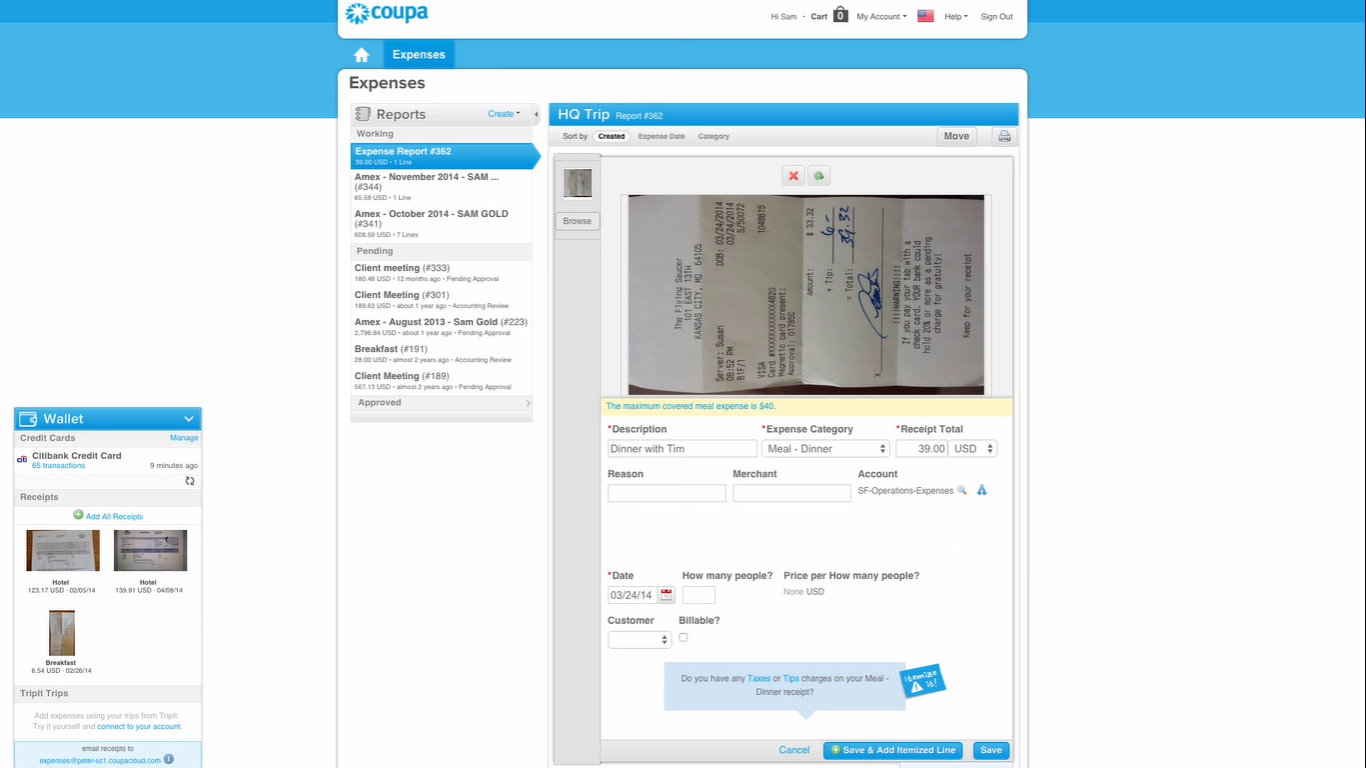

Coupa Expense is a user-centric and smart expense management solution for business. One of its main features is the SmarterTrip, which acts as a personal assistant that guides the user through automating real-time travel expense monitoring and reporting (i.e., receipt capture, mileage tracking, etc.)

Coupa Expense’s intuitive travel management features also help companies take complete control of their T&E programs and policies. These features include pre-trip approvals, integration with other expense and management systems, and email itinerary parser. Coupa Expense also has its own AI-powered fraud detector, Spend Guard, which automatically detects errors and potentially fraudulent transactions.

Integrations for Coupa Expense include credit cards and more than 300 travel integrations (i.e., rideshare, hotels, airlines, etc.) The pricing for Coupa Expense is quote-based.

Coupa dashboard.

4. DATABASICS

DATABASICS offers a suite of applications for travel and expense management. Among these is the mobile mileage tracker application, which provides an accurate and transparent mileage log based on GPS and IP address location.

DATABASICS Expense, on the other hand, completes the next step after mileage tracking. This app gathers all the data from the mobile mileage tracker and prepares expense reports for the reimbursement process. Through this application, reports can be automatically generated from the receipts submitted to or captured by the DATABASICS Expense app.

Aside from streamlining expense reports and reimbursements, DATABASICS Expense also allows you to allocate the budget or set spending limits. You can also customize the app’s workflow to match your criteria for expenses reporting.

When it comes to integrations, DATABASICS API offers more flexibility in integrating with travel, accounting, payroll, credit card, payment services, and single sign-on solutions. The pricing is also quote-based.

5. ExpensePath

ExpensePath is an expense management solution configured specifically to match your company’s needs. The ExpensePath team will take time to gather information directly from you on how you would like your ExpensePath app to work, and they will set up your account based on your recommended configurations.

When it comes to features, ExpensePath monitors an expense’s life cycle from purchase to reimbursement. The approval chain is also easy to set up as well as the internal policies. The reimbursement is also fast and simple through ACH, payroll, etc.

As for the integrations, ExpensePath integrates with QuickBooks, NetSuite, GEP, and other finance and accounting solutions. The pricing for this application is quote-based.

6. Rydoo

Rydoo is the travel expense management app that does not require the use of credit cards or lodge cards. This application has a central billing option that allows employees to bypass the payment process. At the end of the month, the company will receive a consolidated invoice for the employees’ expenses during the trip. This consolidated invoice also serves as an expense report, which saves accounting staff valuable time in reviewing expenses and initiating reimbursements.

Other key features of Rydoo app include in-app booking, control spending, in-app chat, receipt capture via OCR technology, and more. Rydoo also integrates with a wide range of applications, including Uber, SAP, Slack, Dropbox, Microsoft Dynamics, Cash Back, and more. As for the pricing, paid plans start at €6/month for every active user.

7. Fyle

Fyle is a modern credit card spend management solution. The product is prized for its powerful optical character recognition (OCR) capability. This allows users to extract data from receipts using their phones. With this, filing expenses is will be easier–no manual entry, just click and go. Moreover, it is also known for its real-time corporate card reconciliation abilities. It automatically updates financial information and notifies users instantly once a card has been swiped. Hence, users will have real-time visibility and control of their spending.

And, like other top tools, Fyle also comes with compliance features. So, users can rest assured that their data will be structured to fit reporting protocols. Furthermore, Fyle also provides actionable analytics. Thus, users will be able to make better decisions based on real-time data.

This easy-to-use application also works seamlessly with other finance tools including Sage Intacct, QuickBooks Online, and Netsuite. Hence, you can easily incorporate your Fyle data into your accounting or reporting software.

8. Tallie

Tallie is a simple and straightforward expense management software. It has all the necessary features, from mobile mileage tracking, receipt scan, and credit card integration. Once a receipt is recorded in the Tallie app, the system automatically processes the data. OCR technology identifies and records the details necessary for the expense report.

Tallie also utilizes a duplicate technology for credit card matching to make sure that the credit card in your account matches the card on the receipts. Transactions are also organized by category to save time and minimize errors. Once all transactions are recorded, you can immediately generate expense reports and proceed to approval and reimbursement.

As for the integrations, Tallie supports Sage Intacct, QuickBooks, Bill.com, Xero, Oracle NetSuite, etc. The pricing starts at $50/month.

9. Unit4 Travel & Expenses

Unit4 Travel & Expenses delivers a fast and easy way for the finance team to track company employees’ travel expenses. The app doesn’t require extensive user training as users only need to know how to log in their transactions and upload receipts directly to the mobile app. The app itself will take care of the data entry process, validation, authorization, and reporting. All these details can be accessed by the finance team from a single source.

To further optimize Unit4 Tavel & Expenses’ functions, it is recommended to integrate it with your local systems (i.e., ERP, finance, payroll, etc.) As for the pricing of this app, you have to contact Unit4 for a quote.

10. Webexpense Travel

Webexpenses Travel is an AI-supported travel expense management solution. It has an in-app travel booking feature powered by artificial intelligence technology, which can automatically create itineraries and generate travel preferences. This application also provides a detailed history of your travel expenses for transparency.

The mobile application is also a full-featured solution that allows both client and approver to manage expenses using Android and iOS devices. The mobile app is equipped with Google Vision-powered OCR as well as customized policy compliance.

Webexpenses integrates with more than 50 accounting systems, such as Microsoft Dynamics, Peoplesoft, Quickbooks, Sage, Xero, and more. Pricing starts at $8.50, which is a fixed monthly fee.