Payday. It is that time of the month when employees rejoice because their hard work will be rewarded monetarily. And if they really went out of their way to do their jobs, they may even receive additional benefits, too. But for small business owners, the payroll period is not something one delights in.

Employers could spend more than an hour going through labor codes to ensure that they do not break even half of the law. They have to be meticulous in doing so to avoid getting called out or worse, having their shops closed. In fact, in 2018, the IRS collected almost $5 billion because of payroll tax filing errors.

On top of that, business owners need to pore over timesheets. If payday comes twice a month, then it is twice the stress. Everything has to be accurate to avoid disputes and to smoothen the payroll workflow.

Fortunately, these problems have solutions in the form of payroll software for small business. It saves time when it comes to compliance because it has built-in tools in that regard. Plus, it can help avoid mistakes that could land a small enterprise in hot water with the IRS. Moreover, they can ensure that they always have accurate payrolls.

Best Payroll Software for Small Business Table of Contents

- What is Payroll Software for Small Business?

- List of Best Payroll Software for Small Business

- How does Payroll Software for Small Business Work?

- Who is Payroll Software for Small Business For?

- What are the Types of Payroll Software for Small Business?

- Features of Payroll Software

- What are the Benefits of Payroll Software for Small Business?

- What Should You Consider When Choosing a Payroll Software for Small Business?

What is Payroll Software for Small Business?

Payroll software is a critical solution every business must have in its tech stack because it enables employers to calculate the salaries and wages of their employees. With it, they can also pay them via direct deposit automatically and without going to the bank for every transaction. What’s more, a payroll tool lets them manage payroll in-house, thus reducing expenses that could have gone to an accounting house or payroll consultant.

But what differentiates a regular payroll platform from a payroll software for small business? The latter still has the functions that can be found in a typical payroll solution. However, the main difference is the cost. Since small enterprises do not have the tech budget that large companies do, they need a tool that does not break the bank. And this is where budget-friendly payroll software solutions come in.

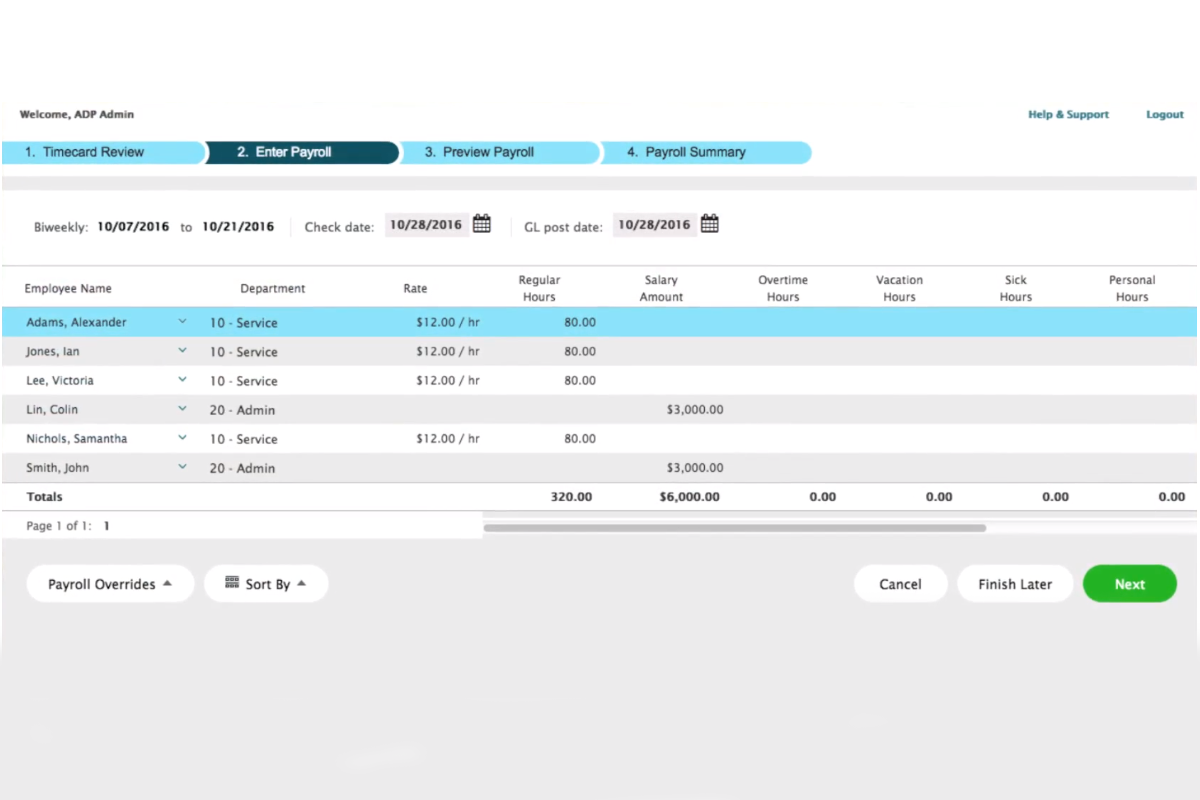

Calculating payroll becomes a smooth job when you use payroll software for small business such as RUN Powered by ADP.

List of Best Payroll Software for Small Business

It is not easy to find the best payroll software for small business, as some are free or economical but do not have the right tools. But you do not have to worry about poring over lists to find the right one anymore. We have the top 10 payroll solutions for small enterprises ready for your perusal below:

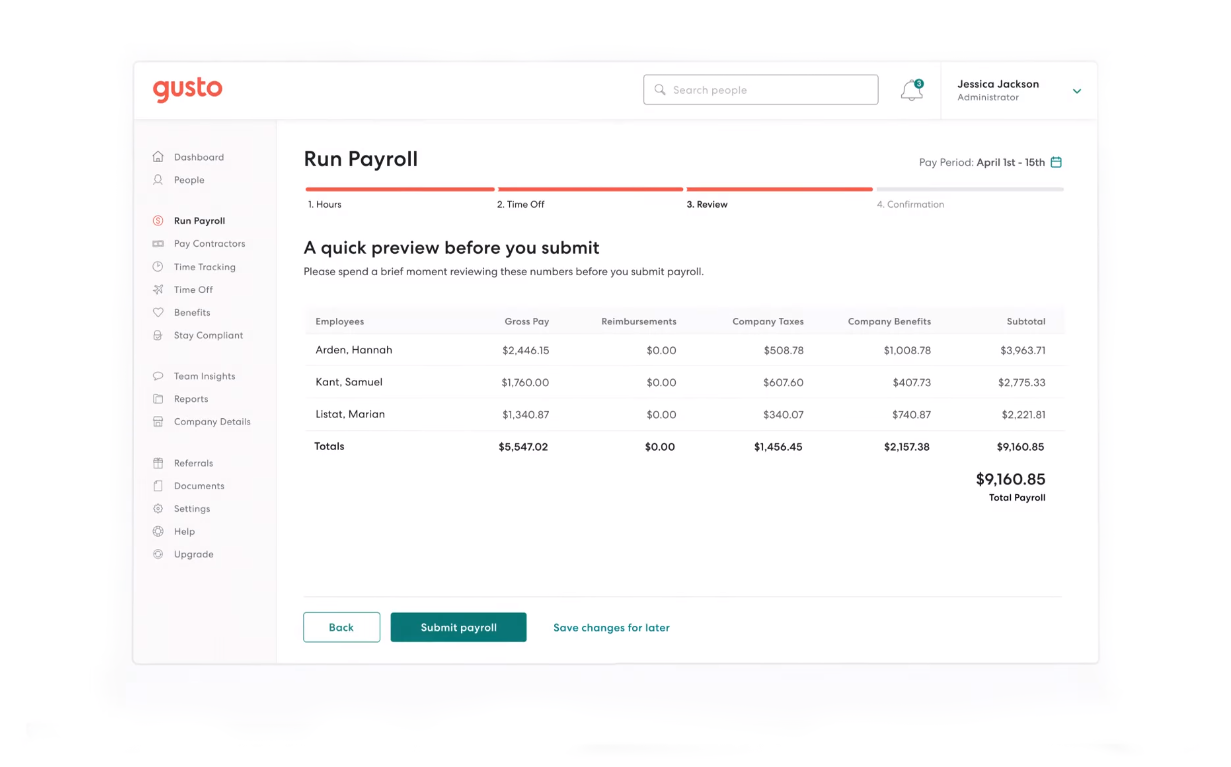

- Gusto: This solution is packed with everything a business needs to manage payroll confidently. On top of that, it has benefits administration features and compliance management tools, which it delivers in an intuitive interface.

- Wagepoint: Because it is a web-based payroll solution for small businesses, it is accessible as long as you have your internet connection and a modern browser. Plus, it has banking and benefits management modules.

- Patriot Software: This well-known accounting software also serves as a payroll tool that is suitable for small enterprises. It has a robust set of functionalities that are easy to learn how to use, thus requiring little training.

- Payroll4Free: As its name suggests, it is a free payroll tool you can access online that lets you pay employees. Aside from that, it can be a B2B software you can employ to pay contractors.

- Wave: This all-in-one accounting software allows you to do payroll and manage your incoming and outgoing accounts on a single platform. It has a free option that lets small businesses explore its tools while keeping the upgrade door open.

- OnPay: Automated payroll deductions and tax payments are possible with this online platform. Small businesses can also complete tax filings using this payroll software.

- SurePayroll: Small businesses looking for a powerful payroll solution without breaking the bank can look to this software. It can automate calculations, thus saving time and ensures that numbers are accurate.

- Square Payroll: You may have heard of the payment solution by Square that is good for small businesses. The good news is that you can also take advantage of its payroll module, letting you complete different but related tasks easily.

- RUN Powered by ADP Payroll: This solution simplifies payroll for small commercial undertakings. Apart from payroll, it has tools for handling tax and compliance, neatly packaged in a fast and intuitive platform.

- Paycor: A unified platform with payroll, recruitment, and human resource management modules, this software is powerful without being overwhelming. Apart from those, it offers timekeeping and reporting tools.

- factoHR: factoHR is a cloud-based platform that is uniquely crafted for an effortless payroll process. It consists of various features that cover all the components involved in salary calculations like statutory compliances and loan management in an organized manner. The software also offers time and attendance tracking, performance management, and employee onboarding modules.

How does Payroll Software for Small Business Work?

Calculates Payroll Automatically

A payroll software for small business can calculate payroll automatically. This reduces the burden of payroll staff, as they only need to ensure that the numbers they input into the system are accurate. They can be confident that the final calculation by the application is right because no manual number-crunching is required.

Deducts Taxes from Pay

Part of the payroll process is the calculation of how much tax to deduct from salaries and wages. This is mandatory and required by law. If the employer does not do so or does it inadequately, it can result in fines and penalties. That is why payroll solutions for small enterprises have components that enable business owners to comply with tax regulations.

Simplifies Tax Filing

Another essential component of payroll software for small enterprises is the filing of taxes. This is the documentation employers have to prepare after they deduct taxes from salaries. After that, they have to submit it to the tax bureau together with the tax payments. This is an arduous task to do manually, which is why payroll solutions simplify it by digitizing the workflow.

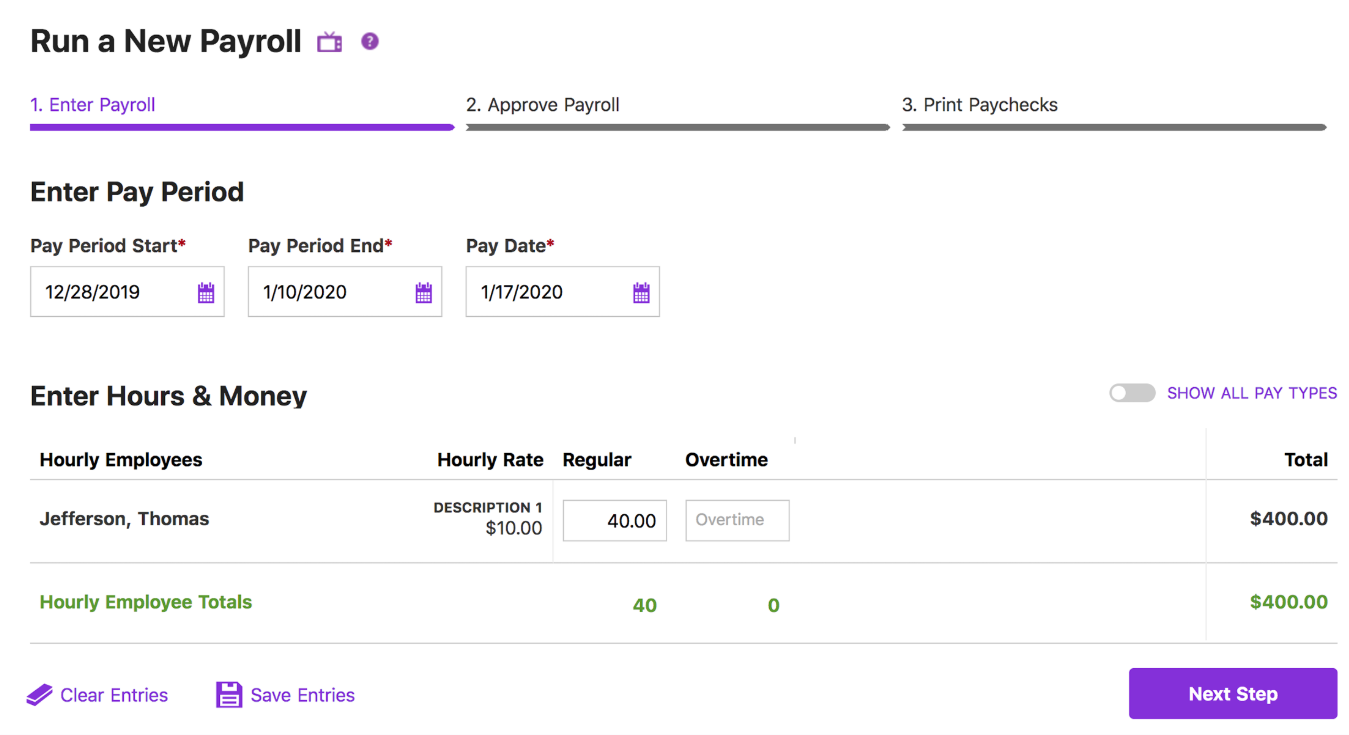

Patriot Software designs the payroll process to be painless. With it, you can finish the whole payroll workflow in just three steps.

Who is Payroll Software for Small Business For?

Payroll software for small business is dedicated to helping small-scale commercial enterprises in managing the pay of their employees.

Startups

Startups begin as small ventures; thus they may not have the budget for full-scale payroll software. Therefore, they need a solution that can meet their needs without having to stretch their finances.

Small Businesses

Brick-and-mortar, online, or combined businesses can take advantage of the tools provided by payroll solutions for small enterprises. These allow them to ensure that they are paying employees properly as well as complying with tax regulations.

Solopreneurs

It may seem odd that solopreneurs would need a payroll management tool. However, they can benefit from it if ever they hire seasonal assistants. They may need to do so when there is a sudden surge in orders that they have to get one or more pairs of helping hands.

What are the Types of Payroll Software for Small Business?

Though the name seems straightforward, payroll software for small business can come in different forms. Below we discuss the most common types that you will encounter:

Payroll Calculation

Wage law violations have resulted in billions of dollars in payouts due to litigation. This is because of the 1,283 lawsuits against companies that shortchanged wages. Small businesses cannot afford lawsuits, as it can not only lead to penalties, but it can also shutter their doors. That is why payroll software exists. They can rely on a simple payroll calculation tool that can automate the process and provide accurate results.

Tax Calculation and Filing

Seventy-five percent of small businesses do not pay tax because they are not corporations. However, they do pay payroll taxes, which is 7.65% of the employee’s gross payroll. Apart from that, they have to shell out for unemployment taxes and workers’ compensation taxes. In light of that, small business ventures can turn to payroll solutions that focus only on calculating taxes and filing forms with the tax bureau. This way, they can be confident that they are paying the right amount of tax and have completed the necessary documentation.

Features of Payroll Software

The following are the standard features of a payroll solution designed solely for small businesses:

1. Employee Data Access. To conduct payroll properly, payroll managers need to see the timesheets of employees. Payroll software enables them to do this by connecting with timekeeping solutions. In some cases, they may have built-in time records for better data access.

2. Fast Payroll Processing. Calculating payroll manually is time-consuming and prone to human errors. Payroll software for small business make certain that it is done quickly and with no mistakes.

3. Accurate Tax Filings. Small businesses have to pay payroll taxes, and they need to do so accurately to avoid penalties. Payroll software for small enterprises come with tax calculation and filing tools, which eases the process for payroll and tax managers. On top of that, these features digitize the filings so the business can save on paper.

4. Custom Reports. You can count on payroll tools to have reporting features. With these, you can see how much tax you have paid in a certain period. You can also use such tools to see the trends of your payroll.

Gusto’s payroll module simplifies the payroll process while taking into account the hours worked and time off.

What are the Benefits of Payroll Software for Small Business?

Error-free Payroll Calculations

The primary benefit of payroll software for small business is error-free payroll. Since it does calculations automatically, there is no need for additional number manipulation. Users only have to ensure that they have accurate time records to base the payroll on.

Tax Regulations Compliance

Tax regulations are strict, and not complying with a single rule can result in heavy fines and penalties. Small businesses can avoid those by utilizing the tax calculation, filing, and compliance tools of payroll software.

Payroll Transparency

In case employees have questions regarding their salaries or wages, they can check their records themselves. This is possible when a business uses a payroll software that has an employee portal. This way, they can review their records at any time. Plus, this allows employers to be transparent to avoid disputes.

What Should You Consider When Choosing a Payroll Software for Small Business?

As you have seen above, payroll software for small business ventures can have different types. That is why you have to think about exactly what tools you need before you sign up with a vendor.

1. Budget. Though they are made for small businesses, some payroll platforms may still be out of reach of some small-scale enterprises. This can be due to add-ons and other fees. Thus, you have to do your research to ensure that you know exactly what you are signing up for.

2. Tools. Again, there are different types of payroll solutions. Each one can have a different set of features than the other. You have to first determine what your needs are before you look for a platform. In this way, you have a checklist ready to narrow down your list of options.

3. Contract. Some vendors lock users in long-term contracts. This can be a good idea if you are sure that you like the solution. But if you are still starting to employ it, it may not be feasible, as you may change your mind about it.

Look Toward the Future

A payroll software that fits the budget of small businesses is a good thing because it lets them compensate employees exactly. Of course, it enables them to stay in line with regulations, too. Still, though payroll software for small enterprises are quite standard, there are things to look forward to in the future.

For example, there may be a need to include tools for cryptocurrency transactions in the future. Moreover, there may be more all-in-one platforms rather than standalone software. Plus, vendors could include more artificial intelligence capabilities as well as offer flexible payment options.