With tax deadlines a reality year in and year out, people routinely find themselves screaming at their scheduling software, scampering to their tax drawers and tax lawyers for instant relief from the IRS. As usual, the big question revolves around whether to give your taxes a go yourself or let the pros handle it. After all, putting your tax faith in the experts never did anybody harm, right?

There is a plethora of tax software out there, each one claiming to know best how to handle your taxes. But how can do we know where we should bring our business (and our tax filings as well)? This H&R Block vs Jackson Hewitt comparison article aims to show you the advantages of the two leading tax software services in the market today.

Two of the leading tax service providers, H&R Block and Jackson Hewitt, have been assisting millions of tax filings over the years, both in-person and through online and software services. With each passing tax deadline, each has laid claim to having the best service available. To settle the score and find out which one does have the advantage, this H&R Block vs Jackson Hewitt comparison article places them side by side and see how they stack up against each other.

So, which software is better?

Taxes are a very sensitive matter. If you don’t do it, you’re dead. If you don’t do it right, you may end up missing the deadline and face more consequences. Of course, you might be privy to the tax rates you’ll be paying if you’re using payroll software for your business.

For property owners, these tax rates are usually included in calculations by property management software. The choice of which service to avail depends much on how much and which taxes are due, your nature of employment, your source of income, and your properties.

The choice of how much you can afford to spend will play a role as well. Off the bat, Jackson Hewitt can provide the cheapest rates, but H&R Block may offer more services. For this article, we will compare both online filing versions of the mentioned services.

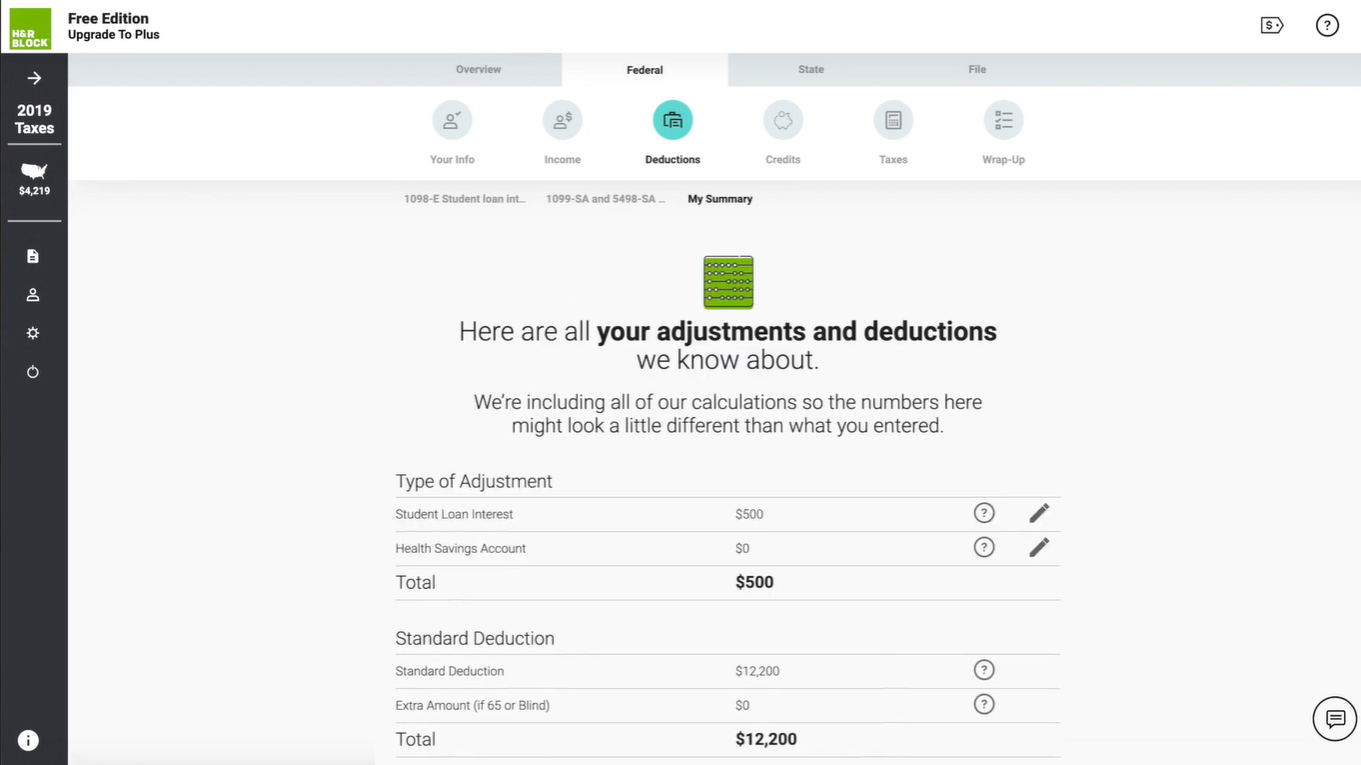

H&R Block payslip interface.

H&R Block vs Jackson Hewitt differences

While both online versions deal with the straightforward filling up and filing of taxes, they do have different approaches to some of their methods. This H&R Block vs Jackson Hewitt comparison section shows you how they differ from each other:

Platforms

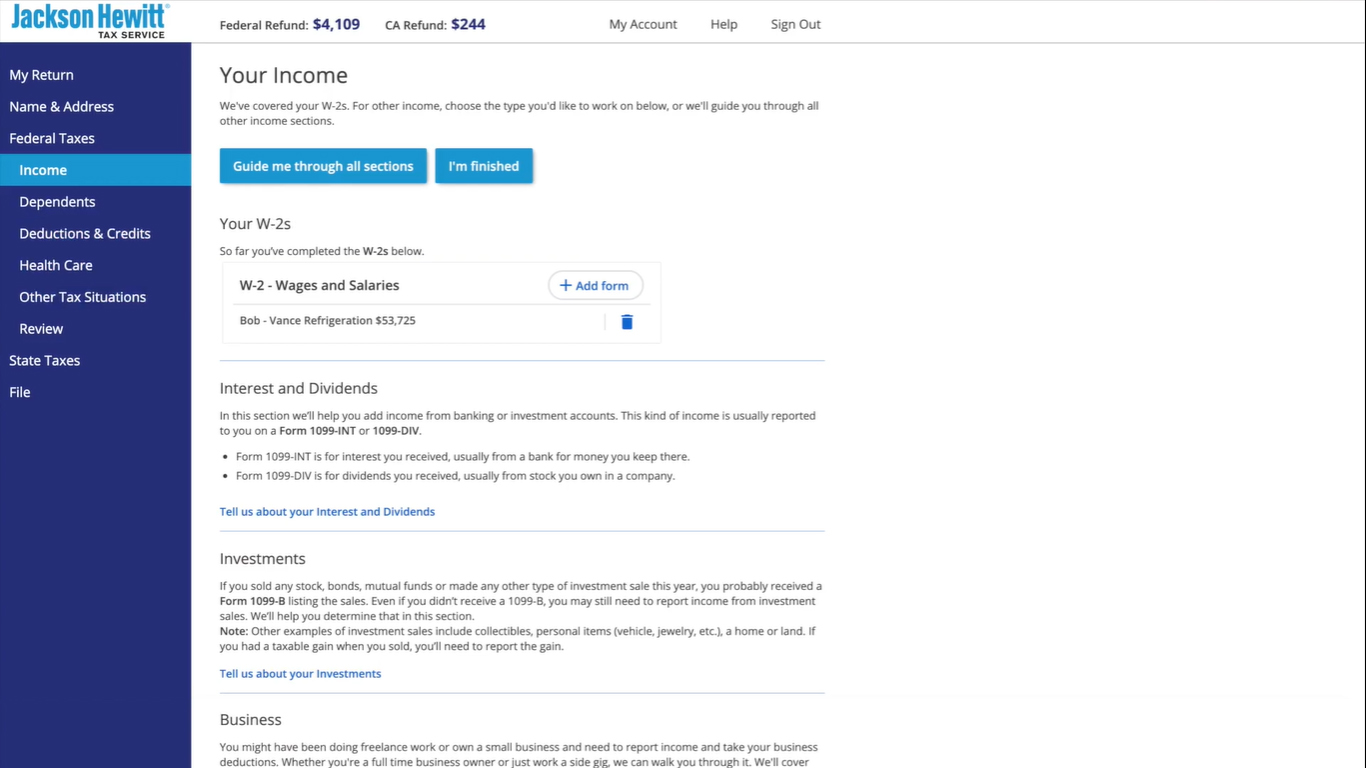

Jackson Hewitt offers two ways to file your taxes: online and personal filing with a tax pro. H&R Block provides three ways: online, file with a tax pro, or through downloadable software. The third option lets you complete your filings offline

Ease of Use

As taxes can be very confusing, especially for novice filers, Jackson Hewitt refreshingly uses simple language in providing step-by-step instructions in filling out the form. In a way, users have an online tax advisor for free!

Resources

H&R Block has provided a Tax Information Center, a resource hub where most tax questions can be answered, including e-filing, tax types, deductions and write-offs, tax forms, communications, advisories on deadlines, and tax tips. Jackson Hewitt similarly provides an all-inclusive tax assistance database on its website.

Pricing

Both H&R Block and Jackson Hewitt offer different plans, with the H&R Block presenting three plans with multiple options (Online, Online Assist, and Tax Pro Review) and the latter three (Basic, Deluxe, and Premier).

- Online / Free: H&R Block offers a free file online version for basic taxes, and Jackson Hewitt offers a free version as well. However, H&R Block offers additional packages that incur costs (Deluxe Online at $49.99, Premium Online at $69.99, and Self-Employed Online at S104.99, with an additional $44.99 per state filed).

- Online Assist (H&R Block only): The only difference between H&R Block’s Online and Online Assist packages is that the latter comes with on-demand help from a tax expert, enrolled agent, or CPA. While it costs more (approximately an additional $50 on top of the plan), this feature can help you finish your filings earlier and more accurately.

- Deluxe / Premier (Jackson Hewitt only): In addition to the free version for simple tax returns, Jackson Hewitt offers Deluxe ($29.99) and Premier ($49.99) packages, with the former targeting families and retirees, while the latter is designed for complex filings. Both come with an additional cost of $36.99 per state filed.

- Tax Pro Review (H&R Block only): Starting at $144.99, this includes a tax professional review of your tax return before filing.

Jackson Hewitt income statement dashboard.

Security

H&R Block outlines its security measures for customers availing online tax filing. It provides web browsing and industry-standard encryption technology to establish a secure connection between your computer and the site, use multi-layer authentication for access. It has a 24/7 security team continually monitoring for breaches in its servers. Also, the company offers Tax Identity Shield, where your SSN and personal information are monitored within the world wide web for any activity outside of your known transactions. In case a tax return is filed with your information, H&R Block will help with the restoration process and help you coordinate with the IRS.

Apart from industry-standard security protocols like secure storage and access to your tax returns, Jackson Hewitt allows you to store your previous returns for up to six years at no additional charge.

Support

Jackson Hewitt assists online users via a step-by-step preparation of your taxes. They also provide real-time customer support for online concerns. In contrast, and for an additional fee, H&R Block offers unlimited help from tax experts to answer questions or resolve your filing issues.

Integrations/Import

H&R Block allows you to import returns from other tax preparers, which makes updating your files easier. Jackson Hewitt does not have this feature available.

H&R Block vs Jackson Hewitt similarities

Tax Tools

For the most common questions and queries about taxation, both services provide a resource page on their websites that contain answers to the most common question and tax tools for easy computations. H&R Block, in particular, provides a tax calculator, tax preparation checklist, current tax forms (federal and per state), and a tax topics page. Jackson Hewitt’s site contains refund calculators: 040 Federal Income Tax Estimator, Earned Income Tax Credit Estimator, Estate Tax Liability, and Self Employment Tax Estimator. It also lets you view the status of your refunds and a repository of tax forms.

W2 support

Both H&R Block and Jackson Hewitt lets you upload or scan your W2 form for easier encoding to your tax forms. Both provide instructions on how to do it. In addition, H&R Block offers a W-2 Early Access tool that lets you download a copy of your W-2 form from a nearby H&R Block center.

Shift to filing with a tax pro

When everything fails during the filing, H&R Block and Jackson Hewitt will both allow you to have your taxes completed by a professional. This will entail upgrade/additional fees – Jackson Hewitt upgrades start at $59, while H&R Block offers online assistance starting at $49.99 as an upgrade from the free version.

Supported language

As tax returns are required to be submitted in English, all information and forms are written in that language. For nonnative filers who have yet to master the language, they may need further assistance from friends or staff, as both H&R Block and Jackson Hewitt only support English.

H&R Block vs Jackson Hewitt takeaway

For income earners, filing taxes is a certainty from which there is no escaping. Unfortunately, the complexities of federal and state tax laws might be too much for some people, and assistance may be necessary. For those on the go, with jobs and families and other duties to fulfill, online filing of taxes may be the best option.

As this H&R Block vs Jackson Hewitt comparison 2020 article showed, both services offer good options for online filing, beginning with free services for simple tax filings and then tiered charges, depending on the complexity of your taxes. Jackson Hewitt offers the lowest rates per plan, even with the additional charges from state filings, etc. H&R Block does have more transparency in pricing, as it shows you the actual cost before your purchase.

As far as features are concerned, both offer a convenient and straightforward way to pay taxes, especially people who need help warming up to the taxation system. As each individual or business has its unique requirements, the choice of online service must be equipped to handle these. In matters of tax type, H&R Block’s strength suits corporate and business taxes in particular, while Jackson Hewitt works well for self-employed workers. For individuals and small incomes, either service can help.

The free software offered by both is only applicable to simple taxes. Better to assess your own particular tax needs, and check if the features (and maybe prices) of either H&R Block or Jackson Hewitt and let them show you how best they can help.