Square Review

OUR SCORE 90%

OUR SCORE 90%

- What is Square

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Square?

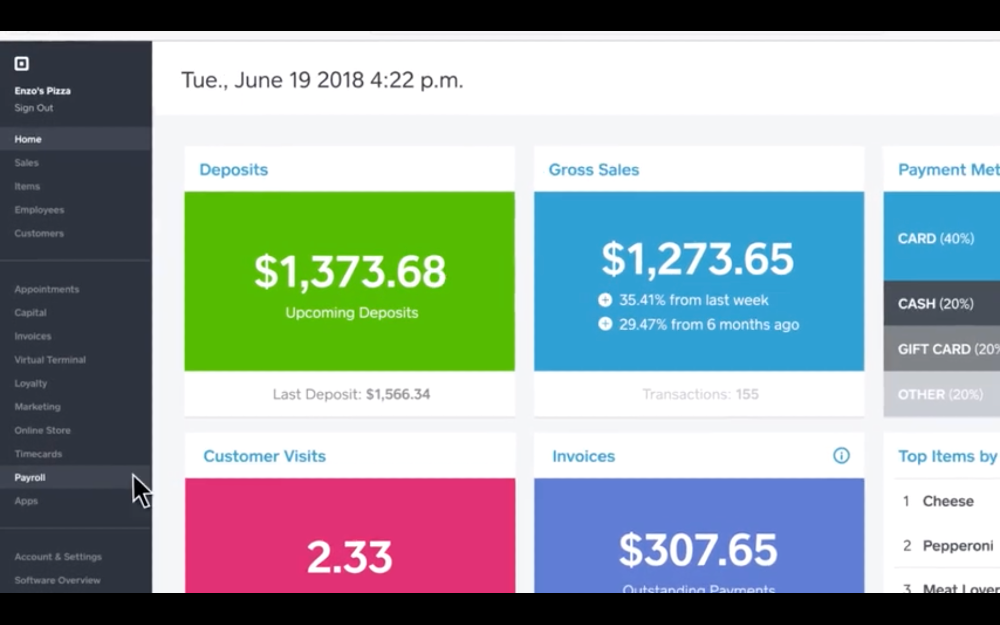

Square Payroll is a payroll software that businesses can utilize to ensure contractors and employees are paid correctly. It can offer a number of benefits such as health, a 401(k), workers comp, pre-tax benefits and can track employee hours as well as pay salaried and hourly employees. Square Payroll can provide employees with online accounts and can also easily import tips and timecards. The mobile app makes it easy for employers to compensate their workers wherever they may be. The service also makes payroll processing easier and quicker as it can handle tax filings and withholdings on its own. Integrations also make it easy to import timecards and point of sale devices. Additionally, any issues customers may have with the service can be easily resolved by contacting phone support from their customer service team based in the United States.Product Quality Score

Square features

Main features of Square are:

- 401(k) Tracking

- Check Printing

- Self-Service Portal

- Vacation/Leave Tracking

- Wage Garnishment

- Benefits Management

- Direct Deposit

- Multi-State

- Payroll Reporting

- Tax Compliance

- W-2/1099 Preparation

Square Benefits

The main benefits of Square are quicker payroll processing, automated tax filings, and a happier workforce.

Quicker payroll processing

Square payroll software has a number of tools that make it easier for employers to compensate their workers, whether they’re fulltime employees or contractors. Employers only need to enter the number of hours an employee worked or import timecards from timecards systems that they’ve integrated into the system. Employers then only need to choose whether the employees will be paid via cheque or direct deposit and the system does the rest. Pay stubs are provided digitally and employees can use the mobile app to check on these stubs or manage their personal information.

Automated tax filings

Correctly filing taxes and filing them on schedule can be a daunting task but Square Payroll can handle it for employers without them having to worry about paying extra. The system can automatically calculate, withhold, and send payroll taxes to the proper agencies, whether on a state or federal level. Quarterly tax forms on the state and federal level can also be handled by the system. Employees and contractors can also get their W-2 and 1099-MISC forms from the service.

Happier workforce

With tax filings handled efficiently and payroll processing streamlined, employees can be properly compensated with very little hassle. This makes for a happier workforce that is more motivated to work for the good of the company.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Square Integrations

The following Square integrations are currently offered by the vendor:

- QuickBooks

- TSheets

- Square Point of Sale

- Deputy

- Square for Retail

- Homebase

- Beekeeper

- TrackTime24

- Hubworks Hostel Management

Video

Customer Support

Pricing Plans

Square pricing is available in the following plans: