Acorns Review

OUR SCORE 84%

OUR SCORE 84%

- What is Acorns

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Acorns?

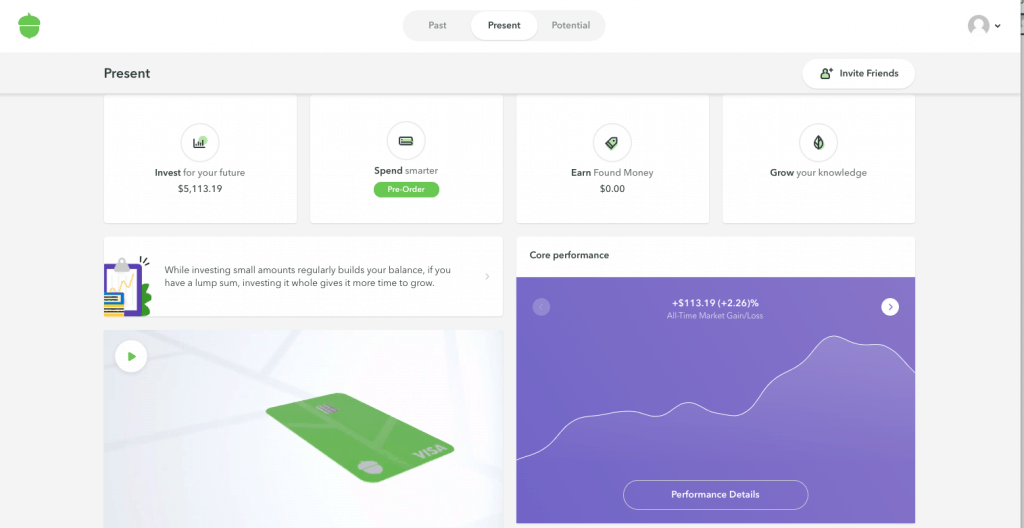

Acorns helps people invest and grow their spare change easily. There's no need for you to have a background on stocks, bonds, and the financial markets because Acorns automatically invests the money available in your account. In every purchase from your credit or debit card, Acorns rounds up the amount and invests the spare change. There is also an option to deposit lump sum amounts, which will serve as top-ups to your existing investment portfolio. Aside from an investment account, Acorns also offers a retirement account, a checking account, and a debit card. Money invested in Acorns goes to the Exchange Traded Funds (ETFs). They take care of diversifying your investment to over 7,000 stocks and bonds. This is made possible because of the Fractional Share Ownership on ETFs.Product Quality Score

Acorns features

Main features of Acorns are:

- Savings Account

- Bonus Earnings

- Retirement Account

- Tax Advantages

- Checking Account

- No Account Fees

Acorns Benefits

The main benefits of Acorns are its round-up feature, unlimited bank transfer, zero commissions, and their strong security measures.

Round-Ups

Every time you purchase something, whether it’s gas, groceries, or coffee, Acorns rounds up the amount to the next dollar. The spare change is then automatically invested into your Acorns account. This way, you get to save every time you make a purchase without really feeling the amount deducted from your funds.

Unlimited Bank Transfers

You can transfer funds as many times as you like to and from your Acorns account. The first step in signing up for this budgeting software is to input your bank account details to make the transfers easier and faster as you do them. You can transfer funds to your Acorns account if you want to add more to your investment portfolio, and transfer money from your Acorns account to your bank account if you wish to cash out your earnings.

Zero Commissions

Acorns does not charge you with additional commissions or fees whenever you make a transaction. You just have to pay for the monthly subscription to maintain your account.

Strong Security Measures

To ensure that your data and your money are protected, Acorns uses bank-level security measures. A 256-bit encryption is used to secure both the app and the website. They also send alerts whenever suspicious transactions are made in users’ accounts to prevent fraud.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Acorns Integrations

The following Acorns integrations are currently offered by the vendor:

No information available.

Video

Customer Support

Pricing Plans

Acorns pricing is available in the following plans: