Personal Capital Review

OUR SCORE 84%

OUR SCORE 84%

- What is Personal Capital

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Personal Capital?

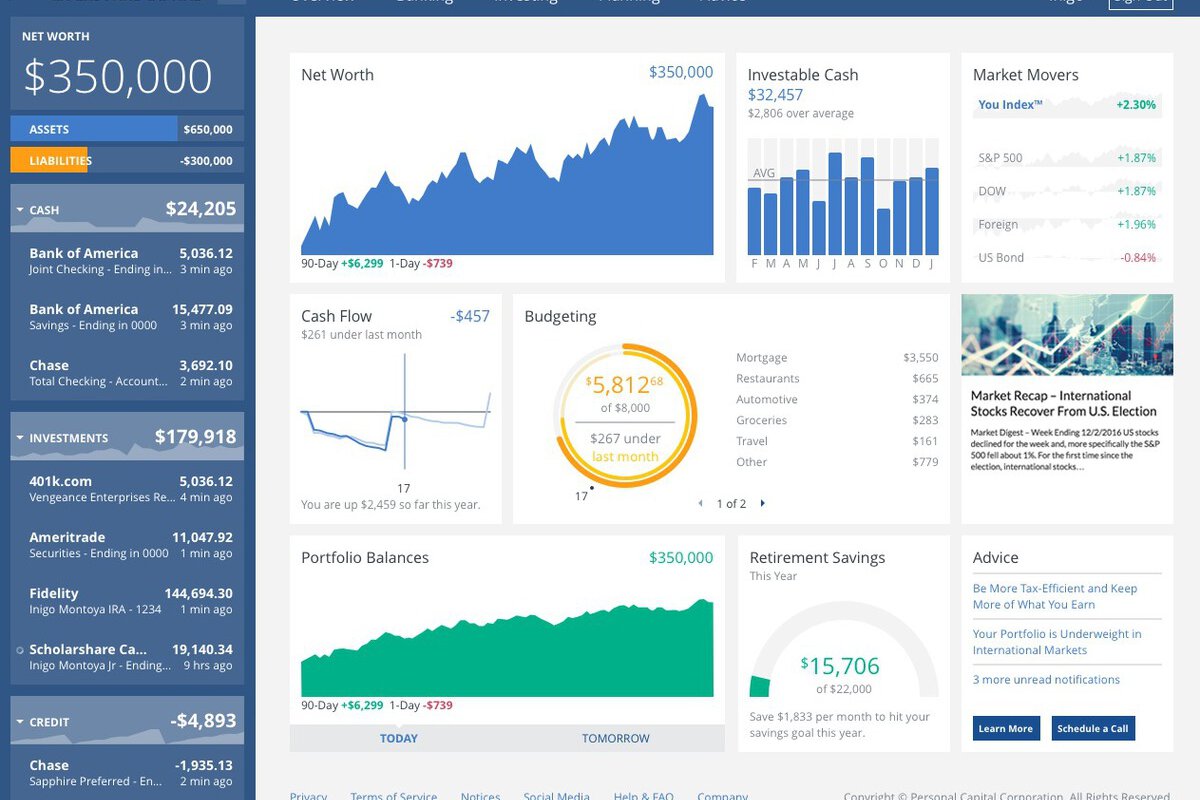

Personal Capital is an extensive cash management application. Beyond the basics of budget monitoring, it also offers investment advisory and tax assistance for people in the United States. It is an affordable platform made for individuals who want sound, tech-based monitoring, and advice on their journey as investors. The free version offers basic budget management, with graphs and charts to plot your finances across the board. It is useful for determining how much you are paying in fees and for keeping track of your retirement goals. The paid version, which includes wealth management capabilities, is used by around eighteen thousand people. While the upgrade definitely gives users access to more features, it is clear that the free version already satisfies most people who are just looking for a budgeting system. Personal Capital’s paid version is best for those who are looking for a closer companion on their investments.Product Quality Score

Personal Capital features

Main features of Personal Capital are:

- Financial Advisors

- Cash Flow Tracking

- Investment Tracking

- Market Tracking

- Online Sync

- Joint And Taxable Investment Accounts

- Traditional Roth Accounts

- SEP And Rollover IRA Accounts

- Trust Accounts

- Data Export

- Security

Personal Capital Benefits

The main benefits of Personal Capital are its budgeting and investing capabilities, tax assistance, financial advisory, socially responsible investing, and high-security platform.

Budgeting And Investing

The first impression most people get from Personal Capital is that it’s just like any other budgeting software. However, that’s actually just a portion of what it does; most of Personal Capital’s strength comes from its position as an investment platform. It helps users start and manage their investments, providing live advisory, recommendations, and market analyses throughout the user’s journey. Personal Capital encourages socially responsible investing and rates companies according to three categories: environmental, social, and governance impact. This is a benefit for investors who want to align their finances with their personal beliefs.

Tax Assistance

Personal Capital encourages users to become self-sufficient by offering a series of tools and guides that focus on three main areas: asset location, tax-loss harvesting, and tax efficiency. This will be an important lesson to learn, especially for users who are new to investing.

Financial Advisory

Personal Capital encourages better money management by connecting every user to two financial advisors. These human advisors are selected based on every individual’s personal needs and preferences.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Personal Capital Integrations

The following Personal Capital integrations are currently offered by the vendor:

- Titan

- M1 Spend

- Robinhood

- Acorns

- Ally

Video

Customer Support

Pricing Plans

Personal Capital pricing is available in the following plans: