Venmo is one of the most popular online payment software today because of the convenience it provides users. Particularly, the app is known for its ease of use and low fees. However, users have also complained about some elements of Venmo’s system. For instance, one of Venmo’s weak points is its privacy. By default, the platform displays all user transactions to anyone on Venmo.

The good news is that there are various Venmo alternatives you can use instead. The 10 platforms in this article facilitate convenient online payment while keeping your financial details secure.

What is Venmo?

Venmo is an easy-to-use online payment platform that can be used to send money and make online purchases. The app allows users to send and receive cash from their friends. With its partnerships with popular online stores, Venmo allows users to shop online as well.

You can easily link your preferred payment method to the platform. Once your payment method is linked, you can use your Venmo balance to send cash to friends or pay at online shops. Venmo also lets you cash out your balance to your bank account.

Venmo also offers a Venmo card and app where you can easily track purchases and split expenses with Venmo friends. By using the Venmo card, you also earn rewards and cashback.

Venmo Limitations

Despite its convenience, Venmo has its share of limitations. Aside from the fact that the platform makes your transactions public by default, Venmo also operates on the principle that senders and receivers of payments trust each other. As a result, the platform doesn’t offer buyer or seller protection.

Using the Venmo card also sets you back $2.50 per withdrawal. Moreover, you can use the card only with US-based merchants and ATMs. If you have to withdraw funds from a financial institution that requires a signature, you’ll also have to pay $3. All these fees can add up if you just want to cash out.

The good news is that we’ve put together a list of the 10 best Venmo alternatives today.

Venmo Alternatives

1. Braintree Payments

As one of the most popular Venmo alternatives, Braintree Payments offers a web-based payment system that benefits personal and business users. This online payment platform is particularly useful to businesses, as it offers numerous security and reporting features that SMEs and large businesses can take advantage of.

Additionally, the software has a web dashboard and mobile app that you can use to send and receive payments. The platform also gives you access to an extensive selection of payment methods, including PayPal, Apple Pay, and Google Pay. This versatility comes in handy if you’re using ecommerce software.

Braintree offers a simple pricing plan as well, charging 2.9% plus $.30 per transaction.

2. Skrill

If you’re looking for Venmo alternatives focused on ecommerce, consider going with Skrill. The platform lets users oversee all their transactions using just one account, providing convenience to shoppers and online businesses. Through Skrill, you can easily fund your Skrill wallet and make payments when shopping online. Rapid transfer services also ensure that sellers quickly receive payments from buyers.

With its international reach, the platform can also be used for a wide variety of online activities, including trading, in-game purchases, and even betting. Moreover, sending and receiving money is free of charge. Transactions requiring currency exchange rates, however, have a fee of 3.9%.

Skrill provides an easy account management.

3. XE Money Transfer

Starting as a platform providing information on exchange rates, XE Money Transfer is now one of the most reliable Venmo alternatives. The platform allows for money transfers that are free of charge. You can send money to over 130 countries at rates lower than those offered by banks.

Businesses can also take advantage of XE Money Transfer’s capabilities. Aside from facilitating international payments, the platform’s API features allow you to integrate the system for processing and delivering mass payments. You’ll also be able to fully customize the app to match your branding. Moreover, XE Money Transfer doesn’t charge fees to receive money or process foreign exchange transactions.

4. ACE Money Transfer

The ACE Money Transfer platform processes money transfers 24 hours a day, 7 days a week. The software uses the highest standard security protocols so users can rest assured that their money is safe. For added convenience, it also accepts payments through Visa, MasterCard, Swift, and Maestro. Additionally, you can use your debit card to send payments. One advantage of using this solution is that there is no maximum limit to sending money.

The platform lets you track transfers through its website. You also have the option to download the ACE Money Transfer app from Google Play or the Apple App Store. These mobile apps can provide instant updates on transfer status and alerts on currency exchange rates. Plus, transaction fees charged by the platform vary per country.

5. OrbitRemit

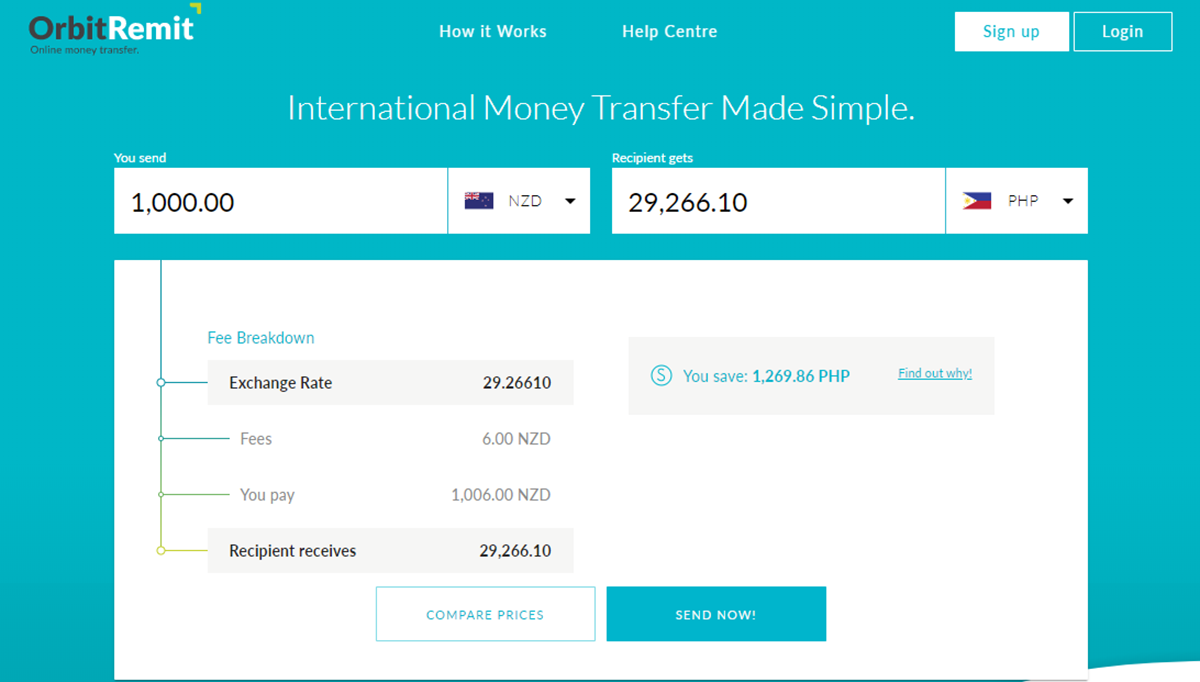

OrbitRemit works as a global money transfer service. The platform offers a simple system for sending money; all you have to do is input the amount you want to send and choose the currency you prefer to use. OrbitRemit displays the total amount that the recipient can cash out, minus service fees and currency conversion fees. It charges a flat fee no matter the amount you transfer, too.

You need to create an account before being able to send or receive money through OrbitRemit. The platform has a mobile app for Android and iOS so you can transfer money on the go and track currency exchange rates wherever you are. Other great features offered by the software are scheduled transfers and the ability to save recipient details.

OrbitRemit with a transparent international exchange rate right on the homepage.

6. Xoom

Working under PayPal, Xoom provides a secure means of sending money without incurring hefty fees. The platform enjoys more popularity in Asian countries. It ensures that all prices and fees are clear and upfront, so you and your recipient will always know how much money to expect from the transfer. This transparency makes the platform easier to use with accounting software. Transaction fees typically depend on transaction types, your payment methods, and the transfer’s destination country.

What’s great about Xoom is that it provides more than one way to send money. It also allows you to send money directly to bank accounts and to have the cash delivered directly to the recipient’s doorstep. Transfers can be completed in a matter of minutes, and payouts can be collected through any Xoom-authorized location around the world. For users’ peace of mind, the system also sends updates through text and email.

7. Payoneer

Payoneer makes it easy for ecommerce sellers and service providers to request and receive payments for goods and services. The platform simplifies international business transactions. Users have the option to get paid in their preferred currency and the ability to sell their products and services on worldwide marketplaces.

Like accounting systems, the platform offers built-in tools for requesting payments, so you can send invoices with just a few clicks. Conversely, you can also use your Payoneer to balance and make online payments to contractors and vendors. For added convenience, money transfers between Payoneer customers are free of charge.

8. Stripe

Stripe offers powerful tools for sending and receiving money online, especially for merchants and online sellers. The software’s payments platform provides an all-in-one solution for online businesses, with smart payment pages, customizable checkout forms, and automated invoicing. You’ll also be able to accept payments from major debit and credit cards.

As a platform that prioritizes ease of use, Stripe is accessible anywhere, whether from desktop or mobile. You don’t have to worry about data security as well, as Stripe’s security infrastructure offers encryption for credit card numbers as well as compliance with the highest industry standards.

9. WePay

A JPMorgan Chase company, WePay, helps facilitate online payments for a wide variety of personal users and business owners, including online sellers and freelancers. The system offers integrated payment solutions for SMBs, POS platforms, and marketplaces, too. Whatever your business model is, WePay has a solution to make online payments more convenient.

For instance, WePay Link ensures that monetizing payments is convenient. Merchants with Chase bank accounts enjoy same-day deposits with no additional costs. You’ll also be able to accept payments through credit cards, debit cards, or eChecks. Moreover, the platform uses state-of-the-art systems for facilitating transfers and preventing fraud. With these safeguards, you can make sure that your money is protected.

WePay helps facilitate online payments for a wide variety of personal users and business owners, including online sellers and freelancers.

10. PayPal

Last but not least, PayPal also works great as an alternative to Venmo. The platform offers a fast, secure means of sending money to individuals or merchants. Individual users with PayPal accounts get a digital wallet where they can add credit cards, debit cards, and bank accounts. These features make online payments or money transfers easier and faster.

Likewise, PayPal offers 24/7 fraud detection monitoring. As a result, the system sends you alerts if it detects suspicious activity in your account. This feature improves protection for your digital wallet and your bank account. The system’s Purchase Protection feature covers all eligible PayPal transactions. In transactions that qualify for the feature, PayPal refunds the full purchase price, plus original shipping costs.

Choosing the Best Venmo Alternative

As you can see, there is no shortage of choices if you want to look for online payment platforms other than Venmo. Many online payment systems offer more than just money transfer options, too. Some platforms, like PayPal and Payoneer, have features that will benefit businesses and merchants as well.

Moreover, many online payment systems offer similar features and capabilities. It all boils down to which platform provides the best value in terms of fees and charges, without compromising speed and security.