The world of taxes is constantly changing and staying compliant with tax laws and regulations can be a daunting task for any business owner. As 2023 approaches, it’s becoming increasingly important for businesses to invest in tax software to stay ahead of the curve. Tax software not only saves time and improves accuracy, but it also helps businesses stay compliant with the latest tax laws and regulations.

Tax Software and Its Benefits

Tax software is any software that can be used to complete information reports using your businesses’ information. Some of the most common types of business information reports are:

- 1099 (like 1099-NEC, MISC, DIV, INT, and many others)

- W-2 (for employee wage reporting)

- 1095-C (for ACA compliance reporting)

Tax software are packaged in different ways. Some older types of tax software are downloadable and must be installed on a computer and more modern types simply require a web login to get started. Many software providers also vary in how much of they process they handle. In some cases, tax software vendors will prepare a file that you need to send to the IRS or SSA yourself, and in other cases, the process is totally hands-off and is handled entirely by the software provider.

The key benefits to using a dedicated tax software are in timesaving and efficiency, improved accuracy and compliance, cost-effectiveness, and increased security, which we’ll explore below.

Timesaving and Efficiency

Perhaps the most compelling argument for implementing a tax software is the timesaving aspect that automation can bring your business. For example, some tax software can integrate directly with your payroll systems to allow you to seamlessly transfer your information into tax forms with no data entry and with less chance of introducing error via manual entry. Similarly, many tax software vendors provide functionality that allows you to pull in data from ecommerce platforms for simple reporting.

Aside from simple integrations, some tax software platforms also support bulk actions to allow you to make bulk edits, which could prove to be extremely tedious if done by hand. Similarly, there are tax software products that allow users to receive a high-level report of all data entered, including totals company-wide for each box reported. This is a standard way for payroll and accounting professionals to check to ensure all data is included and that nothing is missing or double counted in the final report.

Improved Accuracy and Compliance

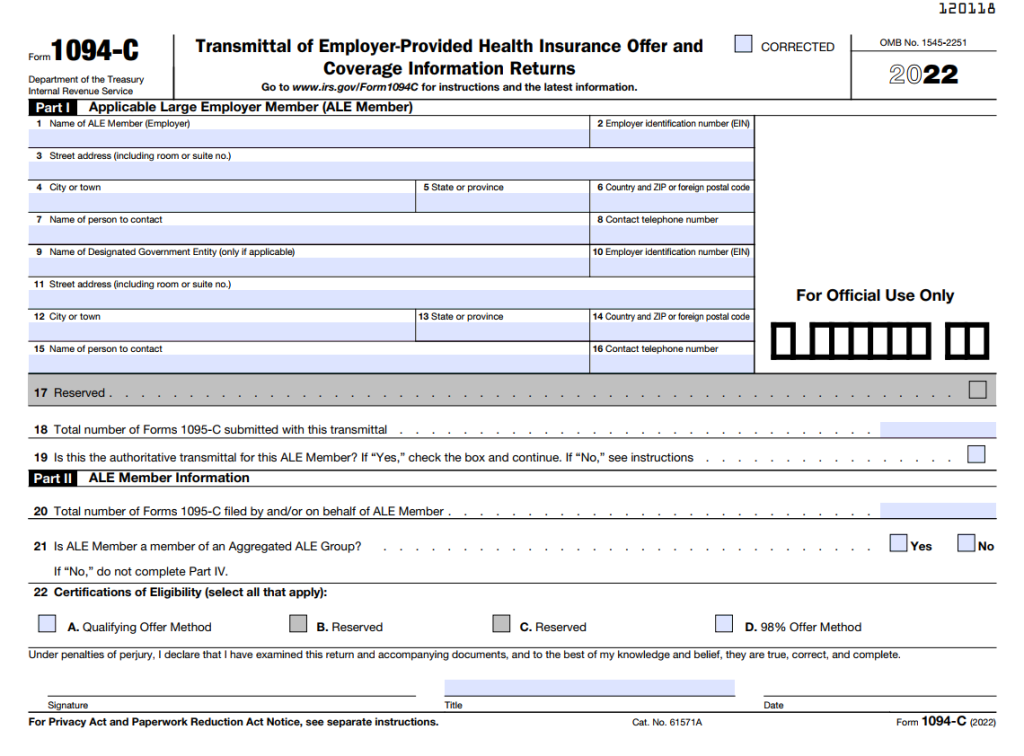

Some tax forms, like the 1094-C, have hundreds of boxes that must be filled in based on complex rules that must be understood to fully complete this information correctly. Using a dedicated tax software product from a trusted ACA software vendor, can allow you to fill in your information while also alerting you to potential issues with data entries.

In the case of ACA reporting, reporting an incorrect value or missing a checkbox can result in hefty fines. According to the IRS, misreporting a value and triggering a fine could result in a “$2,000 (penalty) for each full-time employee”. While it is possible to correct this after the fact, receiving an IRS penalty letter alerting you to this with a 30-day time frame to pay up or fix, is not how most businesses and business owners like to operate.

Cost-Effectiveness

One of the most common mistakes made by businesses is in thinking that you can save some money by doing tax reporting yourself. While on the surface this may be true, once you consider the time spent on manual data entries, the potential cost of mistakes and subsequent penalties, and lack of post filing audit support, the cost of doing it yourself is often much higher.

Increased Security

While counterintuitive at first, using tax software for your information reporting is often more secure than attempting to handle this yourself. This is because most tax software companies are required to comply with a rigorous set of security protocols to handle personally identifiable information. Smaller organizations that attempt to e-file, distribute, and archive their tax documents themselves typically won’t have a similar level of rigor that covers security policies, hardware, software, and their network.

Changes in Tax Information Reporting in 2023

There are many changes each year to tax filing and procedures to accompany changes in tax laws and regulations. Under the Taxpayer First Act of 2019, the IRS has introduced lower and lower thresholds for electronic filing to force businesses to transition from paper filing to e-file. For filers with more than 250 forms across all filing types (for 1099s), you will be required to file electronically. The cutoff for this is scheduled to decrease on a yearly basis until the cutoff is eventually reduced to 10 forms. As a result, this would force many manual filers to transition into using an e-file software provider in future years.

Aside from tax regulations and laws, the IRS and SSA are also implementing major software level changes to their systems. In December 2022, the IRS announced the creation of the Information Return Intake System or IRS IRIS that will allow customers to e-file directly with the IRS in future years. While this sounds like a promising alternative to dedicated tax software, there are inherent system limitations (like a max of 100 forms per bulk transmission) among other issues. Like other IRS systems, this also requires registration to obtain a special identification code to allow you to e-file. This process has proven to be time consuming and typically requires confirming a lot of personal information like your credit card information, home mortgage details, cell phone bill details, and driver’s license information. If a registered responsible individual is terminated, this could prevent the business from e-filing in future years and creates unnecessary risk.

Compatibility with Your Business Needs

Now that we’ve established the importance and benefits of using tax software, it’s important to identify what makes a software a good fit for your business.

User-Friendliness

Tax forms are inherently complex and the benefit to using a tax software is that this should simplify the process and break down complicated concepts without complicated tax jargon. In addition to understanding the tax forms themselves, the user interface of the system is crucial to ensure a smooth process for entering, checking, and e-filing your data. A user interface that simply mimics a tax form doesn’t provide nearly as much usability benefits as a system that is tailored to your needs and only asks for your data when needed.

Security Features

If you’re looking to hand your data off to a tax software provider, you’ll want to make sure they follow and adhere to a number of security standards like: HIPAA, SOC-2, ISO 27001, PCI DSS 3.2.1, SOC TSP. You’ll also want to ask in-depth questions regarding how the data is transported, stored, as well as the procedures for requesting that your data is completely expunged from the system.

Pricing and Affordability

When shopping for tax software, it’s important to consider the pricing model that works best for your business. Some tax software providers bill on a per tax form basis, and decrease the cost with more forms. Others will have a subscription fee, or some minimum yearly fee in order to file. While it may appear that some tax software is extremely cheap, it’s important to remember that cheaper software typically misses the mark on usability and requires far more manual data entry and work to successfully file.

Conclusion

Tax software offers a multitude of benefits, including timesaving and efficiency, improved accuracy and compliance, cost-effectiveness, and increased security. By choosing the right tax software, businesses can streamline their tax preparation process and ensure they follow the latest tax laws and regulations.