Money makes the world go round, and as you know, your business is no different. Ensuring all your finances are above board, invoices are accounted for, and obligations are fulfilled is crucial to keeping your company afloat. Depending on company size, this responsibility would fall on the shoulders of entire finance teams in the past.

Thankfully, nowadays, you don’t have to employ an entire army of financial specialists to keep your books in order. One or two may suffice if you equip them with good invoice management software.

In this article, we’ll explain how that’s possible, outline 8 tips on choosing the best accounting software, and even give you 10 handy options to consider. But before we get ahead of ourselves, we first need to answer a single question…

What Is Invoice Management Software & Why You Should Use It

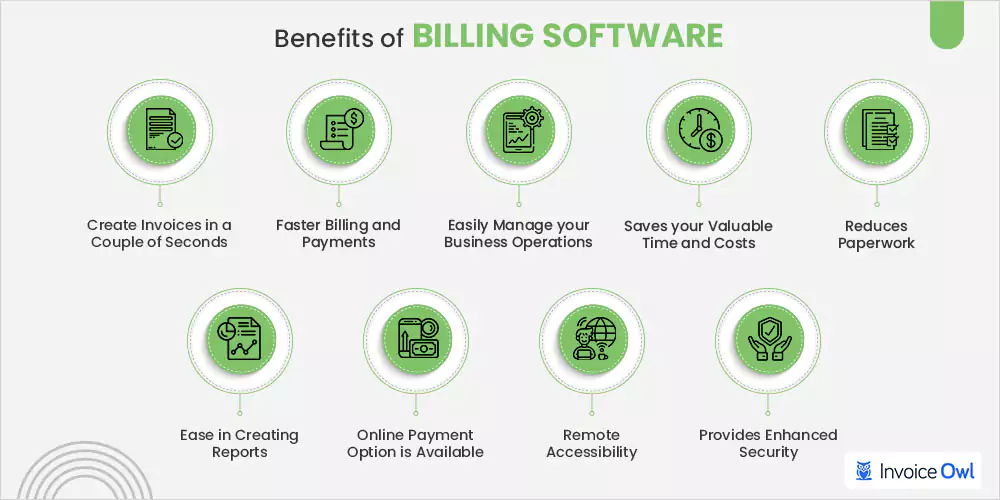

As the name suggests, invoice management software is a type of tool that helps companies automate and oversee tasks related to their invoice processes. Invoice management software can fulfill a variety of roles and offer many features and benefits.

These include:

- Quick and Easy Invoice (and Other Document) Creation (invoice templates included)

- Faster Billing and Payments

- Comprehensive Financial Reporting

- Secure Cloud Encryption

- Remote Access via Desktop and Mobile Apps

- Reduced Paperwork

- Lower Investment in Time and Money

- and more.

Source: InvoiceOwl

Research suggests that 82% of SMBs use some form of billing software in their operations. And while the rate of adoption in mid-sized and big businesses is lower, the technology has been steadily spreading throughout all industries, both B2B and B2C.

According to self-reported statistics, the main motivators behind this switch include:

- Increasing Functionality

- Replacing Dated Systems

- Consolidating Multiple Tools

- Streamlining Usability

- Improving Reporting

- Lowering Costs

How to Choose the Best Invoice Management Software

Judging by the fact you’re reading this article, you’re likely facing some invoicing issues yourself and would like to leverage any or all of the benefits mentioned above. The question is, how do you choose the best system for your company?

#1: Specify Your Needs

Before you ever consider pressing that “buy” button, you need to know exactly what it is you’re looking for. Different invoice management solutions offer different features, and you don’t want to get stuck paying for something you don’t need while lacking the tools to make your life easier.

Do you operate an e-commerce store? Then you should look for a tool that provides the option of online payments, purchase orders, delivery notes, and currencies and languages. Or are you more focused on creating invoices, estimates, and other financial documents? In that case, your priority should be a tool featuring a wide range of document templates, an intuitive invoice creator, and recurrent invoices.

Another consideration should be how many people you want to onboard into the system and where they’re most likely to use it. A mobile app and the number of users may seem like minute details, but you’ll soon discover that these quality-of-life improvements make a huge difference once you actually start using your software.

#2: Set a Budget

Finding software that fits your budget is a topic in and of itself. As we mentioned in our previous point, having access to an infinite amount of tools and features will do you no good if you don’t use them. And it makes even less sense if the software you get to save time and money financially cripples you.

To avoid this unfortunate fate, consider your obligations first. How much money can you afford to spend on a monthly basis and still achieve a good ROI (Return on Investment)? Try to look for a solution that’s transparent with its pricing and details potential additional costs. Compare the two amounts, and your options should be immediately more obvious.

#3: Trust Those Who Came Before You

Statistics suggest that 93% of people read reviews before purchasing anything. And for a good reason! Product evaluations can reveal crucial information from real-life users that flashy advertisements and optimized landing pages could never tell.

To get a good idea of whatever solutions you’re considering, we recommended reading invoice management reviews both by everyday users and industry professionals on specialized review sites. We’ll cover some of the most important aspects to look out for in the following points.

#4: Look for an Easy-to-Use Solution

One of the first thing you should look out for when diving deep into invoice management software research is the tool’s ease of use. Your goal is to maximize productivity while minimizing effort. And to that end, you’ll need to find a tool that offers an easy-to-navigate interface, streamlined document creation, and a variety of ready-made templates.

Make sure to check in with the person responsible for managing your financial documents and see if the tool fits their work process well. Most solutions on the market offer a free trial, so doing so will cost you nothing and radically increase your chances of success.

#5: Consider Security

The unfortunate truth of the matter is that data theft and corporate espionage are nothing special nowadays. Even if you’re running a smaller company, there are still plenty of people who’ll gladly steal your information, given the slightest opportunity.

And since invoice management software deals with particularly sensitive financial data, it’s in your best interest to double-check the tool’s security protocols and ensure your financial information is safe.

#6: Look for Compatibility with Your Other Business Tools

According to market statistics, the average top-performing company uses around 37 unique business tools. Even if your stack is smaller, there’s likely a variety of software you need to keep on top of, including CRMs (Customer Relationship Management Software), payment gateways, and more.

Consequently, another aspect to consider is whether your invoice management software supports any of your current tools via integrations. While there’s nothing wrong with opting for a standalone billing system, consolidating all your apps into a single complex solution can streamline your work processes, save time, and prevent frustration.

#7: Account Best Customer Support

Now, ideally, you’ll never need to interact with customer support. But unfortunately, we don’t live in an ideal world, and unforeseen issues often crop up. When that happens, you need to be able to rely on your chosen provider to support you throughout the troubleshooting process in a timely and helpful manner. Reviews are once again a valuable source of information on this matter, as bad customer support tends to be the first thing people pick up on.

#8: Choose the Best Package

The eighth and final step of your selection process is bundling up all the information you acquired previously and weighing your selected competitors against each other. After considering the overall tool, you’ll want to account for each provider’s various packages.

These tend to differ in several significant ways, including the price, the difference between monthly and annual billing, the number of available users, and the features included in each pricing plan. Congratulations! After the elimination process, you’ll be left with the invoice management software objectively best for you.

11 Examples of Invoice Management Software for Small Business

And to get you started on your way, we’ve prepared this list of the best 11 online invoice systems on the market today (in our opinion).

- Billdu: Create professional and visually-engaging invoices, estimates, and other financial documents quickly and easily with the free invoice creator.

- FreshBooks: Present your small or freelance business professionally with quick and easy invoicing.

- Invoice Simple: Take care of your financial obligations at home or on the go with this specialized mobile and remote-friendly invoicing software.

- Quick Books: Level up your small-to-mid-size business reporting with the platform’s ability to track, collect, and organize metrics.

- Zoho Invoice: Experiment with automating and streamlining your invoice processes for free with Zoho’s standalone application.

- Wave: Automate your bookkeeping with time, invoice, and payment tracking all in one place.

- Invoice2go: Create instant websites and publish your profile on service marketplaces on top of the typical invoicing capabilities.

- Refrens: Create unlimited invoices for an unlimited number of clients completely for free.

- Xero: Connect to your bank, accountant, or any of your other business solutions anytime and anywhere.

- Square: Handle online and in-person purchases with ease with this tool’s invoice and payment processing features.

- Harvest: Track billable time and expenses automatically with this solution, perfect for freelancers, SMBs, and remote teams.

Conclusion

We trust you found this break-down on how to choose the best free invoice management software useful. But before we let you go, let’s quickly review what we discussed.

The world of online invoice software is a varied one, with lots of options to choose from. And although selecting the right one may take some careful deliberation, including considering your use case, budget, and the experiences of other people, it’s well worth your time.

Invoice management software can help you keep track of all your finances and obligations, create invoices and estimates with engaging ready-made templates, consolidate data from other tools, automate billing processes, and even keep you securely connected to your accountant and bank.