Payoneer is perhaps one of the most popular payment gateways for freelancers, ecommerce businesses, and international companies. Its main focus is on business transactions, especially international money transfers. What’s more, it offers global payment solutions as well as other finance-related services, such as virtual accounts on multiple currencies. However, the market for payment gateways is becoming increasingly competitive. This results in Payoneer being far from the only option when it comes to money transfer.

This article discusses other viable payment gateway solutions. We have listed down seven Payoneer alternatives and their own set of features and specialties. Consequently, they too have their costs and fees. Take a look so you can see if there’s one or two that seem right for you or your business.

What is Payoneer?

Payoneer is a cross-border payment solution that connects professionals, businesses, and entrepreneurs through global commerce. Its mass payout service enables companies to pay their partners or employees in one click. This is an effective method, especially for the globally dispersed workforce.

Payoneer also delivers fast, secure, and accommodating services for economical fees. Thanks to this, small businesses and freelance workers can pay and get paid without having to sacrifice too much on the service fee. Aside from those, the system offers multi-currency support, and some currencies’ transactions are even free. The platform is also available in more than 35 languages. It also works seamlessly with some of the best billing software in the market.

Its global payment service deducts 1% from the total of US dollar transactions. Funds receipt from networks and marketplaces depend on the payers. However, do note that banks may charge additional fees.

Payoneer is a secure payment service that performs global money transfers, making it ideal for SMBs, freelancers, and international businesses.

Why Look for Other Payment Solutions?

Hassle-free payment processing, secure transactions, and efficient global bank transfer service are among the many benefits of Payoneer. With these, it seems that the platform is already the perfect payment solution for your business. However, there are some reasons why looking into other payment gateways is productive.

For instance, Payoneer sports low forex rates, which raise the costs of currency conversion. This means that the deduction is pretty high if you convert US dollar to your local currency. The support isn’t fast enough too. It usually takes two days after your question to get a reply. Additionally, private payments have higher limits, and there’s a minimum of $50 when sending money to your local bank account.

Plus, it’s also possible that your business model isn’t just suited for Payoneer’s services. As such, here are some of the top-notch Payoneer alternatives that you can consider.

Payoneer Alternatives

1. TransferWise

TransferWise is a good solution for cross-border money transfer without having to pay a huge sum. It uses the system of local banks to send money across different countries. Thanks to this, there’s no need to rely on slow and expensive international bank transfers. Without having to involve any intermediary bank, people can receive money through their local accounts. A mass pay service is available, as well. Its open API also allows you to integrate the platform with a list of accounting software in the market.

The borderless account provided for every user is capable of holding money in multiple currencies, including euros, US dollars, Australian dollars, and pound sterling. Moreover, the money within the virtual account is ready for global transfer whenever necessary.

TransferWise utilizes the mid-market rate for its transfers, and it doesn’t charge a fee for the exchange rate. You’ll only have to pay for money transfer with a simple upfront fee that’s calculated through the amount you send. The great thing about this payment model is that you won’t have to pay any unnecessary fees for international transfers since it’s available to both individuals and businesses.

2. Skrill

Formerly known as Moneybookers, Skrill provides ways to process payments online without having to reveal any bank details. All you need is an email address, even for international payments. The platform uses a wallet system that allows for the transfer of money from one virtual wallet to another. If the recipient isn’t a Skrill user, you can send it directly to his/her bank account.

With Skrill, payment processing is simpler with clear options for credit cards, email, and cash transactions. It also supports over 30 currencies worldwide. The platform ensures security for each of your transfer with features like anti-fraud screening. Moreover, the services are accessible through mobile devices as well. You can even withdraw cash from an ATM.

There are different ways for Skill to charge you for its services. These include uploading funds to your account, converting it to a new currency, or sending money. Taking money out of your wallet may also incur some fees.

3. PayPal

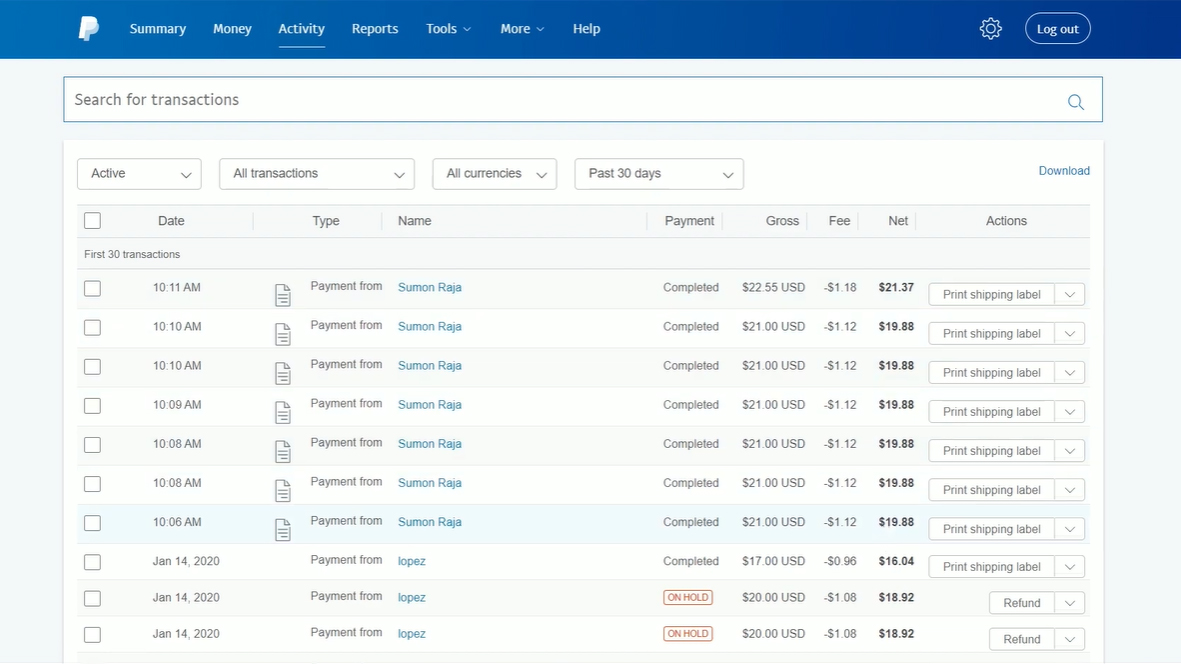

Perhaps the most well-known solution on this list, PayPal also offers tools that facilitate international payments. This is a great option because a lot of people across the world have their own PayPal accounts. There’s no fee when it comes to opening a new account. However, charges come from a variety of things. These include recipient fees and currency conversion.

The platform’s design architecture protects the financial information of companies and individuals that want to send and accept payments. Its bank-level technology provides a great level of security for each transaction between vendors and customers. This applies to all the types of debit/credit cards that the system uses. Based on our ecommerce software research, it is also one of the most flexible and easy-to-use payment gateway.

PayPal has integration support for POS providers for different scales and types of vendors as well. Furthermore, its services, such as invoicing and payment solutions, differ for each country and use cases. For instance, buying with PayPal is free. However, it charges for website sales or email payments.

PayPal is one of the most popular payment gateways for local and international money transfers. It also provides invoicing solutions, making it great for businesses.

4. Entropay

Entropay specializes in virtual Visa cards. With this platform, you can make all kinds of online payments, even international ones. The only difference it has from other solutions is that it focuses on utilizing the account in the same way that you may use a debit or credit card online.

Entropay offers many different products that can be used by SMEs. Entropay Purchasing Solution, for instance, is designed to help businesses manage their spending through a flexible prepaid card using MasterCard.

If you need to make international payments but don’t want to go through banks, you can use the Entropay Payout. What’s more, they don’t have a minimum transfer amount so it’s ideal for making smaller payments.

Just like other services, using this solution will also cost you some bucks. Online purchases are free, but there are some processes you need to pay for. These include currency conversion, receiving or withdrawing money from a bank account, and more. So you better consider these aspects when using this payment gateway.

5. WorldFirst

WorldFirst, which is based in London, focuses on higher-value transfers. The minimum amount that users can pay through this solution is $1,000 so it isn’t ideal for making smaller payments. But it can be useful for businesses as it allows them to make bulk payments as well as forward contracts or transfers booked in advance.

When it comes to fee transfers, the platform does not charge anything if you are making personal transfers. For companies, the transfer fee depends on how much their business brings. You can read on their website that they don’t charge the mid-market rate. However, it doesn’t mean it’s completely free. There are different kinds of fees hidden in this provider’s exchange rates.

To know how much WorldFirst services will cost your business, it’s better to reach out to the vendor to learn more about their fees and additional costs.

6. Payza

Payza is also involved with ecommerce and targets online businesses. It offers a variety of services, including mass payroll payments and online invoicing. There’s also an e-wallet system that both business clients and personal clients can use to store their money virtually and operate in various currencies from around the world.

Just like any other company offering wallet-like online payment solutions, Payza charges users different fees to withdraw, receive, or add money. For currency conversion, the service will charge you 2.5% of the amount that is being processed. So, while it advertises no fees for sending money, it does not mean you don’t have to pay anything.

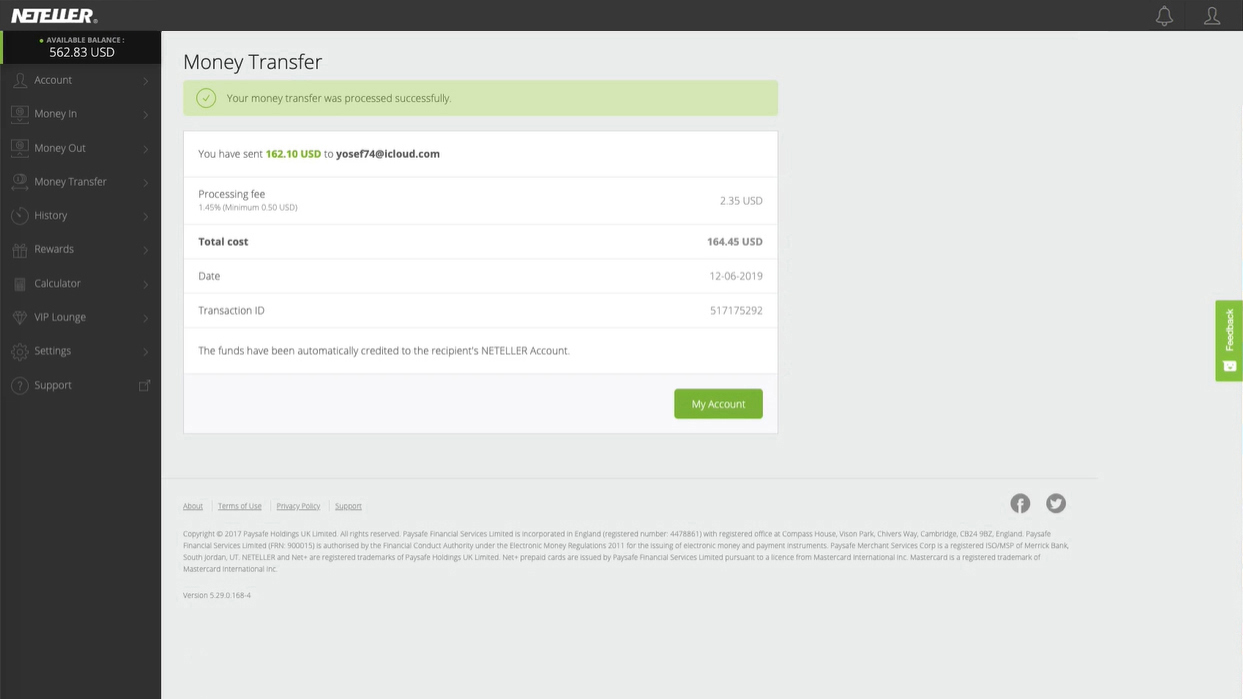

7. Neteller

Neteller provides a suite of products and services that handles online payment processing, including international transfers. A virtual Neteller account allows you to pay people with just an email address; no need to reveal bank details.

The platform uses a membership system—from bronze to diamond—to base the charges on. Some of its fees also depend on your membership level, which is dependent on the amount of money your company handles each year. This means that the bigger the money you deal with, the lower your rates are.

The fees that Neteller charges you also change depending on how you upload your money. For instance, depositing through Visa will garner a different fee from depositing via the Santander bank account. Generally, though, a percentage is cut from the amount you deposit or withdraw.

Neteller is a payment processing platform that doesn’t require you to disclose your bank details. This makes it a go-to for individuals who want to keep their confidential information as safe as possible.

Factors to Consider Before Signing Up for Payment Gateway Services

As you can see, each of the Payoneer alternatives mentioned here focuses on different combinations of services. Some are ideal for general online payments; some are budget-friendly, others give more attention to international transfers, etc. Therefore, we’d like to provide you with a few points to keep in mind before choosing which service to sign up for.

First, check the different potential costs. Always look into which part of the services costs money – deposit, withdrawal, transfer, etc. After knowing that, you must then see if you’re okay with all its terms and charges.

The next thing to look out for is knowing the type of transfers you’ll be dealing with most and checking it against your prospect’s services. If you need something that can efficiently and cost-effectively handle international payments, make sure that you choose the software that offers such.

One more important thing that you should check is the exchange rate. When it comes to services for converting your money, each of these companies will typically pick a rate that’s more beneficial to them. So, be mindful of the rates of your chosen platform. It’s also handy to keep an online currency converter within your reach. This way, you’ll know the actual equivalent of your money and compare it with the ones being offered by your service provider.