SaaS companies typically offer subscription-based products. While the pro is that income is recurring, the con is that your income is staggered over the lifetime of a customer.

This means that you do not have income upfront from the customer to invest in capital expenses (like servers, office space, etc.).

So, you also end up budgeting for these expenses in a recurring model. For example, cloud hosting instead of your own server. This can increase your monthly expense by quite a bit.

Although you have more cash flow during each month than if you were selling products on an ongoing basis, you need to budget carefully so as not to overspend or underfund your company’s needs.

In addition to this issue with recurring revenue, you also need to consider how much money each customer spends on their account (especially when you have a freemium business model) before they pay anything back. This includes things like maintenance fees and support contracts. This makes planning difficult because it’s hard to predict how much money each customer will spend on their account before paying anything back out of their own pockets.

Let’s take a look at a few ways that you can budget monthly costs for your SaaS company.

Ways To Budget Your SaaS Operations Efficiently

Identify The Cost Of Running Your Business

Start by sitting down with your CFO, Accountant, and other management team members.

Identify the fixed costs of running your business. These include things like rent, utilities, and hardware.

Then, identify variable costs — these are expenses that change depending on how many customers you have and how much they spend each month. Some examples include marketing, sales consulting, and other professional services that help you scale your business.

Once you’ve identified both fixed and variable costs for the month, set aside a budget for each category of the expense using budgeting software or just a plain-old spreadsheet. This will help ensure that you don’t overspend on anything but then can’t cover other spending needs later in the year.

Then, figure out your target burn rate. This is the amount of money you can afford to spend each month without putting yourself in financial jeopardy. To calculate this, first determine your monthly fixed costs (i.e. rent, salaries, etc.) and then subtract that from your monthly recurring revenue. The resulting number is your target burn rate.

Once you know your target burn rate, start tracking all of your expenses meticulously. This will help you see where every penny is going and identify areas where you may be able to cut back.

In some cases, it makes sense to move your fixed costs into variable alternatives. For example, you may not need a full time photographer to help with your content creation. You could instead invest in a graphic resource like Envato Elements to get all the assets necessary for your content.

Outsource Non-Core Tasks

The first step is to set up a monthly budget and determine the amount of money that can be spent on each expense. Then you can allocate your funds between different categories such as marketing and sales, infrastructure, payrolls, and taxes.

Once you have identified all the expenses in your business plan, it’s time to figure out how much they will cost each month.

This is where outsourcing comes in handy. Outsourced services can help lower your costs by reducing labor hours or increasing productivity.

You should outsource non-core tasks (like digital marketing or server operations) with favorable invoice payment terms allowing for more flexibility when it comes to managing cash flow in your business plan.

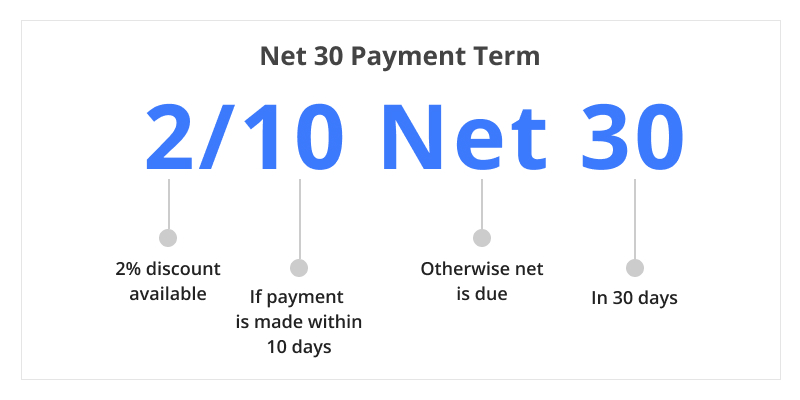

For example, if you want to outsource some of your tasks but still want them done quickly and efficiently, try using the ‘net 30’ cycle (Net 30 Days).

[Source]

Commissions > Equity

When securing startup funding, it is ideal to secure funding that offers commissions/royalties based on sales, rather than equity or debt. This way, you only pay for success, and can also factor in the cost of funding in your product pricing.

The con with this strategy is that if you are in a pricing war with your competitors, then this does not give you much leeway in terms of dropping prices.

[Source]

Also, if you are able to secure funding from angels or VCs who provide higher-than-requested capital at a lower valuation than what they would have paid for your company had they not been involved, then this can be an effective way to minimize the impact on revenue generated by price cuts.

As a SaaS company, you will have to consider how much money is needed to scale up your business and how much more revenue will be needed to reach the break-even point (or beyond).

Split Expenses Into Disposable And Non-Disposable

As a SaaS company, you will have a recurring cost that you need to budget for. This can be either your marketing expenses or your operations costs.

There are two main ways to think about budgeting for your SaaS business.

The first is the monthly breakdown, which is how much money you have available to spend on everything that goes into running and growing your business. This includes things like marketing, sales, product development, and customer support.

The second way is by deciding which category your recurring cost falls into. You need to split these expenses into those that are disposable and non-disposable.

Some expenses can be done away with during hard times (for example, you can do away with your LMS software when there is a hiring freeze), but some are non-disposable (for example, investment in cyber security).

But it’s also important not to get too carried away with budgeting. You don’t want to spend all your time obsessing over how much money you have left in the bank or how much rent would be if you moved into a bigger office space (which is often the case).

Instead, focus on making sure that every dollar spent goes towards something that will help your business grow and succeed.

Work toward making more money while managing revenue well.

Perform Data-Backed Decision-Making

As a SaaS company, you should be able to measure and track every single aspect of your product and marketing efforts so that you can make data-backed decisions about what’s working and what’s not working.

And if something isn’t working, then it simply means that there’s something wrong with either your product or marketing strategy.

The best way to budget your monthly costs is by performing data-backed decision-making.

For example, if you run SMS marketing campaigns, choose a provider who offers analytics reports with their SMS campaigns. This may cost higher, but will help you make better decisions and reduce expenses on channels that don’t provide the same level of insight into their effectiveness.

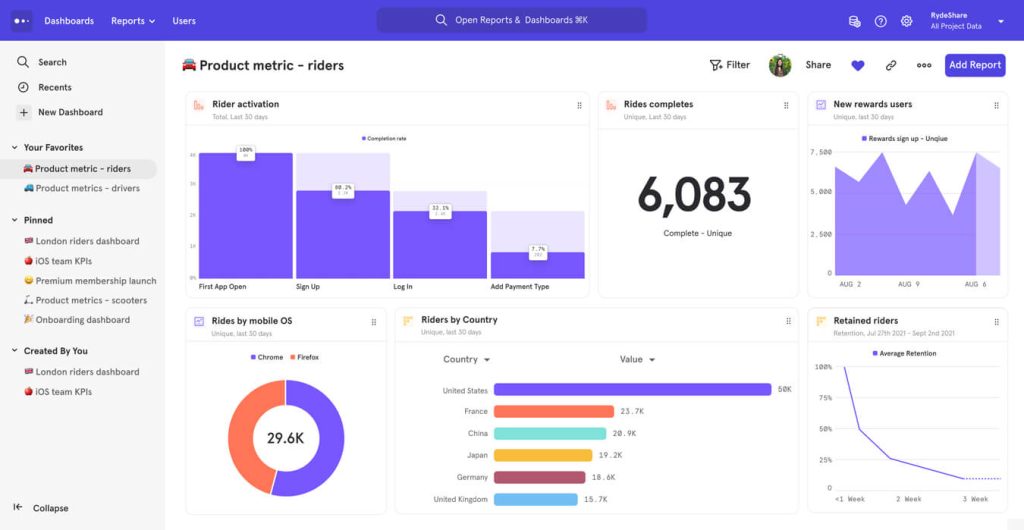

You can also cut down on any expenses that are not data-backed by using tools like Mixpanel for tracking customers’ behavior and interactions with your product or service.

[Source]

Invest In Remote-Friendly Technologies

As a SaaS company, you may be able to use profit as a buffer against bad months and keep the rest of the money aside for future expenses.

But if you have a predictable number of recurring customers, you have to plan ahead.

Invest in tools that allow you to do more with less.

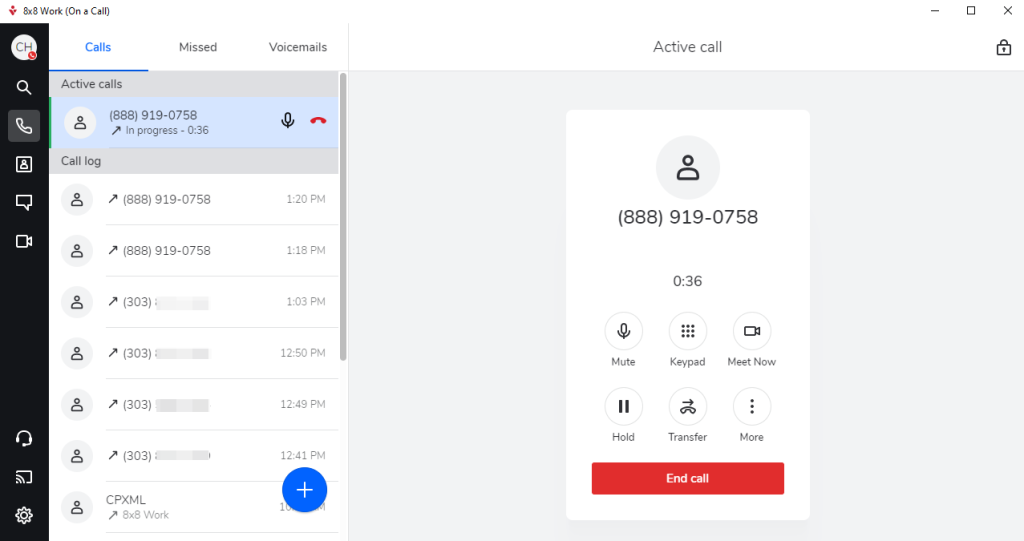

As the pandemic has shown, remote working can be done successfully. So even if you have an office or hybrid working model, invest in remote-friendly team collaboration tools and technologies so that you can cut down on real estate and office utilities in case things go south. For example, a virtual phone system instead of regular landlines.

[Source]

First Plan, Then Hire

The hiring process takes time and effort, so you need to plan it well to save time and money.

It’s important that you don’t hire too many employees at once — this will cause a lot of confusion for both the new employees and you, as well. If any business process can be automated, consider the pros and cons of the move before you make the hire.

If you haven’t hired an employee yet, then look at how much money your company makes per month and divide that number by the number of months you perform business forecasting for. This will give you an idea of how much money each new employee costs you every month.

You must plan out how many employees you want at different stages of your growth, so that when you’re hiring, you know what kind of costs are involved and how much money you need to raise if raising the next funding round is on your mind.

Start by creating a list of all the roles within your business. Then take each role and break it down into smaller sections like ‘designer’, ‘developer’, ‘marketing’, etc., until you have an accurate picture of what each position will cost.

You’ll also want to consider things like benefits, training, and bonus plans for any new hires — these can add up quickly — so make sure to factor them into your budget as well.

Next, decide what type of candidate you’re looking for. For example, if you’re looking for an experienced developer, then there are certain job requirements that may apply (like having experience working with React Native). If your team needs more front-end developers than back-end ones, then this might impact where you place your hiring priorities.

Automation Is Key

Keeping your costs low directly impacts how much money you can invest into building your SaaS brand and landing more customers.

And automation helps precisely with that for a fixed (and low — relative to hiring an employee to do the same task again and again) monthly cost.

Automation can take many forms, but at its core, it’s a system that takes repetitive tasks and makes them easier on yourself and your team.

For example, for you, automation could mean setting up customer accounts for each new customer instead of doing it manually.

It could also mean automating marketing campaigns so you don’t have to worry about sending out emails or creating landing pages. Or, gathering customer feedback through an automated system instead of having your call center employee reach out to each customer manually.

Automation can also mean automating payroll so you don’t have to worry about misclassifying people as contractors or paying overtime when employees work more than 40 hours in a week.

Build An Emergency Fund

As a SaaS company, it’s important to budget your monthly costs carefully. One way to do this is to set aside some cash each month in an emergency fund. That way, if things go south unexpectedly, you’ll have the money you need to keep the business running.

Of course, you’ll want to be careful not to over-fund your emergency fund, as that could tie up too much of your cash flow and leave you unable to invest in other areas of the business. But having a healthy emergency fund can give you peace of mind and help you weather any unexpected storms.

For example, let’s say you have a sudden drop in revenue one month. If you have an emergency fund in place, you can tap into it to cover your costs and keep the business afloat until revenue picks back up again. Or, let’s say you need to make a major repair or replacement on one of your key pieces of equipment. Having an emergency fund can help you pay for that without having to put off other important investments in the business.

So, how much should you set aside each month? It really depends on your specific situation and the needs of your business. However, a good rule of thumb is to put away 3-6% of your monthly revenue into your emergency fund. This will ensure that you have enough money on hand to cover unexpected expenses, without tying up too much of your cash flow.

Final Words

As long as your SaaS company is cash flow positive, your monthly costs are less than your monthly revenue, and you aren’t spending money on anything outside of running the business, you are good to grow!

Keep an eye on things and make sure that you can consistently pay the bills without dipping into any personal savings or credit cards. If it looks like you’re burning through all of your money growing the business too quickly, it’s better to make adjustments right away.

To avoid burning your hands in a raging ‘expense’ fire, follow the budgeting strategies to set your business up for growth.