Are you tired of spending hours manually reminding customers about overdue payments? Are you struggling to track who has paid and who hasn’t? Well, you’re not alone.

Payment reminders can be time-consuming and often frustrating for businesses of all sizes. But what if there was a way to automate this process and save yourself both time and effort?

In this article, we’ll explore the benefits of automating your payment reminder process and provide you with practical tips and strategies to implement it successfully. So, sit tight and discover how to streamline your payment collections and improve your cash flow with automation.

Benefits of Automating Payment Reminders

Have you ever counted how much time you spent last time you reminded a client about paying an invoice? Writing personalized emails (not just one, but usually many), working out the correct copy, and struggling to find a way to be polite and respectful — these are the activities no one likes about payment reminders.

By automating payments, you have so much to win back. Let’s quickly look at the benefits of automated payment reminders.

- Save time: Sending payment reminders manually can be time-consuming, especially if you have many customers. By automating the process, you can free up time to focus on other essential aspects of your business.

- Reduce errors: Sending payment reminders manually often increases the risk of making mistakes such as sending the wrong amount or sending reminders to the wrong person. Automation reduces the risk of errors and ensures that your reminders are always accurate.

- Improve cash flow: Late payments can create a significant cash flow problem for small businesses. If you decide to automate payment reminders, you can improve your cash flow by ensuring that customers pay on time.

- Enhance customer experience: Automated payment reminders can be customized to meet the needs of your customers, providing a more personalized and professional experience.

Choosing the Right Payment Reminder System

When choosing a payment reminder system, there are several factors to consider.

- Integration with existing software: Look for a system that can integrate with your existing invoicing and accounting software to make the process seamless.

- Customization options: The ability to customize your payment reminders with your own branding and messaging can enhance the customer experience and improve the likelihood of on-time payments.

- Automatic scheduling: The system should allow you to set up automated reminders on a schedule that makes sense for your business and your customers.

- Reporting capabilities: Look for a system that provides detailed reporting on payment history, reminders sent, and other relevant metrics to help you optimize your payment collection process.

Setting Up Your Payment Reminder System

Once you’ve chosen a payment reminder system, it’s time to set it up. Here are the key steps to follow.

- Import your customer data: If your payment reminder system allows it, you can import your customer data from your existing software to ensure that your customer information is current.

- Customize your reminders: Adjust reminders to your branding and messaging to make them more effective and professional.

- Set up your schedule: Determine the frequency and timing of your reminders based on your business needs and customer preferences. Be sure to send the first reminder well before the due date to give customers plenty of time to pay.

- Test your system: Send a test reminder to yourself or a trusted friend to ensure everything works correctly before sending reminders to customers.

- Easy to use: When new employees join your team, they must receive employee training on using your invoicing system. Make sure you choose an invoicing and payment reminder system that is easy to navigate and learn.

Best Practices for Automated Payment Reminders

To make your payment reminders as effective as possible, here are some best practices to follow:

- Keep it professional: Your payment reminders should be professional and courteous, emphasizing the importance of on-time payments without being pushy or aggressive.

- Personalize your messages: Use customer data to personalize your reminders, addressing customers by name and including relevant details such as the amount owed and the due date.

- Be consistent: Set a consistent schedule for sending reminders, and stick to it. This will help customers know what to expect and make managing your payment collection process more manageable.

- Offer flexible payment options: Consider offering multiple payment options, such as credit cards, online payments, and automatic bank transfers, to make it easier for customers to pay on time.

- Follow up strategically: If a customer doesn’t respond to your initial reminders, follow up with a more urgent message or a phone call. But be careful not to damage the customer relationship by being too aggressive.

- Monitor your metrics: Keep track of your payment collection metrics, such as the percentage of on-time payments, average days to pay, and total outstanding balances. Use this data to identify areas for improvement and optimize your payment reminder process.

- Functional automation testing: Functional automation testing allows critical user paths to work correctly. If you build a payment reminder module yourself to integrate it with an existing accounting system or use a third-party tool, it’s worth running a few tests using functional automation tools to make sure no errors occur during email sending. Just imagine how awkward it would be for a customer to receive a payment reminder when they don’t owe you anything on invoicing. Functional automation testing will help prevent the issue before a deployment.

Examples of Automated Payment Reminders

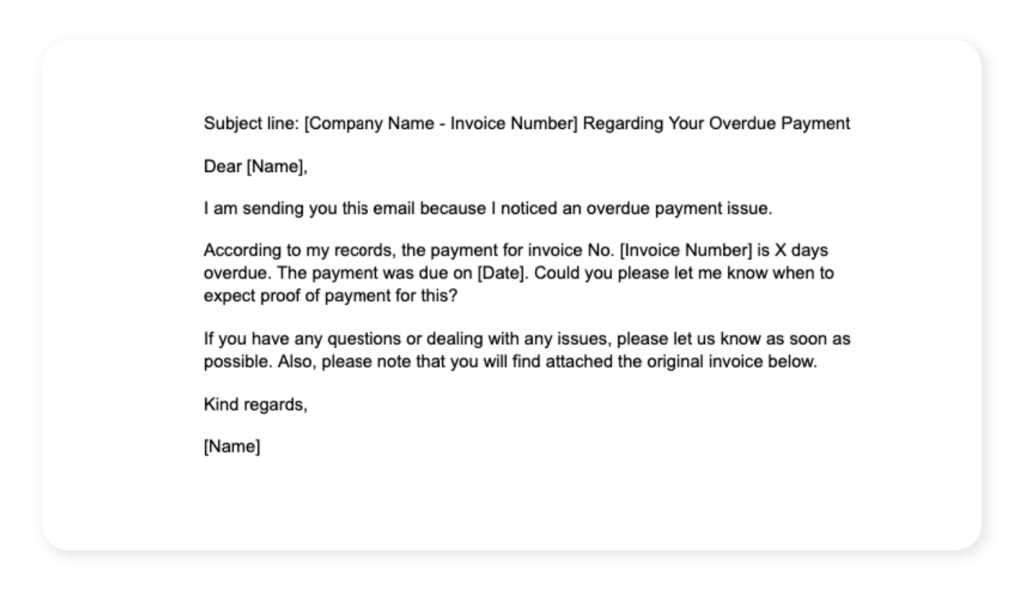

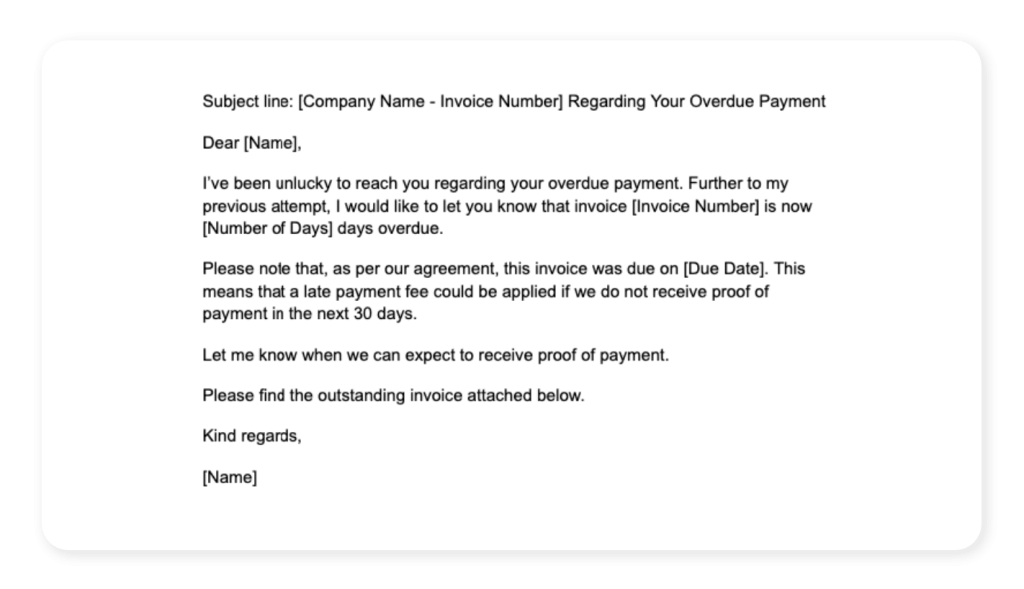

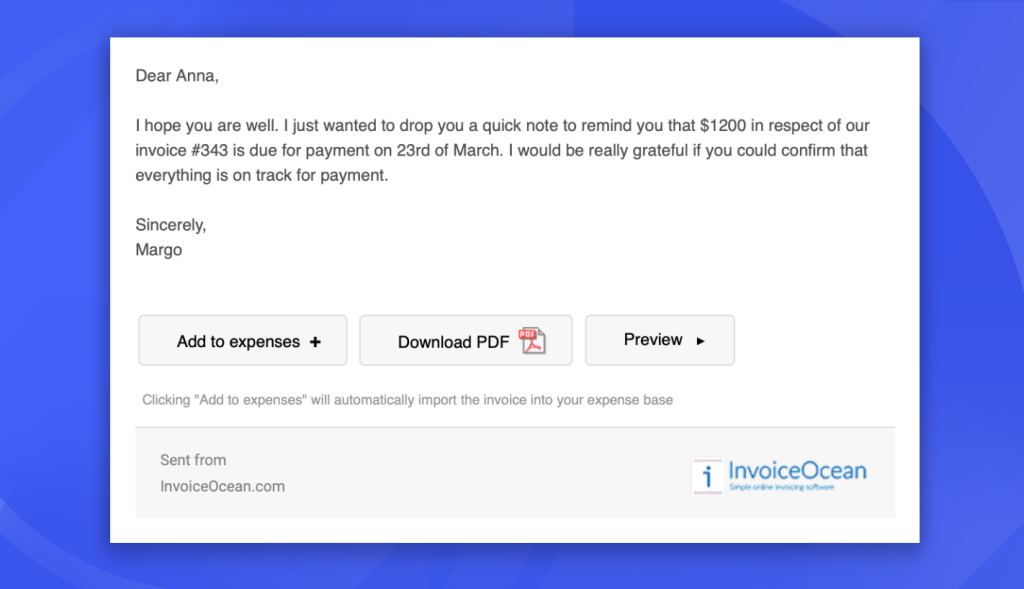

Are you ready to take your payment reminder game to the next level? In this chapter, we’ll dive into some real-life examples of automated payment reminder emails that small businesses use to effectively chase late payments and boost cash flow.

These examples will give you a firsthand look at how businesses use different tones, messages, and designs to prompt customers to pay up. From friendly nudges to urgent demands, each email is tailored to suit the specific business and customer.

- Friendly Reminder Email: This email uses a warm and friendly tone to remind customers that their payment is due soon. It includes a clear call-to-action button that directs customers to the payment portal and an easy-to-read table that shows the outstanding balance and the due date. The email also allows customers to contact the business with questions or concerns. Here is an example of a friendly reminder email.

- Urgent Reminder Email: This email uses a more urgent tone to prompt customers to pay immediately. It highlights that the payment is overdue and includes a clear message that late fees will apply if the payment is not made soon. The email provides a link to the payment portal and a phone number to call in case of any questions or concerns.

- Personalized Reminder Email: This email uses personalization to make customers feel valued and recognized. It includes the customer’s name and account details and thanks them for their past business with the company. The email also reminds the customer of the due date and offers them the option to pay online or by phone. This personalized touch helps build stronger customer relationships and encourages them to pay on time.

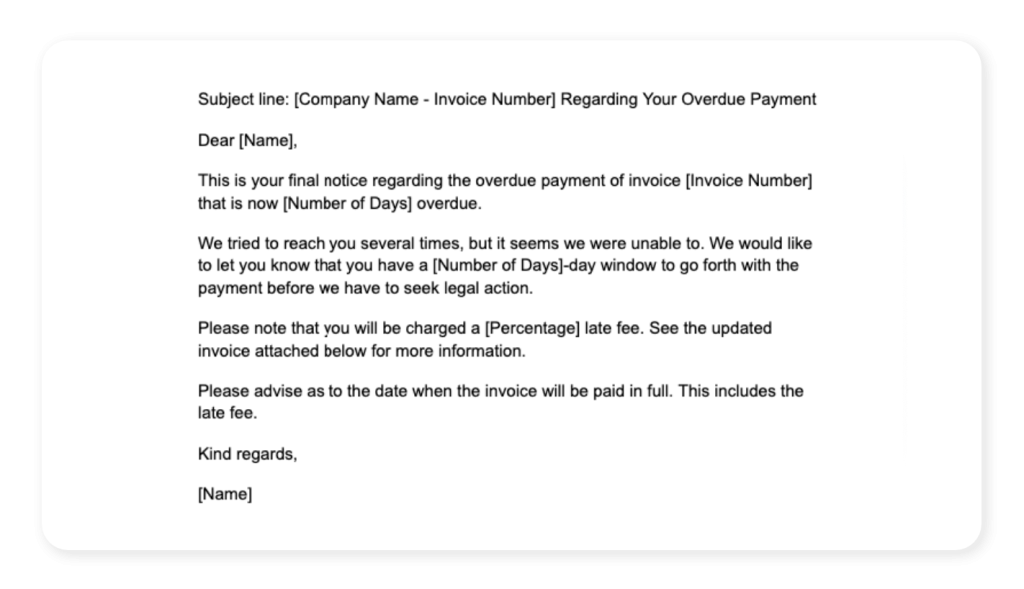

- Final Notice Email: This email uses a more formal and serious tone to inform customers that this is their final chance to make the payment before the business takes further action. It includes a clear message that the account will be sent to collections if the payment is not made soon. The email also provides a phone number to call in case of any questions or concerns. This email is often used as a last resort to prompt customers to pay up and avoid further legal action.

Conclusion

Automating your payment reminder process can be a game-changer for small businesses. By saving time, reducing errors, improving cash flow, and enhancing the customer experience, an automated payment reminder system can help you streamline your payment collection process and focus on growing your business.

When choosing a payment reminder system, look for a solution that integrates with your existing software, provides customization options, allows automatic scheduling, and offers detailed reporting capabilities. Once you’ve set up your system, follow best practices such as keeping your messages professional, personalizing your reminders, offering flexible payment options, and monitoring your metrics.