Fintech has been a rapidly growing industry in recent years. The size of the global Financial Technology market is projected to reach $698 billion by 2030, with companies offering cutting-edge solutions to consumers and businesses alike.

The field’s continuous growth, however, comes with increased regulatory scrutiny – and heightened expectations from customers and stakeholders alike. Pressure is mounting, and the consequences of a failure to comply can be severe. Corporations today can face damage to their reputation and even hefty penalties. It’s becoming more critical – and challenging – for companies to stay compliant with various laws and regulations.

In this article, we’ll explore some of the major compliance and regulatory challenges that a fintech software development company is likely to face in 2023.

Cybersecurity

Services such as Ransomware-as-a-Service (RaaS) and Hackers-as-a-Service (HaaS) are on the rise. They serve to outsource – respectively – ransomware attacks and hacking activity to a third-party provider. As a result, every bad actor with limited technical skills can now launch successful cyber assaults. Lowering the barrier to entry for would-be attackers naturally leads to more attacks. According to a recent report, 55% of financial institutions suffered a ransomware attack last year – a 62% increase from the year before.

At the same time, businesses are facing a lack of qualified talent. And the already existing skill gap is only likely to widen – many firms are freezing hiring or even laying off employees in preparation for an economic downturn. Companies are facing the difficult task of finding the right people to stay competitive – and keeping them.

To stay ahead of potential security threats, security leaders need to optimize their operations. That means creating a strong defence system that can detect threats before they escalate.

One way to do this is by implementing early detection systems. By catching potential risks as soon as they occur, cybersecurity teams can respond to them immediately and stop them from escalating.

Furthermore, automating the investigation and response process is a great way to reduce the burden on security teams. Machine learning algorithms and automation tools can analyze security events, identify potential threats and automatically respond to them. That leaves employees more time to focus on critical tasks that require human input. In turn, this can help reduce response times and improve the overall effectiveness of the security team.

Optimizing security operations also requires ongoing staff training and development. This includes keeping up-to-date with the latest security trends, technologies and threats, as well as developing new skills and expertise to address emerging security challenges.

Anti-money laundering

2022 brought us several unprecedented scandals, such as the anti-Russia sanctions and the Credit Suisse money-laundering case – the first bank in history to go through a criminal trial in Switzerland.

Those events highlight the need for Anti Money Laundering (AML) practices. AML refers to a set of policies, procedures and systems fintech companies use to prevent money laundering and other illicit activities.

A prominent example of AML regulation is the U.S. Corporate Transparency Act (CAT), introduced in January 2021. It serves to protect the North American financial system from money laundering operations and other illegal activities.

Now, the U.S. Financial Crime Enforcement Network (FinCEN) bureau is issuing a “Final Rule” that reinforces the CTA. The rule was issued on September 29th, 2022, but it doesn’t come into effect until January 1st, 2024. The long-awaited regulation implements beneficial ownership information(BOI) requirements of the CTA, fine-tunes some reporting timelines and further defines specific definitions.

In the face of this increased control, fintech companies need to implement strict customer due diligence measures. Maintaining diligent transaction records, conducting risk assessments and verifying customer identities go a long way toward mitigating money laundering risks.

KYC and KYE

KYC (Know Your Customer) and KYE (Know Your Employee) are sets of processes for verifying customer and employee identities, respectively.

The KYC process is usually three-fold. The first step is customer identification – something banks and companies are obliged to do before establishing a business relationship. Then comes customer due diligence – part of compliance procedures that studies potential customers’ capital, activities, and potential risk. Finally, organizations employ ongoing monitoring. Since a customer’s risk status can change with time, organizations follow their clients’ situation to evaluate their continued relationship.

KYE works in the same way, except that it’s used to identify employees. So, while the underlying processes are similar to KYC, the goals and information verified might differ. For example, a company verifying its employees would be looking for potential conflicts of interest or making sure staff isn’t insider trading.

As we mentioned earlier, the need for customer due diligence is growing rapidly. KYC processes are crucial for any modern organization looking to stay compliant, avoid fraud and preserve its reputation.

Environmental, Social, Governance

As consumers become more focused on climate and social change, companies are pushed to think beyond profits. The United Nations shared a goal for a zero-carbon world by 2050, further incentivizing corporations to focus on sustainability.

Environmental, Social, Governance (ESG) is a set of standards measuring how a company impacts the environment and society and how accountable it is. Environmental metrics look at things such as carbon emissions, energy usage, waste management, and water conservation. Social metrics measure a company’s social impact, focusing on employee turnover rates, and diversity and inclusion metrics. And governance metrics focus on a company’s internal policies and processes. This may include board composition, executive compensation, risk management, and ethical standards.

In 2023, ESG reporting is becoming more important as a way of tracking a company’s commitment. However, monitoring those metrics is still underdeveloped compared to financial reporting.

This is about more than complying with regulations. ESG presents a number of business opportunities – and risks. The Corporate Sustainability Reporting Directive(CSRD) requires that all large E.U. companies report their ESG data. In the U.S., the Securities and Exchange Commission (SEC) is moving forward with a proposal highlighting the importance of ESG reporting for businesses.

That means that the regulation promises a significant return on investment if done well. According to recent studies, 89% of investors factor ESG into their investment decisions, while 31% of European and 18% of U.S. investors consider it central to their approach. Furthermore, a Deloitte study from December 2022 shows that 99% of companies plan to invest in ESG this year.

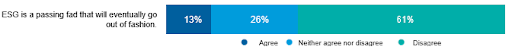

All of this coincides with the findings of a Capital Group memorandum regarding the future of ESG.

With all of that in mind, Environment, Social, and Governance will evidently be at the heart of forward-thinking businesses in 2023.

Wrap Up

Everything points to this being an eventful year for the fintech industry. As always, growth brings new challenges, and companies must stay compliant with various laws and regulations.

With cybersecurity under threat, the industry will need to focus on anti-laundering measures. Identification and verification will become even more crucial for security. And in addition, ESG is becoming an essential metric and an important way of tracking a company’s commitment to the environment and society.

As always, being aware of upcoming developments and taking proactive steps to keep your operation compliant is key to success. As long as you understand potential future challenges and have a long-term strategy for overcoming them, you’re going to come out ahead in 2023 and beyond.