No online and other cashless transactions can be completed without a payment gateway. As the final stop of the sales process, a good payment platform completes a customer’s purchasing experience, and nothing speaks great customer experience better than making it easy, simple, and seamless from start to finish.

The role of payment gateways, however, does not stop at the checkout point, it also takes care of processing, and fulfilling customer refund requests, not to mention the process of setting it up, where things start to get trickier.

In this article, we will examine how two of the leading payment gateway software–Stripe and PayPal–manage to tick the right boxes. Having narrowed down the options to these two, we hope that this Stripe vs. PayPal comparison can help you make the right decision on which payment gateway suits you.

What Is Stripe?

Stripe is a full-featured payment gateway software commonly used not only by online retail stores but also by B2B platforms, SaaS, B2C, and nonprofit organizations. Popular among merchants, Stripe’s tools and features lean on addressing not only the basics but also the more advanced needs of internet business transactions. This payment gateway does not only integrate with ecommerce websites or mobile applications, but it also integrates with point of sale systems, which allows businesses to process in-person payments.

The availability of developer options also makes Stripe more flexible. As long as you have enough knowledge or the right person who knows his/her way around coding, you can pretty much customize Stripe and integrate it with other applications as well as with your existing systems to further optimize your business operations. As for security, Stripe makes sure that not only are your customers’ confidential details are protected from both internal and external threats, but your accounts as well.

Features

Below is a list of Stripe’s key features:

- Custom UI toolkit

- Custom checkout forms

- Supports online and in-app checkout

- Stripe Terminal for in-person payments

- Invoicing

- Open API

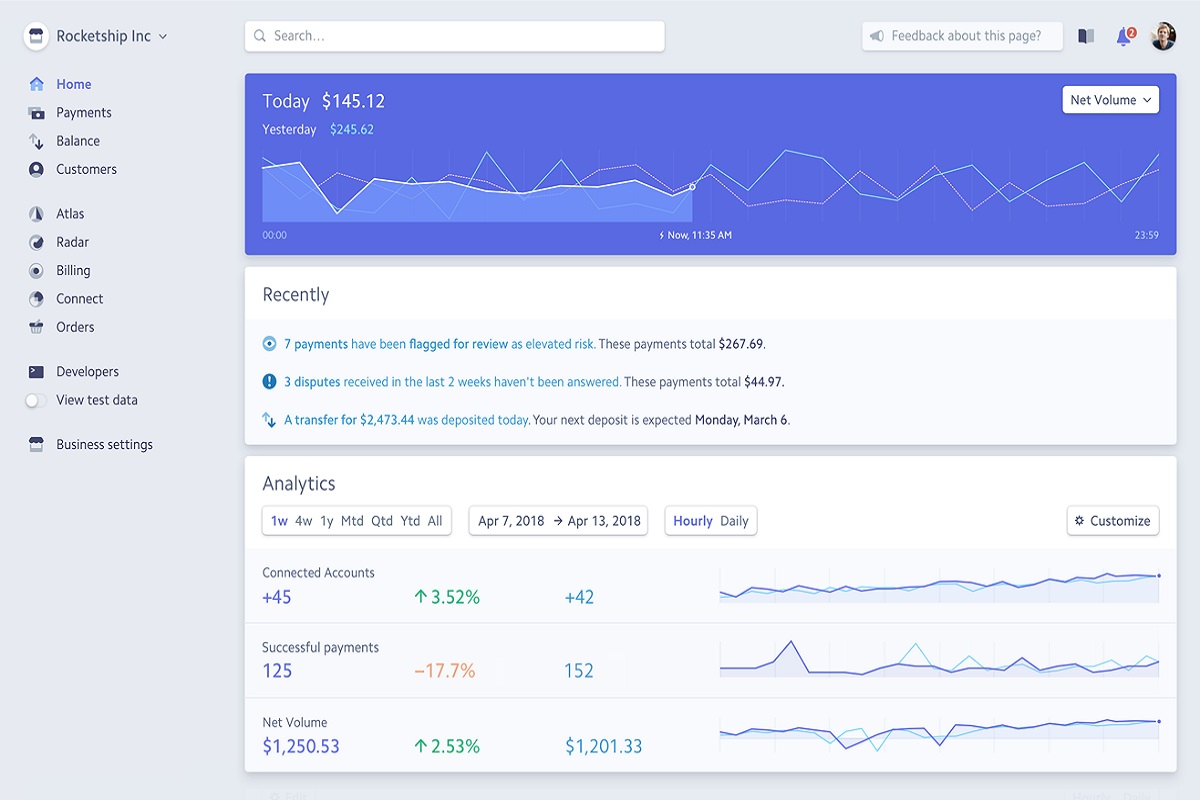

- Advanced reporting and insights via Stripe Sigma and online and mobile dashboard

- Role-based access

- Collaboration notes

Worldwide availability

One of the qualities of a good payment gateway is global reach:

- Supported in more than 36 countries worldwide and counting

- Accepts more than 135 currencies

- Accepts various payment methods, including major credit and debit cards, wallet payment, and payment methods available locally.

Integrations

Below is a list of some of the systems that seamlessly integrate with Stripe:

- MemberSpace

- Fusebill

- Subscription by ReCharge

- Zoho Books

- Ramp Receipts

- PayNow

- Twilio

- Salescamp

- Onboard, etc

Customer support

Stripe has a robust 24/7 customer support system, a dedicated help page with all the relevant guides on Stripe-related issues and processes. Stripe also has a dedicated technical chat support team that takes care of developer-related issues and concerns.

Charge rates

Just like other payment gateway solutions, Stripe charges fees per transaction and below is a breakdown of these charges:

- For credit and debit card payments, Stripe charges $2.9% + $0.30 for every successful card charge.

- For international transactions, there will be an additional 1% charge for currency conversion.

- For instant payouts, there is a 1% charge

- For large transactions paid via ACH direct debit, there is a 0.8% charge capped at $5 (rate varies depending on the payment method used)

For a pricing package custom made for your business, you have to contact the support team.

What Is PayPal?

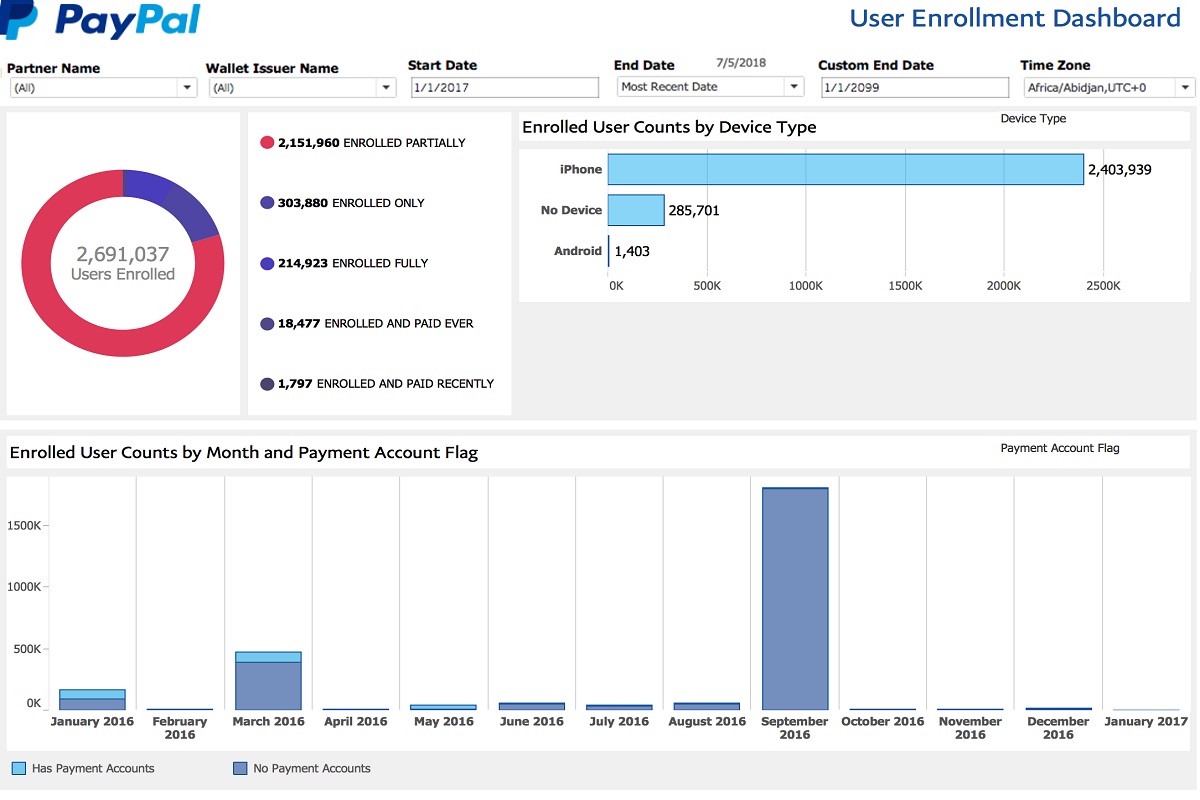

PayPal is a popular payment gateway known for its simplicity and straightforward approach to online payment processing. PayPal is not only easy to use, but it also offers different options on the role you would like for PayPal to take in your business–as the main payment gateway or as an additional payment option. This payment gateway is used by some of today’s top shopping cart software, such as Shopify.

Designed to make online checkout faster and easier and help merchants get higher conversion rates, PayPal Checkout reduces the chance of cart abandonment as it allows customers to skip the dedicated checkout page and check out from where they are on the product page. Not only is this feature helpful to your customers, but merchants can also integrate this feature on their website for free.

Adding PayPal buttons to your website does not require advanced technical knowledge. If you already have a PayPal business account, you can add the Website Payment Standard (WPS) by embedding the HTML code on your webpage. Once done, your customers can use this button even if they don’t have a PayPal account.

Businesses that do not have their own websites can also receive payments via PayPal.Me. All you have to do is set up your account and create a unique PayPal link. By sharing this link to your customers/clients through email, SMS, or other messaging applications, they can send their payments directly to your PayPal account.

Features

Below is a list of PayPal’s core features and tools:

- PayPal Checkout

- Express Checkout

- PayPal.Me (for businesses that do not have websites)

- Website Payment Standard

- Online invoicing

- Mobile application

- Data encryption

- Fraud prevention

- Buyer and seller protection

- Open API

Worldwide availability

PayPal is one of the most widely used online payment platforms around the world, and below is the extent of its global reach:

- More than 98 million active PayPal accounts worldwide

- Supported in more than 200 countries

- Currently accepts 25 currencies

Integrations

PayPal’s API gives you the flexibility to integrate the payment platform with other applications and the systems you are already using. It also integrates with some of the top point of sale software like Vend POS.

Customer support

PayPal has a help page with a list of articles to help users address common issues or concerns. Below are the other ways you can reach out to PayPal:

- Phone support

- Community forum

- Resolution Center (for transaction issues, etc.)

- PayPal Developer Portal (for developer concerns)

Charge rates

While PayPal does not charge customers extra for their purchases, the following list shows the charges on the merchants’ end:

- PayPal charges 2.9% + $0.30 for every successful sale within the US territory.

- For international sales, there is a 4.4% transaction charge on top of a fixed fee based on the currency received.

- For PayPal Here payments, there is a 2.7% charge for every card swipe and 3.5% + $0.15 for manual transactions.

Conclusion

This Stripe vs. PayPal comparison article only shows that both are robust payment gateway solutions, each with its own set of advantages that would attract different types of users and businesses. PayPal’s simplicity and less complex setup will likely be more favorable to retail businesses and users who do not have advanced technical skills or resources. Also, if you are still fairly new to operating an online business, a freelancer, and/or does not have a website yet, PayPal is the right payment solution for you.

Our Stripe vs. PayPal comparison also shows that Stripe, on the other hand, is more favorable to businesses that have more elaborate payment options (i.e., monthly or annual subscriptions, etc.) Stripe also has more ready-to-install plugins, and if you have the knowledge or IT resources, you can take advantage of Stripe’s API to fully customize it according to your business needs. You can also check out our Stripe vs Adyen comparison to find out if Stripe is the right software for you.