E-commerce is becoming more and more popular these days. With this comes the need for electronic payment gateways. Two of today’s top players in the long list of payment gateway software are Adyen and Stripe. These provide secure online payment processing options at reasonable rates, making them popular among many businesses worldwide. The only question is which one of them is better?

To answer this question, this Adyen vs Stripe comparison aims to discuss each product’s strengths and weaknesses so you can make an informed decision about which one suits your business model. However, this isn’t your run-off-the-mill comparison where we simply match their features against each other. This post revolves around the players themselves and how each of them adapts to the field of electronic payment.

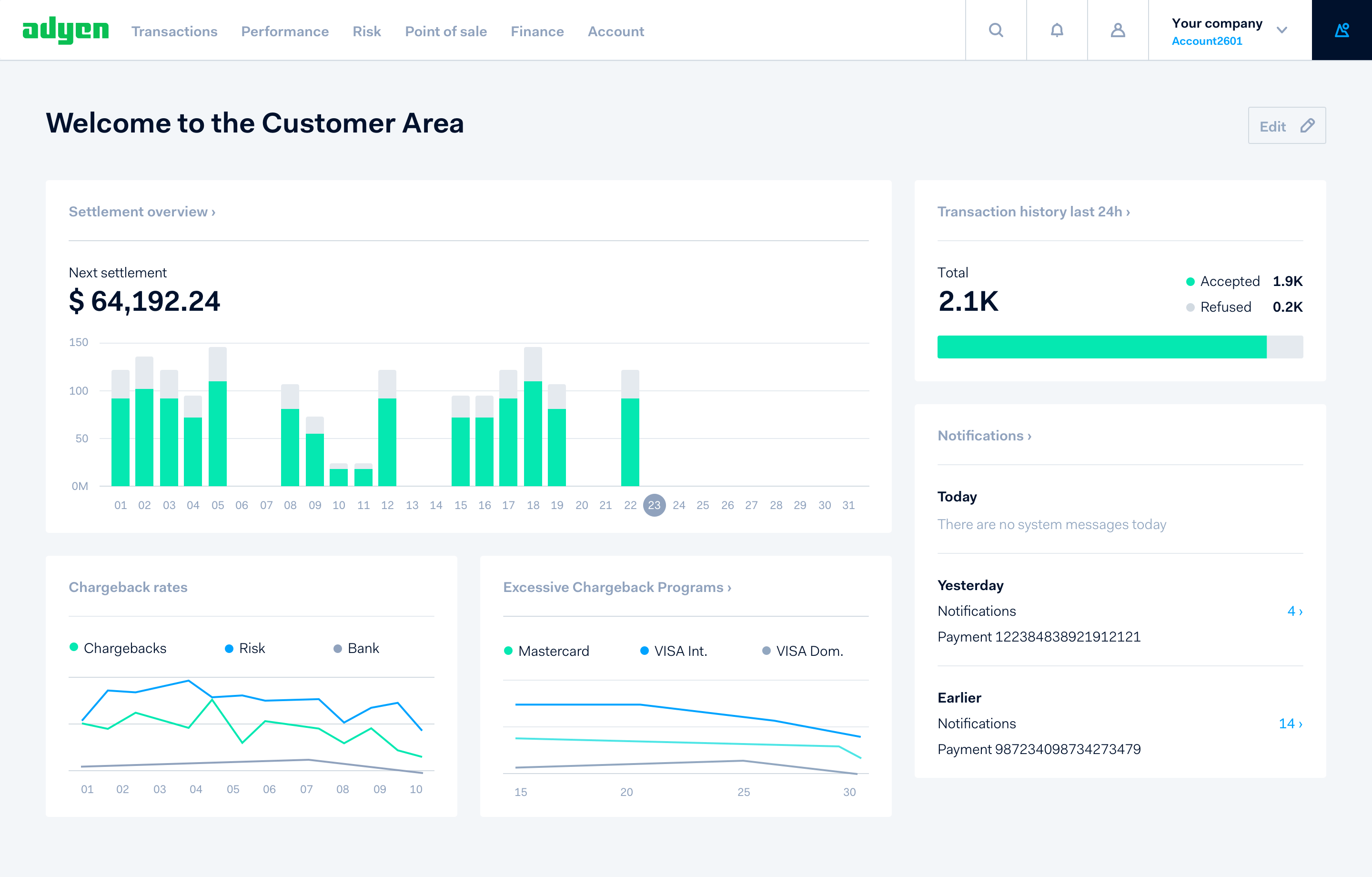

Adyen Overview

Adyen is a prominent US payment technology that’s being managed by reputed industry experts. To some extent, its name has been synonymous with streamlined and hassle-free payment. Some of the features it’s well-known for include instant support access, change viability, and innovative working policies. Every Adyen fee is quote-based and is dependent on the amount you intend to transfer. Furthermore, the system makes sure that all users experience transparent and uniform services. That’s why Adyen offers online payment through mobile devices that guarantee the timely arrival of money regardless of the sender’s location.

Adyen offers hassle-free and reasonably priced payment processing services for US and European companies.

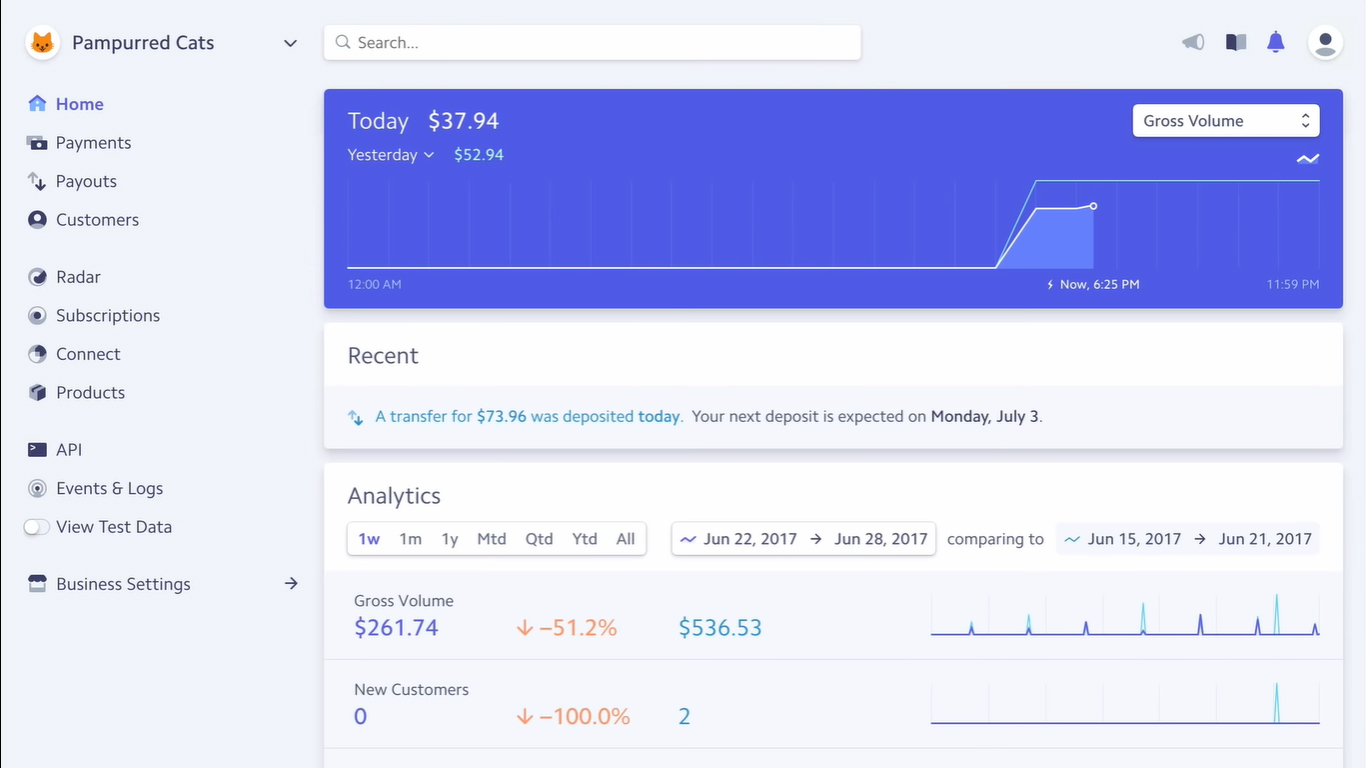

Stripe Overview

Stripe is a cloud-based payment solution that aims to ease the process of accepting and managing online transactions. The system provides a comprehensive set of features that makes it ideal for online business as well as ecommerce platforms. Not only does it expedite the movement of money in your business, but it also integrates with other applications that can safeguard your accounts. Moreover, it has tools for fraud prevention, revenue management, and customized checkout. Stripe also ensures that your business will support the way your customer wants to pay by providing varied payment options. These include digital wallets, debit/credit cards, local payment methods, etc.

Stripe is a cloud-based solution that expedites the processing of transactions as securely as possible.

Adyen vs. Stripe Similarities

Despite being young payment providers, Adyen and Stripe are becoming on par with today’s giants in the field of payment processing. The two are usually integrated with platforms that require online payment processing, such as ecommerce software.

Both players have already achieved a great feat in the field of Fintech. Created in 2006, the Dutch company Adyen has already earned a valuation of about $16 billion in just five months after its initial public offering, not a small number. The Irish-American company Stripe, which was created in 2011, on the other hand, was valued at $20 billion after its fundraising last 2018.

These evaluations aren’t surprising, considering that these businesses have experienced 3x or 4x growth in their first years. Also, Adyen is consistently growing by 10% each year. Aside from fast growth, both companies adopt robust and commercially dynamic business models that make them economically stable.

These payment gateway providers have solid commission-based business models. Adyen invoices in Europe are between 0.9% and 1.1%, plus the $0.11 it charges per transaction. Stripe’s invoices, on the other hand, are 1.4% + $0.27 per transaction on the Old Continent. In terms of margins, Adyen makes a high margin of 0.2%, while Stripe has 0.77%. That is equal to that of Wirecard, a German-based financial technology company. Not only do both companies achieve a high margin, but they are also able to create a vast portfolio. This isn’t surprising, though, considering that both players offer products with a certain value.

Adyen vs Stripe Comparison

Customers

As mentioned previously, both Adyen and Stripe have extensive portfolios. Stripe claims more than a million SMEs and start-up customers from around the world. Adyen targets only huge accounts so it only has more than 3,000 customers. These big brands include L’Oréal, Mango, and Easy Jet. This small number of clients can also be explained by Adyen being picky. If they think the merchant is not big enough, the provider sometimes refuses to respond to them. Despite that, the company still attracts interest from international groups looking for unique integrations.

Meanwhile, Stripe has also started working on large accounts and signed up business giants like Microsoft, Spotify, Booking.com, Uber, the Asian VTC grab, and even Motobike. But for these large merchants, Stripe employs different pricing plans. It’s understandable, but if the company wants to be in line with Adyen, they definitely need to lower their price. The difference in the customers they entertain is also the reason why Stripe can integrate with various payroll software.

Payment Methods

Adyen provides a unique payment platform such as in-store, online, and marketplace, while Stripe offers a more diversified solution. Adyen allows its clients to accept and process payments across mobile, online, and POS. They also offer more than 250 payment methods and over a hundred currencies in just one integration. Meaning to say, businesses can use the solution to accept payments anywhere in the world.

Stripe, on the other hand, is more on payments for developers. It makes it easy for developer clients to accept credit cards on the web. It also integrates with some of the top time tracking software today to help automate the payroll computing process. No need for a gateway or merchant account as well because the service provider handles everything. Furthermore, it allows users to create their own payment forms. On top of that, it lends money to SMEs, which they can use to start a new company from scratch.

Stripe also offers a toolbox feature that allows its users to create their business in the US for $500. Additionally, the company sports a payment platform dedicated to marketplaces, software development for payment terminals, and tools to create recurring payment models.

Culture

Another difference that we can observe between the two companies is their culture. Stripe is techno-oriented. Its founders are coders who considered the product as the strategy, and the rest is just execution. They released more than 3,000 versions of its API in 2018.

Additionally, half of its employees are engineers deployed in different countries, including the United States, Singapore, and Europe. Adyen, on the other hand, has a more commercial culture. Half of their staff is commercial, and businesses drive everything.

Internationalization

When it comes to internationalization, it seems like Adyen has the advantage. Adyen serves a lot of European companies and had to face heterogeneity of the mode of payment. Therefore, this company had a head start as it had spent more time building out support for various alternative payments.

Stripe, on the other hand, targets the North American market so it is less confronted with heterogeneity at the start of its existence. And since each nation has its own technical and regulatory complexities, Stripe will find it harder to enter a new country.

Implementation

Adyen and Stripe turned out to be equal when it comes to implementation. Stripe has 14 offices while Adyen has 15. Both players have offices in France and have around a thousand employees in total. Stripe also claims tens of thousands of businesses in France, including Vinci, ManoMano, and Leroy Merlin, to name a few. Whereas, Adyen got Birchbox, Intersport, Groupon, and Vestiaire Collective. Adyen is also expressing an interest to triple its investment in the aforementioned country in the coming years.

Which is Better: Stripe or Adyen?

This Stripe vs Adyen comparison shows that the two, although they belong to the same category, seem to have their own goals. For instance, Stripe is keen on helping grow the internet’s GDP (gross domestic product) so it offers a broad set of tools that are handy for the payment experience. On the other hand, Adyen is laser-focused on improving payment processing.

Also, as you have seen in this article, Adyen is harder to get to. This means that unless you’re a large enough enterprise, Stripe is the only option between the two. Not that you’ll be left with the short end of the stick since Stripe is a topnotch payment processing solution. If, however, Adyen is a viable payment gateway for you, then it’s definitely worth checking out. You can also check out our Stripe vs PayPal comparison if you’re looking for more options for payment processing tools.