Webtel WEB GST Review

OUR SCORE 81%

OUR SCORE 81%

- What is Webtel WEB GST

- Product Quality Score

- Main Features

- List of Benefits

- Awards Section

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Webtel WEB GST?

Webtel WEB GST is a compliance solution for the Indian market GST (goods and sales tax) regulations with status, invoice reports, accounting software integration and more. It is a comprehensive product for GST compliances and you can use it to generate invoices and file GST returns. A word about the parent company. Webtel Electrosoft is an India-based firm that was incorporated in the year 2000. It stands out from the crowd as it is powered by experienced chartered accountants, company secretaries, and legal professionals who utilize their knowledge and expertise to create and offer top quality accounting products. The company has grown from a small team of seven employees and a single product to more than 250 employees and 20 products. Today, Webtel boasts more than 25,000 customers all over India. Read on below our Webtel WEB GST reviews to know more about its benefits, pricing and technical specs.Product Quality Score

Webtel WEB GST features

Main features of Webtel WEB GST are:

- Auto Import of Import/Outward Supplies and Expenses from Accounting Software(s)

- Auto Intelligence Matching Facility

- Backup and Restoration of Data with Live Update Facility

- Calculation of Net Tax Liability

- Creation of ISD Master and Distribution of Input Tax Credit

- Download GSTR 1A/2A from GSTN

- Dynamic GST Computation

- Generation and Upload of GSTR 1,2,3,4,5,6,7,8,9 and 9A

- Integrated with Accounting Software(s)

- Invoice Mismatch Report in Different Categories

- Online Payment of Taxes

- Print Computation and Return Forms

- Reconciliation of Mismatched Invoice Data

- Report of Debit/Credit Notes with Inbuilt Mailing Facility

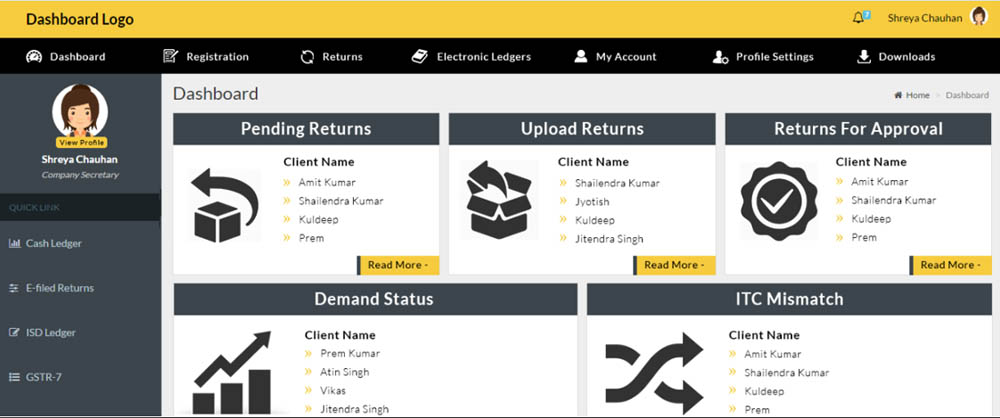

- Report of Pending/Uploaded Returns

- Status of Uploaded Invoices

Webtel WEB GST Benefits

Learning/Training

Webtel WEB GST eLearning solution provides convenient and comprehensive education in GST law and procedures. The methodology, content, and delivery are easy to understand and effective.

Consulting

You need to perform an impact analysis on the profitability of your client to decide whether any change is needed in business structuring. Webtel‘s GST Impact Calculator can help you do basic calculations. Plus, you can view and analyze transitional provisions, working capital assessment, and transaction structuring.

Accounting Integration

Actual implementation of GST begins with making changes in the accounting System. Changes in accounting include: updating GSTIN of suppliers/buyers in accounting master, coding tax nomenclatures i.e. CGST, SGST, IGST, UTGST and cess etc., soft/hard coding the rate of taxes, describing HSN codes for different items, other necessary changes in reports, and setting output file structure for integration/absorption by GST return preparation utilities.

Different companies use different accounting solutions such as like Tally, SAP, JdEdward, Xapta, and other ERPs. Primarily the changes in the accounting systems will be made by the provider of these software products.

Webtel has middleware/connections to pull data in defined structure from any of these software apps. In the case of applications such as Busy and Tally, Webtel has already done end to end integration so there is no need for any connector/middleware. To avoid any hassles during GST implementation, it is important to take precautions and perform disciplined accounting instead of simple accounting.

Compliance

Companies might need to set up a separate compliance team for GST considering that a minimum of three returns need to be filed every month on different dates. You need to do tasks such as calculating net tax liability, adjusting input tax credit on advances, etc., reconciling input tax credit on inward and outward supplies, and more. To manage all these tasks and processes, WEB GST is an ideal tool as it offers many unique and useful features.

Awards Section

- Great User Experience Award

- Rising Star of 2018 Award

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Webtel WEB GST Integrations

The following Webtel WEB GST integrations are currently offered by the vendor:

WEB GST can integrate with your existing accounting software solution.

Video

Customer Support

Pricing Plans

Webtel WEB GST pricing is available in the following plans: