Small business owners’ schedules are already hectic as they are, with all the work that they do. The last thing they need is learning the ropes of professional bookkeeping. However, they can’t also simply take it for granted because it’s an essential aspect of their business. Therefore, accounting software applications for small businesses is bliss for non-accountant owners.

In small businesses, each employee fills the role of multiple positions to get the operation going. This means that easy-to-learn accounting software solutions with robust functionalities are ideal for their finance-related needs. Two, well-known solutions—Wave and Intuit QuickBooks—fit this description.

So, which one should you choose? This in-depth Wave vs QuickBooks comparison of features aims to answer that question.

Wave Overview

Wave is an all-in-one finance management platform that bundles invoicing, receipt scanning, and accounting solutions in one package. It’s ideal for small businesses, freelancers, solo entrepreneurs, and consultants. The software simplifies many finance-related processes so that you don’t have to waste too much time chasing payments, handling taxes, monitoring expenses, etc. Wave also helps in creating and sending professional-looking estimates, receipts, and invoices to help accelerate the cash flow in your organization.

Wave is an end-to-end accounting system that not only helps you with bookkeeping and finance management but also tax preparation and payroll processing.

QuickBooks Overview

Intuit’s QuickBooks Online is the company’s accounting solution for startups, small businesses, independent bookkeeping firms, and freelance accountants. It has a rich set of finance-related tools, such as sales monitoring, tax calculation, expense tracking, and invoice management. The system aims to make financial management and accounting simpler for small businesses. As a result, QuickBooks helps cut down the time spent on mind-numbing accounting tasks so that you can focus on more pressing parts of your business.

QuickBooks Online is an easy-to-use platform equipped with both basic and advanced accounting tools to help small and big businesses alike.

Wave vs QuickBooks Similarities

Our featured products are well-known in this field. They both offer financial analytics, tax reporting, tax tracking, uploading of receipts via mobile phones, permission control, regulation compliance, and more. These accounting apps also serve as double-entry bookkeeping ledgers, which are ideal for professional accounting services.

Furthermore, both of them keep up with the trends surrounding financial applications. That’s why these two products offer a direct connection with credit cards and bank accounts. They also provide you with tools for automating the import of transactions and connecting with external financial apps like PayPal and Square.

Wave vs QuickBooks Comparison

Accounting

Both the products are equipped with enterprise-grade accounting features like double-entry ledgers, budget builders, and connection with bank accounts. Aside from those, they also help you with handling complex currency situations by providing multi-currency support. This is ideal for businesses dealing with international clients, such as online shops.

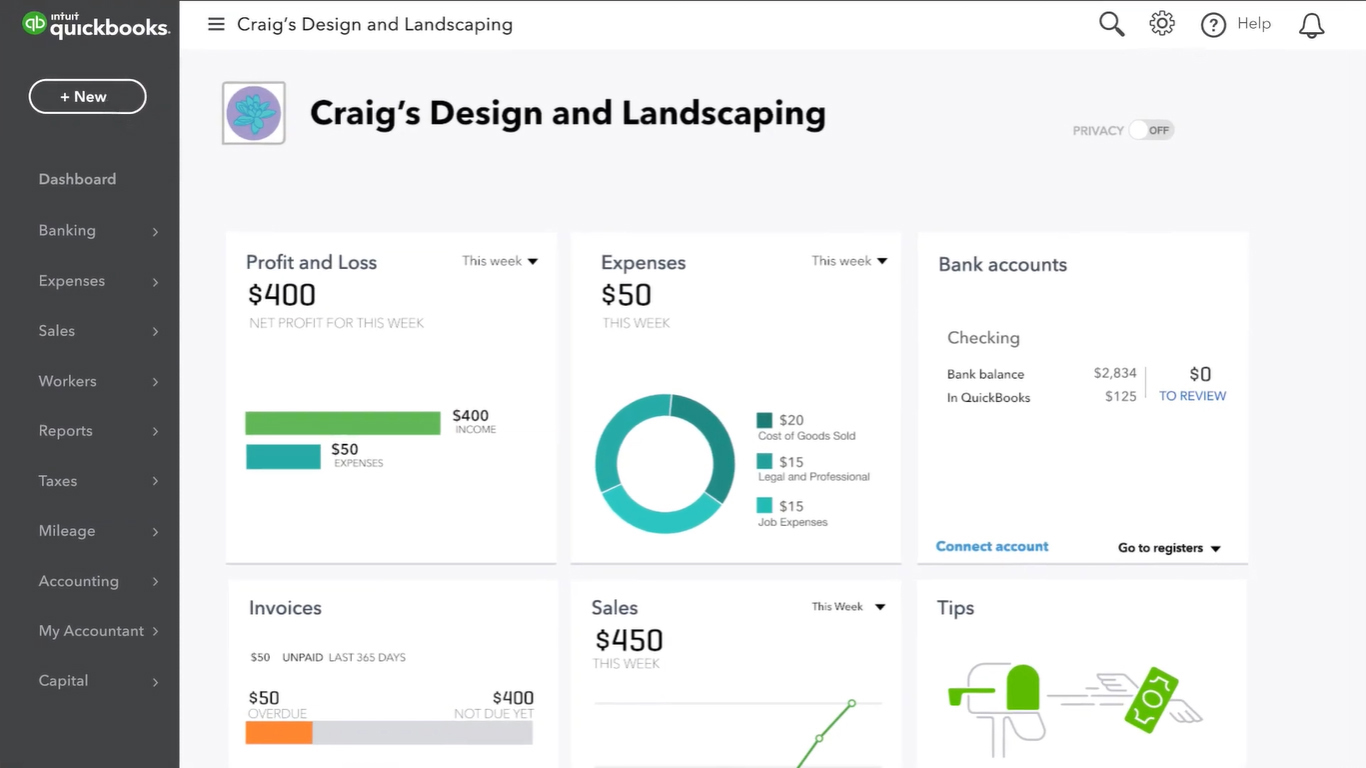

In this particular aspect, QuickBooks is more popular. In fact, our post that details accounting software analysis places QuickBooks at the top of the list. It has a home dashboard that focuses on displaying the financial overview of your account. This includes balances, expenses, revenue, profits, losses, and other finance-related numbers. The system also uses your previous activities to guess the type of transactions you’ll be doing. This allows QuickBooks to automate some of the key operations for you, including account categorization, transaction import, and specific account connection.

Most of the bookkeeping activities you’ll be doing in Wave involve organizing your transactions. This way, you can report on them when you do your tax and budgeting records. All these activities are done straight from the home screen, which also displays all the information on your transactions. All the data that your home dashboard shows come from the financial accounts you’re connected with. Wave also protects your accounts by providing read-only connections so that no one can use the system to withdraw or deposit money from them.

Payroll

For small businesses, gaining as few as two employees means employing payroll software because payrolls aren’t simple by nature. There are different types to consider, plus it’s bound by regulatory issues, such as taxes and compliance. That’s why businesses usually look for this type of solution as add-on features for accounting software. Fortunately, while it’ll cost you extra, both Wave and QuickBooks offer them.

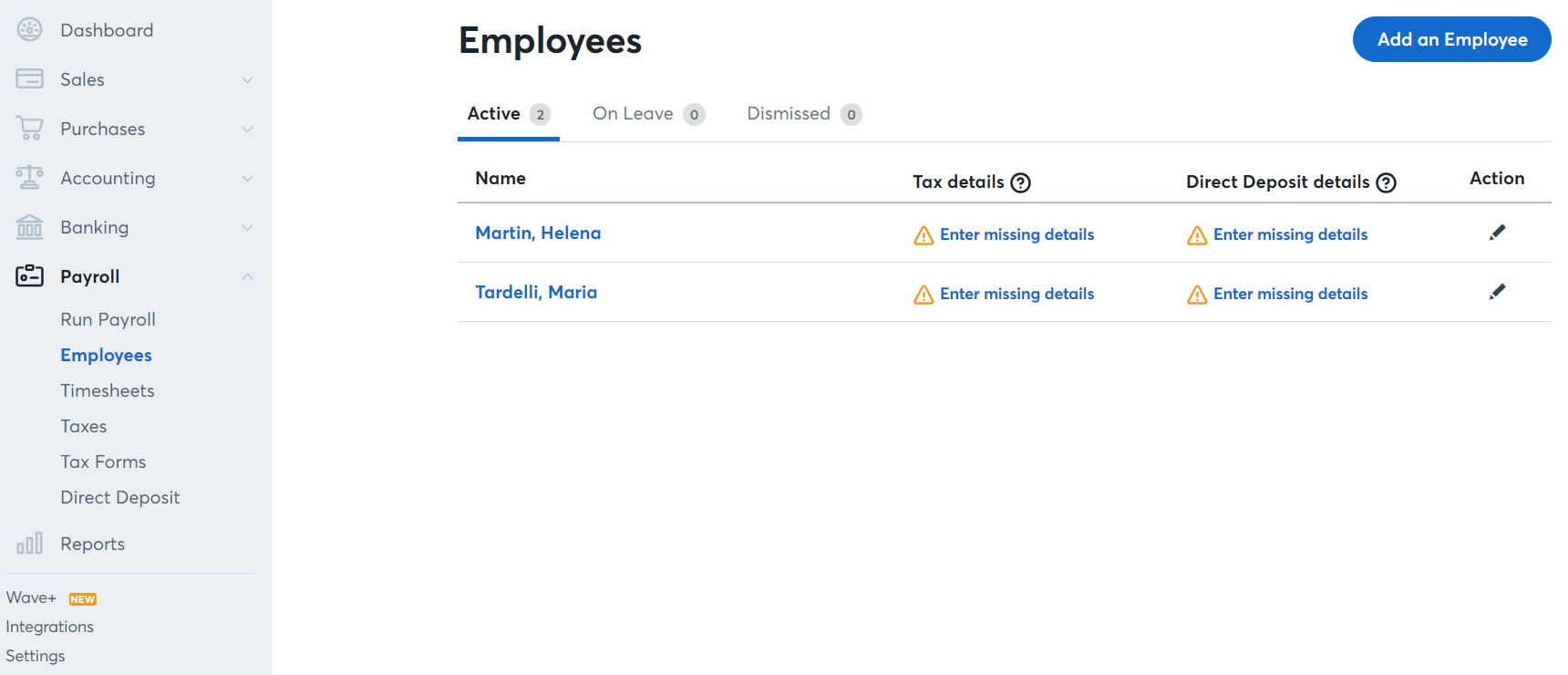

Wave is a good fit for this particular key business aspect. It has such a rich set of essential payroll-related features that it’s included in our list of payroll software as well. Its offerings include direct deposits, quick approvals, banking information self-service portal, automatic tax filings, and more. It even includes special settings so that it can accommodate employees with leaves, vacations, benefits, and the like.

QuickBooks, on the other hand, has two payroll levels, namely Enhanced and Full Service. The first one isn’t as smooth as Wave’s payroll management tools. That’s because Wave automates a lot of features like importing information from time tracking software. With that said, however, QuickBooks makes it easier to file taxes, since it automatically produces tax forms for you. The system also allows you to run a limitless number of payrolls without charging extra. Plus, the Full Service edition will have QuickBooks handle the entire payroll process.

Invoicing and Payments

Running a business might be fun. What’s not fun, however, is spending a significant portion of your time chasing down payments and writing up invoices. The good news is that both Wave and QuickBooks offer solutions for these time-consuming activities. You can create and send invoices for free using any of the two products. However, they both charge you a service fee for being the external payment processor for your cards.

Wave has a series of automatic features when it comes to payments and invoicing. These include the categorization of outstanding accounts and reminders for your customers with due payments. There are three ready-made invoice templates to choose from. However, you can also create your own and customize it so that it reflects your brand. The system also automatically handles recurring billing to help ensure that your weekly/monthly/quarterly customers pay you. Moreover, there’s an option for issuing full customer statements. This is a helpful tool if you want to see how far your relationship with clients has gone.

QuickBooks offers a lot of payment options for your customers, such as via credit card, direct invoice, or third-party apps (Square, ApplePay, etc.) The software also places link tracking in the invoices it issues so that you are automatically notified if your customers view or pay them. Paid invoices will be immediately and automatically matched with your accounts. This is handy because it saves a lot of time from cross-checking, which invoices still need payment and which don’t. You’re also given the option to let your customers pay on an installment basis. If you choose that, QuickBooks will take care of matching the partial payments so that the outstanding balance is up-to-date.

Reporting

The ideal reports are those that you can easily read and understand. This is especially true for small business owners who don’t have the time to thoroughly scan the ledgers for information. Furthermore, overview reports must provide the big picture in a glance.

Wave has made a major update on its reporting module in 2018 so that it has become more intuitive and easy to use. As a result, you can now see the most-used reports from the get-go without having to enter the general ledger view. The reports page also neatly categorizes your account views into more sensible groupings, such as big picture and taxes. However, even though reports are now easier to view, Wave still lacks data analysis features, especially for complex information.

Therefore, by all standards, QuickBooks shines brighter in this category. It features a plethora of snapshot reports, which you can access in one click. The dashboard homepage also displays a series of simple metrics and KPIs for a quick overview of your account’s state. And if you’re looking for advanced reporting capabilities, QuickBooks also has that covered. It comes equipped with tools for generating more complex reports like sales and budget. You can also download a CSV copy of those reports, which you can upload to your BI software for further analysis.

Collaboration

Small business owners are typically more adept at their trade or product, instead of tasks like accounting. This means that they most likely get help from professionals to handle their books and ensure that they stay in compliance with laws and regulations. As expected from topnotch accounting solutions, Wave and QuickBooks offer collaboration features to ease this process.

For starters, Wave lets you add a collaborator to each account—personal or business—that you want to give access to. This is a safety precaution to ensure that you are in control of who sees what accounts. Once in, collaborators will receive notifications for each record update and files you share. They can view, send permissions, and edit your books but not access your credit card and banking numbers. Collaborators can also see every accounting tool on the accounts you gave them access to.

Meanwhile, QuickBooks has an entire software that’s specifically designed for accountants. Through this, they can manage several client accounts at the same time from a single dashboard. All you have to do is provide them with access to the accountant’s copy of your ledger. This is a copy of your business records that allow you and your bookkeeper to concurrently manage your account. Of course, security measures are in place so that accountants cannot overwrite or duplicate your information.

Wave vs QuickBooks: The Verdict

This Wave vs QuickBooks comparison guide shows that the difference between the two is relatively minimal. However, those small distinctions might mean a lot to you. For instance, Wave is a good place to start for smaller businesses as well as freelancers. That’s because it offers free invoicing and accounting tools without having to deal with sophisticated bookkeeping features.

QuickBooks, on the other hand, offers reasonable pricing but with a series of overwhelming features that might be too much for newbies in the field. Therefore, you must use the information you got from this post in conjunction with your business’ specs, requirements, and goals. To expand your options, be sure to check our FreeAgent vs QuickBooks comparison guide.