TRAXPayroll Review

OUR SCORE 76%

OUR SCORE 76%

- What is TRAXPayroll

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is TRAXPayroll ?

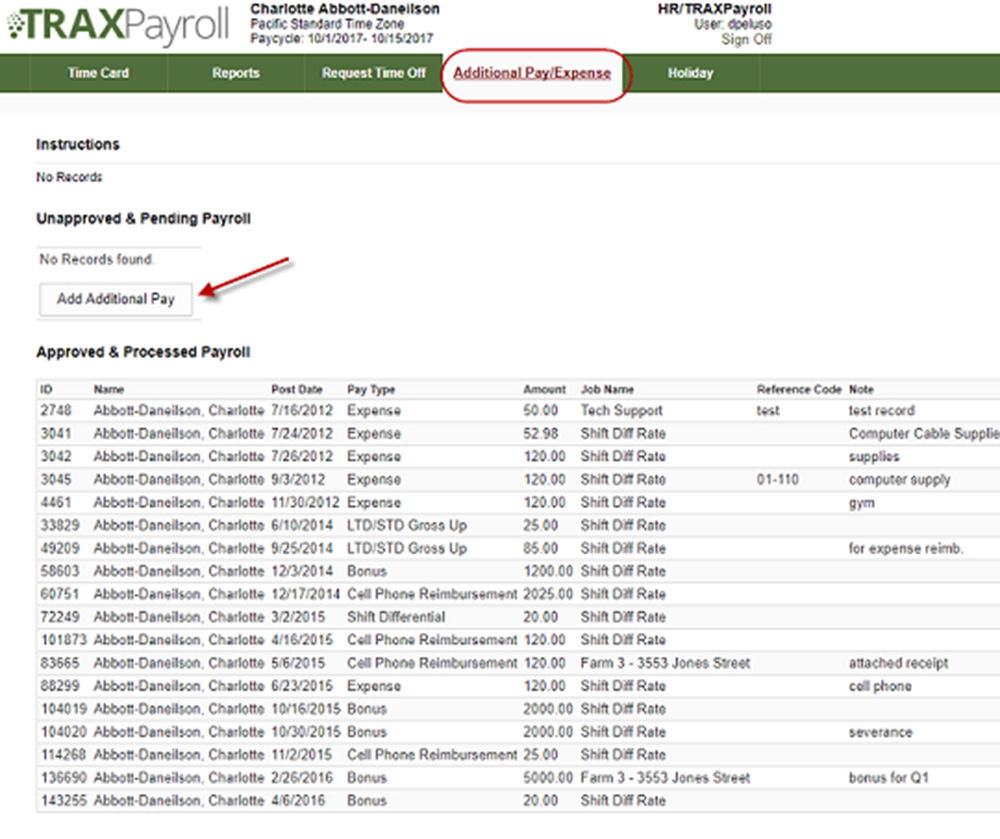

TRAXPayroll is a powerful cloud-based payroll management platform designed to take away all your worries and difficulties when it comes to handling your employees’ payrolls. The platform simplifies procedures related to processing and delivering payrolls which include recording employee data such as work hours and benefits, sending payments to employees, and generating pay reports and pay stubs. Since TRAXPayroll is a cloud-based tool, you can access it from any location at any time by simply using a web browser. The payroll management platform is being leveraged by many small businesses and large companies to attain transparency and accuracy as well as maintain compliance.Product Quality Score

TRAXPayroll features

Main features of TRAXPayroll are:

- Benefit Tracking

- Payroll Deduction Integration

- Time Sheet and Time Clock Software

- Real Time Hour Alerts

- Notifications Tracking

- Management Reporting Solutions

- Bill Consolidation

- Payment Reconciliation

- Job Tracking Software

- Project Tracking Software

- Manager Time Approval Software

- Direct Deposit Solutions

- Wage Garnishment Solutions

- Tax Filing Solutions

- ACA Reporting Requirements

- New Hire Reporting Solutions

- Worker’s Compensation Solutions

- General Ledger Reporting Solutions

- PTO Tracking Solutions

- Paid Time Off Request

- Approval Tracking

TRAXPayroll Benefits

The main benefits of TRAXPayroll are, it eliminates manual payroll management processes, simplifies the processing of payrolls, makes it easy for you to comply with regulations and policies like those related to taxes, and helps you easily handle your employees’ benefits and compensations. Here are some of the advantages to have when you employ TRAXPayroll:

Removes Manual Payroll Management Processes

TRAXPayroll allows you to execute payroll management processes that are automated and optimized. With this platform, you no longer need to perform manual procedures and tasks that are related to handling payrolls such as doing a lot of paperwork, making phone calls that consume much of your time, and faxing documents.

Fast And Simple Processing Of Payrolls

Processing employees’ payrolls using TRAXPayroll is fast and simple. All you need to do is to input all the employee data you need, and the platform will be in charge of processing your payrolls. It can automatically calculate payments, apply the necessary deductions, and give employees quick access to funds, pay reports, and pay stubs.

Helps You Achieve And Maintain Compliance

TRAXPayroll makes it easy for you to achieve and maintain compliance with policies and regulations as you handle your obligations to your employees. For instance, the platform enables you to prepare tax documents and forms and file income tax returns and submit tax reports on time.

Easily Handle Employees’ Benefits And Compensations

The payroll management platform can also assist you in managing the benefits and compensations you should give to your employees like shouldering expenses for hospitalization and medication, delivering payments associated with disabilities, and more.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

TRAXPayroll Integrations

The following TRAXPayroll integrations are currently offered by the vendor:

- ATS

- ShiftBoard

- EaseCentral

- RAMCO

- NATPAY

- Options4Growth

- EffortlessHR

- SharedHR

- Flock

- ShiftHound

- NimbleSchedule

- BambooHR

- Ximble

- Genesis

Video

Customer Support

Pricing Plans

TRAXPayroll pricing is available in the following plans: