Payza Review

- What is Payza

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Payza?

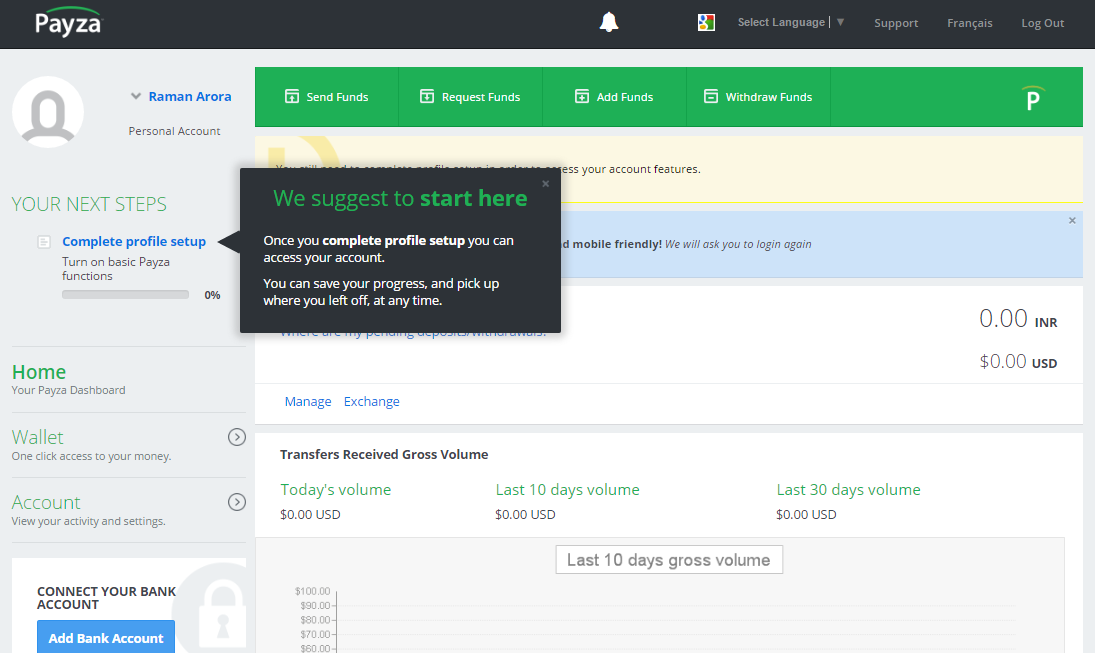

Payza is a safe and easy-to-use solution for sending and accepting payments worldwide securely. Businesses and professionals will find it easy to jump right in the platform as the user interface is very intuitive. The platform is useful for a range of transactions, from personal to more complex business conditions. It is largely similar to other payment processing solutions out there and is capable of traditional online transactions. Payza is mainly used in developing countries. This gives users in such locations convenient yet more affordable ways to make their global transactions. Payza supports 21 currencies and is being used actively in 190 countries.Product Quality Score

Payza features

Main features of Payza are:

- Add Funds and Withdraw

- Centralized Management

- Local Payment Options

- Multiple Currencies

- Paymeny Buttons

- Request Funds

- Secure Online Payments

- Send Funds

- Shopping Cart Integration

Payza Benefits

The main benefits of Payza are ensuring secure transactions, enabling users to send and accept payments via bank transfers, ACH transfers, Bitcoin money orders, and, of course, credit and debit cards, and providing an intuitive user interface.

Today, Payza services 9 million users worldwide. It has a significant customer base and it keeps on growing. So, for online merchants who are operating in or trying to reach developing countries, a Payza account gives a significant edge over the competition that is unaware of this potential market. United States members enjoy many withdrawing options such as bank transfer, bank wire, check, and Payza prepaid card. Furthermore, Payza supports 21 different currencies. This is something that many merchants enjoy.

The service also offers flexibility by allowing users to personalize their checkout processes. Advanced users can design their API to make their checkout platforms reflect their brands’ images and provide a smooth customer brand experience. One can add logos, choose their company colors, or spruce the checkout platform up by customizing it to reflect season sales or other promotions. Payza has various APIs and has an active Developers Community.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Payza Integrations

The following Payza integrations are currently offered by the vendor:

- 3DCart

- AbanteCart

- Cart

- Instant eStore

- OpenCart

- osCommerce

- PrestaShop

- UberCart

- Xcart

- ZenCart

Video

Customer Support

Pricing Plans

Payza pricing is available in the following plans: