PayKings Review

OUR SCORE 80%

OUR SCORE 80%

- What is PayKings

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is PayKings?

PayKings is a payment processing platform designed for merchants that are considered as high risk. These could range from nutraceuticals, pawnshops, debt collectors, travel companies, online dating, firearms, and adult entertainment and devices. PayKings allows these businesses to securely access payment channels at affordable fees and rates. This platform offers merchants payment platforms that have integrated fraud solutions, which minimize the incidence of chargebacks. Businesses that are not prepared for eCommerce can also be helped out by the platform. Merchants can also take advantage of a PayKings program that helps minimize the effect of credit card processing costs. Dozens of payment service providers and banks are also made available to PayKings users. PayKings also allows business to use mobile apps and gives them the ability to accept mobile credit card payments.Product Quality Score

PayKings features

Main features of PayKings are:

- Fraud prevention

- Payment terminals

- Chargeback prevention

- Mobile apps

- Payment gateways

- Payment processing

PayKings Benefits

The main benefits of PayKings are flexible payment terminals, chargeback prevention, and eCommerce fraud protection.

Flexible payment terminals

No business is exactly the same, which is why the payment terminals that businesses need may have different requirements. With PayKings, you can be assured that the payment terminals you acquire can be customized to fit your specific needs. These include EMV-Capable Encrypted USB Smart Terminals, EMV-Capable Encrypted USB Smart Terminals with signature capture, iPS Enterprise Encrypted Mobile Readers, and Encrypted USB Keypad/Card Reader Combos. A list of billing software tools can also show you options to track your customer payments efficiently.

Chargeback prevention and lower processing costs

Chargebacks occur when a charge is disputed by the credit card owner at the issuing bank. Some of these may be legitimate concerns, but they can also be part of a fraudulent scheme. PayKings can suggest solutions like their own iSpy Fraud Tool, secure codes, and gateway tools. Processing costs can also be minimized by PayKings through its SurchargePro program.

Credit card fraud protection

Another reason why PayKings is one of the best payment gateway software on the market is because of its iSpyFraud Tool. This allows you to review transactions quickly and easily, helping you notice any fraudulent activity and block suspicious users that may be committing this activity. The tool can also blacklist email addresses, credit card numbers and IP addresses to further minimize the incidence of fraud.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

PayKings Integrations

The following PayKings integrations are currently offered by the vendor:

- WooCommerce

- Magento

- Gravity Forms

- Ubercart

- Ultracart

- Lime Light CRM

- CiviCRM

- PrestaShop

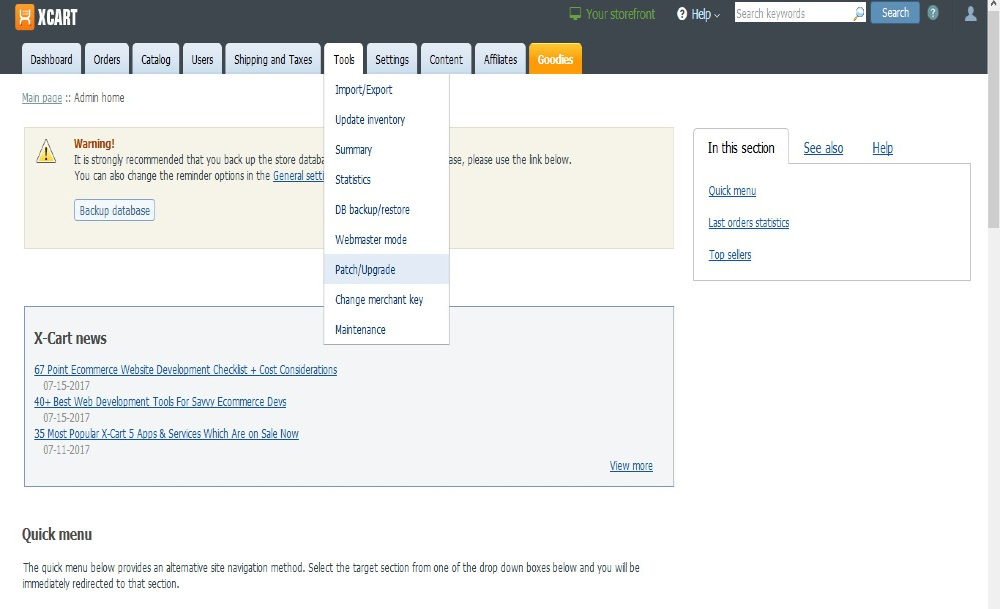

- X-Cart

- Events Manager Pro

- DrupalCommerce

- Ecwid

- Konnektive CRM

- Triangle CRM

- Big Commerce

- Pinnacle Cart

- Paid Membership Pro

- Hikashop

- Event Espresso

- Orange CRM

Video

Customer Support

Pricing Plans

PayKings pricing is available in the following plans: