PEX Card Review

OUR SCORE 81%

OUR SCORE 81%

- What is PEX Card

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is PEX Card?

PEX Card, a spend management software, regulates money flow across the business hierarchy. It’s an innovative solution that handles every finance and insurance issue that a company face. The platform is equipped with a series of advanced features that can manage company spending and can guarantee cut expenses and saved times. By using PEX Card, the accounts officer can allocate a budget to all employees so that spending is controlled. This process is also safe from miscalculations and manual entry mistakes. Furthermore, the solution is very handy for companies that often surpass their budget frame. That’s because once certain spending level limits are designated, they are assured against funds leakage from anywhere.Product Quality Score

PEX Card features

Main features of PEX Card are:

- Analytics

- No minimum funding

- Card suspending

- Credit control

- Bank to PEX account transfer

- Dashboard

- Spend management

- Reporting

- Credit tracking

- Merchant allocation

PEX Card Benefits

The main benefits of PEX Card are its efficient enrollment process, no interruption in business flow, streamlined process for fund transfers, intuitive dashboard, and finance tracking tools. Here are more details:

Streamlined Enrollment Process

PEX Card employs a streamlined enrollment system where users only have to enroll their company on the site and afterward, they can manage the app from any location. There would be no need for complex installations or on-premise deployment as well.

Business Flow Maintenance

After acquiring their own dashboard, accounts officer can immediately issue PEX cards to their employees. With the cards in their hands, employees are guaranteed to be able to make the necessary transactions whenever needed. Thanks to this, businesses are able to keep their flow smooth and uninterrupted.

Efficient and Safe Fund Transfer Process

While users may have different business bank accounts, they are still given the option of transferring funds directly to their PEX Card account. It’s also a secure process and the funds from PEX cards are still transferable to business accounts.

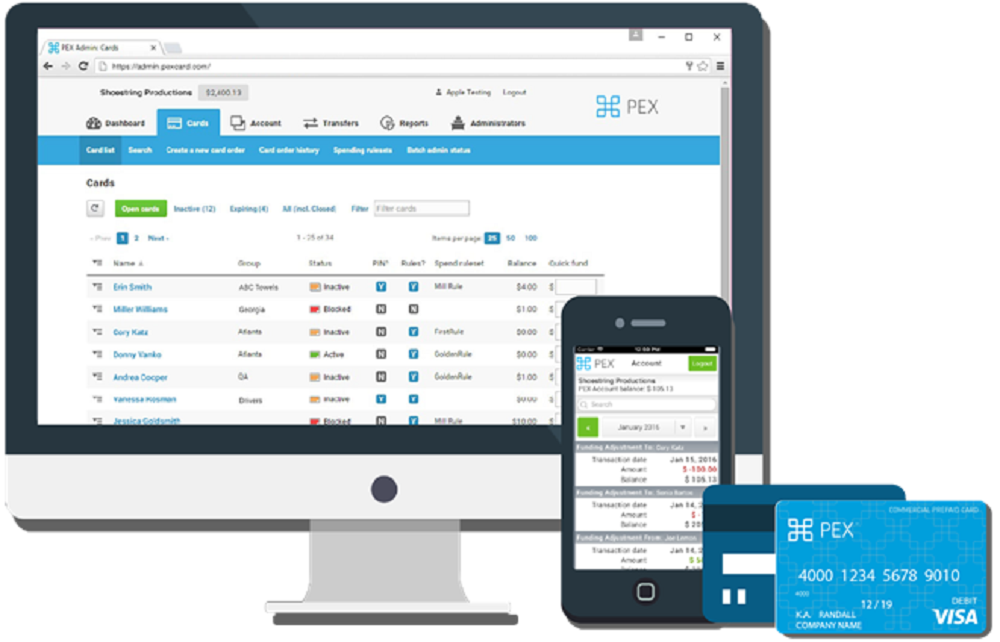

Intuitive Dashboard

PEX has an intuitive dashboard which provides accounts officer with complete control and access to their employee’s PEX cards. They can adjust the balances of every employee and they also have the capability to suspend the usage of cards. For the safety of their finances, they can also allocate acceptable card merchants. To top it off, the dashboard is accessible from any location using any device.

Finance Tracker

Users can easily view their spending analysis by logging into the official website and finding the tab for tracking finances. There are summary reports as well which could be downloaded and some balance tracking features that smoothen documentation process.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

PEX Card Integrations

The following PEX Card integrations are currently offered by the vendor:

- eCapital

- ExpenseWatch

- QuickBooks

- Expensify

- Blackbaud Technology Partner

- Bookkeeping Express

- Xpenditure

- Tallie

- Nexonia

- Expensify

- Xero

Video

Customer Support

Pricing Plans

PEX Card pricing is available in the following plans: