WePay Review

OUR SCORE 90%

OUR SCORE 90%

- What is WePay

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is WePay?

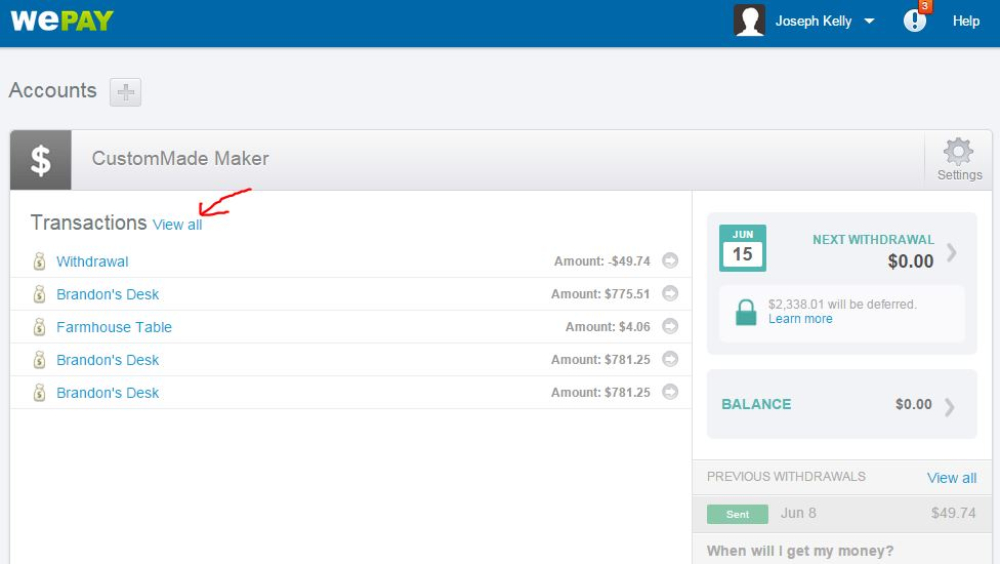

Businesses that use WePay get an online payment solution that works closely with platforms to provide an exceptional payment experience to users. On top of that, WePay gives users risk services and fully synced payments at no overhead cost to them. Thousands of platforms have simple, safe, and seamless payments due to their partnership with WePay. The solution easily provides the payment functions that a platform needs, without any risk attached.Product Quality Score

WePay features

Main features of WePay are:

- Integrated payments

- Apple Pay compatibility

- Android Pay compatibility

- Direct bank transfers

- Transaction-level reporting

- Account provisioning

- Mobile point-of-sale

- High-level PCI security

- Funds settlement

- Tokenization

- Risk API

- Custom UX

- Instant onboarding

WePay Benefits

The main benefits of WePay are its customization options, its advanced risk tools, and its risk management technology.

Businesses have payment needs that can be complex or risky and the payment technologies that WePay has are designed to meet those needs. Checkout, email communications, and sign-up can be customized, and the buyer and seller experience can be white-labeled. WePay also gets rid of tedious merchant onboarding and redirects to third parties, which often undermine payer checkout and user adoption. WePay users are also offered fraud protection.

WePay users also don’t need to worry about going through a tedious underwriting process or having to set up a gateway, as the solution enables payments in a matter of seconds. If the merchant has other processors, the system can also safely accept this thanks to advanced risk tools. Anything related to overhead operations is also handled by the software, which is one less thing users have to worry about.

The solution’s risk management technology is innovative, effectively stopping identity theft and fraud from happening during transactions. Users can also see the movement of money through their platform thanks to data gathered from transaction-level reporting. Compliance with card network, government, and bank requirements, as well as other regulations, are also handled by the software.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

WePay Integrations

The following WePay integrations are currently offered by the vendor:

- Open API

Video

Customer Support

Pricing Plans

WePay pricing is available in the following plans: