Skrill Review

OUR SCORE 90%

OUR SCORE 90%

- What is Skrill

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Skrill ?

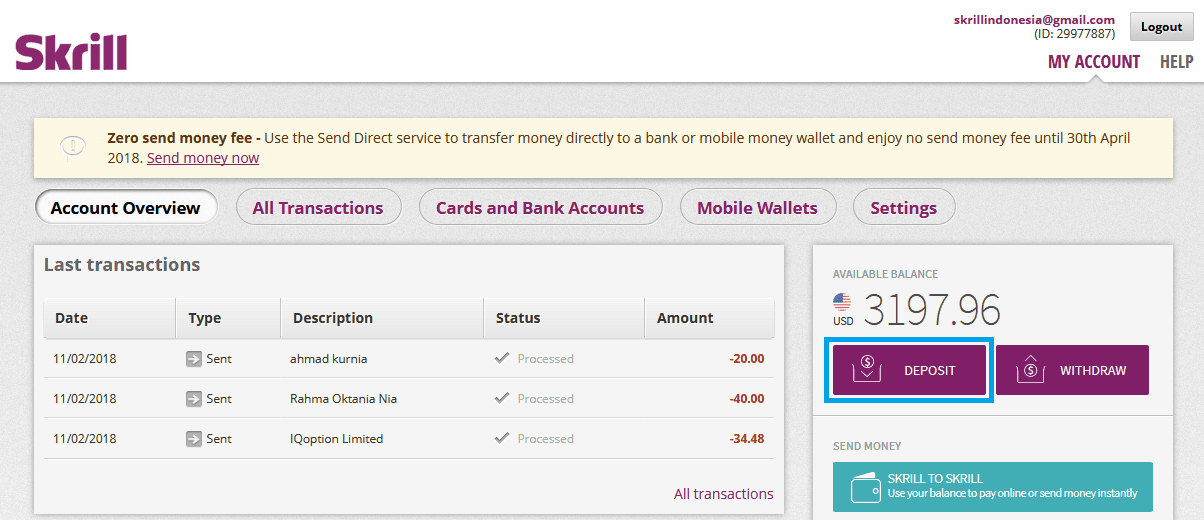

Skrill is one of the most popular payment gateways that allows business to serve their customers more efficiently while eliminating any worries about late payments. Skrill operates with the understanding that in modern business, facilitating customers properly is everything especially when it comes to money transfer and payment processing. With the innovative solutions it offers, Skrill has gone a long way since it first started its services in 2001; capturing the global market and having some of the world’s top brands from various fields as its customer. It has become one of the most trusted names when it comes to money transfer services and payment processing.Product Quality Score

Skrill features

Main features of Skrill are:

- Credit Card Transactions

- Email transactions

- Free account

- Fast access

- One place data

Skrill Benefits

The main benefits of Skrill are its ease of use, enterprise security, and great value for money. Here are the details:

Simple

Skrill makes payment processing a very simple task. It provides several options for payments such as cash, credit cards, and email transactions. Users need only to sign up on the web and they can avail the services the platform offers. Skrill allows users to target audiences around the globe through its capability to transact with more than 30 currencies worldwide.

Secured

Skrill provides the highest level of security and transparency for each transaction that the system handles. Passwords and other critical information are kept strictly confidential to prevent its misuse by other parties. Each transaction to and from an account is monitored with an anti-fraud screening feature, which adds another layer to the security.

Accessible

To access its services, the user only has to open an account at the Skrill website and afterward all is set. Since user accounts also work on mobile devices, transactions can, therefore, be done from almost anywhere, anytime. In addition to that, Skrill also allows users to withdraw cash from ATMs.

Handy for online stores

One problem that Skrill resolves is the trend of potential customers for online stores to abandon a purchase because of the lack of means to instantly pay for the product. Skrill makes payments for online purchases simpler for its online shoppers. With its helpful online features, the platform is a handy tool for online stores and POS businesses.

Good pricing

This money transfer application can be used either for free or for a very low price for distinct types of transactions. As long as the user is active, consistently logged in, and making a transaction at least once every year, then he would not be charged for the service. But inactive accounts will have to pay a fee of €3 every month, which will be taken from the account’s fund.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Skrill Integrations

The following Skrill integrations are currently offered by the vendor:

The vendor didn’t provide any details on integration.

Video

Customer Support

Pricing Plans

Skrill pricing is available in the following plans: