Riskalyze Review

OUR SCORE 86%

OUR SCORE 86%

- What is Riskalyze

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Riskalyze ?

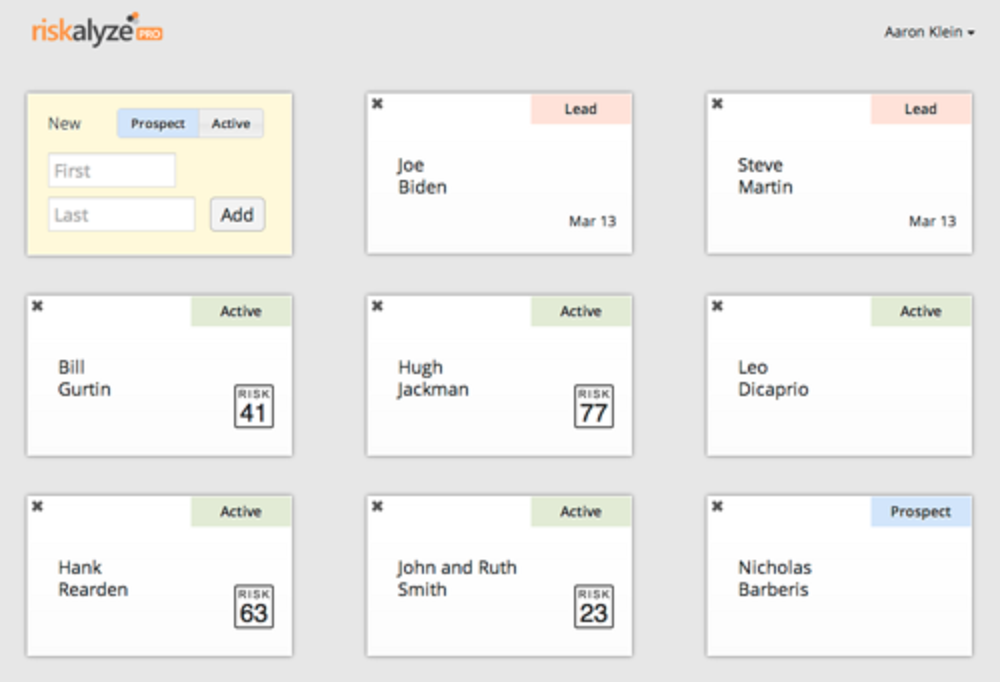

Riskalyze, a Risk Alignment Solution, determines the Risk Number of an investor and make a portfolio that holds just the right amount of risk. It utilizes powerful risk analytics to immediately assess the Risk Number associated with the outside holdings of a prospect. There are productivity tools available which help take ACAT forms signed a lot faster than before. And by setting the return expectations of a portfolio through risk rather than average return, customers are being given more information they need. Riskalyze platform provides other products that utilize Risk Number as the main core to give end-to-end functionalities to users. Some of the mentioned products are Retirement Solutions and Autopilot Automated Account Platform. There is a Compliance Cloud as well which enables big data analytics to find issues regarding compliance that need to get addressed.Product Quality Score

Riskalyze features

Main features of Riskalyze are:

- Account Opening

- Client Dashboard

- Lead Generation Questionnaire

- Check-ins

- Dedicated Account Manager

- Retirement Maps

- Fully Customized IPS

- Customized Contact

- Docusign the IPS

- Investment Policy Statements

- Data Sharing

- Advanced Portfolio Stats

- Asset Sync

- Risk Assessments

- Custom Investment Choices

- Portfolio Analysis

- Single Sign-On

- Custom Market Assumptions

- Meetings

- Stress Tests

- Retirement Plans

- Multi-Team Access Control

Riskalyze Benefits

The main benefits of Riskalyze are the tools for risk assessment, retirement maps for accurate estimates, meeting tools for virtual conference, lead generation questionnaire, printable investment policy statement, and a handy client dashboard. Here are more details:

Risk assessment features

There are various assessment tools in Riskalyze that use scientific theories for objectively pinpointing investor’s Risk Number. By ensuring to avoid stereotypes which make risk tolerance futile, companies are able to get more accurate results. The system’s powerful portfolio analytics engine computes the Risk Number of every portfolio and match it with the risk preferences of the investor.

Retirement maps

Retirement Maps aims to avoid inaccuracies on estimates with regards to the probability of a client’s risk preference leading to goal achievement and then making a map to success about it. Stress tests feature is performed for different bond market scenarios and stocks. This is done by running customer portfolios through a timeline in the market and then compare them to the right benchmarks.

Meeting tools

Riskalyze contains meeting tools that can be used for launching discussions with clients from practically anywhere around the world. Check-ins is available as well which establishes strong foundation for supporting users’ messages between client reviews as well as sending early warning signals if customer psychology starts declining.

Lead Generation Questionnaire

The system is equipped with Lead Generation Questionnaire which serves as an interactive tool for risk analysis. It can also be used for capturing leads for any website.

Investment Policy Statement

A clear roadmap for the client is presented through the printable Investment Policy Statement which is helpful for setting better expectations and for enumerating the key factors that an advisor would need.

Intuitive dashboard

Riskalyze is equipped with a client dashboard that gives clients a Risk Number centered view of their resources. It can also be used to update the Risk Number, check balances, and to progress further to a goal. Users with Autopilot account can also edit their goals as well as request changes on their investments.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Riskalyze Integrations

The following Riskalyze integrations are currently offered by the vendor:

- RetireUp

- Advizr

- Schwab

- Morningstar

- eMoney

- MoneyGuidePro

- Trust Company of America

Video

Customer Support

Pricing Plans

Riskalyze pricing is available in the following plans: