Moneymailme Review

OUR SCORE 65%

OUR SCORE 65%

- What is Moneymailme

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Moneymailme ?

Moneymailme is a free cash transfer application that revolutionizes instant cash transfers in mobile devices. It is a creative application that consolidates the convenience of sending and accepting e-cash and the power of social interactions on mobile. Moneymailme simultaneously facilitates micropayments, chatting, and file sharing to provide a social experience on mobile payment transactions. Its use of social innovation cuts the long processes taken by standard applications in transferring assets on the P2P basis. The software utilizes security protocols and advanced encryption to give users protection against data breaches during conversations and transactions. It is a dependable system that has changed the banking, finance, and communication sector on the go. The application works with multiple currencies including EUR, USD, ZAR, CHF, PLN, and GBP. It also supports multicurrency cards that empower clients to make keen and secure transactions wherever they are.Product Quality Score

Moneymailme features

Main features of Moneymailme are:

- Device validation

- Layered security

- Three-factor authentication

- Transaction security

- File transfer

- Video call

Moneymailme Benefits

The main benefits of Moneymailme are its ease of use, enterprise security, and mobile support. Here are the benefits in details:

Moneymailme is a simple-to-use software that does not require users to have prior in-depth technical knowledge. Its use isn’t restricted to global cash transfer—it also offers an encrypted chat framework that allows users to keep in contact with their loved ones. The intuitive UI enables users to use each element and feature of the software effortlessly. It gives a protected space where you can send photographs, messages, and recordings. Through the software’s interface, chatting with a friend and sending money is made easy and secure.

Moneymailme is a unique application that incorporates video calling with the cash transfer. It enables you to stay in contact with family and friends traveling or living outside the country and send them cash as you talk on a video call. To do this, simply tap on the “money symbol” amid your video calls and cash will be sent in an instant anywhere

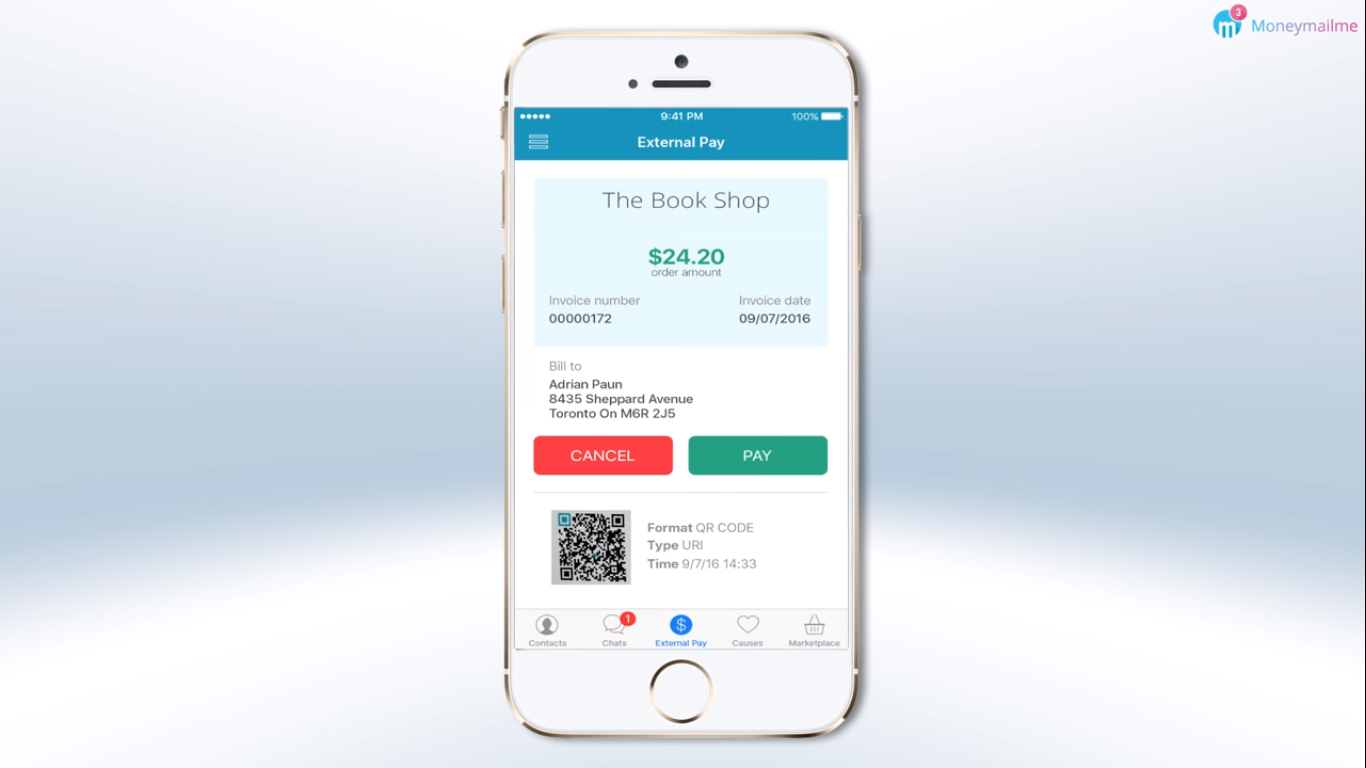

At the same time, the platform can be used by internet merchants to provide a quick and simple payment gateway for buying customers. It only takes a few simple steps to integrate Moneymailme with your online store and includes the alternative “pay with Moneymailme” to your business payment transactions.

The security of this software is structured at the at the highest level with the use of the latest security conventions. The platform executes numerous authentication layers and hardware limitation safety techniques that limit the use of the app to particular devices. Users can use this app on validated phones and logging in simultaneously on multiple devices is not allowed. Additionally, the three-factor authentication feature gives users full control over their account and privacy.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Moneymailme Integrations

The following Moneymailme integrations are currently offered by the vendor:

- Mangopay

- Payline

- Hyve

- GlobalGiving

- Credit Mutuel ARKEA

Video

Customer Support

Pricing Plans

Moneymailme pricing is available in the following plans: