Expensify Review

OUR SCORE 87%

OUR SCORE 87%

- What is Expensify

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Expensify?

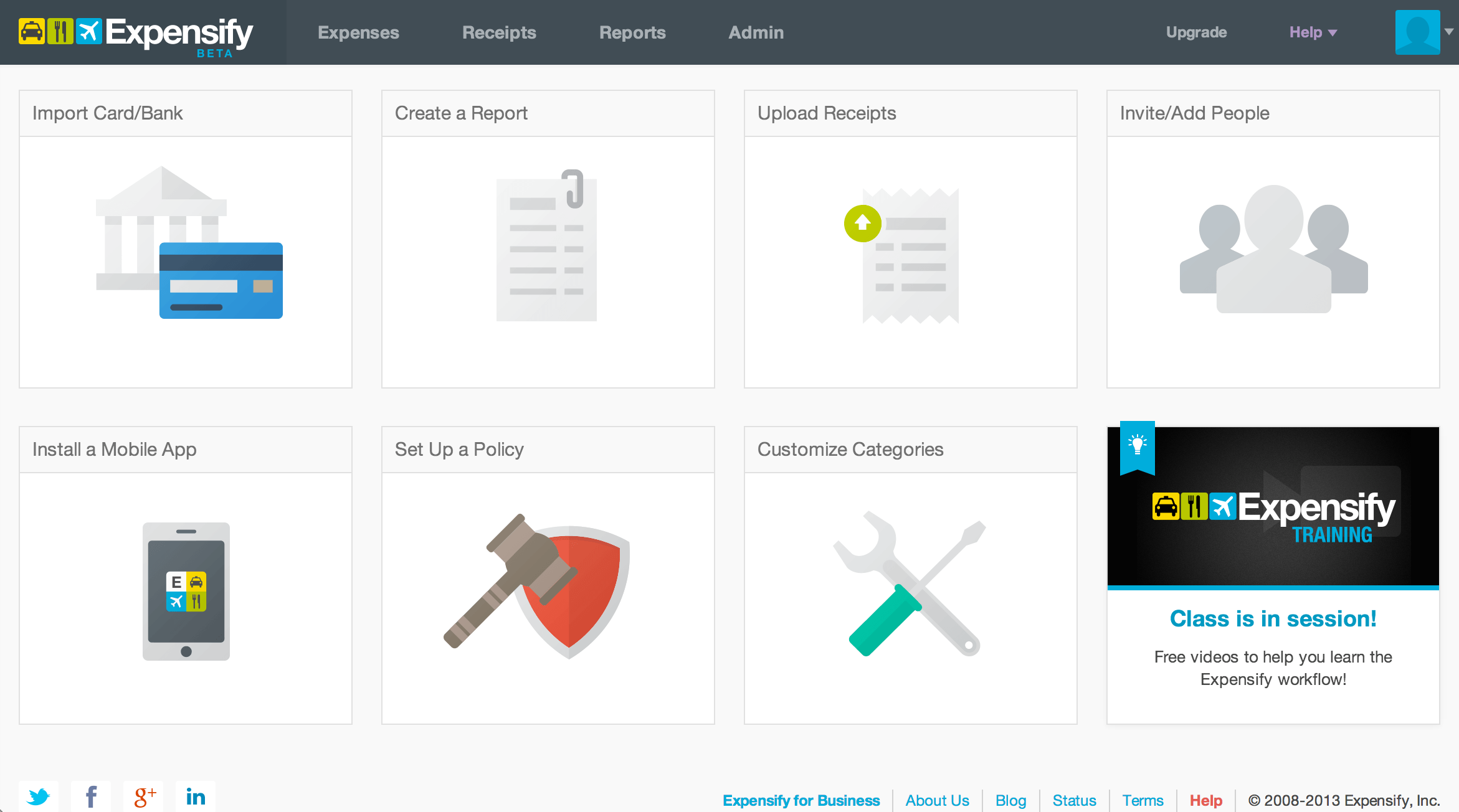

Money management issues will be a thing of the past once businesses get themselves Expensify. With its user-friendly interface, Expensify is the perfect tool to use for managing expenses and transactions like money matters. With Expensify, businesses can expect transparency in record-keeping. This is because the software allows them to maintain summaries of multiple accounts along with calendars. The calendars also help businesses avoid undesirable financial situations, as they have visibility on debt-to-income ratios and can balance this at the right time. Businesses that involve a lot of traveling will also appreciate Expensify’s powerful tools that track travel expenses based on the miles traveled. Expensify can even convert currencies and record the information if the company’s worker does a lot of international traveling. Best of all, it also simplifies record-keeping, as users can simply take photos of purchase receipts, with the software acquiring the information from the photos.Product Quality Score

Expensify features

Main features of Expensify are:

- Real-time Expense Reports

- Corporate Cards

- Flexible Travel Integrations

- Advanced Tax Tracking

- Automatic Accounting Sync

- Automatic Reporting & Submitting

- Direct Deposit Reimbursement

- Advanced Approval Hierarchies

- Vacation Delegate

- Advanced policy enforcement

- Corporate Card Reconciliation

- Custom Report Exports

- Candidate Reimbursement

- PCI-compliant Security

- Expense Rules

- Auditor Access

- Guided Review

- Automatic Approval

- Automatic Reimbursement

- Unlimited Expense/Receipt Upload

- One-click Online Reimbursement

- Multi-level Tagging

- Inbox & Guided Review

- Multi-stage Approval Workflow

- SAML SSO

- Custom Business Logic

- GL Code Mapping

- Automatic Accounting Sync

- Duplicate Expense Detection

- Credit Card Import

Expensify Benefits

The main benefits of Expensify are its robust feature set, mobile support, and great integration. Here are the benefits of Expensify in details:

One of the benefits of Expensify is how it makes it easy for businesses to manage their expenses. There’s no manual data entry needed, as Expensify automates expense reporting and tracking, from getting receipts to finalizing expense reports.

Expensify can also be automatically integrated with financial institutions, credit cards, and other payment modes. You can also record purchases and deposits in real time via the app, and you can also sync account information with your mobile. This enables you to save transactions whether you’re using a desktop computer or your mobile phone.

GPS technology also allows Expensify to track the expenses incurred on business trips. Expensify even tracks and records the miles traveled for any kind of deductions or reimbursements. A currency converter is also available to users.

Best of all, it integrates with a number of other applications, like Netsuite, uber, Microsoft dynamics and so on. CRM, ERP and a number of eCommerce suites are also integrated automatically

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Expensify Integrations

The following Expensify integrations are currently offered by the vendor:

- UBER

- Sane Box

- Oracle

- Sage

- Microsoft Dynamics

- Nex Travel

- Tripcatcher

- Egencia

- Scan Snap

- Intacct

- Financial Force

- Workday

- trainline

- NetSuite

- TSheets

- Travelport Locomote

Video

Customer Support

Pricing Plans

Expensify pricing is available in the following plans: