Dwolla Review

OUR SCORE 89%

OUR SCORE 89%

- What is Dwolla

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

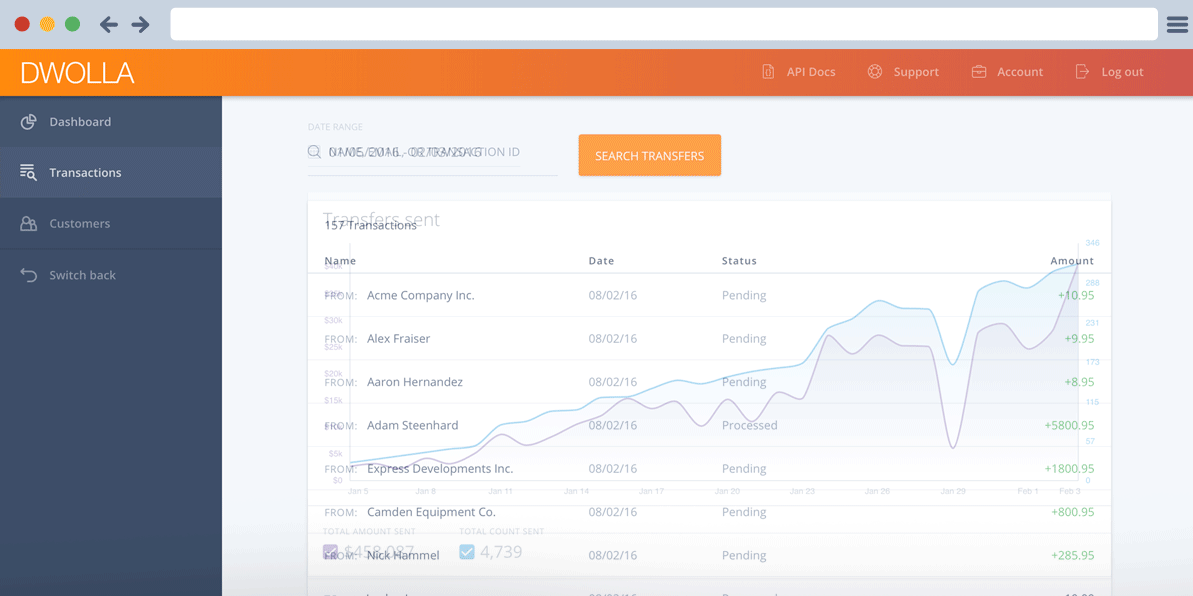

What is Dwolla?

Dwolla is a robust, online payment software primarily designed to facilitate bank transfers. It is a reliable platform that provides a suite of solutions that work seamlessly with credits unions and Banks in the United States. The solution enables financial institutions to build easy-to-use applications that simplify customer management, bank transfers and facilitate instant bank accounts verification. Dwolla is a next-gen API renowned as the ideal solution to move money. The application enables financial institutions to move money and integrate P2P transfers within their platform. It enables banks to build a reliable payment infrastructure to work with the existing systems to streamline payment processing.Product Quality Score

Dwolla features

Main features of Dwolla are:

- Dashboard and admin

- API for ACH payments

- On-demand transfers

- Bank verification

- Expedited transfers

- Fund management

- Custom limits

- MassPay

- Bank verification

Dwolla Benefits

The main benefits of Dwolla are its easy to use, instant bank transfers, and streamline ACH functions. Here are more details:

Easy to Use

Dwolla is designed from the ground up to be easy to implement and use. The platform features an intuitive user interface that includes tools for viewing White Label integrations. Its dashboard displays data gathered by the API and reveals the information needed to run a business successfully. Besides, there is an integration script that can be customized and integrated into the existing system to facilitate instant verification of bank accounts. Besides, there are numerous easy to use tools that make it easy to manage single or millions of bank transfers on demand.

Instant Bank Transfers

Another notable advantage of Dwolla is that it expedites bank transfer. The solution enables banks to process transfers instantly within a single business day. The MassPay feature facilitates the disbursement of single or thousands of payments with a single CSV upload or API request. Moreover, OnDemand Transfers feature gathers variable payments from the payers account immediately after the authorization.

Simplify ACH Functions

Better still, Dwolla provides all the tools needed to streamline ACH functions. It has all the tools a financial institution needs in an API for sending, receiving, or transferring funds between customers. With the application, banks can easily operate with only four endpoints, with fast verification and easy integration.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Dwolla Integrations

The following Dwolla integrations are currently offered by the vendor:

No available information.

Video

Customer Support

Pricing Plans

Dwolla pricing is available in the following plans: