PhonePe Review

OUR SCORE 82%

OUR SCORE 82%

- What is PhonePe

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is PhonePe?

PhonePe is an India-based, all-in-one digital wallet that could be linked to a single debit/credit card or bank account to be used for every online need. This UPI-based platform ensures that every transaction is safe from cybercriminals, making their users' financial details secured. PhonePe can be used by business establishments as a method to settle their utility bills to ensure on-time payments that might otherwise cause interference on their operations. It can be used as a means to pay their employees as well, making it an effective salary solution for companies with a distributed or global workforce. Store transaction is also available as PhonePe can be used as a payment method via a dedicated POS device. The process is quick and safe since a single POS is linked only to a single merchant.Product Quality Score

PhonePe features

Main features of PhonePe are:

- Credit and Debit Card Linking

- Bank Balance Check

- Money Storage

- App to Bank Account

- Send and Receive Money

- POS Payments

- PIN Authorization

- Bank Account Linking

- Wallet Top Ups

PhonePe Benefits

The main benefits of PhonePe are its functionalities, general usability and security. As a centralized digital wallet, PhonePe is a convenient tool for many business transactions. Listed below are what to expect when you implement PhonePe:

All-in-One Solution

With its availability anywhere in India and the wide variety of transactions it can be used for, PhonePe is a convenient tool for business users. Payment of utility bills, payment of wage, and a payment request from clients can all be done through this app.

Direct transfer of funds

A faster and much more secure method of transaction is also available from the app. Direct transfer of funds from the user’s account to PhonePe wallet eliminates the need for an account or card linking. This makes the process hassle-free and more secure, a perfect solution for everyday payments and fund transfers.

Numerous Different Payment Options

PhonePe offers users several options to choose from for their payments. UPI, bank accounts, credit cards, and debit cards can all be linked to the app, making it a flexible payment method that ensures each source does not have an issue and good to go.

Multi-Language Interface

The app supports both English and Hindi languages as well as Marathi, Tamil, and Bengali. This makes the app more usable and friendly to operate for all the natives who speak any of those languages.

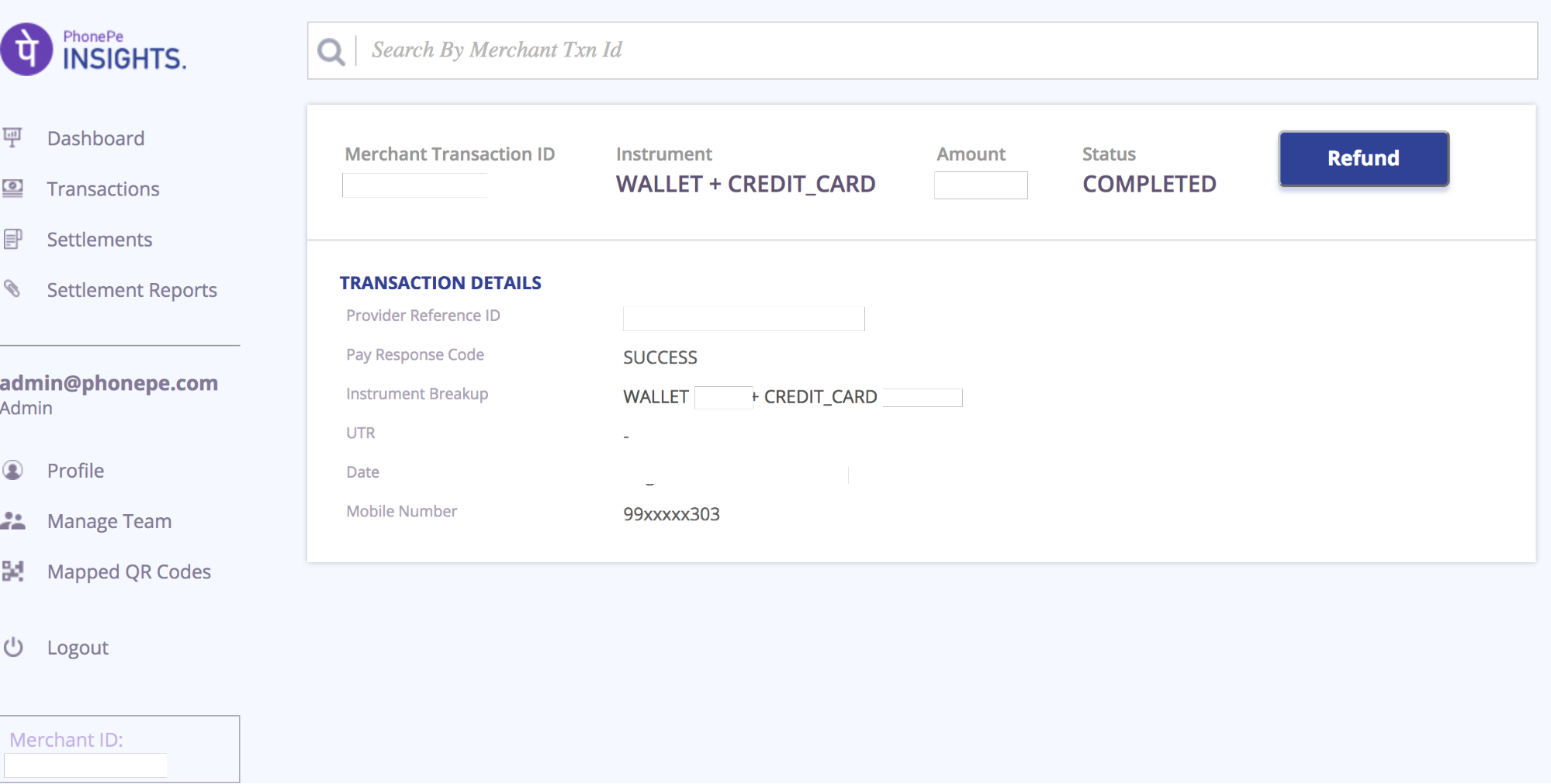

Intuitive POS

Merchants will find the app useful for their business as well since store transaction is available through the PhonePe’s dedicated POS device. The buyers need not queue in line on the register any more to pay for the items they bought and the sellers are able to serve more customers at a time. Security concerns are also taken care of for businesses and consumers alike. One POS device is linked only to a single merchant and a transaction completes only when the buyer enters the proper PIN code on the app.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

PhonePe Integrations

The following PhonePe integrations are currently offered by the vendor:

PhonePe integrates with Unified Payments Interface (UPI).

Video

Customer Support

Pricing Plans

PhonePe pricing is available in the following plans: