PayAnywhere Mobile Review

OUR SCORE 76%

OUR SCORE 76%

- What is PayAnywhere Mobile

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is PayAnywhere Mobile ?

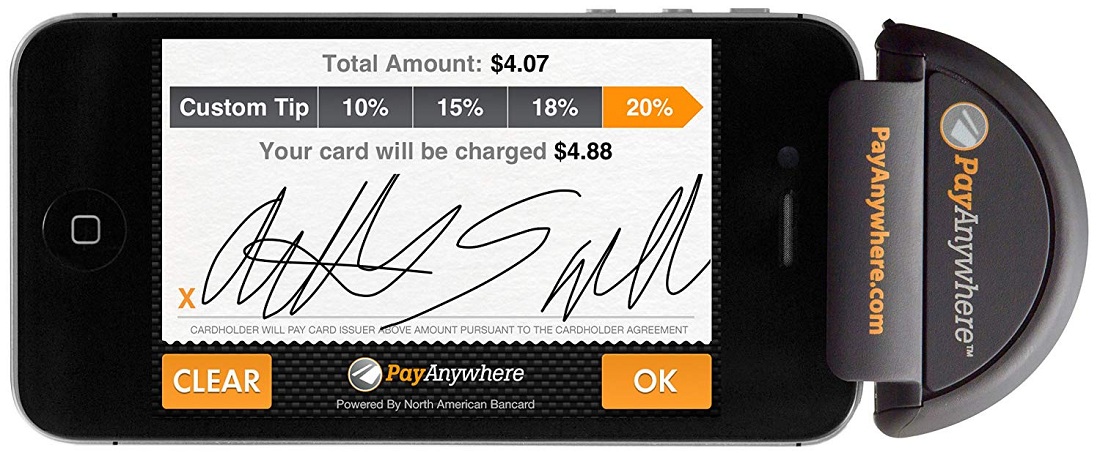

PayAnywhere Mobile is a credit card reader that has an accompanying application that turns Android and iOS devices into mobile payment processing terminals. It provides users with two-in-one card readers which is free to registered merchants. It also offers three-in-one card readers that require a fractional fee to acquire. This makes PayAnywhere Mobile a cost-effective solution which is especially helpful for solo entrepreneurs and small businesses. The platform also aids businesses in protecting their clients regardless of where they are through data encryption, fraud prevention processes, and tokenization. Furthermore, PayAnywhere Mobile can also serve as a portable tool for item inventory. The app that comes with it is equipped with a built-in library with multi-tiered pricing, modifiers, and product photos for faster transactions.Product Quality Score

PayAnywhere Mobile features

Main features of PayAnywhere Mobile are:

- Data Encryption

- Item Libraries

- Reporting

- Credit Card Payment Processing

- PayPal Payment Processing

- Unlimited Users

- Tokenization

- Email or Print Receipts

- Fraud Prevention

PayAnywhere Mobile Benefits

The main benefits of PayAnywhere Mobile are its cost-efficiency, support for multiple types of the card reader, built-in item inventory tool, and strong protection for each transaction. Here are more details:

Cost-Effective

PayAnywhere Mobile has two types of the card reader. The first is the two-in-one which is provided for free to approved and registered merchants. The other one is the three-in-one card reader that can be purchased for a small price. Thanks to this, businesses are able to afford the product without having to stray from their budget while increasing their profits by being capable of accepting various types of payments. The transaction is transparent as well so that businesses are able to monitor how much of the sales went to the transaction fee.

Two Types of Card Readers

PayAnywhere Mobile supports two types of card readers, each having different functionalities. While both are able to read EMV cards and magnetic stripe, only the three-in-one can accept NFC or contactless payments. A two-in-one card reader, on the other hand, has a feature for connecting through Bluetooth. Thanks to this versatility, merchants won’t have to worry about turning away customers just because they aren’t able to process their card payment.

Portable Item Inventory

The accompanying app that comes with PayAnywhere Mobile features a built-in library of items. This can be utilized by businesses to store the images of their products together with additional pricing options so that users can easily offer discounts at the counter.

Stringent Security Measures

To actively protect clients from digital and fraudulent attacks, PayAnywhere Mobile employs data encryption as well as tokenization for each transaction. Thanks to this, card details are protected with a layer of encryption that shields it from access to cybercriminals. Tokenization also provides the same benefits but it utilizes unique transaction codes each time in order to hide the relevant numbers of the card.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

PayAnywhere Mobile Integrations

The following PayAnywhere Mobile integrations are currently offered by the vendor:

No available information

Video

Customer Support

Pricing Plans

PayAnywhere Mobile pricing is available in the following plans: