Dragonpay Review

OUR SCORE 80%

OUR SCORE 80%

- What is Dragonpay

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Dragonpay?

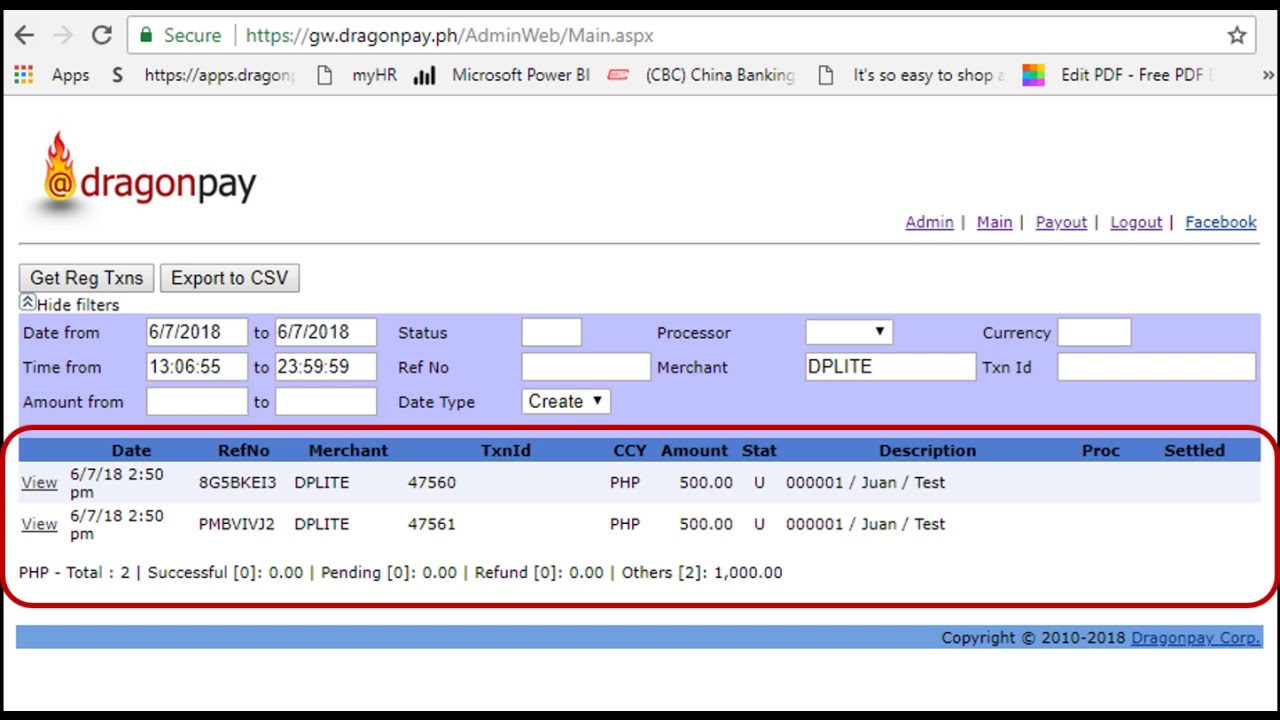

An online payment service provider in the Philippines, Dragonpay allows online purchases and payments to be made by cash or check at both ATMs and payment counters. It also allows payment through an online account and a mobile wallet. Most people in the Philippines do not have bank accounts or even credit cards, hence Dragonpay proves beneficial in making payments and purchases. The payment options offered by Dragonpay are also beneficial for e-commerce ventures in the country. Many online stores and businesses use these solutions. Dragonypay is especially beneficial for people without PayPal accounts or credit cards. It tracks both online and offline payments automatically and also notifies merchants of transactions.Product Quality Score

Dragonpay features

Main features of Dragonpay are:

- Mass payout

- Recurring payments

- Secure transactions

- Online payment solution

- No-chargeback payment policy

- Online payment collection

- Fixed fee per transaction

- Personal escrow service

- Customer support

Dragonpay Benefits

The main benefits of Dragonpay are its assistance in reaching customers who have no bank accounts, security, and merchant-friendly fixed pricing scheme. Dragonpay is useful in countries like the Philippines where most people have to use cash as they do not have bank accounts or credit cards. This proves beneficial for online merchants who are at risk of losing a huge number of customers who cannot make online payments. Thus, the software is useful for both merchants and customers.

The following payment modes can be used via Dragonpay:

Online Banking

Dragonpay allows people to make payments via bank account and money will be deducted from their accounts instantly.

Over-The-Counter (OTC) Banking

The platform lets you pay at the counter of a local bank branch and the merchant is notified once payment is done.

OTC Non-Bank

If you cannot go to a bank’s branch, you can make your payment in cash at a retail store.

Here is the list of benefits of Dragonpay:

Secure transaction is assured, as customers do not have to disclose details of their credit card while merchants are saved from credit card frauds. The no cash-back policy ensures guaranteed payments to merchants.

Merchants get a high profit as they do not have to give a fixed percentage to Dragonpay for their total sales. The merchant-friendly pricing is ensured by taking a fixed fee for every transaction.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Dragonpay Integrations

The following Dragonpay integrations are currently offered by the vendor:

No available information.

Video

Customer Support

Pricing Plans

Dragonpay pricing is available in the following plans: