Remember the good old days when all you needed was Excel for bookkeeping? Okay, those days weren’t all that good. Manually typing numbers is time-consuming and involves a lot of effort. It is also prone to errors.

For example, the 2012 London Olympics encountered major overbooking trouble after a ticketing mistake occurred when a staff member accidentally typed “20,000” instead of “10,000.”

When your business grows, your records grow with it. In a spreadsheet, you have to write formulas to generate equations. If you mistype and your formula is wrong, Excel will do the wrong calculation. Reviewing all that numerical data can become confusing, and you wouldn’t notice that there was a problem. If you do notice, there’s a big chance that by then, it would already be late.

Even the investment banking company J.P. Morgan Chase reportedly lost over $2 billion due to a miscalculation in the spreadsheet.

Fortunately for you, accounting software exists. This helps you automate your accounting tasks so that you can use your valuable time to manage the rest of your business. Using software, you can easily search your entire audit history, make a report on your finances, as well as allocate your money and resources appropriately.

Automating your accounting processes can help you generate faster financial reports. Having a dedicated accounting software is simply fast and furious…ly helpful.

What is Accounting Software?

An accounting system is used to manage all the financial activities of a business. It tracks profit, expenses, and liabilities that a company has. It can also show you a report of financial data, such as loans, stocks, accounts payable, billing, payroll, and purchases so that you can be informed when making future decisions. Seeing reports and statistics can help you asses the general health of your company’s finances.

List of Best Accounting Systems

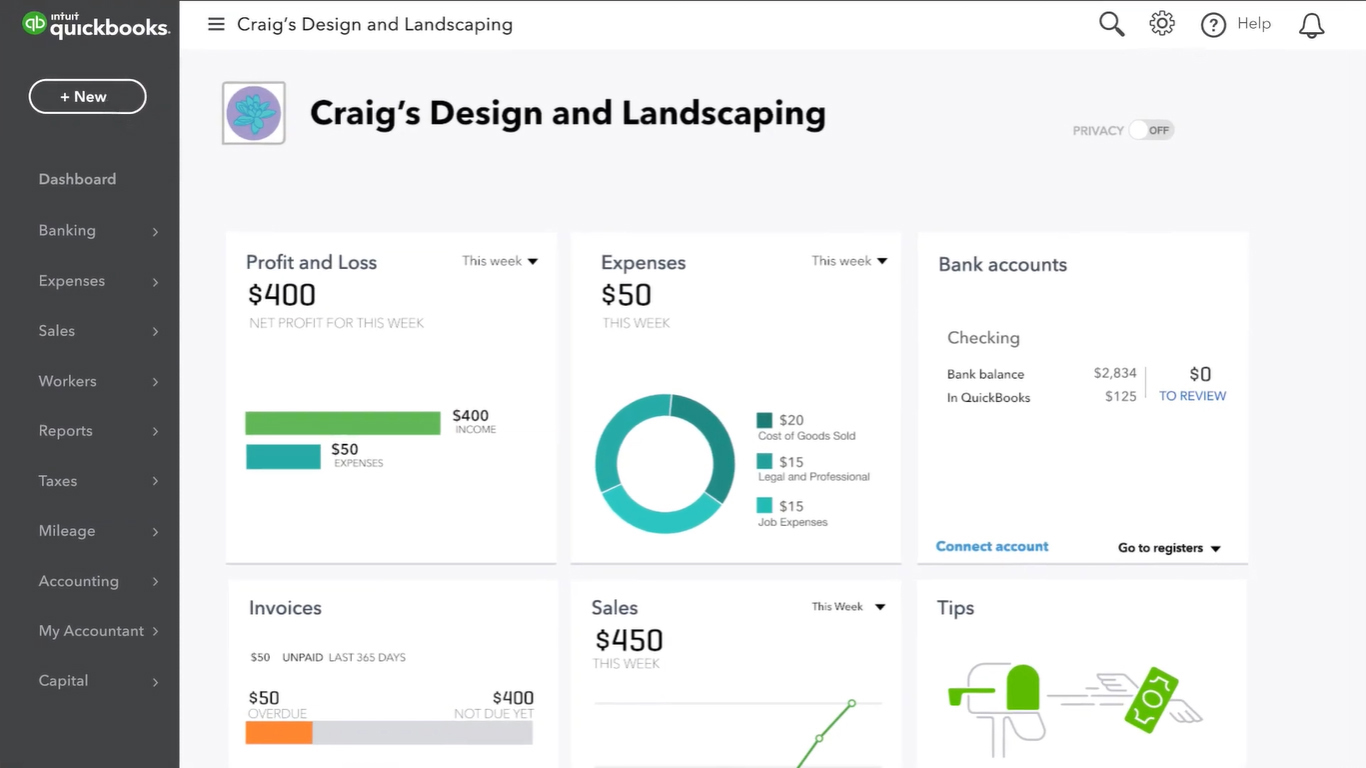

- QuickBooks: QuickBooks is a popular accounting software for small businesses. Its key features are billing and invoicing, expense tracking, asset management, and payroll calculation. The vendor also offers 24/7 live support and in-person training. Price starts at $12 per month, but they offer a 30-day free trial for you to test drive it.

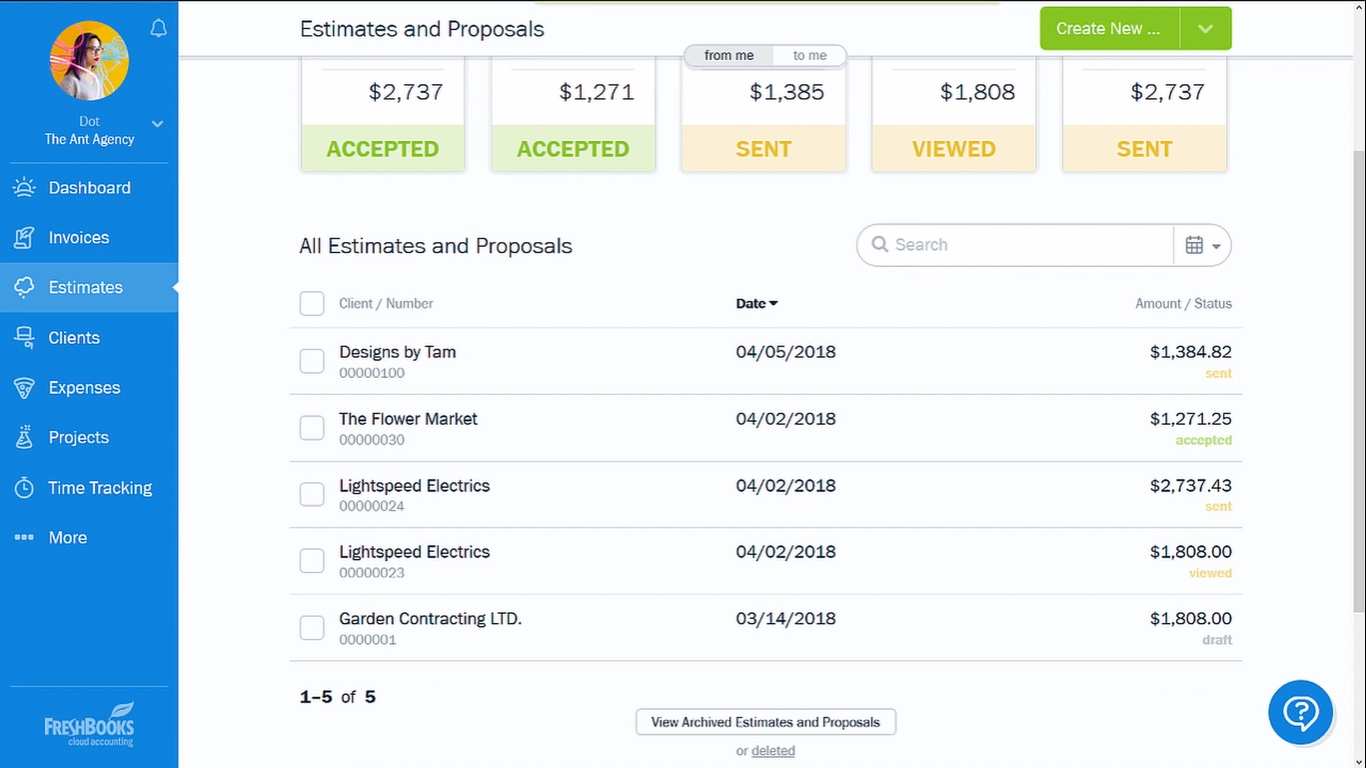

- FreshBooks: Freshbooks is user-friendly and offers easy collaboration among members. Its features include invoicing, expense tracking, payment collection and transfer through direct payment gateways, as well as due payment notifications. It can accept credit card payments, Paypal, and Amex. It is ideal for small businesses and freelancers. FreshBooks starts at $15 per month, but it offers a 30-day free trial so you can test it out before investing your money.

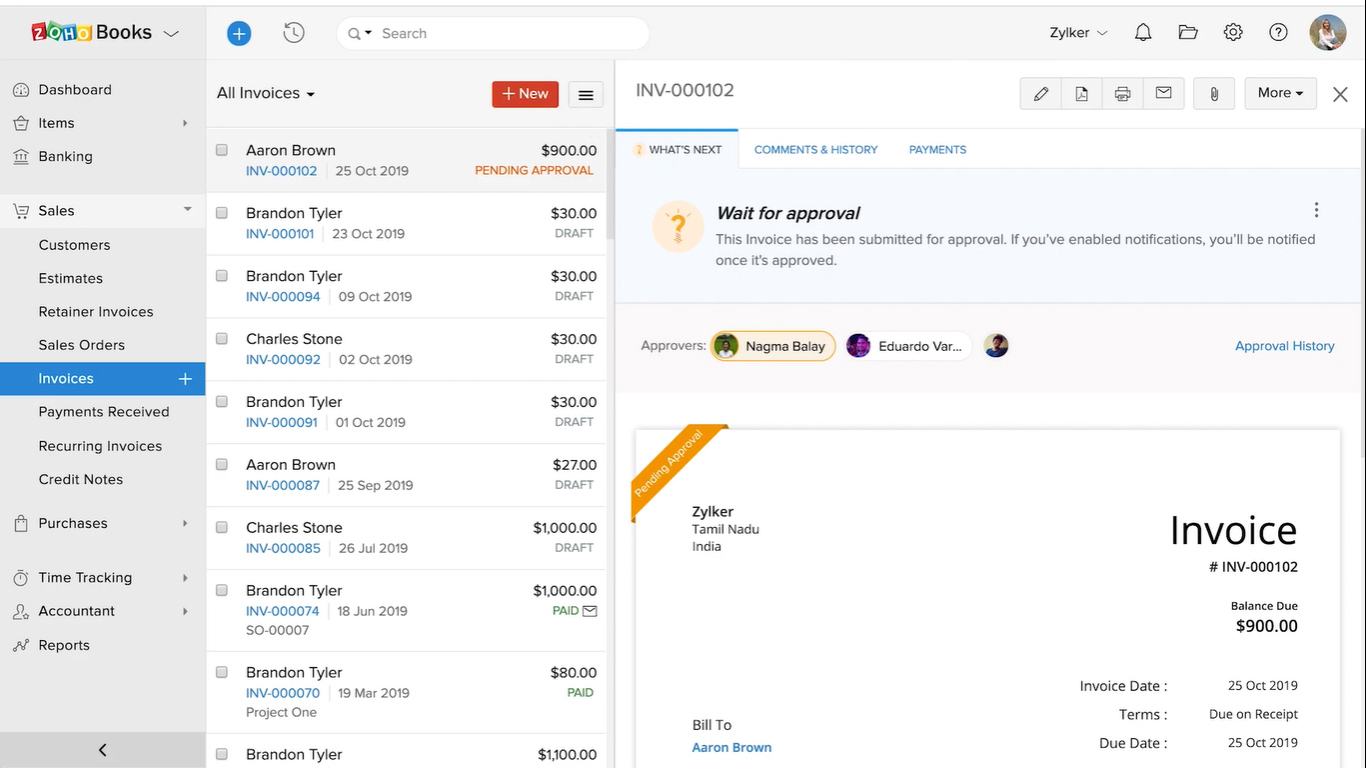

- Zoho Books: Like the above, Zoho Books also offers collaboration among members. Its key features include invoice tracking and payment automation. You can integrate Stripe with Zoho Books for easier payment transactions. It also provides templates for invoices and can set reminders for due payments. It starts at $9 per organization per month, but the vendor also offers a 14-day free trial for you to try if it truly is the software for you.

- Accounting by Wave: Wave has a simple-to-use dashboard. The key features that the vendor offers are receipt scanning and tax calculations. It is ideal for small businesses who are beginners with accounting software, as it is mostly free to use. However, if you want advanced features, such as payroll management, the price starts at $20 per month.

- Odoo: Odoo is an open-source software that is highly customizable. This is the app to look for if you want varied features such as inventory, accounting, sales, project management, and CRM all in one platform. It starts at $0 per month. Yes, you read that right. Odoo has a free version. However, if you want deeper features, the paid plans start at $25 per user per month. The good news is that you can sign up for a free trial even without a credit card.

- FreeAgent: FreeAgent is an all-in-one platform that offers key features such as billing and invoicing, expense tracking, tax management, cash inflow and outflow, direct bank transactions, payroll calculation, and third-party integration. You can even take a picture of your receipt and upload it to the software to quickly track your expenses. It is ideal for small businesses and freelancers. It has a 30-day free trial so you can test all of its features before deciding. It only offers one paid plan, which the vendor calls the “Universal Plan” for $10 per month, then $20 dollars after six months. The plan is called as such because FreeAgent was made to be an all-in-one accounting solution.

- Xero: Xero helps you track account payables and receivables, cash inflow and outflow, as well as manage payrolls. Another key feature is that it has a real-time currency exchange tool. It offers direct connectivity to offer 5,000 banks and institutions worldwide, as well as integration with PayPal for banking transactions. With a starting price of $9 per month, it is ideal for small to medium businesses. The vendor also offers a 30-day free trial for you to see if it fits your company’s needs.

- BigTime: BigTime is another all-in-one system you can use to track time usage and expenses. Other key features include billing, invoicing, and project management. You can add tasks and set deadlines as well as monitor progress in just one software. The vendor also offers cloud deployment. You can try a free trial here before purchasing. Price starts at $15 per user per month. It is ideal for freelancers and small to large enterprises.

- GoDaddy Bookkeeping: The vendor offers integrations with eBay, Etsy, and Amazon, which makes this software ideal for online entrepreneurs. It offers basic accounting tools such as invoicing, billing, and inventory tracking, along with time tracking and tax management — features that also make GoDaddy good for freelancers. Price starts at $4.99 per month. However, you get a one year discount that reduces the price to $3.99 per month for your first year of use.

- Sign Request: As its name suggests, Sign Request is used as a solution for legally-binding contract management via its tool for affixing e-signatures. This is designed for highly regulated industries, such as oil and gas extraction, petroleum and coal manufacturing, electricity, fishing, healthcare, etc. The vendor offers a free version good for one user. To use it with a team, you have to subscribe to the vendor’s paid plans that start at $7 per month. Sign Request also has a free trial that you can try.

- 17Hats: This software does more than just bookkeeping. Its key features include billing, invoicing, lead generation, contract management, project management, questionnaire creation and distribution, email synchronization, calendars, and to-do lists. Since it has a lot of features, this software is on the expensive side with price starting at $45 per month. If you go for the annual plan, you get 45% off; and if you go for the 2-year plan, you get 63% off. It is ideal for small to large businesses. The vendor also offers a 30-day money-back guarantee if you are not happy with your purchase.

- Deltek Vision: This is a browser-based project management software with basic accounting and key features such as time tracking, expense tracking, resource management, purchase orders, and payroll calculation. Deltek Vision is best for industries with specific needs such as IT, engineering, and architecture.

- Sage Business Cloud Accounting: This is a browser-based accounting software that has all the essential accounting features such as billing, invoicing, time tracking, expense management, and daily to-do lists. Other key features include payroll calculation and tax management. You can access it on either Mac or Windows. It also has mobile compatibility for iOS and Android so you can keep up with your accounting tasks on the go. Price starts at $14 per month, with a 30-day free trial. It is ideal for small businesses.

- Netsuite ERP: This is a browser-based accounting software by Oracle. Its key features include accounting services, revenue tracking, inventory management, fixed asset management, and order management. It also features a dashboard where you can view your company’s daily performance in real-time so you can keep track of your progress. Net Suite ERP is also scalable. You can customize it as your business changes and grows. The vendor offers a quote-based pricing plan where you can choose the features that you need so you don’t have to pay extra for the features that you don’t. You can also get a free demo. It is best for medium to large businesses.

- Coupa: An expense management app, Coupa helps gain visibility over your business spend. For small companies with simple financials, this app may be a good starting point. It helps you spot spending leaks and minimize them and automate expense reporting, especially for companies that deal with sending people off to travel. Coupa is accessible via a mobile app, so you can carry it with you wherever you are internet-connected.

QuickBooks is a popular entry-level accounting system for many small businesses.

How does accounting software work?

There are a lot of ways that accounting software can help your business, depending on the features that it has. Basically, accounting software works by tracking your company’s transactions such as the sales you made, loans from the bank, billings from suppliers, accounts payable your company owes to creditors, and accounts receivable that your debtors owe you.

Okay, so what are the features of accounting software?

- Accounting. This is the basic feature of accounting software (as the name implies). Accounting means the invoices, expenses, and funding that are recorded in the general ledger. It also includes the assets and accounts of your company. This helps you search your entire audit history, make a report on your finances, as well as allocate your money and resources appropriately.

- Fund Accounting. This focuses on being accountable to donors, organizations, and authority. This is mainly applied to government agencies and nonprofit organizations. It helps you manage grants, follow GASB regulations, and deliver accountability reports.

- Project Accounting. This focuses on the costs of handling different projects. It helps you manage expenditures such as labor and equipment spending. This feature is especially useful for companies and organizations with various projects that have unique differences in terms of costs and desires results, such as healthcare, information technology, NGOs, construction, and events.

- Budget Analysis. This helps companies set realistic goals for the following year by calculating its current financial capabilities. By analyzing the finances of the company, it can help set up an estimate for next year’s budget as well as analyze areas of improvement to reach profit targets.

- Invoicing Management. This feature helps set up precise invoices for customers. Having this can help you automate monthly, annually, or one-time payment collections, and it can also let customers choose between the payment options that you offer when they buy your products and/or services.

- Inventory Tracking. This is a feature that is used to manage the tools that your company has. It helps you identify the assets you have, where they are located, and what the current conditions of those assets are. This gives you better control and ensures the transparency of your tools and stocks. It notifies you which machine needs upgrading or replacing. Overall, it helps you improve the shelf-life of the current products that you have.

- Payroll Processing. This helps you calculate the payroll of your team members or employees. Included in this is making sure that their checks will be printed without error or delays. Abiding by the financial obligations towards your employees will ensure that you get a happy team. Happy team = more productivity = better business.

One of the most intuitive accounting apps around, FreshBooks has a clean interface that is appealing to non-techies.

Benefits of accounting software

- Automated Inputs. This replaces the manual task of inputting data into a ledger or journal. Time saved on bookkeeping is transferred to more free time managing other areas of your business. Accounting software takes away the pain of compiling data through its automated solutions, such as identifying patterns and notifying you of abnormalities. Advanced software also include calculations on how you can generate more profit, such as which area to invest more in.

- More Accurate Reports. Manual calculations can be prone to errors. Having software that deals with the accounting processes builds the confidence that you have an accurate and more reliable record of your finances. This is helpful because you are then able to collect data percentages on which aspects your resources go to.

- Simplifies Decision-Making. Having a comprehensive record on-hand can also help you assess the progress of your set targets. You also have a bird’s eye view of your data as you can see it on one screen. This simplifies the process of making monetary decisions. You can also make stronger justifications for those decisions because you’ll have the data to back them up.

- Cut Down on Operational Costs. Not all companies outsource accountants. The bulk of businesses locally manage their bookkeeping. By installing one software that takes care of all the accounting paperwork and having them backed up into the cloud, you can cut down on operational costs while ensuring that you still have a comprehensive and reliable record.

- Tax Management. Filing tax forms takes up a lot of time and effort. Statistics show that it takes approximately 175 hours and 10-11 payments every year for USA-based businesses to deal with their taxes. Complying with taxation laws and regulations are simply part of a business owner’s reality, but it doesn’t have to be time-consuming and difficult. With an accounting software’s integrated tax management tool, you can store income statements and billings in one platform.

- Data Security. When you back up your data in the cloud, you can be confident that come hell or high water; your files will not be lost or damaged. Fires can burn paper, and floods can damage hardware. The bonus of using accounting software is that you can put maximum protection on your data by requiring a password so that only authorized personnel can access it.

- File Synchronization. Storing your data in a software or in the cloud lets you access them using all your devices. This ensures that you avoid the panic caused by losing a piece of paper or having an overflowing filing cabinet that can be infested with termites. This also takes out the hassle of having to search for specific data because you can just type what you are looking for in the search bar and viola!

Types of accounting software

- Invoices and Bills Management. This software features notifying clients about payments, as well as writing checks and paying any due bills. Included in this is the documentation of your cash inflow and outflow. It can also make your business credible to potential clients and enforce trust between them and your company so that they are more likely to return in the future.

- Time and Expense Management. This tracks how time is being used by the company and identifies inefficient use of it. It also manages payment collection and transfers. With this type of software, you can produce expense reports, generate statistics and graphs, and approve or disapprove costs.

- Resource Planning. This helps your company with inventory tracking, asset distribution, product marketing, material purchasing, and controlling where the resources go. Advanced software of this type has integrated customer relationship management so that your business can figure out areas of improvement.

- Payroll Calculation. This type of software can calculate your employees’ salaries, including bonuses, overtime additions, and undertime deductions. It can write paychecks and deposit them into employees’ bank accounts, as well as manage taxes and insurances.

Zoho Books has a free version that scales to more advanced features when you upgrade.

Latest Trends in Accounting Software

- Artificial Intelligence. There is a rise of Artificial Intelligence technology today. The same thing is also true for accounting software. The purpose of buying software is to make tasks faster and easier; thus, having AI do all of the accounting tasks can provide accurate calculations and fraud identification.

- Automation. This takes away the burden from accountants. The trend in software now is added workflow automation. The prediction is that one day, all operations can be fully automated.

- Cloud Storage. Browser-based software is the trend these days. Users prefer to store their data in the cloud because it eliminates the need to install software locally in machines. Backing up data in the cloud can also protect your files from natural disasters such as floods, fire, and earthquakes.

Potential Issues of Accounting Software

- Not user-friendly. Some systems are challenging to use and have a cluttered environment. Choose a software that lets you perform intuitive operations that you are already familiar with—no use in buying a powerful software you barely understand how to use.

- Lack of third-party integrations. There are software that have restrictions when adding plug-ins or other software. Choose an accounting software that can be used to integrate the third-party apps that you need, such as project management, customer relationship management, and business intelligence. A software might be the best in doing a certain task, such as invoicing, for example, but it’s better to have a software that allows you to perform many different tasks in one platform rather than a one-trick-pony.

Factors to consider when getting accounting software

- Billing and Invoicing System. It’s important that your software of choice can cover the core accounting aspects of the business so you don’t have to purchase additional software or plug-ins. A system for billing and invoicing is one of the essentials. Choose a software that has this in one platform.

- Clean Interface. Look for something that doesn’t give you a headache every time you look at it. The data must be organized in a neat way so you can easily find what you are looking for.

- Data Security. Choose a software that allows you to require a password so that only you and the staff you authorize can access the files in it. You don’t want nosy people snooping on your sensitive data.

- Customization. Unfortunately, there is no universal accounting system, and rightfully so because different businesses simply have different needs. You can’t fit a circle into a rectangular hole. It’s a diverse world out there for accounting software, and if you can’t find one that fits your needs, at least look for a highly customizable software.

- Mobile Apps. Vendors now usually offer iOS and Android versions for their software. This is good for days when you need to access your files on the go. Who says you can’t be productive on your phone? It’s 2020, and phones already have more robust features than they had 10 years ago.

- User-Friendly. Since you will be purchasing software that can automate your tasks, look for something that is simple to use. It must be intuitive enough that you can easily work in it. It must have an intuitive environment that can let you control it using already familiar operations, such as drag and drop or control/command-A feature.

- Live Support. In cases when you are having trouble operating the software, it would be useful if the vendor offers some sort of live support where you can ask them for help when you encounter a problem.