CyberSource Review

OUR SCORE 89%

OUR SCORE 89%

- What is CyberSource

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is CyberSource?

Businesses looking to simplify and automate payment operations can look to CyberSource for some help. It is a payment management service that processes online payments, simplifies payment security, and streamlines fraud management. CyberSource is used as a payment solution by more than 400,000 businesses worldwide. Key features include cross-channel payments, payment cards, global tax calculation, and fraud alert. CyberSource began in 1994 and then acquired Authorize.net in 2007. It has been a part of Visa Inc. since 2010.Product Quality Score

CyberSource features

Main features of CyberSource are:

- Global Tax Calculation

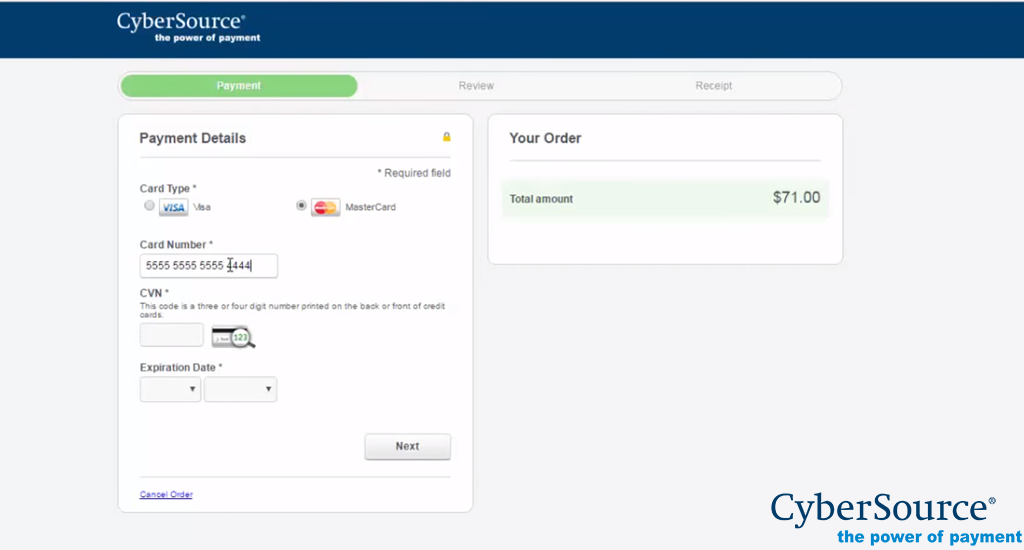

- Secure Acceptance Web/Mobile

- Decision Manager

- Cross-Channel Payments

- Gateway & Processing Connections

- Payment Cards

- Direct Debit & Bank Transfers

- Payer Authentication

- Online and Mobile Digital Payments

- Secure Acceptance Web/Mobile

- Managed Risk Services

- Export Compliance

- Loyalty Fraud Management

- Fraud Alert

- Delivery Address Verification

- Payment Tokenization

- Decision Manager

- Account Takeover Protection

CyberSource Benefits

The main benefits of CyberSource are, users can use it to accept payments in more than 40 currencies from more than 190 countries, plus it has excellent anti-fraud tool. Here are more details:

CyberSource has features like secure acceptance and global fraud management. Tokenization technologies also ensure transactions are secure and remove sensitive payment data from the transaction. Fraud analysts also look at worldwide trends so CyberSource’s own processes can be monitored and fine-tuned.

CyberSource users can also accept payments from multiple channels, be it mobile, web, or even a call center. Transactions have a universal token and central database that supports all channels and offer users a complete view of consumer activity. Information gleaned from this can then be used for marketing activities and customer analysis. Chargebacks, payments, and support queries are all handled safely, thanks to Format-preserving tokens.

Merchants worldwide get an enterprise-class solution when they start using CyberSource, as it has a payment management solution that is comprehensive and can be used for retail, travel, small businesses, and media and entertainment. CyberSource also has a switch-to-issuer through VisaNet that enables them to reach more customers.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

CyberSource Integrations

The following CyberSource integrations are currently offered by the vendor:

Companies who use CyberSource can use its open API to construct their own payment management systems. Check out some of the integrations below:

- Android Pay

- Apple Pay

- Visa Checkout

- Simple Order API and SOAP Toolkit API

- Secure Acceptance

- Virtual Terminal

Video

Customer Support

Pricing Plans

CyberSource pricing is available in the following plans: