TurboTax Review

OUR SCORE 87%

OUR SCORE 87%

- What is TurboTax

- Product Quality Score

- Main Features

- List of Benefits

- Awards Section

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is TurboTax?

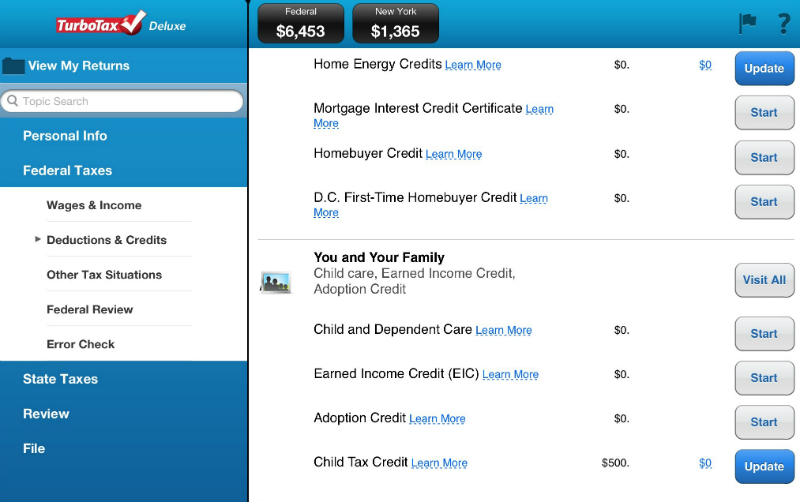

TurboTax is a tax preparation software that you can use to file your state and federal income tax returns online. It is a product developed by Intuit and offers a detailed guide to tax filing to enable even lay users to easily utilize the system. To start, TurboTax asks you to provide info such as your occupation, charity donations made, number of children, whether you are a homeowner, and other details. The tool automatically fills up tax forms – you can simple take a photo of your tax and wage statements and the platform will perform automatic data entry. The best part is the software makes accurate calculations and provides a service guarantee to help you get your tax refund as quickly as possible. Read our TurboTax reviews further to get more info on the tool’s main features and benefits.Product Quality Score

TurboTax features

Main features of TurboTax are:

- Additional help for investment sales such as stocks, bonds, royalties, mutual funds, and employee stock plans

- Creates W-2 and 1099 tax forms for employees and contractors

- Easy preparation, printing, and electronic filing

- Expert assistance with mortgage interest, property taxes, and energy-efficient improvements

- Extra coaching to maximize small business and self-employment tax deductions, such as home, office, vehicle, phone, and supplies

- Extra guidance for rental property income, expenses, and refinancing

- Guarantees maximum tax refund

- Guides users through start-up costs so that new businesses can secure deductions

- Imports financial data including W-2s, investment and mortgage information, plus imports from Quicken and QuickBooks Desktop2

- Imports last year’s TurboTax’s data

- My Analysis & Advice helps assess users’ tax history to maximize next year’s tax refund

- Retirement tax assistance

- Updated on the latest tax and health care laws

- Value donated items with the ItsDeductible™ feature

- Walks users through tax return documents and double-checks on-the-fly

TurboTax Benefits

The main benefits of TurboTax are its accuracy, ease of use, and great support. Here are more details of its benefits:

100% Accuracy Guaranteed

TurboTax is up to date with the latest tax regulations including health care laws and others. The platform performs thousands of error checks and also double checks completely before filing. These verification methods ensure your tax returns are totally error-free and 100% accurate. If the software makes a mistake that results in a state or IRS penalty, the vendor will compensate for the damages and also add interest.

Simple and Easy-to-Use Software

Online reviews reveal that users find TurboTax easy to learn and use for their tax filings. The features are simple and straightforward and even lay users without tax knowledge can easily learn the ropes. Plus, the tool’s intuitive interface helps you save time and minimizes effort.

Avail the Services of an Expert

The SmartLook feature enables you to contact a live expert to get assistance. They have the capability to even draw on your screen to provide you guidance with tax-related questions. If your return is audited, the expert will provide a free one-on-one audit walkthrough. In addition, for a nominal fee you can avail Audit Defense to benefit from full audit representation.

Get Fast Refunds

TurboTax’s e-filing features enable you to get your tax refunds quickly. In addition, you can save time with the application’s document capturing tools that automatically fill up tax forms.

Assured Data Security

TurboTax provides a cloud-hosted mobile option to help you review your documents anytime, anywhere. Plus, complete data security is guaranteed as the software uses measures such as password guidelines and secure encryptions to protect your data.

You can check out this TurboTax review to get more details on this software’s features and tools.

Awards Section

- Great User Experience Award

- Rising Star of 2018 Award

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

TurboTax Integrations

The following TurboTax integrations are currently offered by the vendor:

- Paycor

- Quickbooks

- The Neat Company

- Wealthfront

Video

Customer Support

Pricing Plans

TurboTax pricing is available in the following plans: