Stripe Review

OUR SCORE 96%

OUR SCORE 96%

- What is Stripe

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Stripe ?

Stripe is a cloud-based payment tool that helps users manage and accept transactions online. It's an end-to-end platform capable of processing online payments, which makes it perfect for online businesses or e-commerce. At its heart is a powerful payment engine that effectively streamlines business transactions while linking with other apps that organizes revenue, drive business growth, and prevent fraud. The software makes the most of its cloud-based system to improve security and allow for scalability. It eradicates highly complex monetary processes by leveraging the tool to function hand-in-hand with financial regulators, banks, financial institutions, consumers wallets, and payment networks. Stripe provides a wide range of products capable of addressing essential stages in the payment process. The payment tool provides a one-stop shop solution for managing, settling, processing, and accepting payment. Its billing models are intended for rapidly-expanding businesses. This gives users the ability to bill customers on an automated recurring basis or via an on-off invoice. The platform funtions well in any kind of business model. Its simple system comes with pre-installed UI components as well as prioritizing APIs for customizations.Product Quality Score

Stripe features

Main features of Stripe are:

- Authorization

- Dispute Handling

- Financial Reporting

- Clean Canvas

- Invoice

- Open-Source Plugin

- Payment Options

- Mobile Customer Interface

- Embeddable Checkout

- Multicurrency Payouts

- Roles and Permissions

- Accounting Integrations

- Unified Payout

- Payout Timing

- Consolidated Reports

- Custom UI Toolkit

- Collaboration Notes

Stripe Benefits

Stripe offers a highly scalable and robust payment transaction and processing solution for any online-based business. Its user interface toolkit has the necessary elements for analytics, design, and a front-end for creating and customizing payment forms. Users can quickly embed checkout on their site by simply utilizing a Javascript line.

Invoices are made for sending out and requesting payment from customers who are aligned to the branding. The platform can be utilized quickly on-the-go via an iOS or Android app thanks to its mobile-friendly checkout option.

Stripe can offer payment gateway support options to customers. Users can cater payment to a majority of credit and debit cards in almost every country in the world. Digital wallets like Apple Play, Amex Express Checkout, and Alipay are intended for customers who want to pay conveniently without having to share personal card details. Local payment methods, local Stripe accounts, and preferred currencies are also supported by the platform.

In terms of optimizing revenue, Stripe can optimize routing paths with popular card networks which include American Express, MasterCard, and Visa. This pre-processing layer minimizes latency during transaction and dramatically enhances success rates.

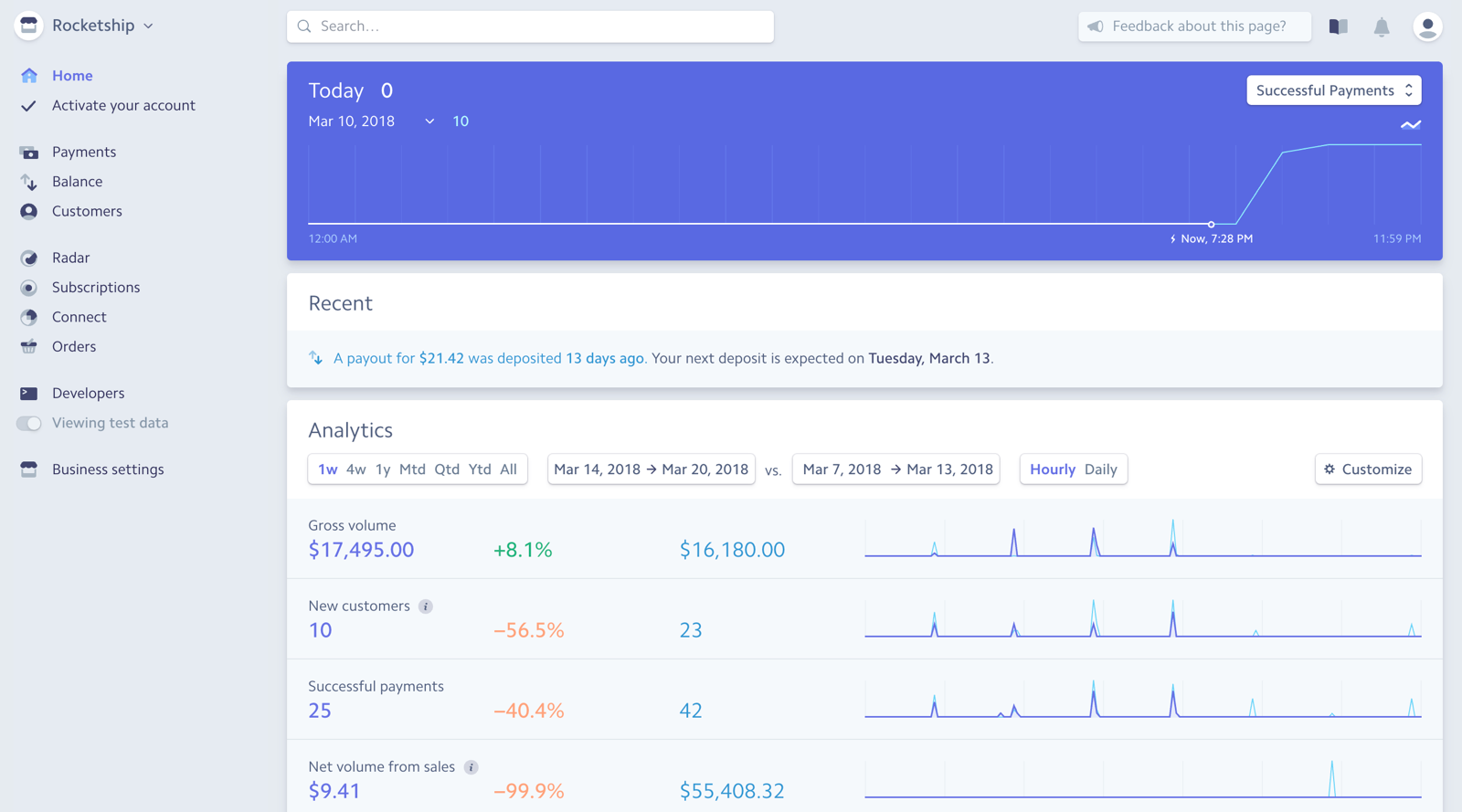

Handling of disputes are now automated to effectively present any evidence in case of conflicts. Automated accounting support, collated reports, and financial reporting helps streamline and hasten reconciliation of transaction issues. This provides users information regarding refunds, transfers, fees, and other charges in real-time via the platform’s API and Dashboard.

Whenever a transaction is resolved, users can simplify and expedite how they can be paid from consolidated payouts. They can also have a bird’s eye view of charges made across payment types, countries, and currencies via information exportability and reporting in real-time.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Stripe Integrations

The following Stripe integrations are currently offered by the vendor:

- Avalara

- FirstOfficer

- Minkasu

- Keen IO

- PennyPipe

- MRR.io

- Quaderno

- Woopra

- Easypost

- GoDaddy Online Bookkeeping

- Thyngs

- Leapfin

- Ronin

- InviteRobot

- Taxamo

- Attribution

- Sage Business Cloud

- Amex Express Checkout

- Visa Checkout

- Plum Voice

- ShipStation

- ShippingEasy

- Masterpass by MasterCard

- Revenue Recognition from ChartMogul

- APIGUM

- SumAll

- Raklet

- Tactill

- Pi.TEAM

- Easyship

- Hall Monitor

- Swiftype Enterprise Search

- Chatfuel

- Compass

- Excel Rescue

- Ship&co

- Xplenty

- Slack

- Control Analytics

- Visible Analytics

- Databox Analytics

- NomNom

- Exploratory

- Statsbot

- Bench

- Blendo

- PieSync

- Cyclr

- CashNotify

- Automate.io

- Chargehound

- Stitch

- Xero

- SaaSOptics

- Payment

- EmailHooks

- Kerpay

- Putler

- Segment

- ProfitWell

- Zapier

- QuickFile Accounting

- Baremetrics

- SuiteSync

- CommerceSync

- Armatic

- TaxJar

- InviteRobot

- Glofox

- Due Mobile Payments

- Shippo

- Redwood Apps, Inc.

- AccountsPortal

- Tender

- Silver

- Siphon

- ChartMogul

- Zoho Books

- InvoiceSherpa

- Fivetran

- LeadsBridge

- LicenseSpot

- Delighted

- IFTTT

- Pay with Bolt

- LessChurn

- Ramp Receipts

- Zoho Reports

Video

Customer Support

Pricing Plans

Stripe pricing is available in the following plans: