Zoho Payroll Review

OUR SCORE 90%

OUR SCORE 90%

- What is Zoho Payroll

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Zoho Payroll?

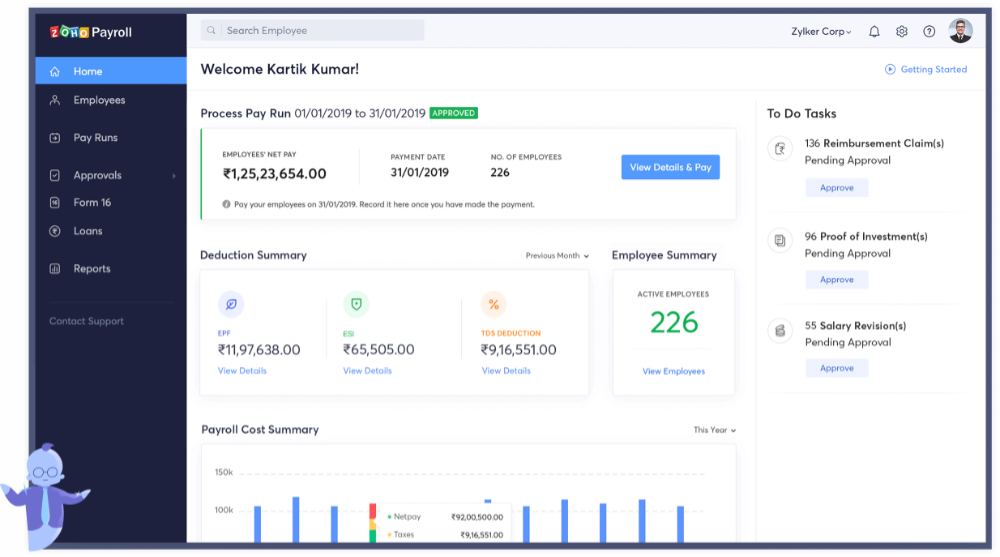

Zoho Payroll is a cloud-based payroll management app built into the Zoho Books accounting system. It is designed to automate the complicated process of payroll processing. The app features automatic payroll calculation that can generate payslips and pay employees on time, statutory compliance to help you avoid possible legal problems, salary structuring to calculate multiple salary arrangements, and an employee self-service portal to reinforce collaboration between your payroll staff and employees. Zoho easily integrates HR activities using Zoho People and accounting processes using Zoho Books to Zoho Payroll. The vendor also offers fast employee onboarding so that you can add new employees to the payroll with a few clicks. Zoho Payroll is ideal for businesses of all sizes that need to manage the payroll of multiple employees from different departments. All in all, the app can automate all your payroll activities so that you can use your time to manage other areas of your business.Product Quality Score

Zoho Payroll features

Main features of Zoho Payroll are:

- Automatic Payroll Calculation

- Statutory Compliance

- Accounting Integration

- HR Integration

- Direct Deposit of Salaries

- Employee Self-Service Portal

- Employee Onboarding

- Pay Run Approval

Zoho Payroll Benefits

The main benefits of Zoho Payroll are automated payroll calculation, statutory compliance, HR and accounting integrations, and an employee self-service portal. Here are more details on Zoho Payroll’s benefits:

Automated Payroll Calculation

Zoho Payroll can automatically generate employee payslips online and send them to your employees. It also calculates bonuses, allowances, taxes, and deductions. You can either pay them online and send the money directly to the employee’s bank account or offline through checks. The app ensures that you pay your employees on time. You can also use the app to track any loans that your employees may have.

Statutory Compliance

Zoho Payroll helps you comply with statutory compliance laws to help your business avoid possible legal problems that cost a lot of money and take up a lot of time. This also protects you from a backlash to your reputation. This feature also helps you easily file tax reports. Following statutory compliance laws also ensures that you are treating your employees fairly and humanely.

Employee Self-Service Portal

Zoho Payroll also has an employee self-service portal where employees can send payment requests, view their salary bill and structure, and ask about other related payroll issues all in one place. These are essential features for payroll software to have.

HR and Accounting Integrations

Zoho makes it easy to integrate its apps to achieve a seamless workflow. You can integrate Zoho Payroll with Zoho People to manage your human resources and with Zoho Books to manage all your accounting tasks.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Zoho Payroll Integrations

The following Zoho Payroll integrations are currently offered by the vendor:

- Zoho People

- Zoho Books

Video

Customer Support

Pricing Plans

Zoho Payroll pricing is available in the following plans: