Zipbooks Review

OUR SCORE 85%

OUR SCORE 85%

- What is Zipbooks

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Zipbooks?

The bookkeeping and accounting needs of growing enterprises, small businesses, contractors, professionals, and freelancers can be handled by ZipBooks. It is a free accounting solution that is web-based and helps its users to get their payments at a quicker pace. Financial processes are streamlined and productivity is enhanced, with payments received faster. Whether payments are made via check or credit card, Zipbooks’ financial partners make it possible for users to easily accept them. Future income projection, expense and time tracking, as well as invoice creation are just some of the things that Zipbooks is capable of doing. Application and business systems like Slack, Google Chrome, Google Drive, Google Apps, and Asana also seamlessly integrate with the software. Bank accounts can be connected, bank statements reconciled, and accounting reports created all thanks to Zipbooks.Product Quality Score

Zipbooks features

Main features of Zipbooks are:

- Online invoicing

- Invoice maker

- Time tracking

- Online accounting

- Recurring billing

- Team management

Zipbooks Benefits

The main benefits of Zipbooks are its availability for everyone, its extensive feature set, and its connectivity.

While some charges may apply when users avail of the services of Zipbooks’ financial partners, the software itself is absolutely free. There is no subscription plan that needs to be availed of. What users get in return is a comprehensive feature set along with a booking and accounting platform that is intuitive.

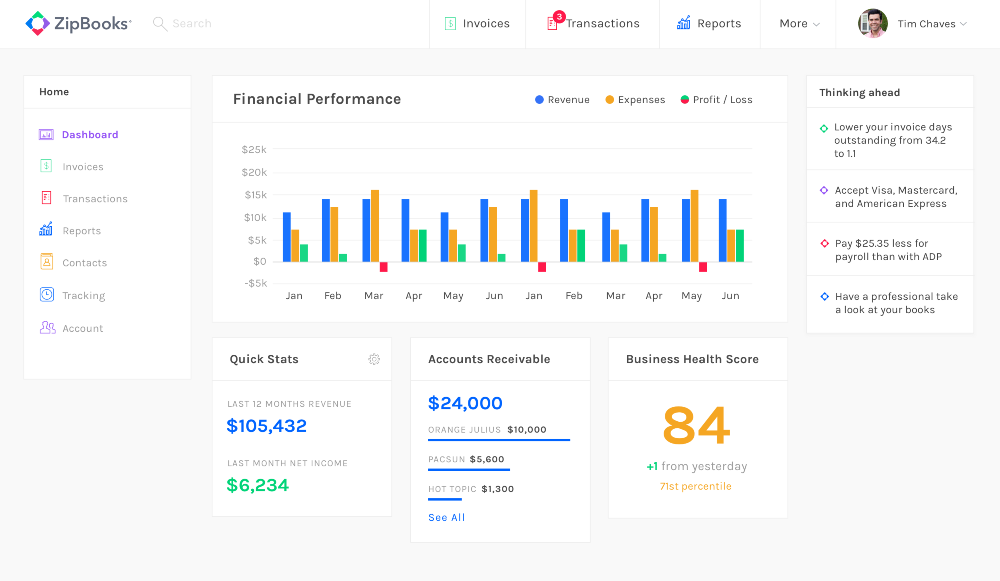

Bank reconciliation features allow users to group their expenses into categories and easily view them from one account. This means that users get to see what they spend their money, on top of being able to create accounting reports and track their finances.

A user’s financial data can be kept updated by having their Zipbooks profile connect with their bank account. Users can easily view their financial information since the software takes all of their financial data and has a centralized location to store them in.

Using just one view, users can see the time tracked by team members, the average invoice age, paid invoices, and total accounts receivable. All users need to do is log in to their account to have an idea of what they need to focus on.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Zipbooks Integrations

The following Zipbooks integrations are currently offered by the vendor:

- Google Chrome

- Google Apps

- Slack

- Google Drive

- Asana

Video

Customer Support

Pricing Plans

Zipbooks pricing is available in the following plans: