Wagepoint Review

OUR SCORE 80%

OUR SCORE 80%

- What is Wagepoint

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Wagepoint?

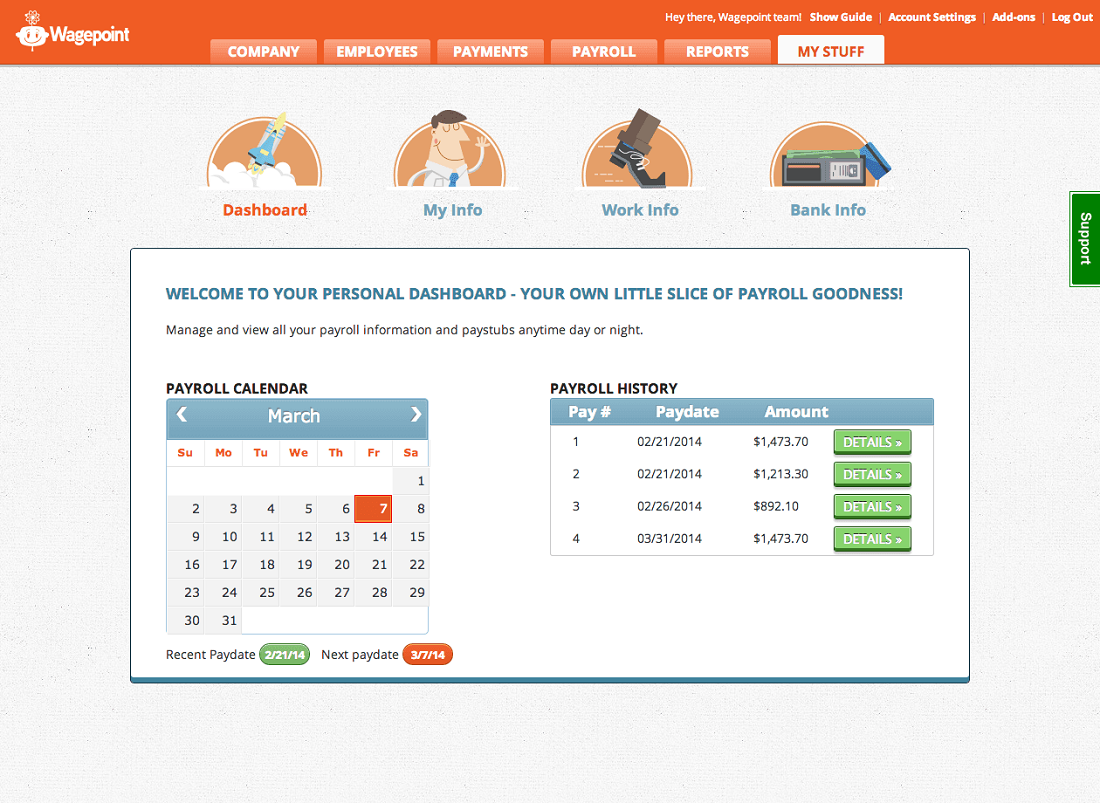

Wagepoint is a straightforward web-based payroll solution developed for small businesses situated in North America. A great app of choice for a wide range of businesses including banking, distribution, healthcare, and retail. It is capable of managing payroll in a quick and easy manner, which is very important for small and medium-sized companies. It can also be utilized for managing government reporting or remittances, direct deposits as well as year-end reporting for employees, whether they’re salaried or hourly. The application is used by numerous small business which is mostly accredited to how easy it is to use and set up as well as its web-based nature. This makes it an ideal payroll solution for consolidating payroll deliverables by users managing either a remote workforce or an in-house team. It is also perfect for small businesses that are looking for ways to convert their contractor payment and payroll systems into a more efficient, tax compliant version.Product Quality Score

Wagepoint features

Main features of Wagepoint are:

- Default Payroll Withholdings

- Hourly & Salaried Employees

- Easy Company & Employee Setup

- Government Remittances

- Paperless Paystubs

- Direct Deposits

- Employees & Contractors

- Cloud-based Payroll Software

- Employee Access

- Company Income Codes

- Company Deductions

- Excellent Customer Service

- Federal, State & Local Tax Reporting

- Year-end W2s (US) & T4s (Canada)

- Workers Compensation (Canada)

Wagepoint Benefits

The main benefits of Wagepoint are its user-friendly operation, fast payment for employees, access to various documents by staff, auto-approve functionality, ticketing support for customer service, security features, and compliance to regulations. Here are more details:

Easy to set up and use

The system is easy and fast to set up and use. It can be operated on Macs and PCs alike and users won’t have to think of fees for contracts, maintenance, and set up. Furthermore, companies with over 10 employees can switch from other payroll application to this for free.

Quick payroll solution

Wagepoint empowers employers to pay hourly rate staffs, salaried employees, and contractors all at once. There is also an option for adding various pay groups, which are handy for payrolls with multiple frequencies.

Document access for employees

With Wagepoint, the need to re-print lost pay slips, forms, etc. of employees is eliminated because users can simply provide them access to personal information. There, they’ll be able to view the data they wanted or independently replace lost documents if they needed to.

Auto-approve feature

If the people managing the payroll need to be away for some time, to be on vacation, for example, they will be able to do so because Wagepoint has an auto-approve feature. All they have to do is to set payroll up and then let it run by itself. This is only possible, however, if payroll doesn’t often change.

Ticketing support

If users got themselves some queries, they can use the system’s floating Support tab. This gives them access to Wagepoint’s knowledge base or it can be used to send a support ticket. Currently, the system boasts a 95% satisfaction rating on customer service.

Secure

The application’s servers are being hosted in Amazon cloud which gives it the ability to support international expansion. Not only that, but this also provides the system with great reliability and security. Wagepoint also utilizes 256-bit SSL encryption which offers security and protection of data from hackers. The system is safe from leakage as well because, without users’ permission, no information is going to be shared with other applications.

Tax regulations compliant

The system is capable of managing a wide range of reporting tasks and tax compliance throughout the entire jurisdiction levels such as local taxes, online payment stubs, 1099s in US dollars and other currencies.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Wagepoint Integrations

The following Wagepoint integrations are currently offered by the vendor:

- LessAccounting

- Deputy

- SwipeClock

- T-Sheets (coming soon)

- Xero

- QuickBooks Online

Video

Customer Support

Pricing Plans

Wagepoint pricing is available in the following plans: