TaxCloud Review

OUR SCORE 70%

OUR SCORE 70%

- What is TaxCloud

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is TaxCloud?

TaxCloud is an online and free tax compliance and management software that provides a simplified approach for internet sales management. The system is popular among online wholesalers and retailers across the United States. It provides tools for maintaining compliance, simplifying tax collection from customers, and calculating taxes. TaxCloud is also a platform for aiding users in automating the process of tracking the tax rates and product type of sales as well as use based tax exemptions in all states. It can also calculate and collect sales taxes easily while being in full compliance with sales tax laws. TaxCloud can also be integrated with over 85 e-commerce platforms and it also provides APIs for public sales tax that can be immediately implemented by users for their existing ERP systems, order management tools and shopping carts. The platform is also able to generate monthly reports which can be organized per tax jurisdictions by city, country or state.Product Quality Score

TaxCloud features

Main features of TaxCloud are:

- Track Sales Taxes

- Sales Tax Calculation

- Hosted Marketplace Integrations

- Rapid Implementation

- Payment Processing Services

- Advanced APIs

- Manual Sales Tax Management

- Easy to Use

- Reporting Features

- Core Public Sales Tax APIs

- Automated Compliance Service

- Sales Tax Collection and Filing

- Integration with ERP systems

TaxCloud Benefits

The main benefits of TaxCloud are its capability to efficiently manage sales taxes, its automation of compliance service, and its APIs that provides various useful functionalities like Public Sales Tax API, Lookup API, and Returned API. Here are more details:

Manage sales taxes

Through the aid of TaxCloud, online retail businesses are able to manage their own sales taxes without getting the service of software developers and tax attorney. They wouldn’t have to spend money on costly tax compliance platforms as well. With the help of its public sales tax APIs, users will be able to calculate sales taxes accurately for any address in the US.

Automated compliance service

The system provides an Automated Compliance service to users for free since the states are the one shouldering the fees paid to TaxCloud for managing sales taxes of its clients. With this, users are able to compute their sales taxes for any address in the US, get tax reports to be used for filing sales tax returns, and track all exemptions rules in any state. However, for those users who would like to use the system to manage their taxes on their own without using the Automated Compliance service will be charged with a monthly service fee.

Public sales tax APIs

TaxCloud is equipped with public sales tax APIS which enable users to perform the following actions: Address Verification, Ping, Order Completion, Merchandise Returns, and Tax Amount Lookup. Once activated, these APIs will work together with the TaxCloud which will enable them to manage their sales taxes faster and more accurately.

Lookup API

Lookup API is another API provided by the system used for calculating the proper sales taxes for items that are purchased by customers. It works with VerifyAddress API to get the address of a customer which is used for the computation of sales tax amount for each item.

Returned API

Returned API is used to aid businesses in their management of sales taxes for canceled, returned or modified orders. Online stores or e-commerce platform utilizing this API send a notification to TaxCloud which allows the system to update the right transactions record accordingly for returned, canceled or modified for a completed transaction or purchase.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

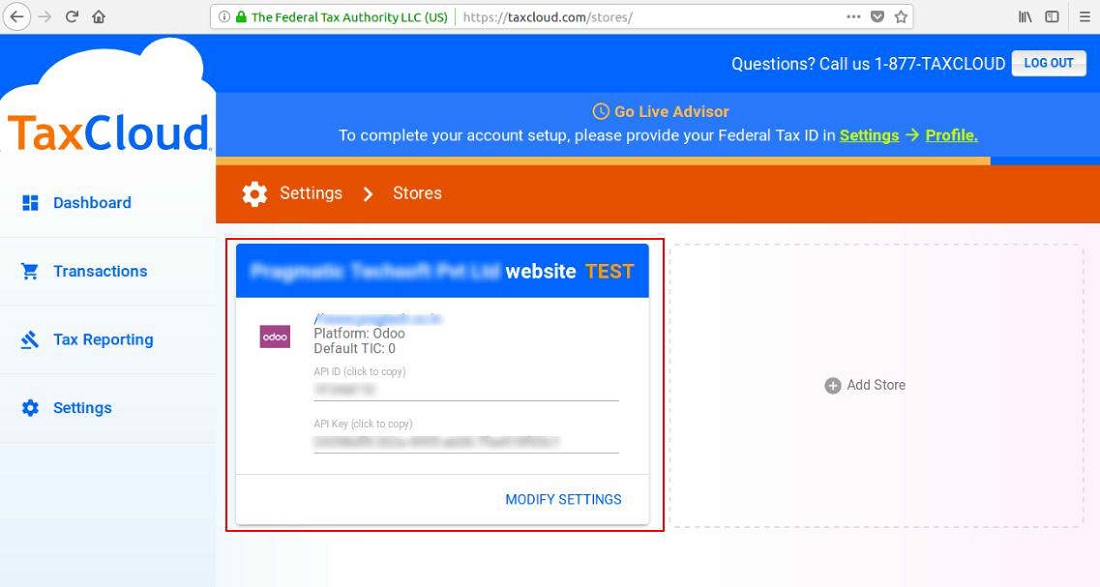

TaxCloud Integrations

The following TaxCloud integrations are currently offered by the vendor:

No information available.

Video

Customer Support

Pricing Plans

TaxCloud pricing is available in the following plans: