Plaid Review

OUR SCORE 90%

OUR SCORE 90%

- What is Plaid

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Plaid ?

Plaid is a platform that aids in the development of applications with tools that enable users to leverage innovations for financial services. The platform streamlines how users connect their bank accounts to their apps. The clean and simple interface of its front-end module helps users learn and operate your app easily. Plaid offers 6 products: Assets, Auth, Balance, Income, Identity, and Transactions. Each of these products generates data that can be used to improve end-user experience and they facilitate access through a single integration. Whether it is for business finances, personal finances, consumer payments, lending, and banking and brokerage, the platform allows users to build and customize solutions as per the user’s needs. A wide range of financial institutions available through API are supported by the platform’s suite of analytics tools. A user does not have to pay anything for using core features of the platform and live set of API keys. Besides availing development environment for free for first live accounts, a user can also generate ample Sandbox items. You can opt to upgrade to a production-level account.Product Quality Score

Plaid features

Main features of Plaid are:

- Bank Account Integration

- Identity Verification Option

- Credential-Based Workflow Option

- Income validation

- ACH Authentication Tool

- Comprehensive API

- Real-Time Account View

- PDF & JSON Format Support

- Standard/enterprise support

- Categorized transaction data

- Account authentication

- Transaction Geolocation Tracking

- Borrower asset verification

- Mobile-optimized forms

- Transaction Data History

- Custom Integrations

- 256-bit AES Encryption

- Routing Number Support

- Auto-Fill Tool for Forms

Plaid Benefits

The benefits of Plaid are reducing fraud, streamlining bank accounts authentication, providing a comprehensive transaction history, showing account balances in real-time, conducting borrower’s assets verifications, and validating user income. Plaid provides a development platform to strengthen financial services. Some of its main benefits are as follows:

Reduce fraud

Plaid allows users to create an app that can verify user identities according to bank files. You can collect information including names, email, addresses and phone numbers to let you personalize the forms while linking accounts.

Streamlined bank accounts authentication

The tool doesn’t ask for micro-deposits and simplifies the process while setting up EFT and ACH payments. The mobile-optimized flow offered by the platform lowers overdraft fees and NSF by optimizing the transactions.

Comprehensive transaction history

You can access transaction data from up to 24 months from thousands of financial institutions. The app also offers insights through updates on recent transactions to help improve the user experience.

Show account balances in real-time

Plaid’s Balance product verifies account balances in real time. The return of funds to bank account enables account pre-funding and reduces fees accumulated from overdrafts and NSF.

Borrowers’ assets verifications

The Asset Report shows transaction history, identity information, and account balances of the account holder. Users can reduce risks by using bank data and optimizing borrower experience with time-saving processes.

User income validation

A comprehensive analysis of bank deposits allows the validation of employer information and user income with accuracy. The projection of the current year annual income is streamlined to leverage employment validation as well.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Plaid Integrations

The following Plaid integrations are currently offered by the vendor:

- 1,500 fintechs and institutions via Auth.

Video

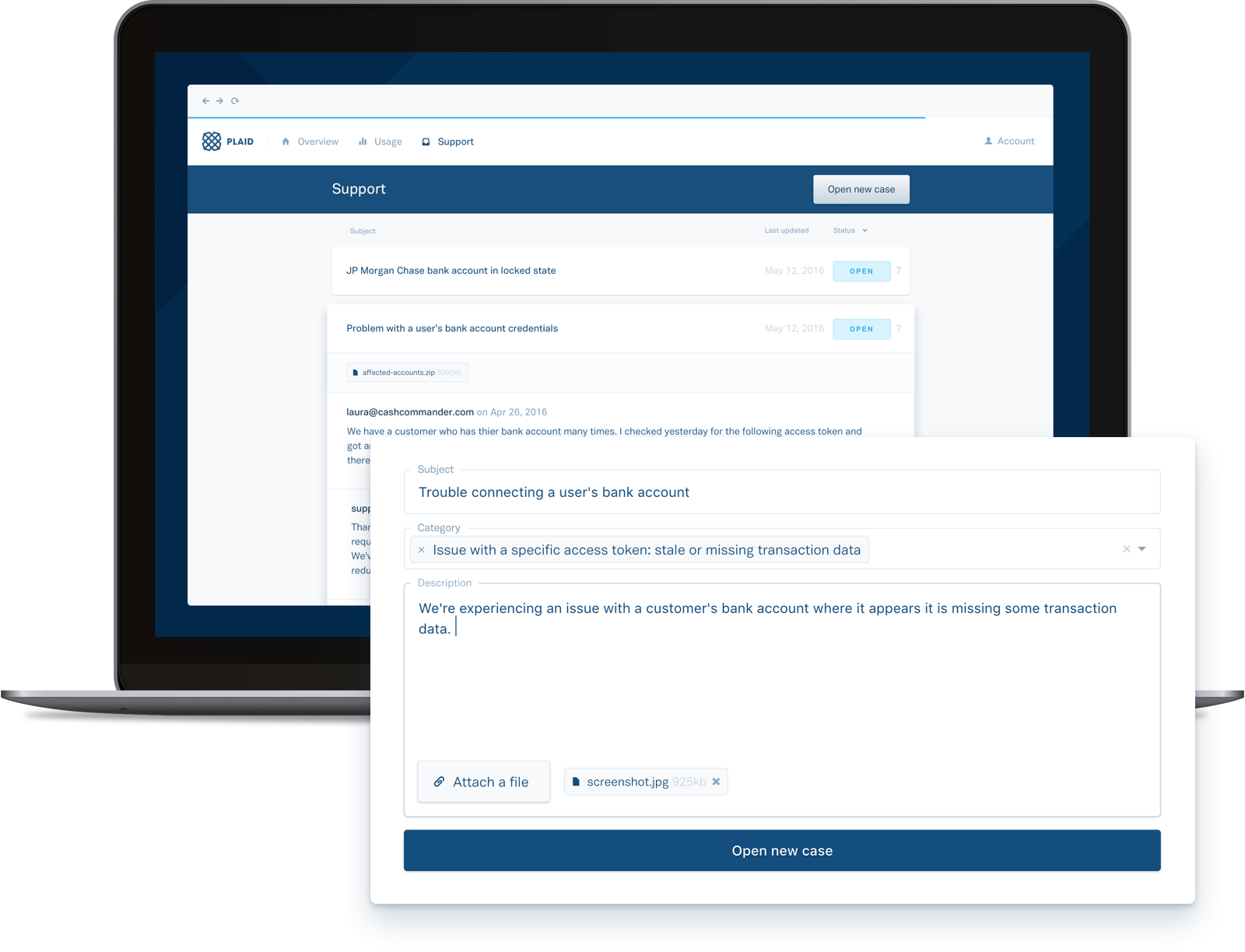

Customer Support

Pricing Plans

Plaid pricing is available in the following plans: