Paybooks Review

OUR SCORE 86%

OUR SCORE 86%

- What is Paybooks

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

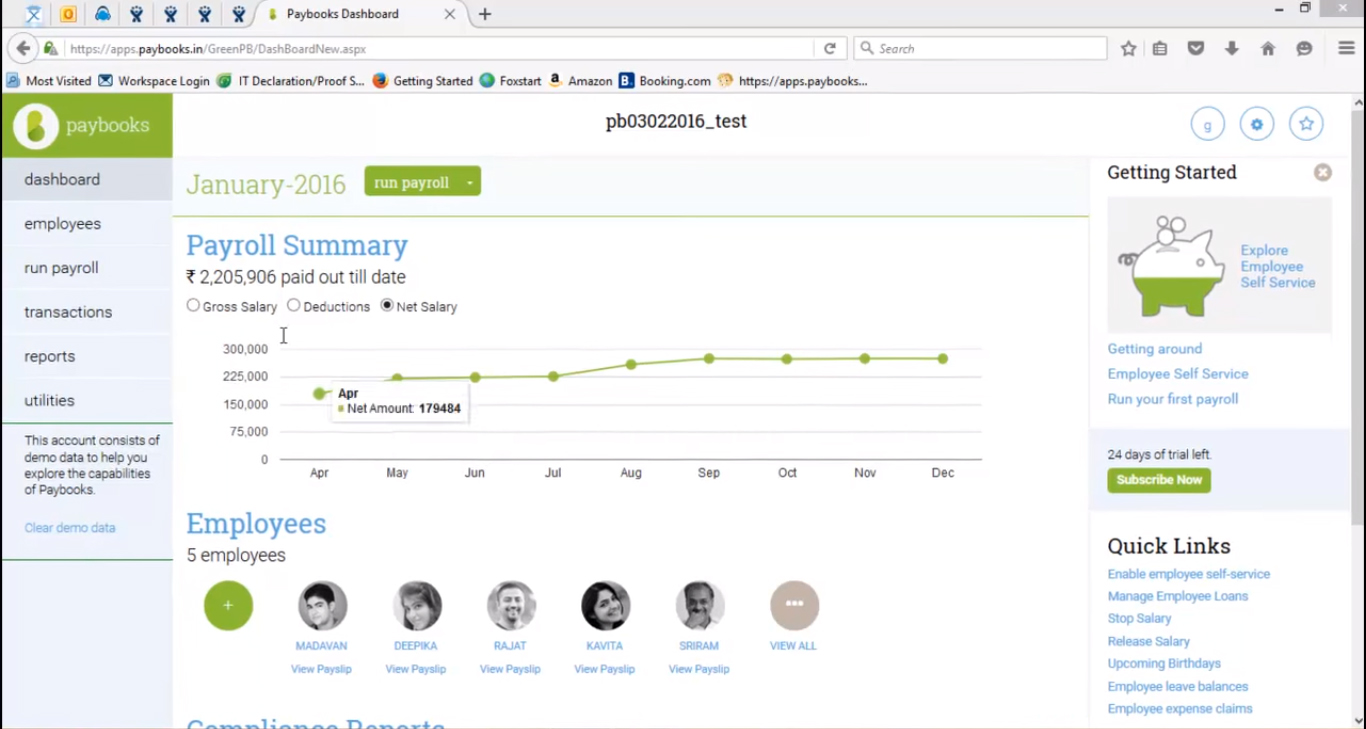

What is Paybooks?

Businesses and organizations based in India can turn to Paybooks to help them simplify payroll processes and related workflows. This online payroll solution has a dashboard that is neat and intelligent, and also comes with a wizard that helps users effortlessly perform payroll tasks. Paybooks is law- and policy-compliant, with compliance, reports easily generated right from the system. Some of these reports include Professional Tax, Income Tax, Form 16 Provident Fund, ESI, and other reports. Salaries can also be sent out automatically and securely from the Paybooks system, thanks to a partnership with ICICI Bank.Product Quality Score

Paybooks features

Main features of Paybooks are:

- Auto Generate Salary Slips

- Ready Bank Statements

- Setup Wizard

- Guided Payroll Run

- Payroll Laws Compliance

- Pay Slips and Reports

- Preview Reports

- Employee Self-Service

- Leave and Expense Management

- Document Management

- Shift Management

- Role-based User Profiles

- Employee Exit Management

- Auto Sync With Biometric Devices

Paybooks Benefits

The main benefits of Paybooks for India-based enterprises is how payroll and all related processes are simplified and accelerated. Companies can also be assured that all their processes comply with India’s payroll laws and policies. Paybooks is also easy to use even for users who have no experience in using payroll software, thanks to its powerful Wizard and intuitive design.

Employees also get a lot of benefits when their company decides to use Paybooks. With Paybooks, they can use the self-service app on their mobile devices to look at their payslips, Form 16, and year-to-date salary reports.

Leave requests and expense reports can be filed and submitted from Paybooks, and managers can approve or decline them either via the mobile app or through email. Paybooks also lets employees plan and submit income tax declarations from the system.

Paybooks’ ICCI Bank partnership allows companies to use their Paybooks accounts to send out salaries to their employees. This streamlines payroll processes, as companies no longer have to prepare checks, upload payment instruction files, or deposit money to distribute employee salaries.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Paybooks Integrations

The following Paybooks integrations are currently offered by the vendor:

- Zoho

- Securax

- Intuit

- QuickBooks

Video

Customer Support

Pricing Plans

Paybooks pricing is available in the following plans: