MANGOPAY Review

OUR SCORE 85%

OUR SCORE 85%

- What is MANGOPAY

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is MANGOPAY?

MANGOPAY is an end-to-end payment processing solution for marketplaces, crowdfunding platforms, and FinTechs. On the whole, it provides you with payment-processing capabilities that can scale with your business. More specifically, its technology makes room for made to measure solutions, equipping you with a developer-friendly API, a white-label solution, and the freedom to map out specific payment flows that makes sense to you and your clients. Although generally operating in Europe and adhering to its regulations, MANGOPAY lets you conduct your business globally by accepting online payment in multiple currencies and methods. By running your transactions through this platform, you can better protect your business with its multiple anti-fraud and money laundering prevention tools. MANGOPAY also has the capacity to hold the funds in segregated accounts and bill customers on a recurring basis. It is trusted by over 2,500 platforms across Europe.Product Quality Score

MANGOPAY features

Main features of MANGOPAY are:

- Fraud Prevention

- White Label

- E-Wallets & Ibanisation

- Methods of Payment

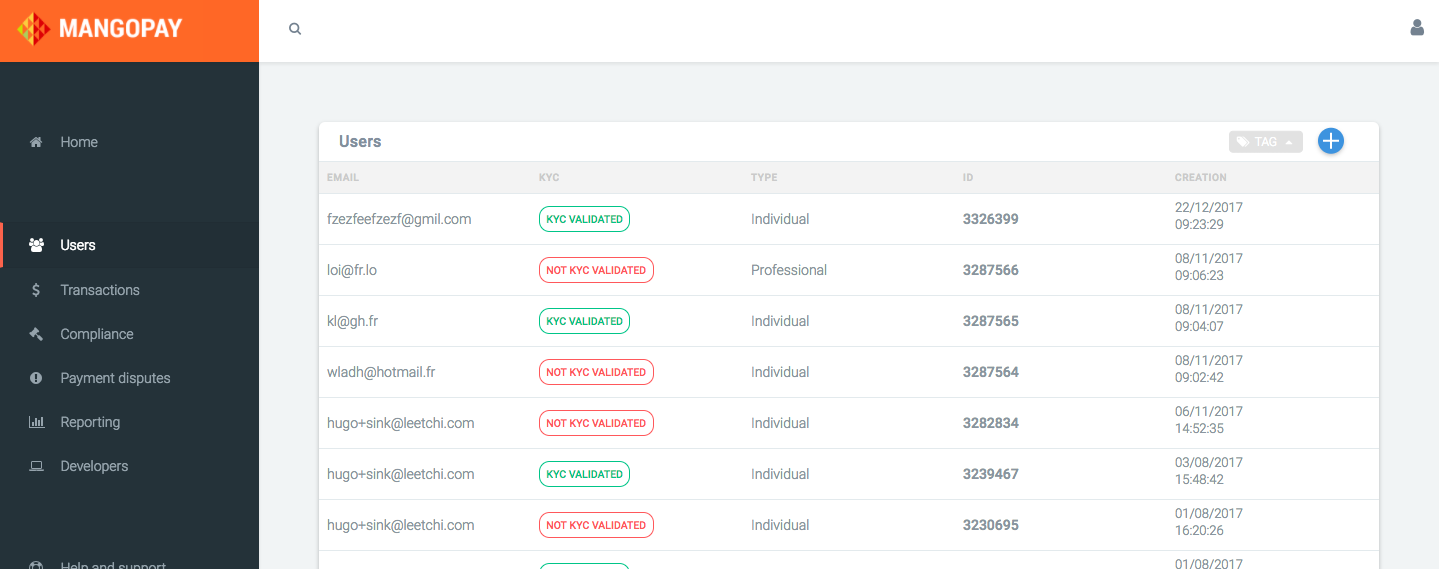

- User Verification – KYC

- User Protection

MANGOPAY Benefits

The main benefits of MANGOPAY are seamless payment processing, customizable payment flow, security, and real-time monitoring. Learn more about these benefits in the section below.

Seamless payment processing

Through MANGOPAY, you can process recurring payments and even set up a global payments platform. Whether you are running a marketplace, a crowdfunding platform, or a FinTech business, it allows you to accept payments in multiple currencies over a variety of methods without any problem.

Customizable payment flow

You also have the option to build your own integrations and map out your own payment flow with MANGOPAY. This way, you can make sure that the solution complements your business model, your preferences, and how you choose to interact with your customers.

All this is possible with MANGOPAY’S developer-friendly API and white-label capabilities. These are essential capabilities and features of payment gateway software.

Security

Of course, one major pain point for every online business is making sure that all transactions and data are secured. MANGOPAY addresses this by implementing anti-fraud and anti-money laundering features that safeguard both the payor and the payee. It executes several verification steps that are all in compliance with European regulations.

Real-time monitoring

Finally, you can also oversee all transactions through MANGOPAY’S dashboard. This allows you to automatically track earnings, commissions, e-wallets, customers, and financial reports.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

MANGOPAY Integrations

The following MANGOPAY integrations are currently offered by the vendor:

- Katipult

- Deemly

- ShareIn

Video

Customer Support

Pricing Plans

MANGOPAY pricing is available in the following plans: